Last Friday continued the pullback and lost the support of the 6250-6350 zone briefly but closed back inside the lower range. I'm still unsure on whether or not this support is taken out and we go deeper to the next support down around 6100 or so, but time-wise we should see a bottom by this Thursday roughly.

From that low we should rally up into OPEX week and there's still good odds that we hit the 655.66 FP on the SPY, which will be roughly 6600 on the ES. Now if we fall off a cliff this week and hit the 588.79 downside FP into Thursday everything will change as then I'll have to look for the upside FP getting hit in September. But right now there's still good odds of this happening.

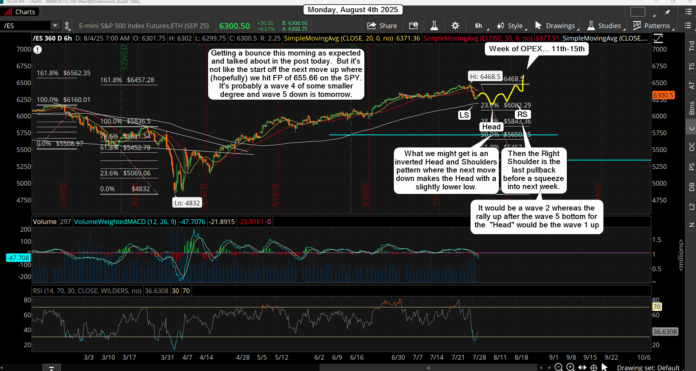

On a short term we probably have declined in an ABC where the B wave up did a slight "throw-over" an inched out a slightly new higher high. From there we dropped in the 1,2, and 3 waves inside the C wave. The 2 wave wave quite small and short lived, so possible we get a longer drawn out wave 4 followed by a wave 5 down to end the C wave. Here's a chart...

If this happens we could see the wave 1 up and wave 2 down into this Thursday to put in the last important low before we squeeze one last time for the wave 3, 4, and 5 to end some larger degree wave 5, inside an even bigger wave 3. I say that because the pullback coming to the 588.79 should be a wave 4 of a larger degree, so therefore the 655.66 coming top should end a wave 3 of a larger degree. Here's the bigger picture chart..

The move down to the 588.79 FP could be just an A wave of the 4 down? I don't know yet as the speed of the decline will tell me as if it's a slow decline I'd look for that FP to hit on September 18th, but if it's fast, like it hits in late August, I have to think we'll bounce for a B wave and go lower again for a C wave into September 18th to complete that wave 4, which then the door will be open to fill the gaps on the ES with the lower one around 5300 or so. It's too early to know which one will play out, so for now I'll keep it simple and jut look for a low this Thursday to appear and then a rally up into OPEX for the hitting of the 655.66 FP on the SPY.

Have an blessed day.