Are all the Bears dead now? It seems so, as other blogs have given up on the market and are closing up. Over on Cobra's blog (who's isn't closing, by the way), a commenter mentioned that a blog called "Trading the Odds" is closing up. He also stated that another blog had closed too, but I'm not sure which one it was?

Then there is my friend Anna, over at Hot Option Babe... who is also very worn out by all the nonsense in the market, and thinking of closing her blog too. I hope not, and I really don't think she will. She just needs to take a break from all the bull shit and go relax on the beach or something. (Sorry about the cussing, but sometimes you just need to tell it like it is!)

Mole, over at Evil Speculator shut his doors down for a day or so... about a week ago. But, he's back up now. He never really left, just took some time off from posting, is more accurate. Even Alexander Grant over at AMBG Trading has cut his posts down from almost daily, to once every week or so. Why post when nothing changes? (Everyone mentioned here can be found in my blogroll... except "Trading the Odds").

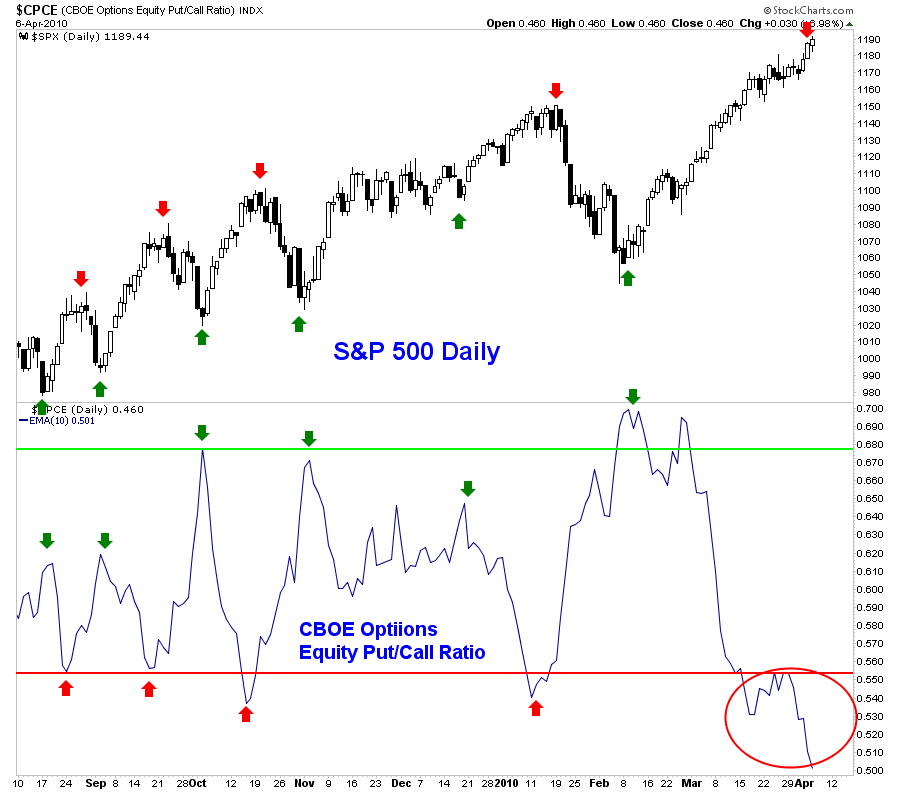

I wonder if it was the same during the 2007 summer rally? Is that a sign that the "TOP" is in? (Short term TOP of course). It's called "Bear Blog Capitulation"! Look at the the put to call ratio on the chart below. That's lower then the reading in the 2007 high! Every bear that's still alive is now bullish. Too many people are on one side now. This boat has got to sink soon!

It makes you wonder if the government has super computers scanning the Internet, reading the bearish blogs, and predicting sentiment from that data? Probably...

But regardless of whether they do, or don't, it doesn't really matter, as all the bears are dead broke by now. That's quite obvious by the extremely light volume. Looking back at the chart I posted on the weekend, we are now at day 10 of a sideways movement. But, we did breakout of that range between 1160-1180, so I guess the count isn't valid anymore?

