Well, it seems that small bounce up wasn't good enough for the bulls, as they rallied back well above 50% of Friday's sell off. Those bulls are pesky and irritating creatures... to say the least. But, I knew that it was possible that they'd rally it back up, as the charts were showing that the market was oversold on a short term basis.

However, today they ended overbought. So, I do believe we will sell off some tomorrow. I'm not looking for anything major, as I think everyone is waiting on the job's reports on this Friday. That should be a big market mover. Of course between now and then, any news out of Greece or some other event, could spook the market first... and let the selling begin.

One thing of interest today, on both the 60 minute and the 15 minute charts, was how the market couldn't get above this downward sloping trendline. It is clearly putting pressure on it, and if the market wants to go above it, then a gap open over top of the trendline, is going to be required.

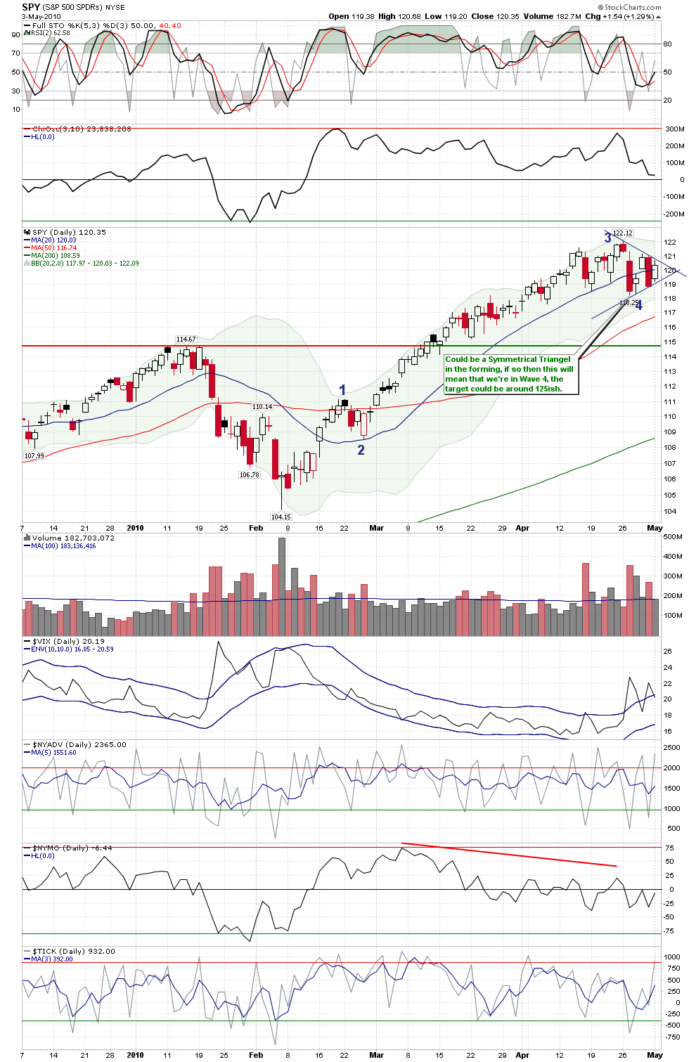

