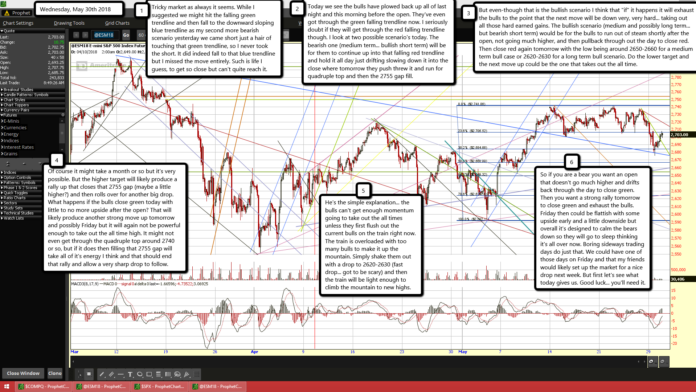

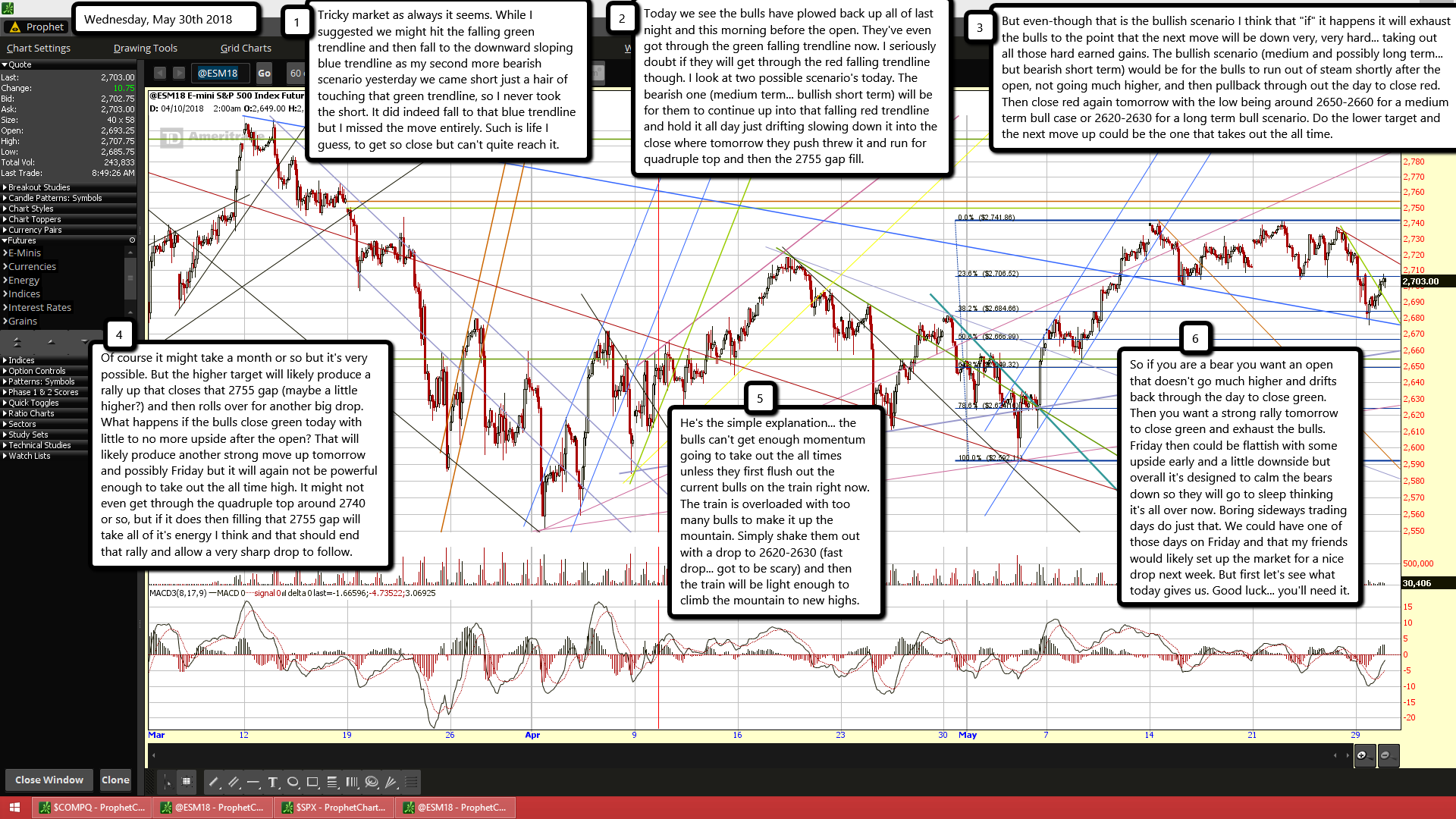

Tricky market as always it seems. While I suggested we might hit the falling green trendline and then fall to the downward sloping blue trendline as my second more bearish scenario yesterday we came short just a hair of touching that green trendline, so I never took the short. It did indeed fall to that blue trendline but I missed the move entirely. Such is life I guess, to get so close but can't quite reach it.

Today we see the bulls have plowed back up all of last night and this morning before the open. They've even got through the green falling trendline now. I seriously doubt if they will get through the red falling trendline though. I look at two possible scenario's today. The bearish one (medium term... bullish short term) will be for them to continue up into that falling red trendline and hold it all day just drifting slowing down it into the close where tomorrow they push threw it and run for quadruple top and then the 2755 gap fill.

But even-though that is the bullish scenario I think that "if" it happens it will exhaust the bulls to the point that the next move will be down very, very hard... taking out all those hard earned gains. The bullish scenario (medium and possibly long term... but bearish short term) would be for the bulls to run out of steam shortly after the open, not going much higher, and then pullback through out the day to close red. Then close red again tomorrow with the low being around 2650-2660 for a medium term bull case or 2620-2630 for a long term bull scenario. Do the lower target and the next move up could be the one that takes out the all time.

Of course it might take a month or so but it's very possible. But the higher target will likely produce a rally up that closes that 2755 gap (maybe a little higher?) and then rolls over for another big drop. What happens if the bulls close green today with little to no more upside after the open? That will likely produce another strong move up tomorrow and possibly Friday but it will again not be powerful enough to take out the all time high. It might not even get through the quadruple top around 2740 or so, but if it does then filling that 2755 gap will take all of it's energy I think and that should end that rally and allow a very sharp drop to follow.

He's the simple explanation... the bulls can't get enough momentum going to take out the all times unless they first flush out the current bulls on the train right now. The train is overloaded with too many bulls to make it up the mountain. Simply shake them out with a drop to 2620-2630 (fast drop... got to be scary) and then the train will be light enough to climb the mountain to new highs.

So if you are a bear you want an open that doesn't go much higher and drifts back through the day to close green. Then you want a strong rally tomorrow to close green and exhaust the bulls. Friday then could be flattish with some upside early and a little downside but overall it's designed to calm the bears down so they will go to sleep thinking it's all over now. Boring sideways trading days do just that. We could have one of those days on Friday and that my friends would likely set up the market for a nice drop next week. But first let's see what today gives us. Good luck... you'll need it.