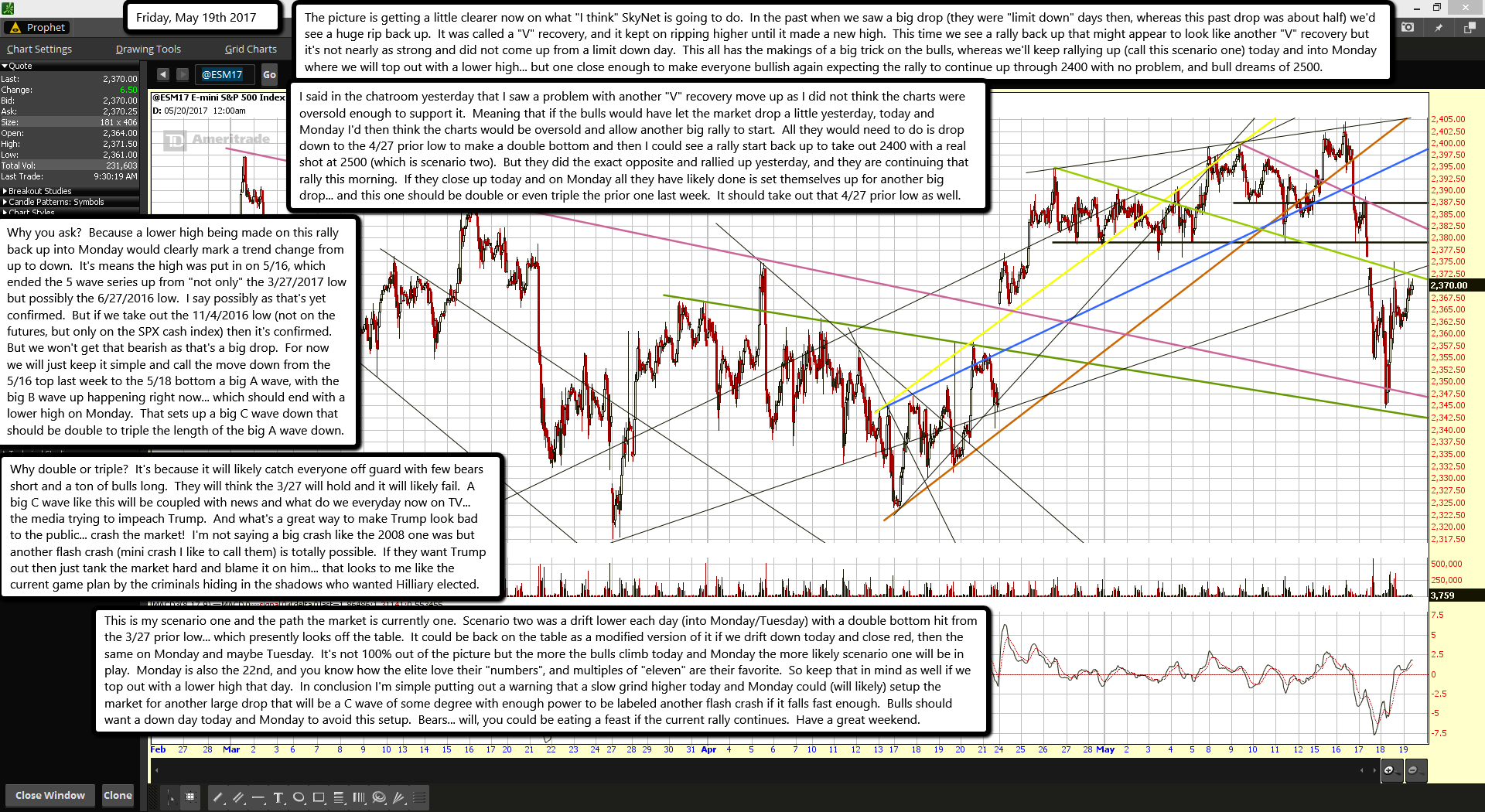

The picture is getting a little clearer now on what "I think" SkyNet is going to do. In the past when we saw a big drop (they were "limit down" days then, whereas this past drop was about half) we'd see a huge rip back up. It was called a "V" recovery, and it kept on ripping higher until it made a new high. This time we see a rally back up that might appear to look like another "V" recovery but it's not nearly as strong and did not come up from a limit down day. This all has the makings of a big trick on the bulls, whereas we'll keep rallying up (call this scenario one) today and into Monday where we will top out with a lower high... but one close enough to make everyone bullish again expecting the rally to continue up through 2400 with no problem, and bull dreams of 2500.

I said in the chatroom yesterday that I saw a problem with another "V" recovery move up as I did not think the charts were oversold enough to support it. Meaning that if the bulls would have let the market drop a little yesterday, today and Monday I'd then think the charts would be oversold and allow another big rally to start. All they would need to do is drop down to the 4/27 prior low to make a double bottom and then I could see a rally start back up to take out 2400 with a real shot at 2500 (which is scenario two). But they did the exact opposite and rallied up yesterday, and they are continuing that rally this morning. If they close up today and on Monday all they have likely done is set themselves up for another big drop... and this one should be double or even triple the prior one last week. It should take out that 4/27 prior low as well.

Why you ask? Because a lower high being made on this rally back up into Monday would clearly mark a trend change from up to down. It's means the high was put in on 5/16, which ended the 5 wave series up from "not only" the 3/27/2017 low but possibly the 6/27/2016 low. I say possibly as that's yet confirmed. But if we take out the 11/4/2016 low (not on the futures, but only on the SPX cash index) then it's confirmed. But we won't get that bearish as that's a big drop. For now we will just keep it simple and call the move down from the 5/16 top last week to the 5/18 bottom a big A wave, with the big B wave up happening right now... which should end with a lower high on Monday. That sets up a big C wave down that should be double to triple the length of the big A wave down.

Why double or triple? It's because it will likely catch everyone off guard with few bears short and a ton of bulls long. They will think the 3/27 will hold and it will likely fail. A big C wave like this will be coupled with news and what do we everyday now on TV... the media trying to impeach Trump. And what's a great way to make Trump look bad to the public... crash the market! I'm not saying a big crash like the 2008 one was but another flash crash (mini crash I like to call them) is totally possible. If they want Trump out then just tank the market hard and blame it on him... that looks to me like the current game plan by the criminals hiding in the shadows who wanted Hilliary elected.

This is my scenario one and the path the market is currently one. Scenario two was a drift lower each day (into Monday/Tuesday) with a double bottom hit from the 3/27 prior low... which presently looks off the table. It could be back on the table as a modified version of it if we drift down today and close red, then the same on Monday and maybe Tuesday. It's not 100% out of the picture but the more the bulls climb today and Monday the more likely scenario one will be in play. Monday is also the 22nd, and you know how the elite love their "numbers", and multiples of "eleven" are their favorite. So keep that in mind as well if we top out with a lower high that day. In conclusion I'm simple putting out a warning that a slow grind higher today and Monday could (will likely) setup the market for another large drop that will be a C wave of some degree with enough power to be labeled another flash crash if it falls fast enough. Bulls should want a down day today and Monday to avoid this setup. Bears... will, you could be eating a feast if the current rally continues. Have a great weekend.