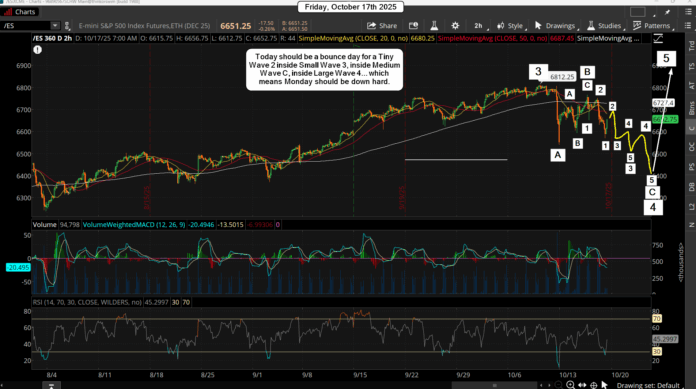

We rolled over yesterday to start what should be a wave 3 down inside a C wave. That wave 3 is probably going to subdivide into 5 smaller waves and with today being OPEX we could see the wave 2 bounce with yesterdays drop being the wave 1 down. If this happens we'll see the wave 3 of 3 of C down on Monday and into Tuesday where we could see the bottom of this move get hit, which I still think is around the 6400 zone.

Basically the market will want to break the low from last Friday to hit all the stops on the bulls, and after that the bears will be loaded up fully short and we should see a powerful rally back up the rest of the week. In conclusion I'm looking for a "pause" today that looks bullish but should hold support and not break it until Monday.

I only say that because today is OPEX and they might want the market to close around a certain zone to pin it for max profit of expiring options. The wave count is very bearish, and so are the technicals, which both support a bounce, but how long it holds is unknown. It might hold all day long and at the last hour rollover hard and keep going into next Monday. But I lean is that it holds all day to close the week out.

Have a great weekend.