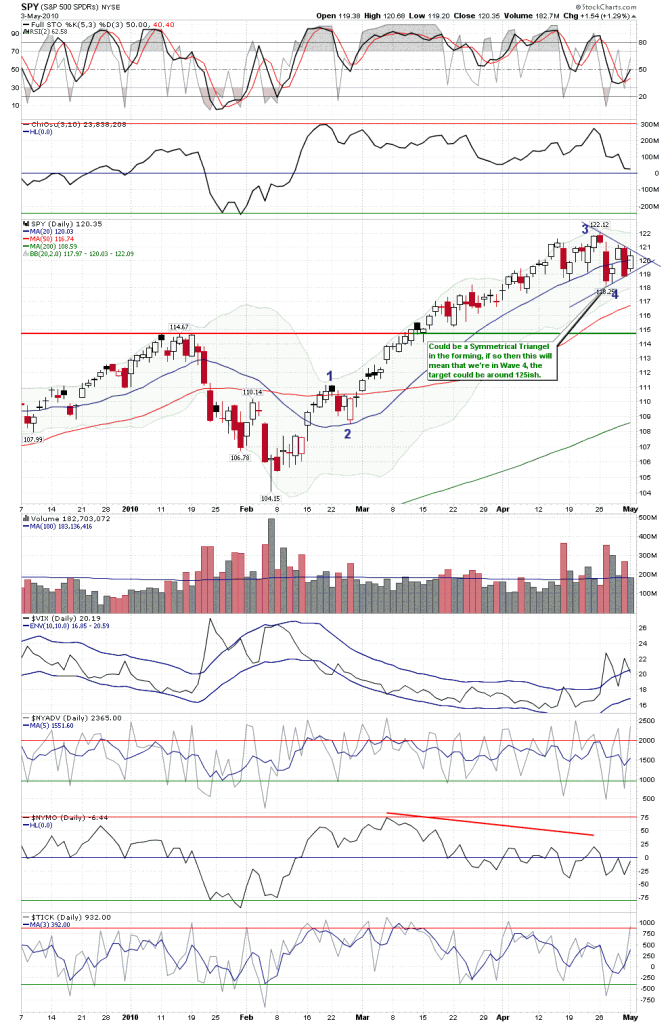

It's the same trendline shown in this chart below (found on Cobra's blog). Problem is, there is also a lower trendline that is supporting the market, and preventing further selling. This is looking like a symmetrical triangle (credit goes to Cobra for spotting it, as I didn't), which still has another day or 2 of room to trade in, before it reaches the apex, and must jump out.

All the other charts are still signaling that the market will pull back, but unless we get some bad news event to cause the selling, we are waiting for Friday to produce it... and that's only if the jobs data is bad. You know how the government likes to erase some of the digits on the report. It's just like giving the report card of the students grades, to the student first, and telling him to give it to his parents. Funny how easy it is to turn those "F's" into "A's"... So as much as I'd like to tell you that all the charts are pointing down, the chart above could go either way.

