The light volume continues to allow the market to float higher as NO Big Institutions are doing any large selling. Why? Simple... they all owe a favor to Uncle Sam. Put simply, I believe that Obama, Bernanke, and Geithner are sending a message to the big boys... which is "Don't Sell" until I tell you too.

Remember, the government and Goldman Sachs have a revolving door now. And since Goldman and all the other big banks and institutions stole the tax payers' money, and used it to buy up their own stock... instead of getting it back out to the economy in the form of loans, they now have too listen to what Obama and the gang wants.

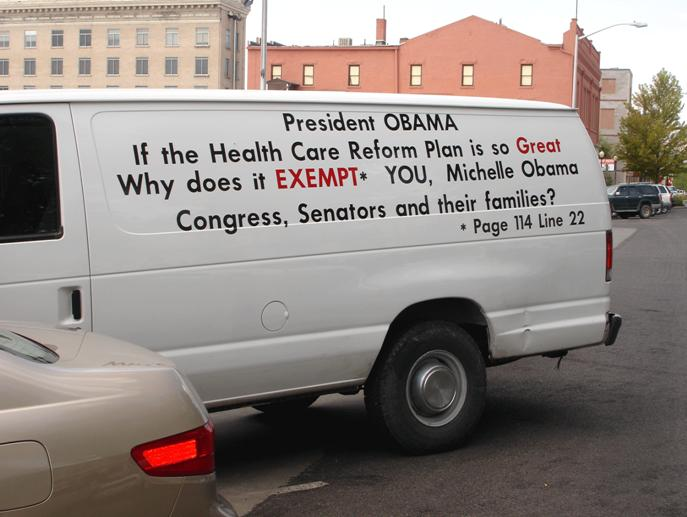

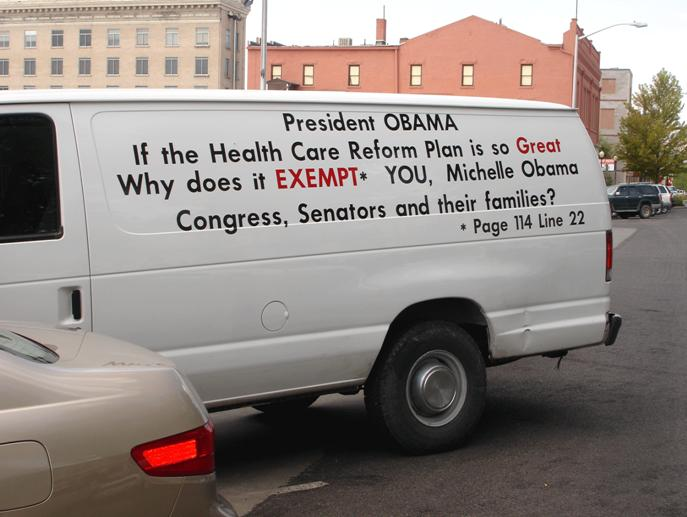

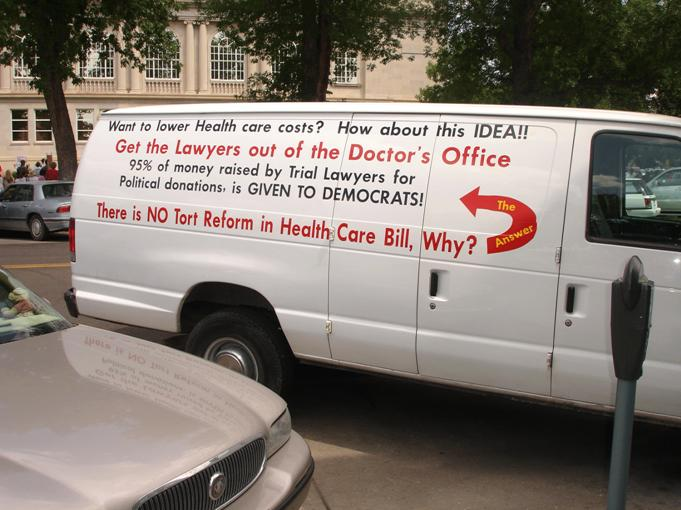

What do they want? Probably to pass that worthless piece of crap health care(less) bill (The actual bill). I don't know for sure of course, but Obama has been pushing it down our throats for quite some time now. It's his baby, and he's not stopping until he screws every middle classed American.

