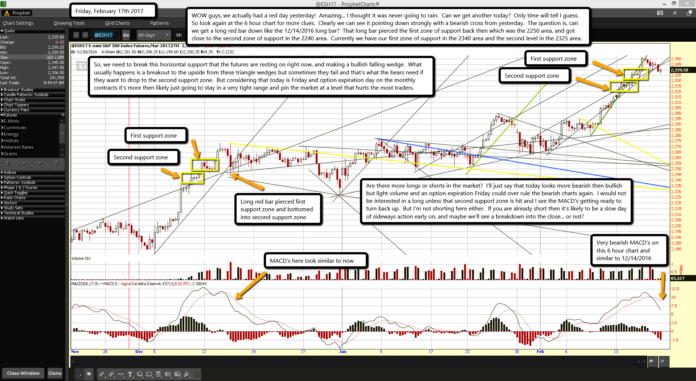

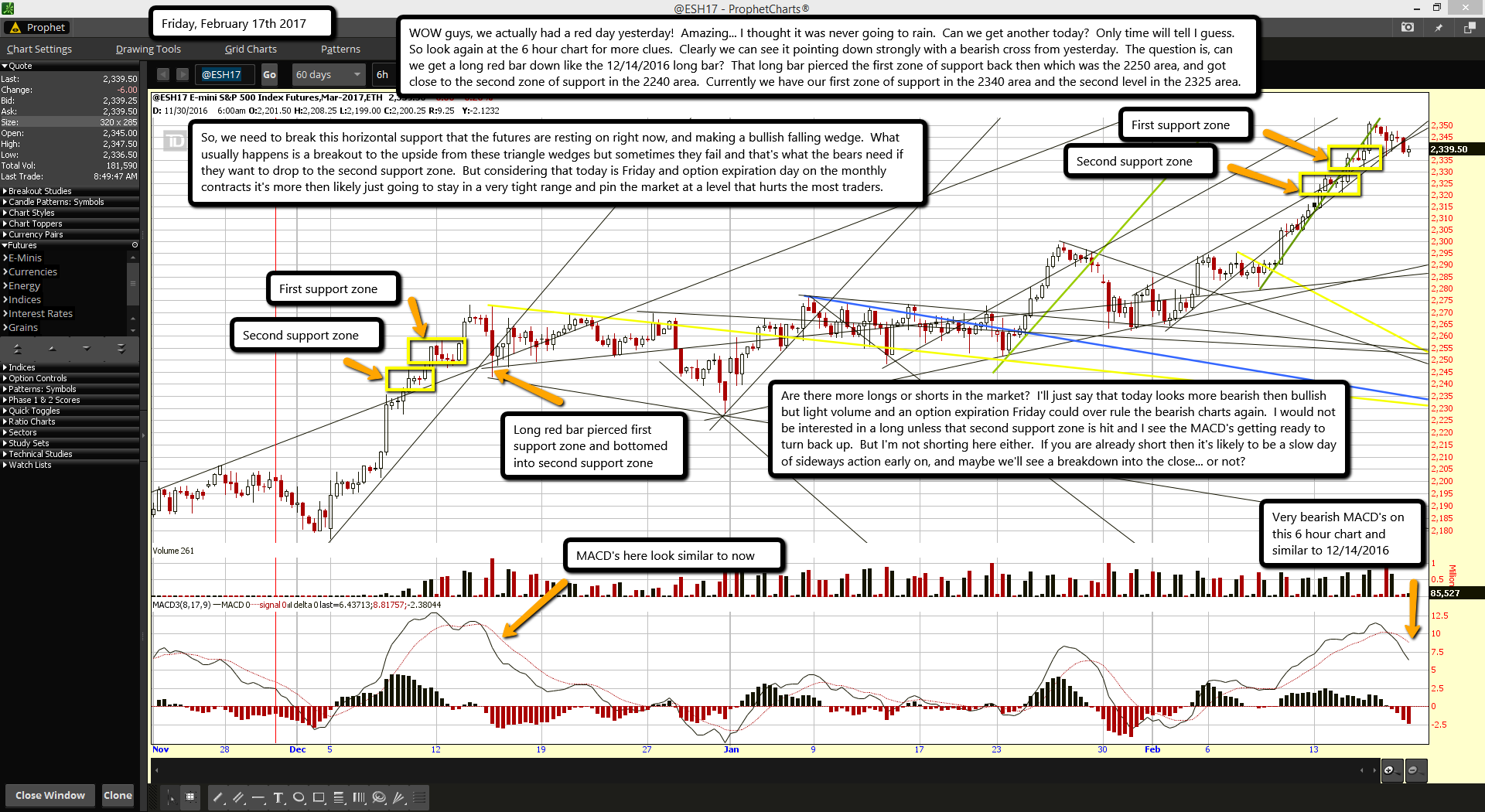

WOW guys, we actually had a red day yesterday! Amazing... I thought it was never going to rain. Can we get another today? Only time will tell I guess. So look again at the 6 hour chart for more clues. Clearly we can see it pointing down strongly with a bearish cross from yesterday. The question is, can we get a long red bar down like the 12/14/2016 long bar? That long bar pierced the first zone of support back then which was the 2250 area, and got close to the second zone of support in the 2240 area. Currently we have our first zone of support in the 2340 area and the second level in the 2325 area.

So, we need to break this horizontal support that the futures are resting on right now, and making a bullish falling wedge. What usually happens is a breakout to the upside from these triangle wedges but sometimes they fail and that's what the bears need if they want to drop to the second support zone. But considering that today is Friday and option expiration day on the monthly contracts it's more then likely just going to stay in a very tight range and pin the market at a level that hurts the most traders.

Are there more longs or shorts in the market? I'll just say that today looks more bearish then bullish but light volume and an option expiration Friday could over rule the bearish charts again. I would not be interested in a long unless that second support zone is hit and I see the MACD's getting ready to turn back up. But I'm not shorting here either. If you are already short then it's likely to be a slow day of sideways action early on, and maybe we'll see a breakdown into the close... or not?