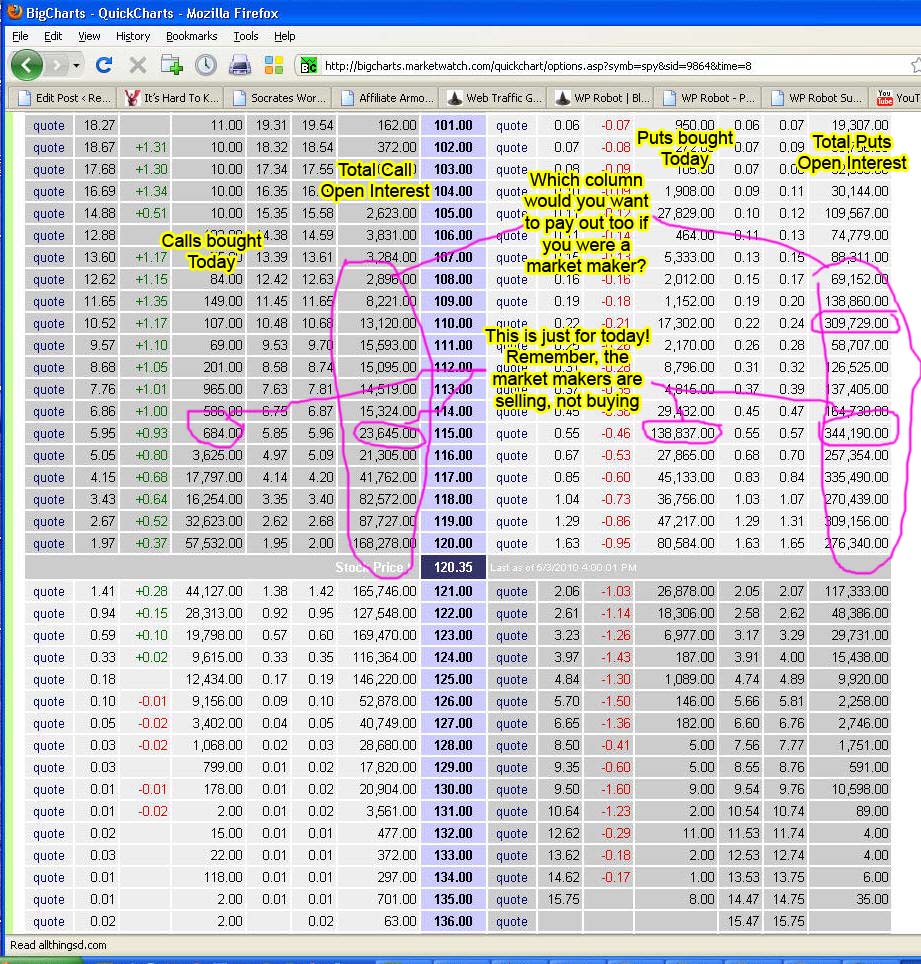

We are also now 3 weeks away from this months' option expiration, and although the market sentiment is still extremely bullish, the amount of puts purchased versus calls, for the month of May, is way too heavy on the put side.

That doesn't mean we can't sell off this week, and rally back hard into opx, but the chance of the market crashing into opx is very slim. Those market makers are not going to pay out on all those puts. I've seen it too many times, how they sell tons of puts to the retail trader, and then rally the market, making them expire worthless.

Of course after opx is another story, but for now, the bears have really only got this week too get a sell off to happen. The week of opx, and most of the week prior to opx is already reserved for the bulls I'm afraid...

Red

$VIX targets

1-2-3

27.70

29.48

31.51

http://www.flickr.com/photos/47091634@N04/45782…

A number of large entities are looking for a $VIX spike of 37 – 44.5

In other words they think the “spike event” that I talked about a couple weeks ago is right at the door step

It would be nice to be on the right side for once.

there are few guarantees in the market, one of them is Speculative Capital ALWAYS gets harvested

Wednesdays close will give us clues, as to whether the downward thrust extends to 12 TD (5.16.2010)

I hope it does, but will all the open interest on the put side, I really doubt it. The only unknown is if the majority of those puts were something that the market makers want too pay out on…. maybe because they took those positions themselves?

Other then that, I can't find any reason for them to close it down into opx. If May the 16th is the final low, then they would only have 3 days to rally the market into opx on the 19th. I'm sure it's possible, but from what I've noticed, most major sell off's are right after opx, which allows them to rally into opx, making those put options expire worthless.

Anyway, what are we looking for on Wednesday's close to give us the answer of 6 or 12 TD's? Is your support line around 115.00, like I have too? If 115.00 breaks, then I see 107.38 in the cards, and a 12 TD event instead of only 6.

Sorry, I must be drunk I can't count, it's 5.12.2010 not the 16th

So that changes the dynamics relative to OPX

I'll post some long term charts later, but we're perfectly on track for a late June or early July top

No… Sundancer drunk! LOL

That I'd like to see…

Ritual Sequences in early May

5.10.2010 = 942 CD from 10.11.2007 (Pi Ritual)

5.11.2010 = 999 CD from 8.16.2007 ( Sun Ritual)

HOD on $VIX =25.70

I will be forced to lighten up some inventory should the $VIX penetrate 31.51 area

8:19AM Eastern Carl just sold one unit at 1190.00 (loss of 7.50)

He bought this late yesterday.

First time I've seen Carl do anything outside market hours

Well Earl…

Looks like me and you took Carl's money this time… Glad you were short too.

Good Morning Red.

I'm not ready to fade Carl on everything just yet, but he is certainly off his game lately.

