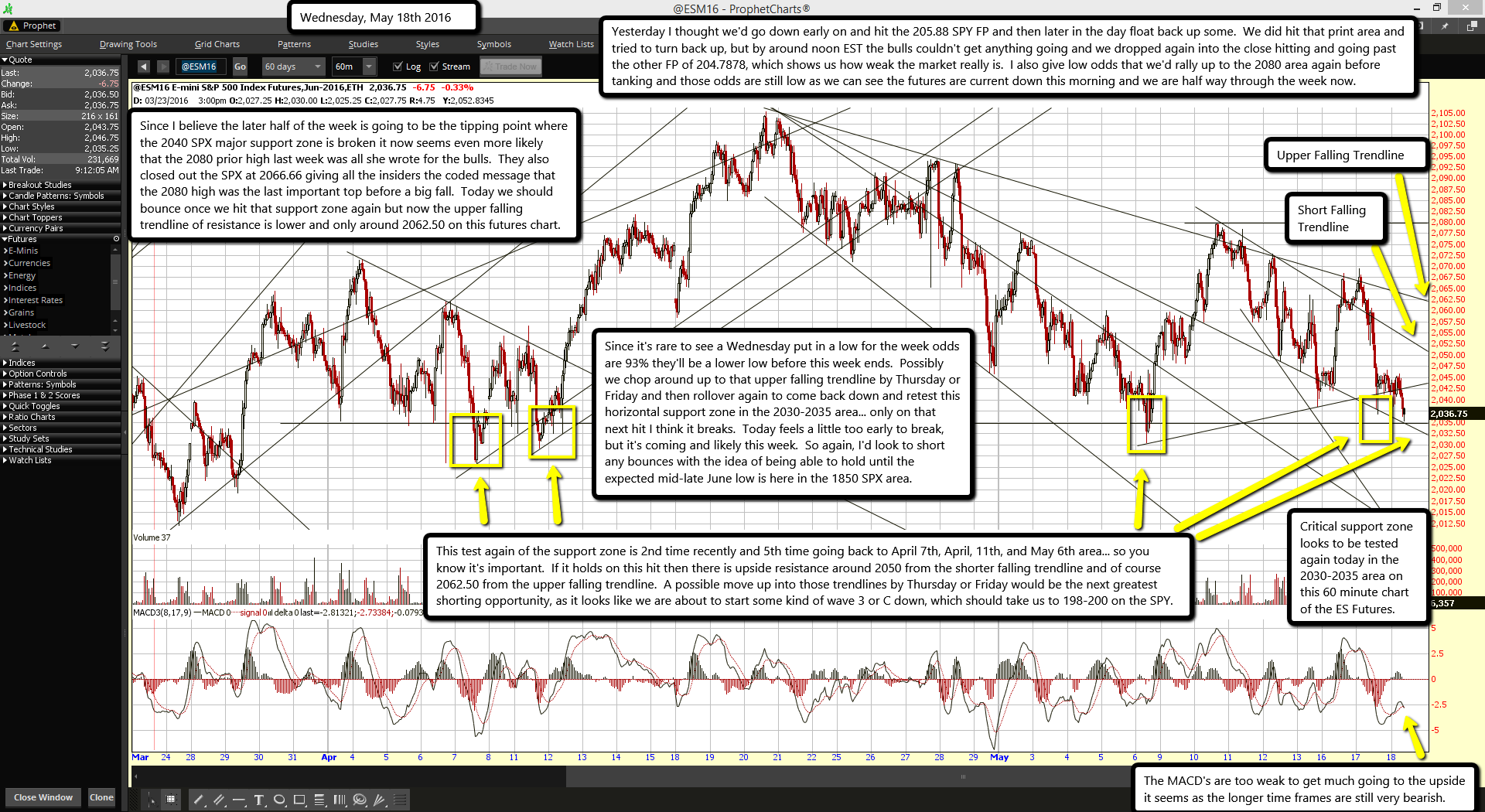

Critical support zone looks to be tested again today in the 2030-2035 area on this 60 minute chart of the ES Futures.

The MACD's are too weak to get much going to the upside it seems as the longer time frames are still very bearish.

Yesterday I thought we'd go down early on and hit the 205.88 SPY FP and then later in the day float back up some. We did hit that print area and tried to turn back up, but by around noon EST the bulls couldn't get anything going and we dropped again into the close hitting and going past the other FP of 204.7878, which shows us how weak the market really is. I also give low odds that we'd rally up to the 2080 area again before tanking and those odds are still low as we can see the futures are current down this morning and we are half way through the week now.

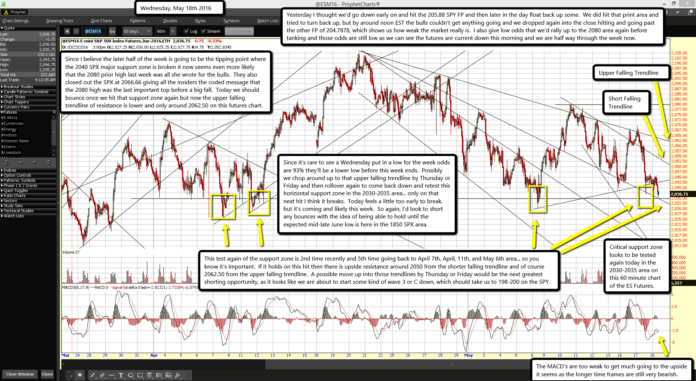

Since I believe the later half of the week is going to be the tipping point where the 2040 SPX major support zone is broken it now seems even more likely that the 2080 prior high last week was all she wrote for the bulls. They also closed out the SPX at 2066.66 giving all the insiders the coded message that the 2080 high was the last important top before a big fall. Today we should bounce once we hit that support zone again but now the upper falling trendline of resistance is lower and only around 2062.50 on this futures chart.

Since it's rare to see a Wednesday put in a low for the week odds are 93% they'll be a lower low before this week ends. Possibly we chop around up to that upper falling trendline by Thursday or Friday and then rollover again to come back down and retest this horizontal support zone in the 2030-2035 area... only on that next hit I think it breaks. Today feels a little too early to break, but it's coming and likely this week. So again, I'd look to short any bounces with the idea of being able to hold until the expected mid-late June low is here in the 1850 SPX area.

This test again of the support zone is 2nd time recently and 5th time going back to April 7th, April, 11th, and May 6th area... so you know it's important. If it holds on this hit then there is upside resistance around 2050 from the shorter falling trendline and of course 2062.50 from the upper falling trendline. A possible move up into those trendlines by Thursday or Friday would be the next greatest shorting opportunity, as it looks like we are about to start some kind of wave 3 or C down, which should take us to 198-200 on the SPY.