So, I guess we are going higher again tomorrow, as trying to predict the top is useless at this point. It will go higher until the government's target price and date is met. When? I still think it will be this week, but I don't know Jack Shit it seems? Do you know Jack Shit? Let me introduce you... (you might have too hit the play button twice?)

Well, there's your daily humor. At least I have the good fortune of posting whatever I want, and not just charts like all the other blogs out there. I'd post another chart if you really want me too... but basically, I'll sum it up for you like this...

This is the market direction until the Obama Gangster Gang turns it around.

Red

Hysterical Red. Now I can go to bed happy. Thanks!

I laughed my ass off too… Too Funny!

welcome to the casio I'm standing in line behind the guy who bought 3000 tza apr 10.00 calls for .01, and 1200 7.50 calls between .04 and .06

Thinking about going in boss,look out

tza 7.50 calls ( about a buck away) thinking about .03

call it a sueaside run ( 50 contract 150.00)

Red:

I stated yesterday that I believed the market would tank before OPEX next week, judging from the low 10-day EMA of the CPCE, but now I'm changing my opinion. I now think the market will float at roughly the current level through OPEX and should it drop, it's after OPEX, not before.

Too many technical indicators have stopped working that it's discouraging.

4/07/10, a day of infamy?

“…The SPX is in a turning point window defined by Mc Hugh’s PHI date on 4/7 and a geo-cosmic signature on 4/6 – the Martin Armstrong date of 4/16 (2/28/07 + 3.14 years) looms large before us. A small move in the McClellan Oscillator today argues for a big market move by Thursday. The SPX appears close to completing an EW 5-wave rally pattern since 2/5…”

http://allstarmarkettiming.typepad.com/

Note: I can't say I put much faith in geo-cosmic signature, golden ratio whatever. But if the market wants to turn down on that basis, then who am I to argue with the market? lol

SC, the McClellan reference seems like total BS to me because I have been following it for a while. While the fact that it is bouncing around the 0 line may be interpreted as bearish, typically once the MACD lines cross to the upside and the MACD crosses up through the 0 line, (which it looks like it is just about to do), the market moves up. Based on the index, the market should have dropped significantly in the past two weeks so it isn't really working along with any other indicator for that matter. However, I am throwing all indicators out the window and staying bearish. McHugh seems to keep changing his tune. He called the top months back as far as I know.

http://stockcharts.com/h-sc/ui?s=$nymo

His phi mate turn date analysis seems to add value, but the turn dates are not exactly precise, and are often clear after the fact. I was thinking last night that the April 7 Phi turndate may have actually occured on the 5th. His “small change in McOsci” used to be very accurate in predicting strong moves. But then people started to frontrun it and ran up the futures overnight. The last one was a dud. So far this one seems to be too…. but it may come tomorrow.

Your article is useful.

Thanks.

i had a similar conversation with a long time friend last week regarding that this is probably the weakest group of market participants since 1998 when I first started

The amount of speculative capital that was harvested during 2008 was massive. I can say with a great probability that the owners of that capital were in the older demographic. Now I can only guess, but given the gullibility of the current market participants I would say this current group is very very young relative to other batches of market participants.

When I see posts around the internet that say, “don't fight the trend”, “the fed will never let this rally end”, “the government will never let the market fall”, “nothing works anymore”.

That individuals liquidation date in the market is already cemented. It's sad when I see things like this but sometimes people are so mind controlled there gone.

*If* there is one thing I hope some of you are taking from my posts that this game is not difficult. People let diversionary events take their attention away from the numbers and then their emotions take over. This is a regulated numbers game.

I'll warn you now the operators will be baiting everybody in 3 weeks with financial Armageddon stories. Extremely few people are short now, people are who aren't short won't be able to short as their handy dandy oscillators will be screaming buy buy buy at the time $SPX prints 1150. Since 99% of participants trade with the trend, people will open new short positions between 1050-1080.

Hopefully I can save at least 1 person from repeating this sequence.

You will save me because I am listening. If I could figure out the numbers game, I would. It may be easy but so far I don't get it. Sadly, I think a majority of the speculators now in the market are the massive amount of unemployed hoping to survive somehow. And again, while there are number of relatively young people like me, I also think that there are many in their 50s, 60s and 70s.