Good morning to you as well Earl…

And NO, you shouldn't fade Carl just for a few bad calls. Hell, I'll made tons of them. I think his better in the bull market, and I seem to be better in a bear market.

He's a good trader, and wish him well. Nobody is perfect in this market… that's one thing I know for sure.

Red,

I sold my TZA already. Too early, the way it looks.

Carl is good at this. And struggling. To me, that means the market is hard to trade, and somewhat goofy at the moment.

If I didn't think Carl was really good at this, I wouldn't be tracking his every move 🙂

Carl’s morning call:

June S&P E-mini Futures: Early this morning the ES gave back almost all of yesterday's rally. This weak action leads me to believe that the market will drop below last week's 1177 low, probably down into the 1162-68 zone. Today's range estimate is 1178 – 1192. Even so, I think a swing to 1270 will begin soon.

1187–1202 actual yesterday (15 points)

1185.50-1199.75 range last night (14.25 points)

1178-1192 estimate for today (14 points)

1185 currently, so estimate is -7 to +7 from here (neutral)

Red Flag Alert

Operators gapped $NDX below 2004

Co-relational 4.13.2010 close of 2003.81 to 5.4.2010 open of 2003.59

Red Flag Alert

Operators gapped $NDX below 2004

Co-relational 4.13.2010 close of 2003.81 to 5.4.2010 open of 2003.59

Monica,

If you're out there, pop in and tell us how you and your baby is doing. Much better today I hope…

I was just reading thank you! we are doing good. Family in town and very busy. Hope all of you are doing well. Crazy market – wish I could watch. I still own 90 May 122 puts but closed out my 119 puts just a little while ago. Looks like we are about to take a nose dive.

Glad to here that girl…

Hope to see you in here more, once things settle down for you.

You can't get rid of me Red! My kids might slow me down but they won't stop me!

we're on a grueling pace today for volume

SPY 81,555,000 first 60 minutes

Red are you enjoying this harvest of speculative capital?

I'm lovin' it! (just like the McDonald's commercial… by the way, where is SC?)

His lottery puts are finally ITM, so probably out looking @ Lambo's

By the way Red. Congrats – you must be making good money on the puts you bought yesterday. Looks like we made it past your fake print of 118.30.

Yes Monica, I almost doubled my money. I'm going to close them out here and wait for a bounce to get back short, as 117.50 is some good support.

Yeah Red! You totally deserve it!

OK – to hold or not to hold, that is the question?!

I'm out for now. I'll wait for a bounce, but 115.00 is the next support.

Excellent Red! I think I will hold onto my 122s until (if) we hit that 115 but will short more if we get to SPX 1183.

That 115.00 is a critical level, and should be good for 1-2 days bounce… or more, if this is only a 6 Trading Day event sell off, as Sundancer mentioned.

After the bounce, we will have to see if more selling is coming, making it a 12 TD event, which is what I'm hoping for. Regardless, I'm going long at 115.00, as I don't want to be left out on a bear squeeze rally, if this is only a 6 TD event.

A hard rally into opx is possible, as you can clearly see by the chart I posted today, that there are way too many open interest contracts on the put side.

Close partial to recoup the capital and some gains. Put some profits in the bank. 🙂 Then you are just playing with the house's money.

I did earlier.

Think I will close the rest of my puts at 1171 SPX, if we get there today.

OK Monica,

We just put in a bottoming tail candle on the 10 minute chart, so it's starting to look like this level might hold for the rest of the day. Of course there is more selling coming, but based on what time it is now, and the bottoming tail, and finally the fact that 117.50 is good support, I'd say the bottom is probably in for the day.

I'll look to get short again late today, or early tomorrow, after we work off some of the oversold conditions, as 115.00 is next up I believe.

I think you are right but I am still holding my puts just in case. I'll ride the wave back up, short some more and then ride it back down.

Halloo everyone.

Kaching! Sold all my beloved stocks yesterday. Puts are paying off.