I thought Bush was bad, but Obama is worst. It's not just the health care bill, it's everything... from this manipulation of the stock market to the outright lies on economic reports, and of the Billion's of tax payer dollars that was given to the crooked banks. Sheesh... Bushs' biggest lie was the ol' "They got Weapons of Mass Destruction" speak. He was too dumb to speak about the economy.

Obama is the slickest crook since Nixon (well, I guess he wasn't that slick after all). Of course Obama is really just a front man for the real people that run the country, behind the scenes. I think most all elections are already planned out who is going to win, and become the next president... just like the cities are already picked out for the future Olympic games.

Regardless of who is running the country, the manipulation in today's market is absurd. So trying to forecast this market is just as absurd. I'll repeat it again... just to hear myself say it! "This market is EXTREMELY Overbought and should sell off some very soon (like last week)". Will it? Of course not. However, it should (might... maybe... LOL) sell off after option expiration is over this Friday. But a BIG Sell Off might not happen? We'll just have to wait and see...

Red

Tue 3/16. There was a significant surge in moneyflow across the board. It is possible for a sector to experience such surge in money flow while the rest of the market segments collapse around it, bringing it down, despite the surge in money flow. What is difference this time is, the surge is across the board. It would be an exceptional event, a true outlier, for the market to collapse. If anything, it actually lends weight to the possibility of a meltUP. A snapback collapse may follow that. Giiven the new high in the AD line, it virtually ensures that any down turn will not exceed 10%.

I actually agree with you SC… At this point the bears would be lucky to get another 10% correction. Right now it's pretty clear… Free Money = Up Market.

Today 3.17.2010 is an important day as a number of sequences align.

3.17.2010 is 888 days from the 10/11/2007 $SPX all time high

111 = 1.30.2008 high

222 = 5.19.2008 major high

333 = 9.8.2008 major high

444 = 12.29.2008 low

555 = 4.17.2009 high

666 = 8.7.2009 high

777 = 11.26.2009 dubai ritual (ES dumped 40 handles overnight)

another sequence aligns from the 3.6.2009 low

3.17.2010 = 1 year 11 days

important sequence from the 3.24.2000 $SPX high

9 years 11 months 21 days

Very freaky! If they dump the market today, that would just blow my mind!

Does Monday 3/22/2010 hold any significance?

important sequence from the 3.24.2000 $SPX high

9 years 11 months 21 days

thank you operators for the $SPX closing number

1166.21 = 11 – 9 (9) – 21

My thoughts- all the technical conditions within the next two days should make the market ripe fro a major sell off (except for the dollar needs to rally but maybe a small sell off would actually spark that). The government says the healthcare plan resolution will be announced within 72 hours. I believe they will hold the market up until then and maybe for a day after (so it doesn't look like the market sold off because of a passed plan). Maybe the day after the plan passes (over the weekend), the government will stage a major catastrophe (perhaps in the middle east) so that a market sell off can then be attributed to something besides the health care plan. I know it sounds like a conspiracy theory, but I am beginning to believe in them 🙂

Here's a “conspiracy theory” for you… the government is honest. LOL Anyone believing that one has to be insane!

Carl's morning call:

June S&P E-mini Futures: Today's range estimate is 1147 – 1161. The ES should reach the 1200 level by the end of May.

1145.50-1155.75 range yesterday

1159.50 high overnight

1147-1161 range estimate today (June contract) 14 points

1157.50 currently, so -10.50 to + 3.50 from here (Bearish)

Take a look at Serge's post today. Anna also seems to be expecting a drop. But Anna says she would cover all shorts. I don't know why though.

Looks like Serge was bearish for today.

Anna was probably just reacting to feeling poorly and needing to be away from the market.

I've been watching TZA today, and the weak bounce off the lows is not encouraging.

I am not feeling good about TZA today. I may bail.

I think the close will be very important today to determine what the heck to do.

$7.02 low is holding.

I have S2 at $7.03. S2 or thereabouts is a reasonable place for a bottom.

I'm still ok holding.

Carl just went long.

Did he say why since his projection was lower?

