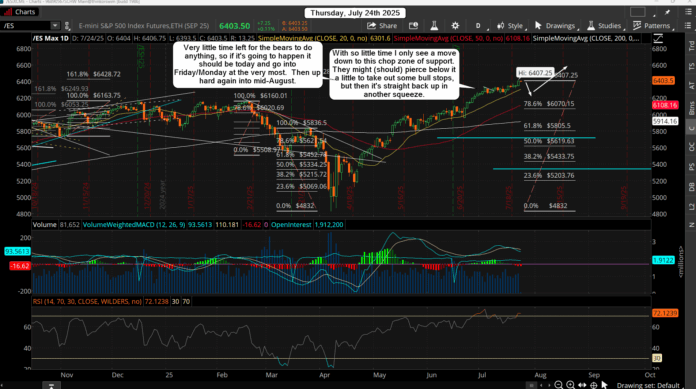

The market pushed through the 6370-6400 zone yesterday with a late day squeeze that happen and more afterhours. It looks like an exhaustion move to me, but until it tops and does a fast 1-2 drop I have to just sit and watch as there's no way I'm chasing the market up higher from this level.

If it skips the pullback and goes straight up to the 655.66 FP on the SPY then that's fine as I'll just wait and short it there. Of course if we get a fast pullback of 200-300 points I'll get long on it and hold until the FP is hit. There's still a little time left, like today and tomorrow roughly. AFter that though, if we don't pullback, it's not likely going to happen until we reach the upside FP in August sometime.

Also, NVDA slammed right into a major trendline of resistance at last weeks high of 174.53, and it's looking like it wants one more crack at it today. If it gets through it I think it will squeeze to 176-178 from all the shorts from the 174.53 high that placed stops overhead. Every trader see's the rising trendline that starts at the 6/20/24 high and connects to the 11/21/24 top.

It was an obvious short for everyone to take, so "if" the markets to dump it should take out the stops overhead first on NVDA (and the SPY/SPX/ES, etc...) in an exhaustion move, but I don't think it will stay above that rising trendline as the move up has been too parabolic and there's nothing but air below until the 150's. So, for today let's see if the bulls can do that last squeeze up and tank quickly with a 200-300 point drop into Friday or Monday.

Have an blessed day.

Tomorrow is the big 25. (777) We’ll see if anything materializes. The stock market is holding up but it is probably making a high today.

If there isn’t a disaster tomorrow then it can hold up into next week which would be 16 weeks off the low (matching wave 1) but today was not a positive day underneath the surface.

We have Saturn approaching Neptune to its closest point in many years. It will start to retrograde away. And several planets are lining up in squares (even T squares). We have the dangerous Mars Rahu opposition (see Oct 7 for a recent occurrence) among those squares. The new moon was today.

Crude oil held firm and so did interest rates which are potential ominous signs.

It could be we get denouement later on, following a final high (after a big correction–see November 2021)

SP 500 dropped to its trend point indicator and bounced last week. Nasdaq never did so it’s still in extreme exhaustion phase.

I was able to access your site today which is a rare occurrence from this access point.

You need to setup an account so you can login and then you won’t have any problems posting. Just send me an email with the username and password you want and I’ll set it up for you.

Geccko, I had to turn the captcha back on as I get 10-15 spam comments every day when I leave the comments open to guests. Please take the time to create a free account so you can login and then you can comment whenever you want as the captcha won’t appear on logged in users… just for guest. And unfortunately 99% of them are spammers. Sorry bud.

If we can squeeze one more time tomorrow to 6450 zone on the ES then I think will will have topped and will pullback 4% into next week.