Red, we can quit McDick nightshift now.

Sundance, encore!! encore! keep'em ringing!

Monica, double congratulations! Salvation has arrived! Take the money and run. And please…. don't bet the farm again. (Yes you can thank me for talking you out of 3x inverse by leaving a big tips at the McD drivethrough window next time when you order. heheh)

Earl, keep raking it in going both ways with them 3x'es. HAHA, that sounds dirty.

There you are… late to the party as usual! LOL

Yeah SC! Congrats! I had to bet the farm to get the farm back! I will be more conservative going forward. I know gambling is no way to win in the end. But I do think I prefer options to the ETFs so I appreciating you swaying me. If your timing is right with options, you can do really well but of course if your timing is wrong. . .

Yes. You got it. 🙂

We tagged the 50ema perfectly today, so that's why I sold my put spread. I'd like to see a small pop tomorrow, or late today. I'll re-enter short again with a downside target of 115.00 spy.

http://stockcharts.com/def/servlet/Favorites.CS…

then again, look what happened last time we tagged the 50ema.

You're right Monica, no backtest…

Well, I'm patient, and will wait until the EOD to see what plays out.

Either way you will make money.

Probably smart especially since GS is barely down. I just figure expect the unexpected so I figure if I have to ride a wave up again, I will.

Red, SC, why would you ever buy out of the money puts? Let's say SPX gets to 1184 and I have a strong suspicion we go down significantly from there. Would i always buy 119 puts at that level? Or would I buy 118 or 117 puts because the premium is so much lower? And, does it make sense to buy options when the VIX is so high (premiums get higher, no?)

Monica,

I always do spreads to neutralize the VIX. So I first have to look for what level I think it is going too end up at first, and that's the level I would sell. Then I buy a level somewhere around the money. The time left before opx is important, as the closer it is, the more likely I will buy the “at the money” or one strike “in the money”.

Since we are 3 weeks from opx, I felt comfortable buying the 118 May put yesterday, and selling the 112 (knowing that it's not going past that level before opx).

Yesterday, the spy was at 120.50 level when I bought the 118/112 spread, which is 2 points out of the money. But, I did that because we are 3 weeks away from opx. When it's only one week, I might have bought the 121, and sold the 115 or something.

The time factor is important, as you don't want to be caught without enough time left for the market to go below your strike price. Since 121 would have already been 50 cents in the money, as long as it didn't go higher, I'd still make some money.

Hopefully that makes more sense to you now…

It's all making sense to me now and I really appreciate your continuous explanations. I realize it makes sense to do a vertical put spread now (since the VIX has had a pop) but if the VIX was in the teens, wouldn't it make more sense just to buy straight out puts since you are not getting much of a premium on the puts you would be selling (in a vertical put spread scenario)?

It cuts both ways, Monica. The low volatility lowers the premium you receive on the short leg, but also lowers the cost you pay on the long leg.

Doing spread is a lazy way to deal with the option Greek parameters. One leg offsets those of the other. You only need the market to move to the spot in due time. You spare yourself the concern about time decay and volatility crush etc.

A spread is not as sexy as holding the right front month options when the market moves in your direction in a big way.

Just the past weeks,many naked puts have doubled in one day and got cut in half the next. In theory you can mint coins just trading them back and forth. The spread, otoh was moving like molasses going up hill in January. The positive part was that it didn't go underwater much and thus saved a lot of maalox.

I did ok. Closed out shorts at 100%, and various stocks for 10 -30%. It has not been as efficient as it should and I left money on the table which could have been harvested with more aggressive trading. I shall do better… 🙂

Just went long hold til opex. …. To new highs.

Might buy some GS too

http://stockcharts.com/h-sc/ui?s=gs

LOng SPY and GS

Long DRN at 224.1

Still short which scares me since you and bear/bull are usually right. But so be it. Sticking with my conviction.

