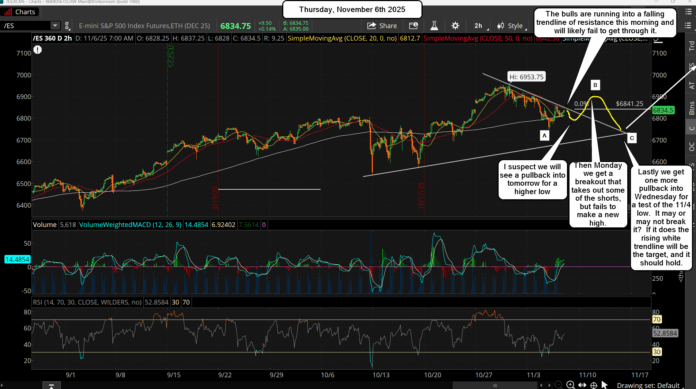

Chop today is what I'm looking for as support held yesterday and the market bounced. It's not ready yet for another new all time but after one more pullback mid-late next week we should start another big rally up.

I spoke about massive QE on the sidelines several weeks ago and I thought it wouldn't be used until we got a correction to my target of 5339 on the ES to fill the gap. But I was wrong as the Fed injected it into the market last Friday as explained in the video on yesterdays post. This tells me they will not let that correction happen as they want the market to continue higher for some unknown period of time.

Maybe they keep it up all year, who knows for sure? But right now it's obvious that they won't allow any crash to happen, so I expect chop for about a week to work off some of the overbought conditions on higher time frames, and the only way to do that is to either chop to burn time or drop in price quickly to get it oversold. I'm thinking that we'll get down close to the 6700 zone on the ES at some point next week, and from that zone we'll start the next nice rally up into the first week of December where we should hit resistance and exhaust that 2 week rally.

Have an blessed day.