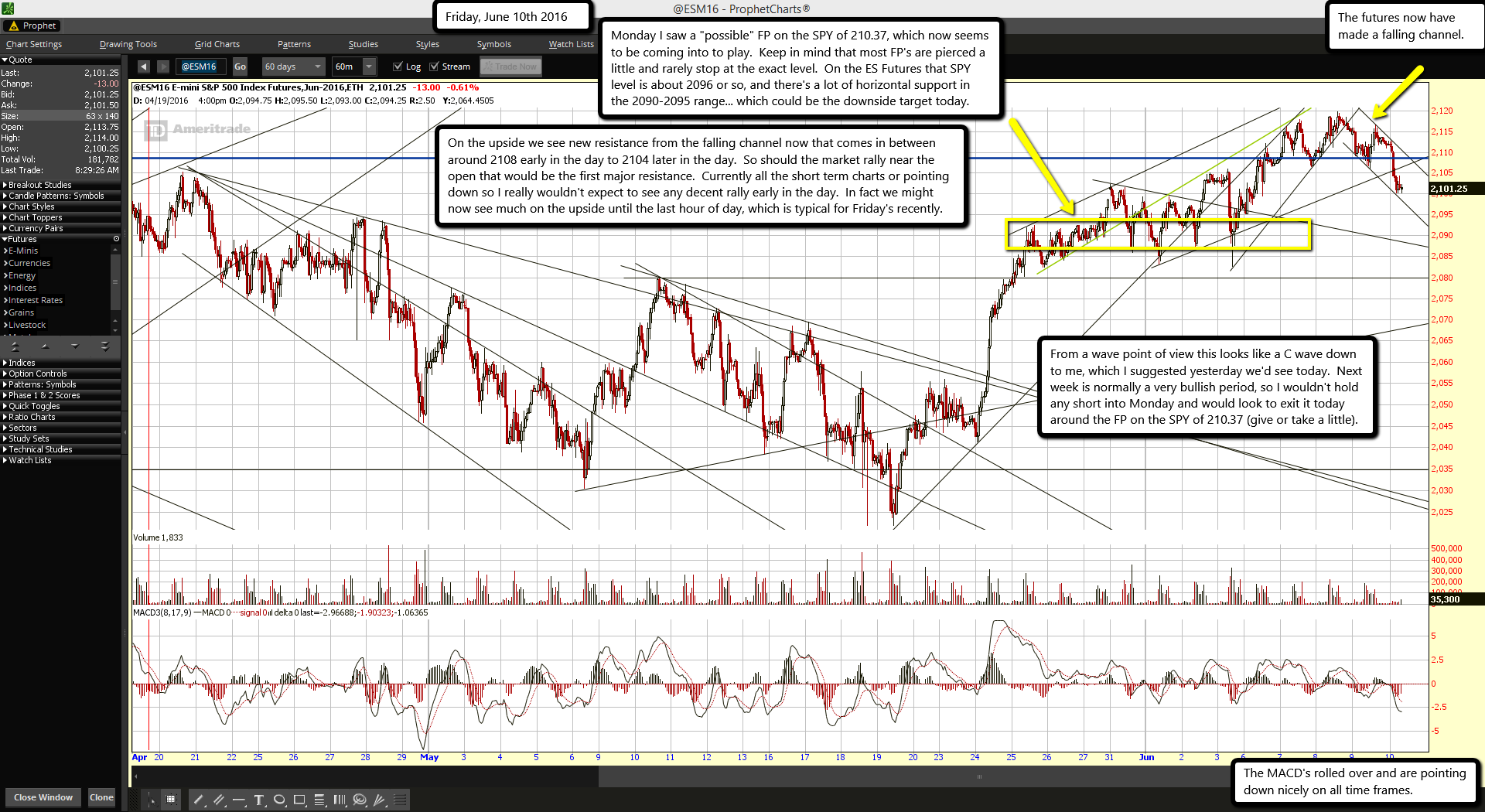

The futures now have made a falling channel.

The MACD's rolled over and are pointing down nicely on all time frames.

Monday I saw a "possible" FP on the SPY of 210.37, which now seems to be coming into to play. Keep in mind that most FP's are pierced a little and rarely stop at the exact level. On the ES Futures that SPY level is about 2096 or so, and there's a lot of horizontal support in the 2090-2095 range... which could be the downside target today.

On the upside we see new resistance from the falling channel now that comes in between around 2108 early in the day to 2104 later in the day. So should the market rally near the open that would be the first major resistance. Currently all the short term charts or pointing down so I really wouldn't expect to see any decent rally early in the day. In fact we might now see much on the upside until the last hour of day, which is typical for Friday's recently.

From a wave point of view this looks like a C wave down to me, which I suggested yesterday we'd see today. Next week is normally a very bullish period, so I wouldn't hold any short into Monday and would look to exit it today around the FP on the SPY of 210.37 (give or take a little).