DRN likes to flip out and kill bears. I think it is playing out an ending diagonal. Any EW wizards want to take a look at IYR and chart it? I think it could provide some insight into the rest of the market.

A little concern that I have is AAPL looks like it will not fill the gap in the next few days. If the whole market makes another run in the next few weeks then next month the Market could take another dive. But again its too early to tell now. But upside target for SPY is 125-127 for may

GS 175 IMO

Don't make this game anymore difficult than it already is……

The SPY 115.58 tick from 3.24 will be hit, which will create a host of problems for the bullish case as it will violate major TL's.

As I wrote last week, the hardest thing to do is nothing, those that were short are getting rewarded, speculative capital is getting harvested.

Here is a chart of the $DJI daily containment

http://www.flickr.com/photos/47091634@N04/45786…

the bulls will need a miracle in the last hour to close the $DJI above brown containment that has been holding the $DJI up since 4.12.2010

Red containment is in the mid 10,700's.

GS, AAPL, IYR are sending very clear messages………..

Do you see anybody puking up there shares in any of those individual issues?

If the answer is no, go for a walk on the beach as the harvest of speculative capital is not completed.

Ok gang I'm back… I had to leave for a little while. Looks like I need to get short again, as we are forming a nice bear flag. More selling is likely tomorrow, from the looks of it.

Bulls better hope this closes @ the low today and climaxes tomorrow as it is the 9th CD from 4.26.2010 highs

Shortest counter-move of 02-07' mkt and current bull mkt. is 9 CD.

Otherwise things are going to get real fun………………..

Indeed…let the fun begin…

I'm short again, with a 116/108 put spread…

for those trading IWM

67.39 de-leverage pt. established 4.1.2010

This bull looks like he's ready to fall over and die! LOL. Some how I don't see any rallying back up tomorrow, as they had their chance today. I do believe we have more selling coming.

Sundancer, is that 115.58 tick from 3-24 also meet with your trendline support?

it's below them, so it will have to be an intra-day spike below the TL's if it's going to be a terminal pt.

Gap on all indexes qqqq, spy dia spy spx but no gap on vix??? humm.

Carl at day’s end:

1178-1192 estimate for today (14 points)

1164.25–1185.50 actual today (21.25 points)

Carl didn’t anticipate the drop today.

Trades: In /ES at 1197.50 from yesterday, sold it today at 1190 (loss of 7.50)

Grade: D (lost some money)

SPY sequence 2 of TL's

http://www.flickr.com/photos/47091634@N04/45788…

the 7 pt. reaction @ the end of the day occurred with the hit of the red TL

The SPY 115.58 tick is going to correlate with the Blue TL which was @ 115.45 today

I'll post a chart tomorrow showing the TL which correlates with the DIA tick of 118.16

I see a fake print in the afterhours of 120.38, man I hope that one doesn't play out… at least until we hit that 115.00 area first. How much damage was done to the bulls today?

I'm so programed to expect a bounce, that it makes me nervous being short again. But, I think we will open flat and continue selling more tomorrow, without much of a bounce at all.

That's just based on looking at the previous sell off, and how it hit the 50ema, and then opened the next day flat and continued selling. I'm looking for more of the same.

those are trades getting processed from yesterday's close which was right @ that level

HUGE damage to the IWM,

2 out of the last 6 days 100+ million volume

IWM volume today 4 million shares shy of 2.5.2010 low

$NDX reversal setup gives TA enthusiasts wet dreams

That's what I like to hear… thanks.

For an alternate view, see the chart I posted.

Congratulations to Red, Monica, SC & everybody else who got paid today!!!!

Thanks Sun… it's always good to have you around. I look forward to you DIA 118.16 trendline chart tomorrow. Of course we first have too figure out if 115 stops this sell off, or if it's going deeper to 107 area. Time will tell us… hopefully.

Same to you!

TZA opened up 4.3%. TZA was up 11% at the high, and closed up 9.2%.

