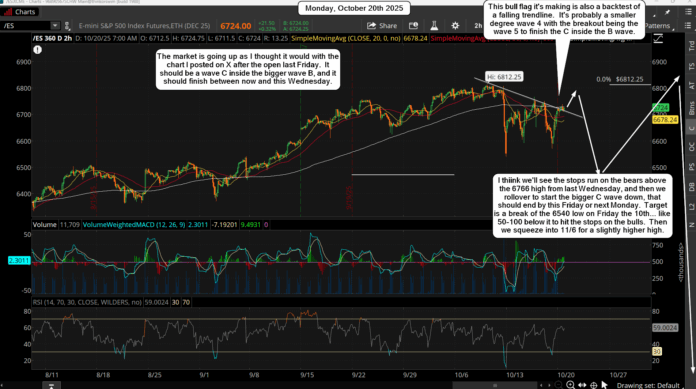

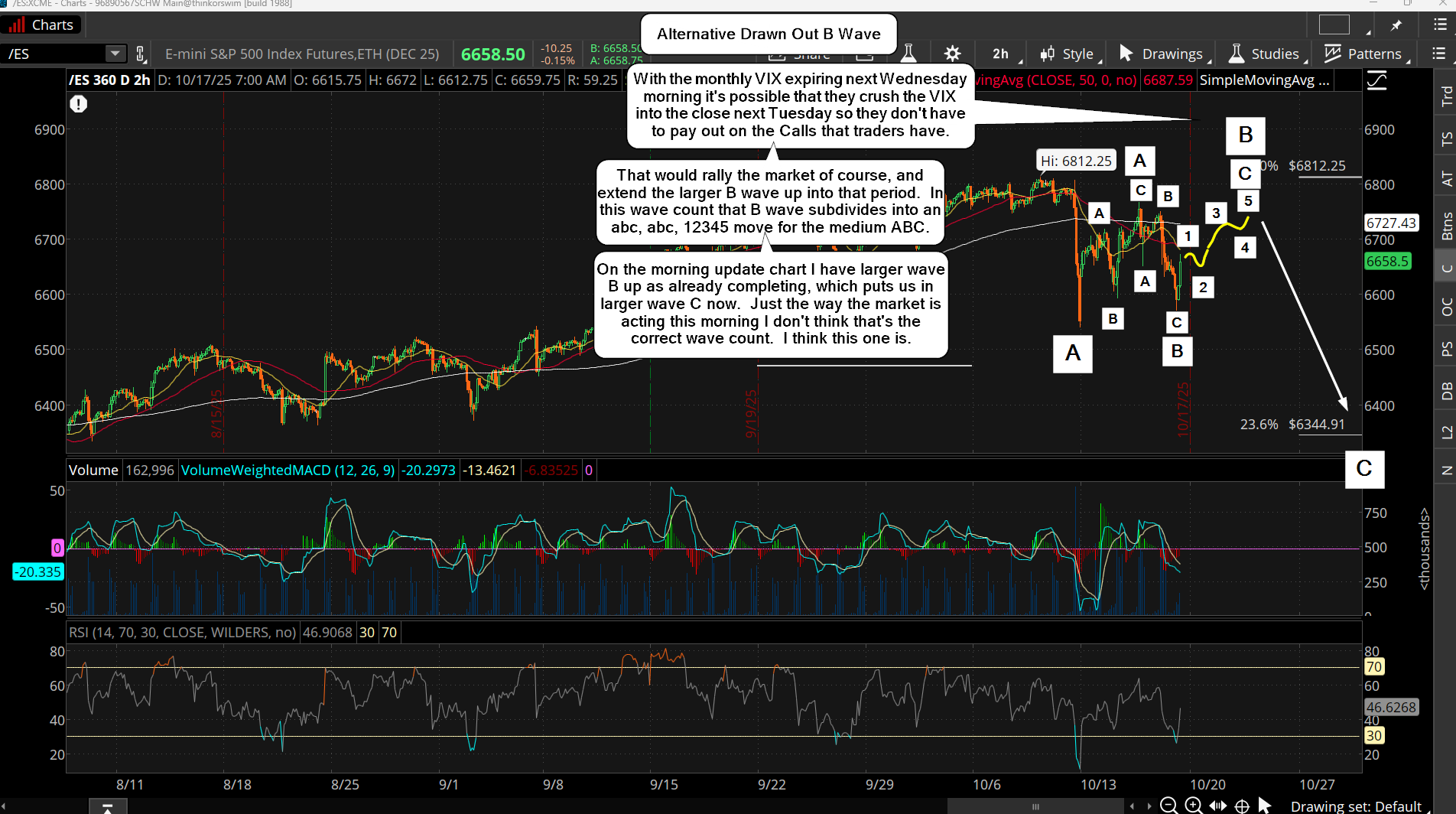

This week I'm looking for more upside into Wednesday to get the VIX down lower as it expires Wednesday morning at the open, so Tuesday at the close is the last trading for it. Because market makers want it down, so that they don't have to pay out on the calls, we should not see the ES/SPX do much downside, (if any?) and should see more upside to take out bears currently trying to short it.

I posted a chart on it on X shortly after the open Friday as I felt my current wave count needed to be updated to one where there's more subdividing waves. That chart is below...

After Wednesday though the monthly VIX will have expired for October and therefore it can be pushed back up again, and that means down in the ES/SPX. There's still a good chance that the recent low on October 10th will be taken out into next week, and I'm not expecting a lot below it, but we could see 50-100 points below that 6540 ES low to hit all the stops on the longs.

Then we can see a face ripper into my target date of November 6th for a slightly higher high, which after that I think we could crash and fill the gap on the ES down around 5339, and that will have every bear in the world looking for the April low to get hit next. But if I'm right that won't happen and we'll turn back up in a major big squeeze from that 5339 zone, with a new high into January most likely.

As for today... up into Wednesday, but not a new high , just a stop run on the bears shorting the peaks last week.

Have an blessed day.