Last week was wild with all the big swings up and down but as we enter this week of Thanksgiving, and into next week, the bulls have the ball again according to the cycles. I said last week after the surprise big drop that odds were low that the bulls would make a new high, but really that's not the case.

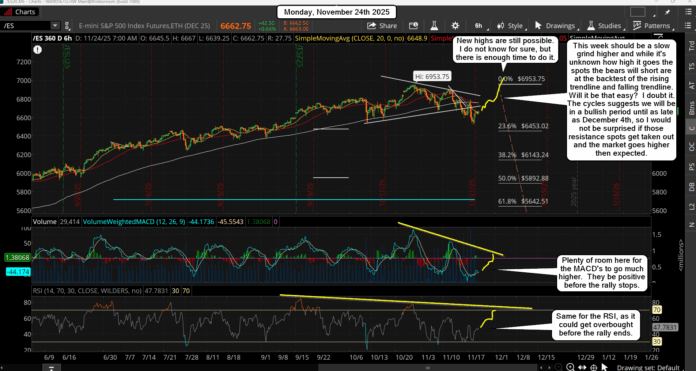

With so much time left the bulls could still reach the 7000+ level into next week as it's really not that many points higher when you really look at it. Bears are going to be focused on the backtest of the falling trendline of the triangle, which is an obvious target for a move back up to end and rollover from. It's also a picture perfect right shoulder for a head and shoulder pattern. But with the Fear and Greed index buried so deeply in extreme fear I just don't think it's going to be that obvious and easy. Now if the bulls spend all of this week and part of next week to just reach that zone, then yes, that's likely all she wrote for them.

But I suspect we'll see that falling trendline hit this week, and the expected pullback from it won't happen like the bears are expecting. Sure, there should be some reaction there, but I think any pullback will be only be done to trap more bears before the squeeze through it. New all time highs are still possible into next week if the bulls want them.

We could then see a negative divergence setup on the MACD's of the daily chart of the ES and SPX, and even positive divergence on the VIX if it makes a higher low. That would be the perfect trick on the bulls and bears both to hit 7000+ into late next week when the bears will finally give up and the bulls will be thinking the Santa Rally started early and 7400, 7500, or even 7600+ is coming in December. But that is the trap on those bulls as they will be fully long and all the bears will have capitulated after the new highs.

It's a sneaky setup for a large drop to 6000 or so in front of Christmas, when no one is expecting it. It happened in 2018 and it could happen again this December, and I suspect that whatever high we get into next week will remain the high for several months as after the real Santa Rally happens January should have another drop even lower. Ultimately the ES is going to have to close the gap at 5339, but that might not occur until February or March of next year. After that we should see one final blow off top rally into April or May where 7600+ is likely... then the bear market starts.

Have an blessed day.