Yesterday’s gap down today from $5.93 to $5.83 was filled today.

A gap up today from $5.53 to $5.77 remains unfilled.

We are now in a Full Moon Trade, which tends to favor TNA.

AmericanBulls had TNA with a possible Buy today, but TNA fell, so TNA will return to a Wait.

AmericanBulls had TZA with a possible Sell today, but TZA was up, so TZA will return to a Hold. TZA bought at $5.54. TZA closed today at $6.04, so this trade is now up 9.0%.

Volume for TZA today was about 50% above the average.

$RVX (VIX for $RUT) closed up 18.3% with TZA up 9.2%. No divergence.

TZA has been up, then down, then up, then down, then up today. Chop, but drifting up. Good for TZA.

The low for TZA was from five days ago at $5.30. Today’s low was $5.77, 8.8% higher. Good for TZA.

Today, Ultimate Oscillator for TZA rose from 46.92 to 55.9 – a nice gain to match the gain in TZA. A reading over 50 is good for TZA.

MACD on the monthly chart had been a flat line at -0.50 for 10 days. Now has been moving up a bit, and up more today. Good for TZA.

Bollinger Bands for $RVX (VIX for $RUT): Today’s long white candle closed far and away above the upper Bollinger Band. MACD is aggressively rising. This could be the 1st day of a 3-day $RUT buy signal. Good for TZA for the time being.

Bollinger Bands for $RUT: Today’s long red candle fell below the mid Bollinger line (20 day moving average). The last time $RUT fell below the the 20 day moving average, it fell for days. MACD has rolled over (down). Good for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): The red candle today was entirely below the bottom Bollinger band(This happened Jan 22nd, and at that time $RUT fell generally for 9 days). This also happened 5 days ago and was followed by two up days. This also happened 2 days ago and was followed by one up day. Seems to happen a lot lately, but it’s really rare. The close below the lower Bollinger Band is considered a $RUT buy signal. Bad for TZA, for a day or two.

Down volume on the NYSE today was 15 times the up volume. In the recent past this has been followed by an up day either the next day or the day after that.

TZA had a higher high, higher low and much much higher close – Good for TZA.

Money flow for the Total Stock Market:

$ 108 million flowing into the market 2 days ago on a down day.

$ 1,375 million flowing into the market yesterday.

$ 1,736 million flowing out of the market today.

Good for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks good for TZA.

The Daily view from Americanbulls

TNA was a possible Buy for today, was down today, and has a Wait signal for tomorrow.

TZA was a possible Sell for today, and was up big today. In spite of that, the possible Sell continues tomorrow. The TZA buy price was $5.54. TZA closed today at $6.03, up 8.8% since the buy.

Of the stocks & ETFs I follow, only these are to hold on to:

SLV(silver), QQQQ

The list to avoid:

IWM (1x $RUT), UWM (2x $RUT), TNA (3x $RUT), USO(oil), ERX(3x energy), AMZN, DRI, GOOG, DIA, SPY, EWU(England), EWX(emerging mkts)

The following are possible buys tomorrow:

IYR(1x RE), URE(2x RE), DRN(3x RE), GS

The following are possible sells tomorrow:

GLD (gold), UCO(2x Oil), AAPL, EWG(Germany), EWQ(France)

Action for TNA or TZA for tomorrow: Possibly Sell TZA

See above chart of $RMZ (the index that DRV/DRN trade).

Dreadwin, Nice chart. I can see why you bought DRN.

Good Luck!

Interrupting the bear party, here:

http://www.screencast.com/users/dreadwin/folder…

Note the pattern of higher lows on $RMZ (RMZ.X on Google). This is a chart of one of the Real Estate indexes. At this point, the move down today looks corrective, not impulsive. That's why I bought DRN today (I could have gotten a better price had I waited longer, though).

Hmmm, I have to agree with you that chart doesn't look bearish. But, the overall market still looks bearish too me. Maybe it can rise tomorrow, while the market sells off?