Full Text:

During the past month the e-minis have rallied 80 points. Yet the market has been very quiet during this rally. Volume has been moderate and pit session volatility has been low.

I find this remarkable market behavior. Today, for instance, the ES is trading at new bull market highs. Volume has been very moderate and the market has traded in a five point range over the past two and a half hours. One thing I have learned over the years is that short term tops of any importance generally occur when trading activity is relatively high and intraday volatility is relatively high. Advances generally end with a bang, not a whimper.

So I have to conclude that the 20-30 point reaction I have been looking for is not here yet. Instead I think the ES will reach 1175 before any significant break of more than 10 points develops.

I am revising today's range estimate to 1157-1170.

Is this changing your outlook on TZA?

To me, Carl's reasoning for the day seems somewhat suspect because the volume hasn't really changed in the recent past. And where the heck is he getting his numbers from? Not to say he's not correct but his reasoning is definitely suspect.

For all I know, his reasoning might always be suspect. He doesn't usually explain his thoughts. Does pretty well though, and that's what counts for me.

Fair enough. Do you have his bio? Just want to see if he worked at GS too:)

Email on the way

Earl,, will you send that to me also.

I am far more concerned about it, but the $7.02 low is still holding.

My worry/relax line is now $7.04 and TZA is at $7.05.

So for these precious few seconds, and am relaxed 🙂

A 10 cent drop in 3 seconds doesn't seem out of the question. It's a war of nerves.

Thank you.

Wow He is actually bearish for once?

I remember seeing it one other time 🙂

Added tZA at 7.05

Added TZA at 7.06

Where is your stop. mine at 7.00

Expecting $7.02 to hold.

$6.98 would change my mind.

It is hitting the S1 support on the underside. room to run if it breaks above 7.10

XLF prints 15.82, completing it's bullish setup on a day when 3 sequences align, I'm sure it's just a coincidence

http://www.flickr.com/photos/47091634@N04/44234…

Thanks – besides UUP is there anything else we have to wait for?

the UUP setup is separate setup from the equity markets, if the uup gets above it's knot of containment points any upward movement in the equity markets would then be corrective

the only other setup I have is the 16.26 de-leverage point on the $VIX

Not sure we can get there today on the VIX but we'll see.

The VIX sure is coming down fast though with no move in the equity markets.

Goodness – we need that healthcare plan passed during market hours today so that VIX can spike down just for a millisecond! I have a feeling there will be no such luck.

vix ain't budging.

Carl is Long one unit at 1161.50

Carl just revised today's range estimate to 1157-1170.

Don't doubt he is right. Let's see where the VIX is when we get to 1170.

This is unbelievable. IYR has an RSI of >80. $RUT has an RSI of >77. $RUT:$RVX still not giving a BB sell signal. I'm just dying to short something.

Dread, I'm just dying from shorting everything! Even if you guys decide not to go short, I would not go long, even if we run much higher. EVERYTHING is saying this market is overbought.

I still have about 33% of my 401k long, so I am benefiting from this insane ramp up. My trading account is all cash, except for a (worthless) $50 position in SRS calls.

This market was overbought at 1150. Now it is really overbought.

Tell me about it.

Shorting something and dying seem to go together 🙂

Since Feb. 4th, that's been soo true.

Shorting a liquidity driven market = standing in front of a runaway freight train with a gold vault on it.

Logic says good idea to intercept that train of gold. But you'll be dead.

I don't believe market forces can be controlled over any long term by intervention.

While that statement is technically correct, the application of it is based on too many assumptions.

I think people are over estimating the degree of control and intervention. I think crowd or mob psychology has a better explaination for market action. It is more likely that the effect of any intervention is a function of harnessing the mob psychology.

WallStreet runs on one axiom : Let the devil get the hind most.

I really don't think that many retail investors are involved in this market.

Not direct retails. Things have changed. Nowadays, retails are in the market involuntarily, via their retirement plans. So they are not in via their own brokerage accts. But they are all in via institutionally managed retirement plans. The American people are being screwed b/c most of them have no clue what is going on with their retirement plans. They know they have one, but no clue what is being done with their money in those.

That is very true but I don't think that many new people are pouring money into their 401K plans with the state of unemployment.

When is the last time you saw it like this?

Late July/ Early August for IYR.