The simplicity of this game complexes the human mind. Keep an open mind and one day everything will be crystal clear.

You hit the nail on the head with the unemployed, it's sad but some people don't have any other choice.

The transition away from sophisticated living is not far off. Those who have eagle eyes have been monitoring real estate transactions in Montana.

Montana? Is that you, Ted Kaczynski? good behaviour? Or prison internet? 😀

montana isn't my cup of tea, but it's a great option for people wanting to stay domestically

I have a good friend that decided with his wife that they were going to stay domestic and bought a beautiful ranch. They love it up there.

Thanks Sun…

That 1 person is me… and you can rest assured that I won't be going short at 1050-1080 (like I did the last time). I'll join you in going long.

I'm already short, from last week, and will just wait it out. I'm still inclinded to believe that we will start this fall before next weeks' opx.

I don't have any way of knowing, but I would suspect that there are a lot more calls then puts right now, on the SPY. Which leads me to believe that the market makers don't want to play out to all those calls… so a drop before opx seems likely.

And, since most opx weeks are bullish, and this month of April is bullish (from a chart on Cobra's blog), it also seems logical to do the opposite of what the masses think… taking their money once again.

That 1150 area seems like a first target, then 1115, and then the finally bottom in the 1050-1078 area by the end of the month. Perfect thinking actually, as May is usually bearish. So go into May, with the market tanking, everyone will go short at the bottom… as you quoted.

Makes more sense every day now. I'd still like to see the move start this week though, as it's really wearing me down.

Hi Sundancer,

If you can just confirm this is accurate.

You are predicting a “coming debasement will @ a minimum print 1078 $SPX and final terminal pt. between 1049.98 & 1078.” “by the end of April” followed by a “blow-off into the fall, the operators told us last week $DJI 11,816 will be the terminal de-leverage pt.” (which percentage wise roughly translates to 1280 on spx).

Thanks in advance

I don't like to use the term predicting, the probabilities on the weekly setup favor a debasement here.

Should a debasement be initiated then 1078 is de-leverage pt. 1. the 1049.98 number is derived from the current co-relational ritual : value setup based upon the terminal high being 1191.80.

Time wise should a debasement be initiated now then I would look to the end of April at the earliest given the dynamics of daily & weekly containment pts.

The current setup in the equity indexes is a great learning opportunity. There is a series of de-leverage pts. underneath the current price levels, and we have 1 de-leverage pt. above the current price level.

What would happen if the operators took the index to the higher price level before the lower price level. For those using highly levered instruments short it would blow you out of the market.

Staying power in this game is allocating capital to setups using non-levered capital. The reason why most people use leverage is they are under-funded in their operations.

If one was to initiate a series of short positions on the SPY right here, you know the terminal upward de-leverage pt. is ~7.7% away or downward de-leverage pt. #1 is ~9.2% away.

If you want to short 20k shares of SPY, you can use containment pts. as sell triggers on the upward thrust to the terminal de leverage pt or use containment pts. along the way downward as VST cover triggers.

The market moves in 2 directions on infinite number of time frames due to the regulatory aspect. This is what precisely gives people problems, the time frame.

April 7:

Situation Update: I am waiting for the market to make a move, one direction or the other. Either way, I am throwing in the towel on the short term bear case after the move. B/c after the move, it is a mad dash to the cliff. Join the crowd! Let the devil get the hind most!! lol

Fake print to 119.35 spy came in on the 10 minute chart earlier.

Yes – I see it … also that is a TL top from Aug which has been holding the mkt … mkt hit it first time yest at the high … 119.35 is where it is today …

The real high on the day should read 119.05 right?

I've got 119.08 as the real high today, but yeah… 119.35 was a fake print Monica. Don't know if it will play out tomorrow morning on the usual ramp up, or into the close today?

It might not play out at all? I've noticed that they aren't as accurate on the intraday time frames, as they are on the daily. We'll see I guess?

The high could already be in? Or one last pop before the drop? This market is like a bad, and I mean really bad horror movie, where the killer or monster just won't die. You stab him, run over him with a car, throw him over a cliff, shot him, and set him on fire… and he's still alive!

