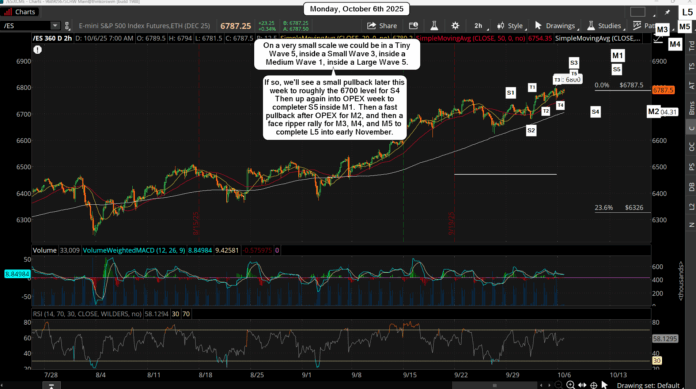

We reached the 6800 level last Friday, so that level of resistance should produce a pullback of some degree. The problem is that the bearish window of time has passed now and we are entering a bullish window. Therefore any decline we get this week is likely to be small and probably a "1 day wonder". Unless some unknown event happens I don't see more then 2-3% (at the most), and it should happen early this week (if it's going to happen?).

The last half of this month is very bullish from prior cycles, so I'd look for it to produce the strongest move up, like a wave 3 inside a wave 5 or something. Basically after OPEX on the 17th we could see an explosive rally that takes us into the first week of November where a significant top could appear. We could see 7400+ into that period, and if we do reach those insane levels the market will be ripe for a crash in November.

In the short term we could see the market carve out a wave 1 and 2 of the bigger wave 5, into OPEX next week. As for today I don't really have any thoughts about it. All wave 1's and 2's are hard to figure out the day to day movement. If one was interested in catching a wave 3 up I think we'll see it after OPEX.

Have an blessed day.