The Bears celebrated today by laughing and giving each other "High Fives"...

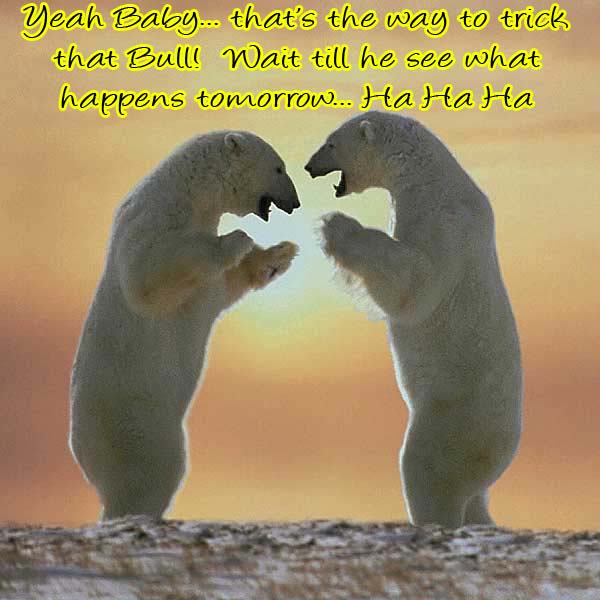

It's seems it's been such a long time since the bear has had a decent meal, that this one almost seems like a dream. The sell off I've been waiting for is finally here... but will it end today? I don't think so. Here is the same chart I posted on Sunday... now look at where we are compared to the last sell off?

Do you notice anything similar? I certainly do, and I believe that tomorrow will not bounce at all, as many of the bulls are expecting it too. I think it will open and continue selling off until we hit the 115.00 spy level, and then a bounce will occur. How much is still unknown? It could end the correction and then we are back to the slow grind up to our finally destination of 11,816 (DIA 118.16), where we have our fake print that Sundancer caught many weeks back.

However, the way the market climbed to it's current height, leads me to believe that we will continue on down to the other fake print of Dow 10,000 and 107.38 spy first, and then rally hard. The climb up is too step I believe, and a larger correction needs to happen before turning the ship back around.

Think of it as a large ship, traveling way too fast in the water. If it sees danger ahead, (like a fleet of enemy ships), it must turn the ship around as fast as possible and go back another direction. Unfortunately, it's been moving too fast for too long, without stopping for any maintenance (pullbacks in the market), and now the engines are kicked into full reverse causing the ship too turn quickly.

But, half way through the turn (the coming bounce at 115.00), the ship's engine's lock up from the stress, and a quick repair must be done (another sell off to 107 area), before she can get back up to speed and away from the enemy ship (full of an army of bears of course).

So as you can see, I'm really leaning toward fulfilling the lower target fake prints first, before the rally continues back up again. Will it play out that way? That's any one's guess? I think it will, but time will tell...

Red

great read red (as always)…read this too…this is an eye opener as well. i know, lots of comparisons made to 1929 over the last several months…interesting analysis nevertheless!

http://market-ticker.denninger.net/ “Does Anyone Remember 1931? Of course not.”

Everyone that reads my blog knows that I'm a Bear. Now that doesn't mean that I won't go long, but I prefer the short side.

Here's something funny…

Herbert Hoover was the President during “The Great Depression”, and he was born August 10th, 1874, and died in 1964.

I was born on August 10th, 1964 (and of course I'm still alive), hence the “Leo” in my name… plus 1964 was the year of the Dragon, which is why I'm Red Dragon Leo.

Isn't that strange?

that is funny! i wondered where the red dragon leo came from. i thought it was just your 'funky' trading name. 🙂 it actually has real meaning. what a hoot! i did well last year 2009, and got spanked thinking there is no way it can go on…and on…and on…and on…damn, that last move from Feb 5th was brutal. i'm sure a lot of shorts got murdered! I'm looking forward to seeing 1070 or lower on the S*P! thanks for sharing sir.