Die Jason Die!

Die Jason Die!

here's a view of the current horse SPY is riding

http://www.flickr.com/photos/47091634@N04/45000…

the horse DIA is riding comes in about 109.48 today

We had 2 closes above that line yesterday. Another close above it today would probably mean that the market will go on up to the next level before pulling back.

I don't know that to be exact of course? I wonder if the 119.35 spy print will be hit today, or tomorrow? I think we will sell off into the close and end below that line.

Then rally up to the 119.35 tomorrow… maybe? The market looks pretty weak right now. It seems to be losing steam. Don't know if that print will be hit or not?

If it's hit, then the Dow should hit 11,000… and I really don't think they plan on letting that happen. Call me nuts, but baiting everyone into going long… assuming that 11,000 is guaranteed, and then not hitting it, seems to make more sense.

Then sell off next week on the usually bullish opx week. Lot's of longs in the market right now, and too many shorts on the VIX too.

Is the close today important at all?

the open tomorrow is more important than the close today

today is already wednesday, so we're two days away from completing the weekly print & we've got containment pts. that are providing structure on the $SPX & $DJI weekly

once we get consecutive hourly closes below max containment on the 60 an avalanche of selling will ensue. Currently about 117.60

Thanks.

That's basically saying that we need to fall outside the huge support line from the 1044 low, that the market has been riding up ever since then.

correct, as the co-relational structures will trigger all at the same time causing an avalanche

Also, can you share what you would be watching on the open tomorrow ?

At work in the am, so can't read everything then …

Thnx a ton 🙂

So Sun … essentially, you are saying once we break max containment on the 60 min which is the TL from the feb lows @ 117.6, then we fall to 1150 … but you think we will fall much further to the debasement point at 1078 or go as low as 1050 … and this is where we should go long …

Did I paraphrase this right 🙂

finally one red candle on the chart after many days …..

They'll be many more red candles too come…

If this is a fakeout, I am going to punch somebody or at least something!

It looks like McHugh's Phi turn date and small change in McOsc are working this time.

woohoo. I can quit my McDick nightshift now.

Not sure if that is what is working and we are not through the woods yet but I am feeling better.

SC, I would wait until next week to give notice.

This makes me suspicious of if someone already knows about the unemployment numbers tomorrow?

Does any news really matter?

Russian troops storm the White House.

Chinese troops take San Francisco.

Obama vows to negotiate partial access to the White House, and demands the citizens of San Francisco get access to their former homes to retrieve families photos and such.

Obama also pledges, again, not to nuke anyone over minor property disputes.

That news might matter 🙂 but don't think it is coming tomorrow.

Earl, +10 ROFLOL!!!!

I just have this horrible feeling we are going to pop tomorrow and chop back and forth for a while. But, I gotta hang on at this point.

Well, just so you don't panic… it is common to do a backtest of the broken trendline before moving down. Of course it doesn't always happen, but many times it does.

So, since it looks like we will close outside the trendline today, a pop tomorrow could happen? But, I do think we are in the final last breath of the bull.

Yep, everyone seems to be going long now.

Pretty much in agreement with you on that one. My guess would be that it will look like an impulsive “straight up” rip to scare the living daylights out of any who would dare go short.

Well, I'm not saying that it will go back up tomorrow… only that in the past, that's what always happens. I'm short now, and staying short. I know that once the move occurs, there will be little chance to get short.

Alphahorn's wave count is that we're just about to begin 3 of 5 up, and we just concluded 2 of 5 today. He is quite confident that 1200 will be reached.

http://alphahorn.blogspot.com/2010/04/correctio…

I like Alphahorn, but I think he's wrong on this call. I think too many people are expecting 11,000 dow and 1200 spx… and that's why it won't happen.

No. the damage is done. This is just the opening salvo. Money flowed out of the market across the board today.

No P3. Not yet.

You sure its Pee3 not X3? 🙂

U mean pee pee indicator

can the operators make it any more obvious

$DJI -72.47 = -9.11

$SPX-6.99 = -6.66

Too Funny! I think a storm is coming… Time to close the windows and bolten down the hatches.

