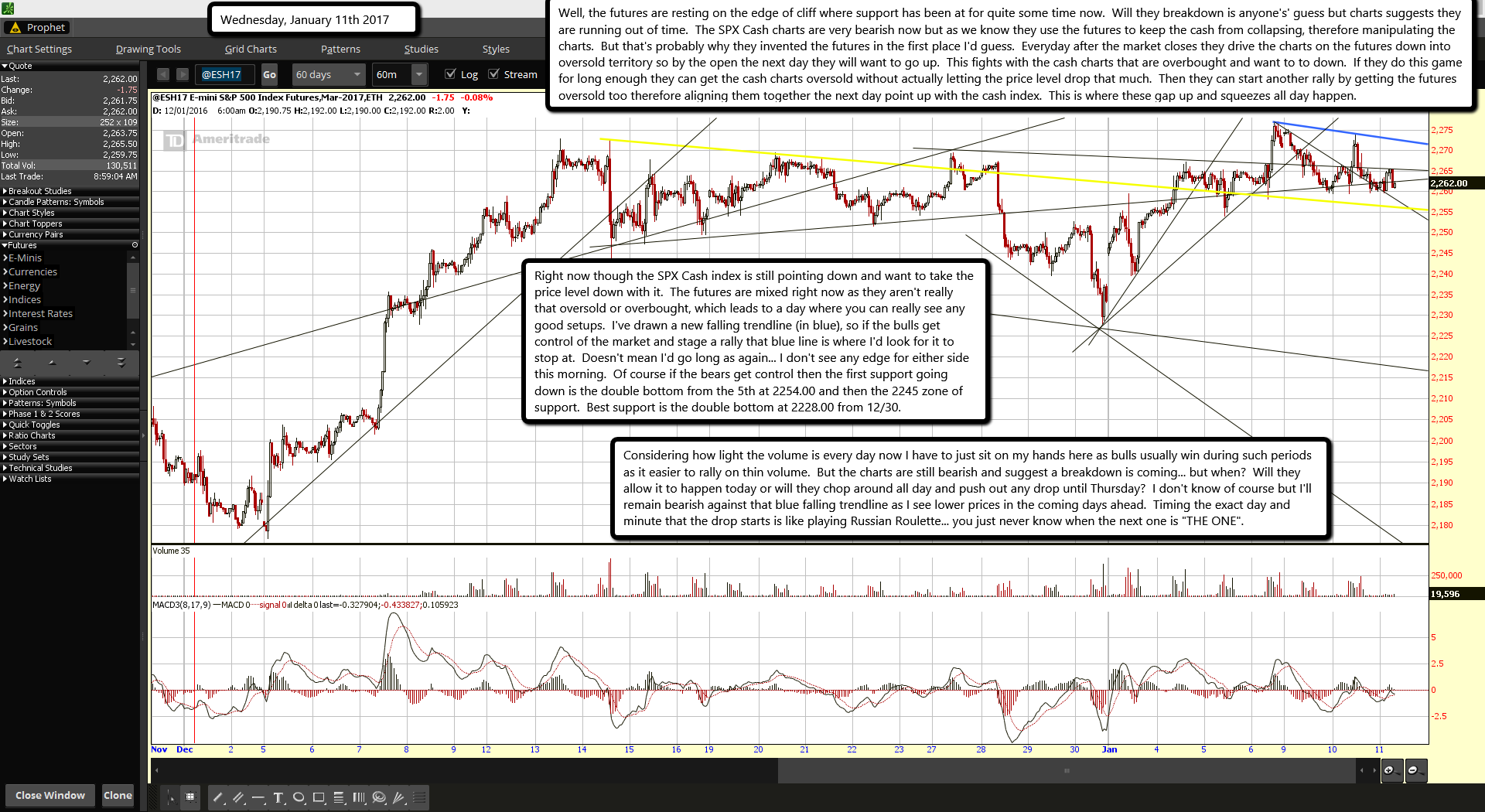

Well, the futures are resting on the edge of cliff where support has been at for quite some time now. Will they breakdown is anyone's' guess but charts suggests they are running out of time. The SPX Cash charts are very bearish now but as we know they use the futures to keep the cash from collapsing, therefore manipulating the charts. But that's probably why they invented the futures in the first place I'd guess. Everyday after the market closes they drive the charts on the futures down into oversold territory so by the open the next day they will want to go up. This fights with the cash charts that are overbought and want to to down. If they do this game for long enough they can get the cash charts oversold without actually letting the price level drop that much. Then they can start another rally by getting the futures oversold too therefore aligning them together the next day point up with the cash index. This is where these gap up and squeezes all day happen.

Right now though the SPX Cash index is still pointing down and want to take the price level down with it. The futures are mixed right now as they aren't really that oversold or overbought, which leads to a day where you can really see any good setups. I've drawn a new falling trendline (in blue), so if the bulls get control of the market and stage a rally that blue line is where I'd look for it to stop at. Doesn't mean I'd go long as again... I don't see any edge for either side this morning. Of course if the bears get control then the first support going down is the double bottom from the 5th at 2254.00 and then the 2245 zone of support. Best support is the double bottom at 2228.00 from 12/30.

Considering how light the volume is every day now I have to just sit on my hands here as bulls usually win during such periods as it easier to rally on thin volume. But the charts are still bearish and suggest a breakdown is coming... but when? Will they allow it to happen today or will they chop around all day and push out any drop until Thursday? I don't know of course but I'll remain bearish against that blue falling trendline as I see lower prices in the coming days ahead. Timing the exact day and minute that the drop starts is like playing Russian Roulette... you just never know when the next one is "THE ONE".