I'm betting that shorts piled on the REITs when the broader markets showed weakness. They'll get squeezed tomorrow (I hope).

Usually, after a distribution day (which today was), the next day is green, followed by more selling which sets a near term bottom.

http://cobrasmarketview.blogspot.com/2010/05/05…

Looking at a bigger picture, you can read some statistics here:

http://www.biasedsurvivor.com/blog/?p=242

I made a comparison to the last sell off in my newest post that I just uploaded. Here is the chart from it…

http://reddragonleo.com/wp-content/uploads/2010…

It may not play out, but the futures are down right now, so we'll have to wait until tomorrow I guess?

Do you every play the spy, or just other etf's and stocks?

I like to pick a small number of things to track, and focus focus focus. I have done SPY calls/puts but mainly as a hedge. I like to watch real estate and silver (which means that I also watch $USD), with occasional forays into $RUT and oil (usually via long or short DTO).

If you believe the bear hype, REITs are going to go to zero. They just set a new high yesterday on the strength of earnings reports. I would find it really strange that we're in a wave 3 down without REITs taking a serious beating, wouldn't you? I think this is some other complex corrective structure going on — Alphahorn has this:

http://2.bp.blogspot.com/_-p17nqJfPI8/S-COjqYl6…

and Carl Futia has this:

http://1.bp.blogspot.com/_sL6ril9lDkw/S-BBR12z4…

Carl's channel is readily verifiable based on the price action in the coming days.

I guess it's possible that we start a channel down like Carl's chart, but the way I'm reading the market, I don't agree. We just had 350 million shares dumped today, and the average volume up has been 150-180 million shares. I don't think the big boys are done yet.

But, it's always good to see other alternatives, as that's what this blog is about… sharing ideas. Although I'm mainly bearish, I always welcome the other side.

Believe me, I've been wrong many times, so listening to others opinions will help me, and others, to look at all the possibilities.

The other chart is just showing that the market is oversold, which you and I know that it can remain overbought or oversold for an extended period. Notice that the MACD's aren't showing any sign of turning back up yet.

So maybe… we get a bounce tomorrow, but I see more selling coming.

Thanks for posting your thoughts too…

I think that the main reason the US indexes have not suffered as much as the rest of the world is that the US is still viewed as a “safe haven” for assets. What I've been saying for the last couple of weeks is that smart money has fled from Europe and is currently sitting in things like TLT (RSI on TLT has not been this high during the last year!), LQD, etc.

Take a look at the chart of JNK (Junk bonds), and compare that to the price action in January / February. Does the price action look corrective or impulsive? If we are in a wave 3 down, it is nothing like what happened in Jan/Feb. … yet!

With the gap down on JNK today, it looks too me like it want's to go back to the 50 sma at 39.00…

http://finviz.com/quote.ashx?t=jnk

You think it's going back up tomorrow? A gap down, and big sell off, closing at the low… is very bearish. I really doubt that it goes back up tomorrow. I think it's going to that 50 sma before bouncing… of course I could be wrong?

During the move up, JNK flirted with the 20 ma (as support) many times. I think it will back-test the 20 ma from the underside first. If it closes underneath, I would agree that the 50 ma is the next likely target.

Back in January, $RUT made a new high around the 20th ($SPX made it's high on the 11th, IIRC as did IYT). JNK was already making red candles down after the 11th. The point here is that there was clear non-confirmation of new highs in several asset classes.

JNK has not yet taken out the low set on April 19th (when you adjust the price for the $0.31 dividend). At this point, I'm taking the lack-of-moves in IYT and JNK as non-confirmation of the bearish case. That could change tomorrow!

Well, you've been around long enough to know how accurate these fake prints are. So, after this sell off is finished, to whatever level, I do see the bull back in charge until we reach the DIA 118.16 area.

After that, I'll have to start back to being bearish again.

Come on VIX close on a long black candle and its all up from here….. equities.