Out of TZA

OK – I don't blame you.

Remember that TZA tends to take a few days to bottom out. If we have a reversal soon, you should have another chance to get in.

Thanks for the reminder. I do tend to forget that.

I'm expecting a squeeze into the close. If I get that, I'll probably take a real short position via DRV.

Dread, DRV down 3.00 in last 10 days. What is the attraction to it. Would you do it via stock or options?

DRV is the 3x bear real estate. $DJUSRE is outside of the upper BB right now. It closed yesterday outside of the upper as well. Volume in DRV was highest ever, yesterday. Looks like it is putting in a doji today, which is not what I had hoped for. I'm not messing with options for the time being.

so if we trade down into close you will pass?

I might. It's hard to say. DRV was up about 3% since the earlier 52-week low. I think there will be at least one more chance to get in by the close today or maybe tomorrow am. Like with TZA, it tends to take a few sessions to top out. The only thing that has me worried is opex.

That is a wild card for certain.

Also if they are going to vote on healthcare this weekend. They may sell this market on Friday.

Why would they sell the market off before the healthcare plan is passed? I would think they would hold it up until the plan was passed, no?

Sell the news. I think they wait for it to pass. It could be weeks before they finally find a way to pass it.

Or months. They don't seem to be able to pass it or quit trying.

They said on good morning America this morning that a decision was to be made in 72 hours.

Baloney. The decision is: try to pass it.

72 hours or 72 days makes no difference.

They are idiots.

Yes, perhaps. But why would they come out and say a decision would be made if they couldn't be sure it would? That would just make them look bad?

Obama wanted it all finished before the August recess. There have been lots of deadlines. Just creates a sense of urgency. After the deadline passes, there will be a new deadline.

I'm no longer pretty sure we see a squeeze into the close.

TZA is bouncing back (figures).

I think you'll get another shot tomorrow. The MACD on $RUT is closer to “closing the loop” than $DJUSRE is. But there is still room for an insane price surge. Look for a long tailed doji tomorrow. If we don't get that, then I have no idea what is going on 🙂

What's bothering me is that the VIX is not coming down as the market is moving up.

We are very close to the lower bollinger band on the $VIX.

What does that mean exactly? Does that mean it will be hard for it to go lower?

If it closes beneath the lower bollinger band, that is step one of generating an equity sell signal.

Hmmm.

Happy days for the bears are coming. We have several indicators lining up for a short but sharp correction.

Not giving the bears false hope here. The AD line basically immunizes against any thing major. 112011-1130 most likely. 1100 at best.

To the perma bears here, it is my sincere hope that you take the opportunity to make a full regroup and reassess your overall strategy. If you haven't read Van Tharp's books, please do so. There are certain trading principles that you cannot hope to suceed if you violate those. There is no glory, honor or profit in being stubborn and blowing up an account. You are not blazing new trail there neither. Being there done that. I am not being holier than thou here. I feel like an old man watching a bunch of kids joyriding, drinking and running red lights.

“Cut that shit out, kids!”

” SHUT THE F UP, GRANDPA! Go suck a tea bag!”

No, appreciate it. Thanks SC. I will have to access if/when we get there, but most likely I will be covering my shorts if/when we get there.

Meant to say assess!

SC, The trend is your friend. The trend is still up. I will cover any shorts on a pull back. Good Advice.

Yes. You are correct. I didnt mean to mislead by saying 'it's here'. I should have said 'expecting it soon'.

SC I did not take it that way.

Don't think we are going to make it to that VIX number if we pull back now.

the low of 16.52 corresponded to the controlling TL on the weekly

http://www.flickr.com/photos/47091634@N04/44415…

Yes, sundancer, but I am assuming that doesn't have any long term implications since it didn't hit it's containment level. I guess we have a pullback now to 1120 or so and then new highs. Oh joy.

i wouldn't worry too much about .26, the sequence setup I posted this morning is much more important

Yes, but are you suggesting the sequence setup could indicate a long term top or do you think it is just an interim top? I need to decide now whether I cover on a decent pullback or stick with my original conviction that we are at a long term top. Regardless of how you answer though, I will not pin my final decision on you.

Carl just sold long unit at 1161.50 (breakeven)

Still short but I don't see any reason why we can't go higher tomorrow.

