A very controlled decline yesterday... super sneaky. I was looking for either a move up at least get close to the falling trendline to play out, and then down. But they just rolled over very slowly and declined all day to a new lower low then the Friday low. The rising trendline was broken on that move down but was recovered back into the close.

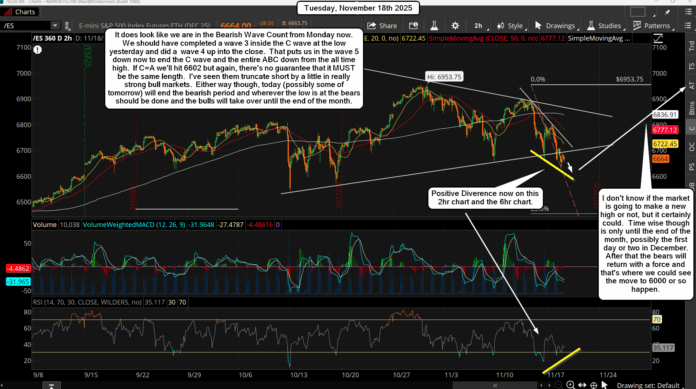

I said in yesterdays post that we could have a Bearish Wave Count play out where the C wave was equal to the A wave, and NOT a deep one to the 640.44 FP on the SPY like I would have loved to seen happen. This is looking more likely now that the C wave has either already ended at the 6658.50 low yesterday or will go a little low again today to reach the 6600 level. With the VIX up over 10% yesterday odds are very strong that we'll see a green day today or tomorrow at the latest.

If we decline again today for a lower low then it's a big buy in my opinion as there's positive divergence forming on the 2hr and 6hr chart of the ES, so a strong move is near. And the bearish period (from cycles) is ending today and/or tomorrow. The bullish period then starts and goes into the end of the month, where we could see a new all time high reached, like the 7000 level that the market is very attracted too.

We have earnings from NVDA out Wednesday too, so that could be used as a trigger for a squeeze to start... especially since we will be entering a bullish period then. All things point to a strong rally starting tomorrow, so if I was a bear I'd be looking for an exit today as "time" is running out for them.

Have an blessed day.