Saturday, July 12th 2025

Last Friday was very disappointing as the market did not do that final push to 6350-6370 ES to get an "exhaustion" move that could be shorted. Instead they pulled back small to control the move and not allow a deeper move back down. Then they grinded back up the rest of the day to erase about half the decline.

This is very frustrating as the market is refusing to do the blow off to allow a decent pullback (200+ points), and it's making it impossible to trade. Ultimately we will see the 655.66 FP on the SPY and that high (a very ritual number) will cause a strong pullback from it. Whether or not it a crash like move is unknown, as it depends on when it hits.

The perfect scenario is to hit it on a ritual date, like September 18th, 2025 (999). Between now then it's looking like the market isn't going to give the bears much on the downside. We could still see the 588.79 FP on the SPY at some point (August?) but I think they will keep this market in a tight range until the upside FP is hit. Then we'll see a crash like drop to fill the 2 gap's on the ES at 5715 and 5339, and that should happen into October.

Short term though we are very overbought and a pullback of few hundred point is still likely to happen soon. It might be a 1-2 day event but it's still likely to happen before the blow off into September. For today though I don't have much to add.

Oh... NVDA, I forgot to add that it failed to drop like a rock Friday too. I was hoping that the ritual 166.66 early high would hold and that we'd see a 10%+ fast 1-2 day collapse move but it was stopped from happening as that high was taken out. It will at some point have a surprise drop that very few catch. For now though I've moved on and will focus on the market.

Sunday, July 13th 2025

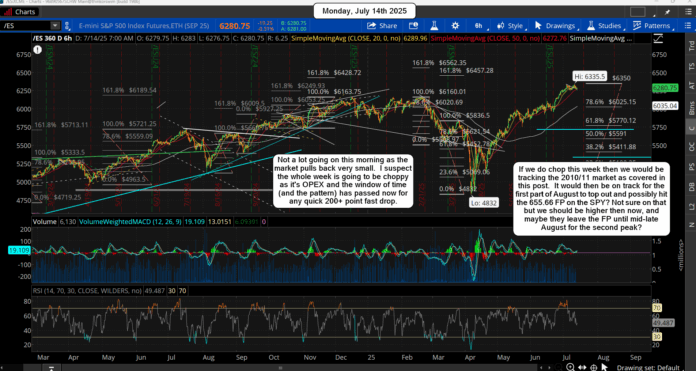

So I've taken some time to go back into the past to see if there's any pattern that looks similar to today's market, and I found one. It's the 2010-2011 period, which I'm posting below in a chart.

Nothing is an exact match of course but this one is close. It unfolded in 15 months and I'm expecting today's market to unfold in about 5 months, so we are running 3 times faster now. But it all aligns up nicely with a crash like move this coming September to October.

As for the short term, I don't think there will be any decent trade (up or down) until we get into the first (second?) week of August. Then we could see a similar to the 2/18/11 top to the 3/17/11 pullback. Of course it should be 3 times as fast if we are in that pattern. It was a 7-8% pullback so if we hit the FP of 655.66 on the SPY then the pullback would be around 606 roughly, which I'd guess will be around 6100 on the ES.

Have an blessed day.