What level are we looking for tomorrow? I suspect that we will rally in the morning as the dip buyers jump on the bull train, but I could be surprised…

i want to see a gap down

it would initiate the downward thrust the same way the upward thrust was initiated

remember this chart

http://www.flickr.com/photos/47091634@N04/43698…

From that chart, it looks like there was a quick push down, then sideways for the next 3 days… then a huge dump!

I was thinking of going short again today, but I chickened out. Maybe it will pop tomorrow before dropping, and I'll get another shot at getting further short?

I did notice that most of the big drops were on Wednesday or Friday… of course that's just the last 5 drops, and not a whole lot of data to compare it too.

I guess it could go sideways for a few more days. Guess we will have to wait for that gap down.

Yes, they actually could for me! But glad I have you hear to clear it up!

shake out today. That is all

Carl at day’s end:

1174-1185 estimate for today (11 points)

1173.25 -1186.25 actual today (13 points)

Carl was pretty darn close.

Trades: no trades today

Grade: C didn’t lose any money

I'm currently in cash. I think that Carl goes long tomorrow. I'll join him if he does.

It does look like Carl called it right today. Bounced right at his low of the day. If he is right about tomorrow, up we go.

After much thought on the subject, I got rid of my TZA and DRV. All cash again.

DRV got a huge boost today because of the successful Fed auction and (therefore) $TNX getting whacked. I would love to get long DRV again, as it gave a BB buy signal with yesterday's and today's price action. Let's see what tomorrow's candle looks like.

30 year auction tomorrow. Could change things.

TMF Daily 30 year treasury bull 3x

TMV Daily 30 year treasury bear 3x

TNA opened down 0.37%. Monday’s gap from $55.95 to $56.03 was not filled. Today’s gap was filled. TNA was up 0.75% at the high, and closed down 0.96%.

We are now in a Full Moon Trade, which tends to favor TNA.

AmericanBulls has TNA with a hold. This trade bought TNA at $56.50, and closed today at $59.55, up 5.4%.

Volume for TNA today was noticeably above the average for the past 6 days, and about average for the past 21 days.

$RVX (VIX for $RUT) was up 1.7 % today with TNA down 0.9%. No divergence.

TNA has now been up 5 of the last 10 days. Chop generally. Hard to read.

The high for TNA today was $60.58, the highest TNA price since November of 2008.

Ultimate Oscillator for TNA rose from 56 to 58 today on a down day, a divergence. A reading of 58 indicates strength for TNA. Good for TNA.

MACD on the monthly chart crossed over downwards eight days ago, but has moved back up and crossed over to the upside today. Good for TNA.

Bollinger Bands for $RVX (VIX for $RUT): today’s doji candle touched the lower Bollinger band and closed above that band. MACD seems to be topping. Looks like $RVX might rise tomorrow. Bad for TNA.

Bollinger Bands for $RUT: Today’s doji candle for $RUT touched and closed above the top Bollinger Band. Just like yesterday, it looks like $RUT may have topped, but need to watch tomorrow for confirmation. MACD has crossed down, but may be working back up. Unclear.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): today’s doji candle closed below the upper Bollinger Band, after a close yesterday above that band. The upper Bollinger Band is rising. Looks like we are near a top for $RUT. Bad for TNA, but maybe not right away.

TNA had a slightly higher high, higher low and lower close – Good for TNA.

Money flow for the Total Stock Market was $264 million flowing out of the market. Bearish – Bad for TNA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks bad for TNA soon, perhaps tomorrow.

Ahhh… so here's the reason blamed behind the selling around 2pm today. It seems that Tom Hoeing, President of the Federal Reverse Bank of Kansas, came out today (around 2pm est.) and stated that he thought they should raise the interest rates to 1%.

http://kansascity.bizjournals.com/kansascity/st…

Are they preparing us for the coming meltdown? It seems so… We must keep our ears open, as they are now letting the market know ahead of time… that more bad news is coming.

Selling should start very very soon now…

The Daily view from Americanbulls

TNA today went from a hold to a low reliability SELL-IF signal. The TNA buy was at $56.50. TNA closed at $59.59, up 5.4% since the buy. The candlestick today High Wave (a great amount of indecision in the market). The last two candlesticks form a low reliability Bearish Harami Pattern.