You are welcome Bob… and I also got spanked in this brutal bullshit rally. But pay back is a bitch, and I'm going to get some money back on this sell off… that's for sure.

you and me both sir…for sure. best of success to you Red. Keep up the great work. you're the highlight of the TZA/TNA board on FB. We always get a hoot out of your pictures and analysis!! have a great night.

Sorry for butting in. I do not know what you folks do over at your forum. But for the love of god, country, apple pie and motherhood and what not, please do not deploy your hard earned money in leveraged ETFs to fight a war of attrition against the prevailing market trend. It is very likely that irrecoverable damage can be inflicted in the course of an unfavourable whipsaw market.

hey sc. yeah, they can be tricky for sure. however, what about the person who bought TNA at 34 (when the RUT was 585) just a couple months a go. not a bad return for that fella/fellee. 🙂

Expecting deadcat bounces in the QQQQs and other indexes. But the trend has changed. The deadcat bounce will fail. We are in short the failed rally mode now.

The DIA 118.16 terminal de-leverage tick correlates to one of 2 TL's that held the $DJI during the asset appreciation pays the interest expense scam

http://www.flickr.com/photos/47091634@N04/45806…

The 4.26.2010 high on the $DJI came 1 pt. above the white TL.

It's Twin, the yellow TL is the one that correlates to 118.16. The Yellow TL is currently is in the mid 11,700's. It will be in prime territory during June & July.

What kind of clues are we looking for today, in order to figure out if this is a 6 TD or 12 TD event? I do plan on selling out around the 115.00 area, but I'm still uncomfortable on going long.

All the other charts show a deeper correction, before they roll back up. The monthly put in a bearish topping tail candle pattern, the weekly is bearish, and the daily is just now pointing down, with no signs of rolling back up yet.

This all leads me to believe a 12 TD, just based on the charts. But, anything can change. Just wondering what you are expecting to see, or not see by the close today?

yeah for those with highly levered short positions I would probably lighten up around the 115.58 de-leverage area

This has all the markings of a 12 TD event (5.12.2010), the volume that showed up on the IWM & QQQQ yesterday was very damaging.

As i posted yesterday, big money is looking for a $VIX spike of 37-44.5, fading them generally is not the best idea. They have 100% figured out the ritual timing which is why their rolling around in their 100 ft yachts.

Carl’s morning call:

June S&P E-mini Futures: I estimate today's day session range will be 1156-1175. I think a swing to 1270 will begin soon.

1164.25–1185.50 actual yesterday (21.25 points)

1162-1175 range last night (13 points)

1156-1175 estimate for today (19 points)

1161 currently, so estimate is -5 to +14 from here (bullish)

SPY Red Flag Alert

http://www.flickr.com/photos/47091634@N04/45807…

same setup as 1.22.2010, SPY gapped below 2 containment pts.

Sundancer, it looks like from your chart, a logical place to stop would be the 1131 gap level.

Yeah that's definitely a possibility, the white TL that held the SPY during the Jan. High is right in that area

It looks like that blueish line below is the next support level. That's more like 114 or something. Where does your 115.58 level come in at?

the teal line (Max Contain) is in the 114.60 area

this is a bit scary…

the 1.22.2010 first hour low & subsequent rally came off this exact TL, then teased everybody like a $1,000 hooker with the vaunted “bottoming tail” candle

Here a $VIX daily containment Chart

http://www.flickr.com/photos/47091634@N04/45814…

gapped above gray, HOD right @ brown so far, brown contianment held the $VIX during 2.5.2010 lows, brown fails then Red-Yellow-Light Purple

ah so we got our gap fill on AAPL

This reaction came off the TL that contained the SPY during the 10.10.2008 crash lows

http://www.flickr.com/photos/47091634@N04/45808…

Looks like it wants to fill the gap this morning, before heading lower.