Although the MACD on all time frames are pointing down. Who knows with OPEX though.

Actually, looks like the short term turned up at EOD. Not sure though.

$SPX 1 – 2 – 3 dance

http://www.flickr.com/photos/47091634@N04/44408…

all dogs get trained the same way, Fido is almost full trained once again and he only knows one command

Carl at day’s end:

1147-1161 1st estimate today for /ES (14 points, June contract)

1157-1170 2nd estimate today (13 points)

1157.50 -1165.50 actual today (8 points)

Missed it so bad he revised it.

Trades:

In /ES at 1161.50, out at 1161.50 for breakeven

Grade C (didn’t lose any money)

Index %

$SPX 75.44%

$NDX 90.99%

$DJI 66.43%

$RUT 100.51%

TZA opened down 0.8%. Gap today was not filled. TZA was down 0.8% at it’s high (the open). TZA closed down 2.0%.

We are in a New Moon Trade, which favors TZA, starting at the close today.

After two days, this trade is down 4.3%. AmericanBulls will surely issue a sell signal in 90 minutes, so I am selling now. TZA can be sold now in the after hours session at $7.06, so that is the selling price. This trade will buy TZA again once AmericanBulls issues a BUY signal.

Volume for TZA was the highest of the last 25 days.

$RVX (VIX for $RUT) closed down 1.0% with TZA down 2.3%. No divergence.

TZA has now been down 9 of the last 11 days.

The low for TZA today was $6.93. This is the lowest TZA price ever.

Ultimate Oscillator for TZA bottomed at 20 eighteen trading days ago and has generally risen since then but has remained below 50 and is currently 32. Indicating continued weakness for TZA. Today’s value was lower than yesterday which was the highest of it’s previous 4 days, so the mild Ultimate Oscillator up trend ended today. Not good for TZA.

Bollinger Bands for $RVX (VIX for $RUT): today’s candle finally fell below the congestion area toward the bottom Bollinger Band. Lowest close of the last 7 days. The lower Bollinger band quit rising. MACD has crossed from below. Looks like $RVX is dropping. Bad for TZA.

Bollinger Bands for $RUT: The white candle for $RUT moved up today, along with the upper Bollinger Band, indicating that $RUT might rise tomorrow. $RUT hit a new high today. Bad for TZA. (everything same as yesterday)

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s candle rose above the

congestion area. The upper Bollinger band rose after being flat for days. Perhaps indicating that TZA will fall.

TZA had a lower high, lower low and lower close (2nd day in a row) – all bad for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks like TZA might fall tomorrow.

Thanks Earl.

USO 2nd backtest of TL

http://www.flickr.com/photos/47091634@N04/44411…

USO is giving clues…

The view from Americanbulls

TNA is a confirmed BUY today. TNA is available now for $55.93 in the after hours session. AmericanBulls recorded their buy at $55.36 (opening price). The candlestick of today was a White Candlestick (normal buying pressure).

TNA was up 3.6% since the sell signal two days ago, using AmericanBulls price points.

TZA is a confirmed SELL today. TZA can be sold for $7.05 now in the after hours session. AmericanBulls recorded their sale at $7.14 (opening price). The candlestick of today was Black Spinning Top (complete indecision between the Bulls & Bears).

TZA was down 4.3% since the buy signal. The buy was at $7.37, and the sell at $7.05 using after hours prices available when the signals were confirmed.

AmericanBulls has this at down 3.9%, using their buy and sell points.

In this particular situation, the difference between the buy and sell points as calculated by AmericanBulls and those price points available after hours once the buy and sell signals were confirmed was: 10.3%. Sounds like a really big number, but it’s only one trade, and really need quite a few trades to see how this looks longer term.

Summary: Sell TZA, Buy TNA.

Earl, Do you own anything?

TZA looks awful.

TNA must therefore look wonderful. But a gap and go at this point in the rally has me thinking exhaustion gap.

Or just a powerful unending rally.

Nope

That's a good position.

http://www.screencast.com/users/dreadwin/folder…

While the results may vary, I think this is a high probability setup. It should be possible to get 15-30% using DRV if you can time the top of the doji. It's gotta be close. Really close.

great chart Dread. I admire your patience.

http://www.screencast.com/users/dreadwin/folder…

While the results may vary, I think this is a high probability setup. It should be possible to get 15-30% using DRV if you can time the top of the doji. It's gotta be close. Really close.

great chart Dread. I admire your patience.