TZA yesterday had a highly reliable SELL-IF, but got no confirmation so the SELL-IF has been extended one day. Yesterday, TZA was a hold, down 8.2%. The buy price was $7.04. TZA closed today at $6.51, down 8.1% since the buy. The candlestick today was a White Spinning Top (complete indecision between the bulls and bears).

Three recent TZA Buy signals have failed and may perhaps serve as a warning:

Buy at $7.33, sell at $7.14

Buy at $7.11, sell at $7.05

Buy at $7.04, now down 8.1%

For that matter, recent TNA Buy signals (until this last one) have also been uninspiring:

Buy at $55.36, sell at $55.43

Buy at $55.69, sell at $55.63

Buy at $56.50, up 5.4%

Summary of $RUT based ETFs & a few popular ETFs & stocks (Market positive):

Hold: GOOG(down 0.5%),

New Confirmed BUY: GS

Transition to Market Positive:

Not Very Reliable BUY-IF(2nd day): AMZN

Highly Reliable SELL-IF (2nd day): TZA (-3x, down 7.5% )

Transition to Market Negative:

Low reliability BUY-IF: DRV(-3x), SRS(-2x), RWM(-1x), TWM(-2x)

Low reliability SELL-IF: DRN(3x), QQQQ, IWM(1x), UWM(2x), TNA(3x), URE(2x), IYR(1x)

Not Very Reliable SELL-IF: DIA , AAPL

Market Negative:

Wait: SPY

Hold: DTO(-2x oil, down 13.1%)

Comment: market more negative than yesterday

Action for tomorrow: Possible Sell of TZA, Possible Sell of TNA

hey gang, hope everyone made money today.

I made 3 perfect shorts today I would like to share since it was a rare day to get all three correct lately. I did research last night and had them lined up ready to go this morning…. I know the stocks below inside and out and how they act compared to their “sisters” AA,AKS, STI,RF ect… I checked the news for all of them, had my coffee and was ready to go.

I have 3 monitors and watch everything like a hawk including CNBC on low volume( like to hear important things). I entered X 1000 short and ZION 5000 short as soon as they went red… they were easy in the morning and just had to set my stops though out the day…. it was CENX that didn't want to give in. but when I saw Apple dumping in the corner of my eye (late day) and saw AA go under support at 14.80 I clicked the short button of 8000 shares of CENX without even looking and market order too! bang it drops…I'm screaming! laughing ! 1000 negative TICK! 1200 neg tick 1400 neg tick! laughing … I set my stops all the way down and making them tighter and tighter knowing full well the “buy the dippers” would be coming. and they did stopping me out…

to short in this market I do several things now ….well at least for a day trade and when I go in heavy like I did today.

SPX is red.

Stock you want to short is red

stock you want to short got negative news

stock you want to short is overbought

stock you want to short has sector wide negative news.

know your support and resistance and that includes “sister” stocks.

A new high that goes read the next day is sometimes a good short …X..and ZION ! would you want to be the last dumb ass to buy in?, i bet you would have a tight stop.

ok got to go, talk tomorrow.

Red … the print on BIDU was real from way back…. and Reaper is taking time off too from his blog

“The Grim Reaper”… what a cool name. Bummer about him shutting down… but at least he still posts on other blogs regularly. I couldn't read his blog the last time I checked because it was by invite only or something?

Glad you made some money today. It's about time some of us bears get to eat a nice dinner for a change. As for BIDU, it almost hit that target today. Add that to the SPY print today of 119.35 on the 10 minute chart, and that could be the finally high before the plunge.

Don't know if it will happen tomorrow, or Friday? But I do believe that we are being told that the market is going to correct very soon.

I would love to see that SPY high, so I can short some more. We'll see tomorrow I guess.

TraderJohn, Congrates on your day. Thanks for sharing. A good plan lessens the risk and sure is sweet when it all line up and works.

TraderJohn, Congrates on your day. Thanks for sharing. A good plan lessens the risk and sure is sweet when it all line up and works.