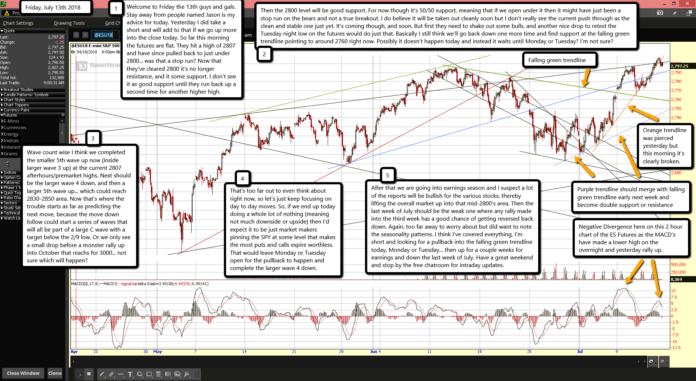

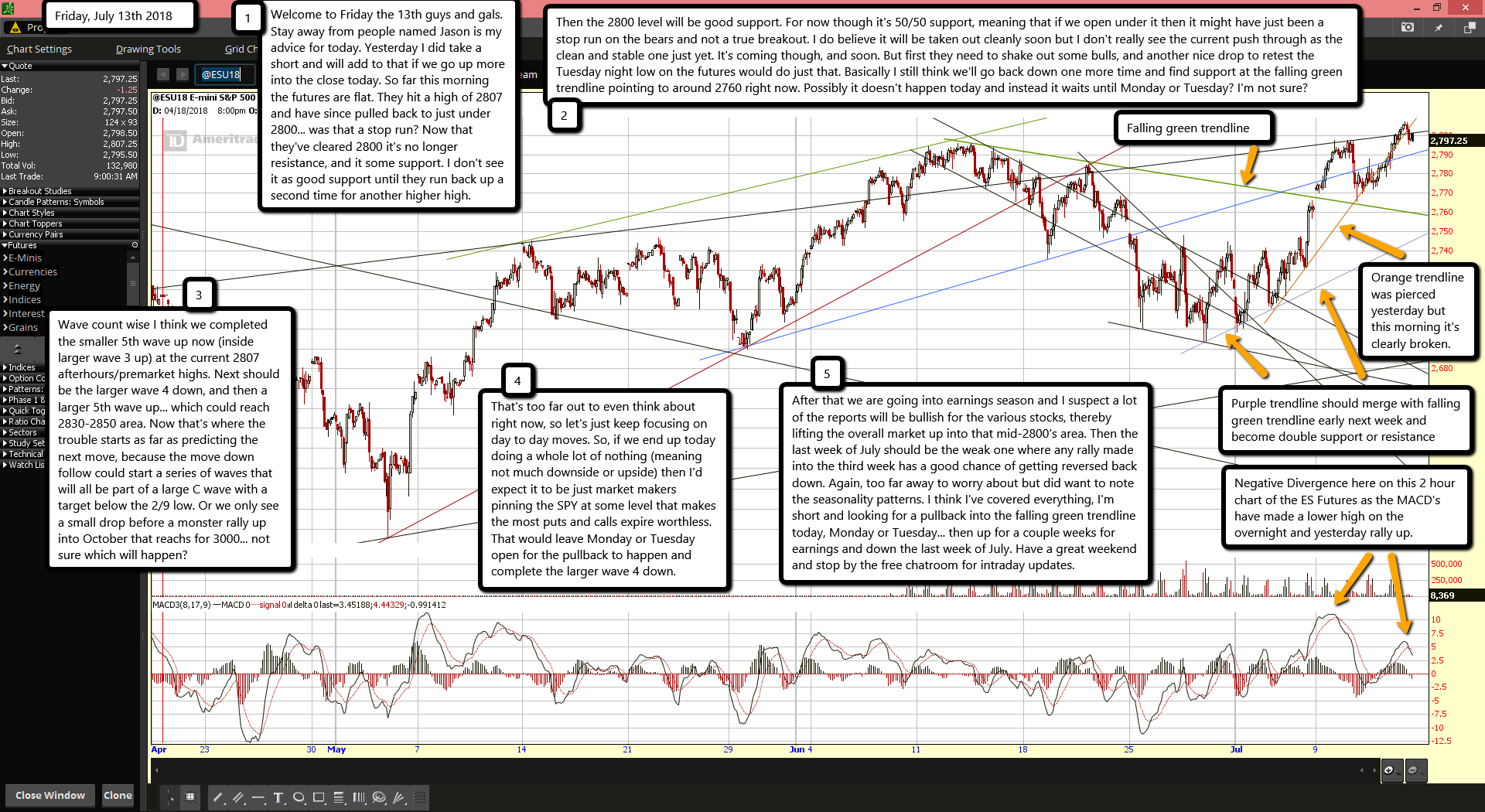

Welcome to Friday the 13th guys and gals. Stay away from people named Jason is my advice for today. Yesterday I did take a short and will add to that if we go up more into the close today. So far this morning the futures are flat. They hit a high of 2807 and have since pulled back to just under 2800... was that a stop run? Now that they've cleared 2800 it's no longer resistance, and it some support. I don't see it as good support until they run back up a second time for another higher high.

Then the 2800 level will be good support. For now though it's 50/50 support, meaning that if we open under it then it might have just been a stop run on the bears and not a true breakout. I do believe it will be taken out cleanly soon but I don't really see the current push through as the clean and stable one just yet. It's coming though, and soon. But first they need to shake out some bulls, and another nice drop to retest the Tuesday night low on the futures would do just that. Basically I still think we'll go back down one more time and find support at the falling green trendline pointing to around 2760 right now. Possibly it doesn't happen today and instead it waits until Monday or Tuesday? I'm not sure?

Wave count wise I think we completed the smaller 5th wave up now (inside larger wave 3 up) at the current 2807 afterhours/premarket highs. Next should be the larger wave 4 down, and then a larger 5th wave up... which could reach 2830-2850 area. Now that's where the trouble starts as far as predicting the next move, because the move down follow could start a series of waves that will all be part of a large C wave with a target below the 2/9 low. Or we only see a small drop before a monster rally up into October that reachs for 3000... not sure which will happen?

That's too far out to even think about right now, so let's just keep focusing on day to day moves. So, if we end up today doing a whole lot of nothing (meaning not much downside or upside) then I'd expect it to be just market makers pinning the SPY at some level that makes the most puts and calls expire worthless. That would leave Monday or Tuesday open for the pullback to happen and complete the larger wave 4 down.

After that we are going into earnings season and I suspect a lot of the reports will be bullish for the various stocks, thereby lifting the overall market up into that mid-2800's area. Then the last week of July should be the weak one where any rally made into the third week has a good chance of getting reversed back down. Again, too far away to worry about but did want to note the seasonality patterns. I think I've covered everything, I'm short and looking for a pullback into the falling green trendline today, Monday or Tuesday... then up for a couple weeks for earnings and down the last week of July. Have a great weekend and stop by the free chatroom for intraday updates.