The view from Americanbulls

TNA is a confirmed BUY today. TNA is available now for $55.93 in the after hours session. AmericanBulls recorded their buy at $55.36 (opening price). The candlestick of today was a White Candlestick (normal buying pressure).

TNA was up 3.6% since the sell signal two days ago, using AmericanBulls price points.

TZA is a confirmed SELL today. TZA can be sold for $7.05 now in the after hours session. AmericanBulls recorded their sale at $7.14 (opening price). The candlestick of today was Black Spinning Top (complete indecision between the Bulls & Bears).

TZA was down 4.3% since the buy signal. The buy was at $7.37, and the sell at $7.05 using after hours prices available when the signals were confirmed.

AmericanBulls has this at down 3.9%, using their buy and sell points.

In this particular situation, the difference between the buy and sell points as calculated by AmericanBulls and those price points available after hours once the buy and sell signals were confirmed was: 10.3%. Sounds like a really big number, but it’s only one trade, and really need quite a few trades to see how this looks longer term.

Summary: Sell TZA, Buy TNA.

Earl, Do you own anything?

TZA looks awful.

TNA must therefore look wonderful. But a gap and go at this point in the rally has me thinking exhaustion gap.

Or just a powerful unending rally.

Nope

That's a good position.

USO 2nd backtest of TL

http://www.flickr.com/photos/47091634@N04/44411…

USO is giving clues…

TZA opened down 0.8%. Gap today was not filled. TZA was down 0.8% at it’s high (the open). TZA closed down 2.0%.

We are in a New Moon Trade, which favors TZA, starting at the close today.

After two days, this trade is down 4.3%. AmericanBulls will surely issue a sell signal in 90 minutes, so I am selling now. TZA can be sold now in the after hours session at $7.06, so that is the selling price. This trade will buy TZA again once AmericanBulls issues a BUY signal.

Volume for TZA was the highest of the last 25 days.

$RVX (VIX for $RUT) closed down 1.0% with TZA down 2.3%. No divergence.

TZA has now been down 9 of the last 11 days.

The low for TZA today was $6.93. This is the lowest TZA price ever.

Ultimate Oscillator for TZA bottomed at 20 eighteen trading days ago and has generally risen since then but has remained below 50 and is currently 32. Indicating continued weakness for TZA. Today’s value was lower than yesterday which was the highest of it’s previous 4 days, so the mild Ultimate Oscillator up trend ended today. Not good for TZA.

Bollinger Bands for $RVX (VIX for $RUT): today’s candle finally fell below the congestion area toward the bottom Bollinger Band. Lowest close of the last 7 days. The lower Bollinger band quit rising. MACD has crossed from below. Looks like $RVX is dropping. Bad for TZA.

Bollinger Bands for $RUT: The white candle for $RUT moved up today, along with the upper Bollinger Band, indicating that $RUT might rise tomorrow. $RUT hit a new high today. Bad for TZA. (everything same as yesterday)

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s candle rose above the

congestion area. The upper Bollinger band rose after being flat for days. Perhaps indicating that TZA will fall.

TZA had a lower high, lower low and lower close (2nd day in a row) – all bad for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks like TZA might fall tomorrow.

Thanks Earl.

Index %

$SPX 75.44%

$NDX 90.99%

$DJI 66.43%

$RUT 100.51%

Carl at day’s end:

1147-1161 1st estimate today for /ES (14 points, June contract)

1157-1170 2nd estimate today (13 points)

1157.50 -1165.50 actual today (8 points)

Missed it so bad he revised it.

Trades:

In /ES at 1161.50, out at 1161.50 for breakeven

Grade C (didn’t lose any money)

$SPX 1 – 2 – 3 dance

http://www.flickr.com/photos/47091634@N04/44408…

all dogs get trained the same way, Fido is almost full trained once again and he only knows one command

Actually, looks like the short term turned up at EOD. Not sure though.

important sequence from the 3.24.2000 $SPX high

9 years 11 months 21 days

thank you operators for the $SPX closing number

1166.21 = 11 – 9 (9) – 21