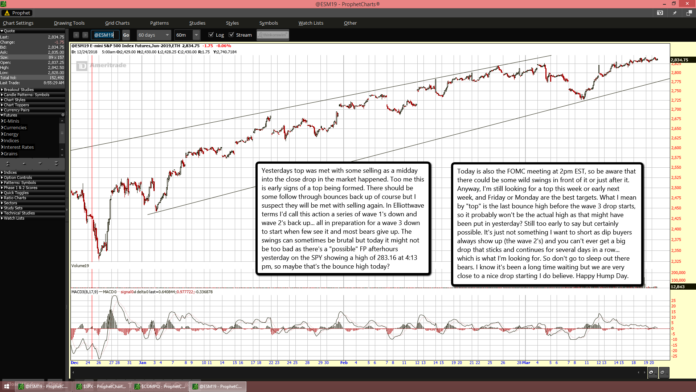

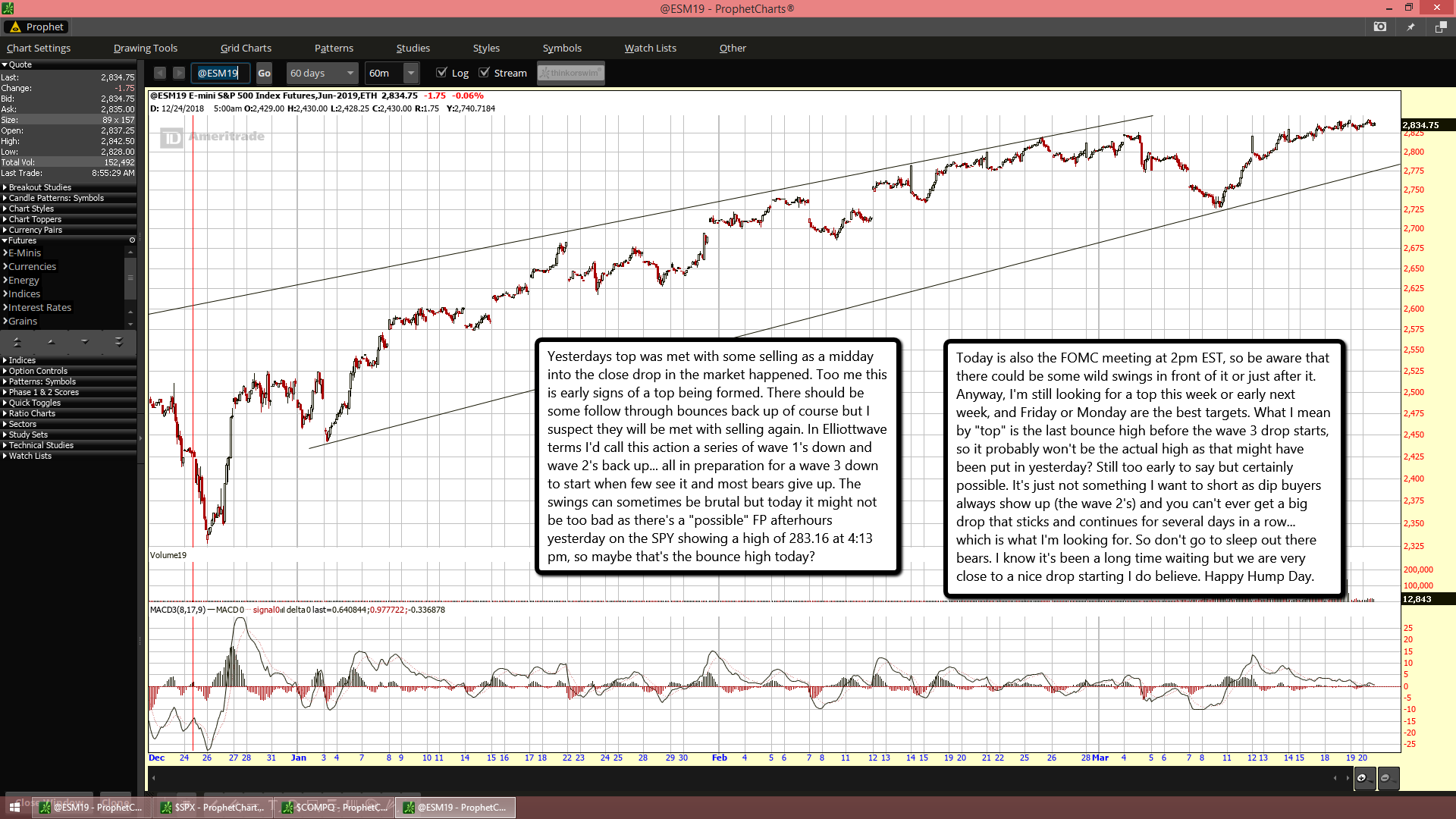

Yesterdays top was met with some selling as a midday into the close drop in the market happened. Too me this is early signs of a top being formed. There should be some follow through bounces back up of course but I suspect they will be met with selling again. In Elliottwave terms I'd call this action a series of wave 1's down and wave 2's back up... all in preparation for a wave 3 down to start when few see it and most bears give up. The swings can sometimes be brutal but today it might not be too bad as there's a "possible" FP afterhours yesterday on the SPY showing a high of 283.16 at 4:13 pm, so maybe that's the bounce high today?

Today is also the FOMC meeting at 2pm EST, so be aware that there could be some wild swings in front of it or just after it. Anyway, I'm still looking for a top this week or early next week, and Friday or Monday are the best targets. What I mean by "top" is the last bounce high before the wave 3 drop starts, so it probably won't be the actual high as that might have been put in yesterday? Still too early to say but certainly possible. It's just not something I want to short as dip buyers always show up (the wave 2's) and you can't ever get a big drop that sticks and continues for several days in a row... which is what I'm looking for. So don't go to sleep out there bears. I know it's been a long time waiting but we are very close to a nice drop starting I do believe. Happy Hump Day.