The market is getting short term oversold, but should have another push lower before any good bounce. There's still a chance we haven't topped yet. Yes, I know we had a ritual number high on the SPY with the 666 close last week, which could be equal to the 666 low in March of 2009, but without some "event" to cause a sharp drop to break support the market might go back up higher again.

I watched a video yesterday that spoke about the Fed preparing for a large QE injection by buying long term bonds to keep the interest on them stable. What I don't know is... "do they plan on doing that to create the last big squeeze to 7400+?", or "are they preparing to do that after the crash at the bottom of the market?" If the QE is to fuel the last leg up from here we should know this week as the pullback will not happen this week that many are hoping for, and instead it will hold support.

Quite frankly this market is so heavily manipulated that it seems impossible to trade it. Every pullback we get is stopped magically just at support that if broken a very large drop would follow. Also, let's not forget the common pattern that the market does around the end of each month, or the beginning... which is that it makes a "turn".

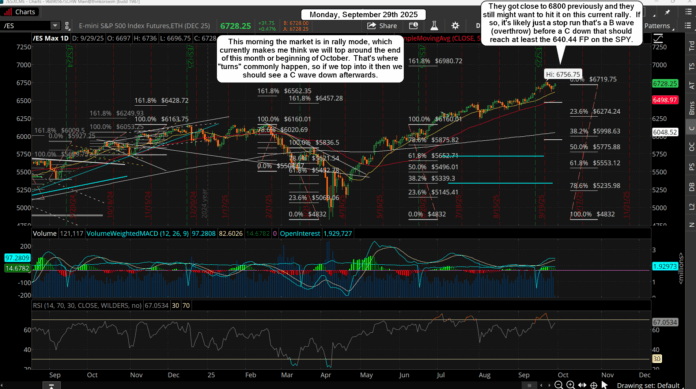

So if we hold support into tomorrow, and/or into the first then sadly I have to be open for the mega squeeze to happen the rest of this month, which is going into a low. If we go up into tomorrow. Wednesday, or even Thursday, and put in a high (could be higher higher or lower) then we could be in a B wave up with a C down to follow. At that point I'd be looking for the 6400 zone into next week.

I can't make the market do anything, and just have to be open to change if the does. Meaning... I don't think 6800 will be the high and hold the next move up if we see QE quietly come into the market, and instead I would have to think the 6756 high (ES) was "close enough"... meaning that rally was supposed to hit 6800 on that run but it failed on that run up, so it could be off the table now? Or we hit it mid-week and the drop.

For any big breakout though I'd want to pullback one more time early this week to bottom around support and chop there all week to "base" before starting that next big squeeze. Currently the market is looking more like the opposite will happen and we will rally up into mid-week, and that will open the door for a C wave down (even if we see a slightly higher high... 6800?).

Today and tomorrow should give us the next direction. If we chop, pullback small, and hold support (6600's) then short term charts will get oversold and I'll have to give up on the crash and look for the next big rally to start next week (Note: I don't lean this way, but have to cover it as "possible").

The market has been selling off in front of the government shutdown fears on the 30th, but that might not be enough to cause a crash. It might take something else to cause it... who knows for sure what will be blamed? The point here is that everything is a little too bearish with talks of crashes on social media, and we didn't get some big gap down this morning, so I'm losing my mega bearish bias and just focusing again on the technicals.

Yes, we could still see a nice correction in October, but not 50%... which would be a crash move. It might be 10-20%, I don't know, but it should setup the next and final move up for the 5th wave, and then the crash can happen. If we see at least a 10% correction then that final high should push out in time into 2026.

In summary... Plan A is that we continue higher into mid-week to make a B wave, leaving a C down to unfold into next week with 6400 minimum as a likely target (maybe more). Plan B is that we will end some kind of medium (or larger?) degree wave 4 down with one more small pullback this week to complete the smaller 5 wave decline, which should retest the lows and build a base to launch the next big rally up next week (a larger degree wave 5?) that will reach 7400+ into early November.

One of the two plans should unfold here and if it's Plan A then the C down will be much welcomed and should be perfect to get a great long for the last wave 5 up into November, possibly December for the blow off top (depending on how deep of course as the deeper the pullback the more time will be needed for the last rally up).

Have an blessed day.