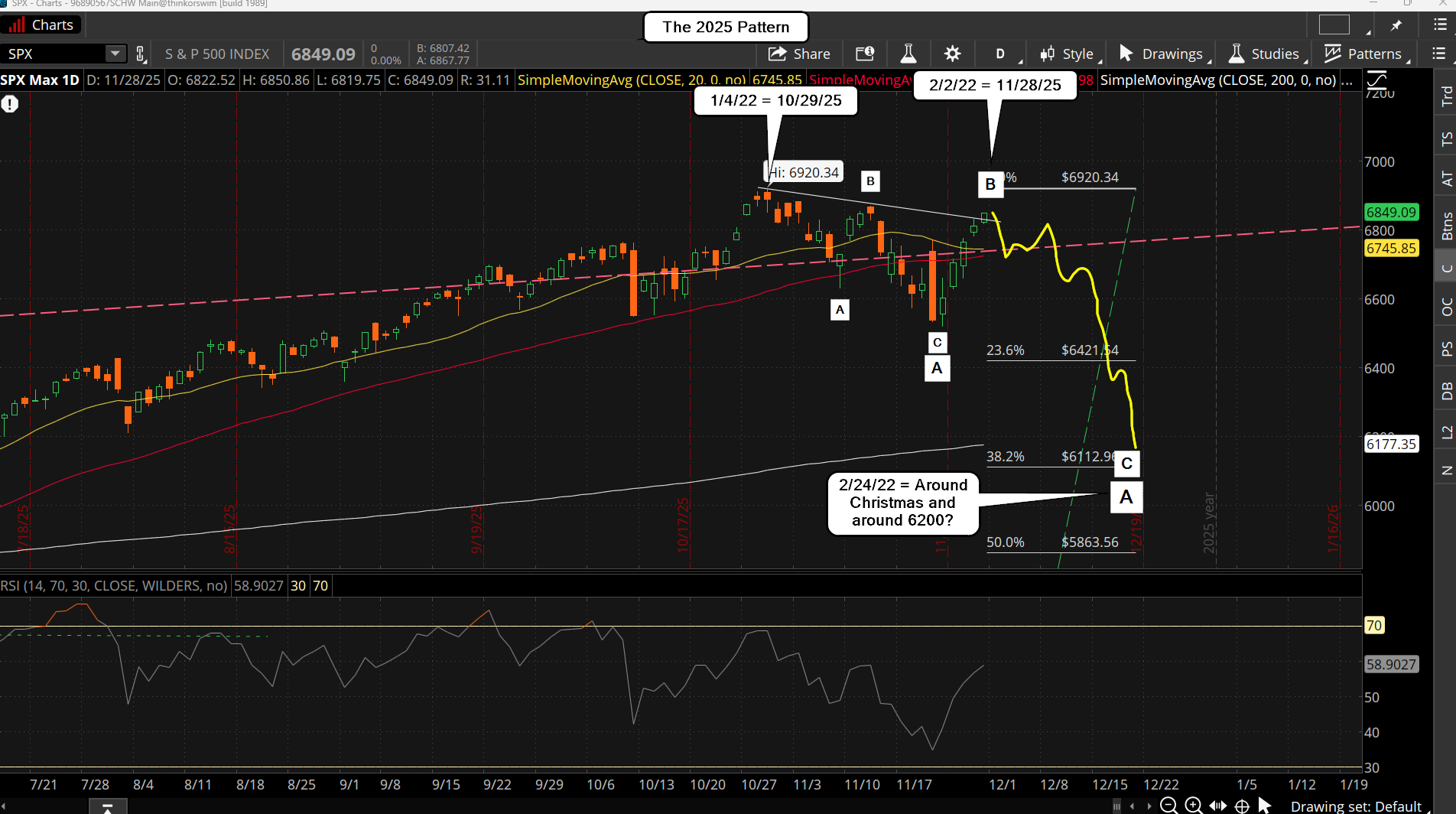

We got the 30-50 point move up on Friday as I thought was possible. I did take a short and will get another one early this week if given another good spot to take one. The rally that we had last week was very similar to the 3/17/22 to 3/30/22 rally, but not equal in "time" though. That entire decline looks similar in "pattern" as there was an ABC move down from the high on 1/4/22 to the first low on 1/24/22. Of course it's not "day for day" an exact match but it sure looks like our decline from 10/29/25 to the low on 11/21/25. Look at the charts below...

Even the about of the pullback was similar as that first ABC down in 2022 was roughly to the 23.6% Fibonacci Level when starting from the 2020 COVID low up to the 2022 high. If you start at our April 2025 low (which also was similar to the COVID crash in "pattern") and go up to the current high, then the decline we had few shy of the 23.6% level, but was close. After the big bounce that happened in 2022, which is similar to last weeks bounce, the next decline went down to make a new lower low on 2/24/22, which if we did that again I think we will be looking for roughly the 200 Day SMA around 6200. Look at the charts below...

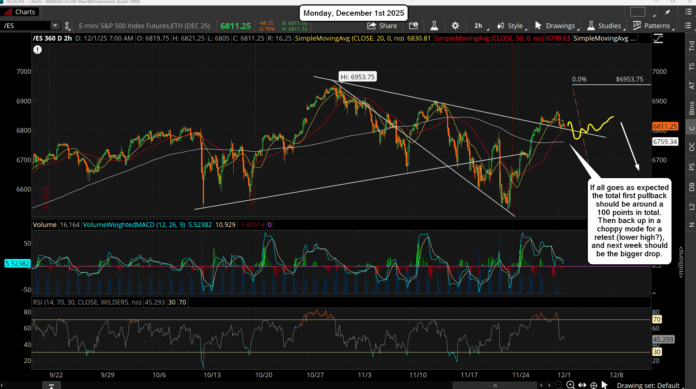

If the pattern remains similar we could see a quick 1-2 day pullback early this week, then a move back up for a slightly lower high this Friday then last Friday, which is like the two highs on 2/2/22 and 2/9/22. If this happens again it will be next week when we see the bigger drop, which carries into the following week as well. It could bottom right into Christmas if the pattern continues to repeat. Even the Santa rally is in that prior chart, and it would be one that fools everyone as back then it rallied from the 2/24/22 low until 3/2/22 (which could be equal to January 2nd 2026?) and the dumped for a couple of weeks to dance around the prior lows but not break them. Then a big rally back up followed, and that might be equal to a second half of January 2026 move? If it repeats February and part of March will be ugly for sure.

But I'm getting ahead of myself as while the pattern has been tracking recently it doesn't mean it will continue. We'll just have to take it week by week, and for this week I'm looking for a wave 1 down inside a C wave to play out, and a wave 2 back up. Again, that's similar to the 2022 pattern as well, whereas last weeks rally was a bigger B wave up, with the ABC down from the all time high being the bigger A wave down. We should be starting the bigger C wave down this week and end by Christmas. That entire move will be an ever larger A wave, and the rally back up in January will be a larger B wave.

So, for the short term, I see a 673.72 FP on the SPY that was put out last Friday. I'd say that will hit early this week and it will be my wave 1 down. Then we bounce into this Friday for wave 2 back up.

Have an blessed day.