Now lets just say if a positive development from GS and greece occurs in the next few days. What do you think will happen to the market?

Greece situation is a non issue. IMO

The news is just an excuse to get the market going in the direction they want it to go. They will sell on bad news, sell on good news. They will also buy on bad news, and buy on good news.

Bottom line, at this point I don't think the news matters too much. They have already started the sell off, and it will end when it hits their target area… which I think is around Dow 10,000 (per the fake prints).

If that's not the case, then whatever level that they want to take it too, will be the point at which they start buying again. The news will be spun positive then, as it's all negative now.

Red one of these weekends you can pull out your black monday picture again…

All those suckers that have been going long on Friday's close via Futures or Options are going to get liquidated

A 40 or 50 pt. S&P debasement will liquidate all of that speculative capital

Are you suggesting this Friday… 🙂

I don't know when but it will conclude the Greek/Zeus ritual

the announcement will happen on a SUNday

If I'm putting 2 and 2 together properly, then the 10th or 11th will be the bottom… according to the ritual, which means that it must happen on this coming Monday, as it's the 10th.

Maybe third times' a charm? He He He…

Back on January the 22nd (Friday), when the market sold off hard, closing at the lows of the day, did the early morning action look similar to what we are seeing right now?

I was really expecting today to sell off hard again, closing near the low of the day, and then the government come out with so manipulated Initial Claims numbers tomorrow, causing a rally.

Then more manipulation on the Unemployment Rate on Friday, sparking another move up. Then of course, something big to happen over the weekend, causing the next leg down.

That's what I'd do if I controlled the market…

Keeping things simple from a NUMBers perspective

Problems in paradise for the bulls….

I posted this last week

$SPX % setup

1219.8 = 16.78%

16.78/4.56 = -3.679% (1174.93)

OR

16.78/1.245= -13.47% (1055.5)

We have firmly blown through the 1174.93, with our current low @ 1158.15

Here are the numbers from the current Bull mkt.

#1

$SPX 3.6.2009 : 6.11.2009 = 43.41%

$SPX 6.11.2009: 7.8.2009 = -9.09%

43.41/9.09 = 4.77

#2

$SPX 7.8.2009 : 9.23.2009 = 24.25%

$SPX 9.23.2009: 10.2.2009 = -5.57%

24.25/5.57 = 4.35

AVG. of 4.77 : 4.35 = 4.56

#3

$SPX 10.2.2009 : $SPX 10.21.2009 = 7.98%

$SPX 10.21.2009: $SPX 11.2.2009 = -6.54%

7.98/6.54 = 1.22

#4

$SPX 11.2.2009 : 1.19.2009 = 11.76%

$SPX 1.19.2009 : 2.5.2010 = -9.21%

11.76/9.21 = 1.27

AVG of 1.22 : 1.27 = 1.245

my buddy out of CHI-cago is going to be right with his prediction that the operators are going to game the Massive H&S formation on the daily, Coincidentally the neckline is going to be @ 1056 which is co-relational to the 1.245 mult. which puts the $SPX @ 1055.5

It will have everybody & their dog short convinced that the top is in

If you know people that are convinced the top is in, please send them my screen shot of the DIA tick, it will save them from bankruptcy

That 1055 is a lot closer to the DOW 10k print, then the 107.38 spy I got, which leads me to believe that 1055 is more likely the correct target.

Besides that, my print was on the 10 minute chart, not the daily. I think the daily holds more weight in this case.

Careful here we could have a nice bounce here. Close green and it up tomorrow. IMO

yep. lets see if resistance holds. just reloaded puts but will cover if we move higher

For those wandering what has kept a lid on the SPY yesterday afternoon & today this may help

http://www.flickr.com/photos/47091634@N04/45819…

thank you!

I've got this:

http://screencast.com/t/OTdjMDA1ODgt

Good Job!!!

There's a big slip zone, below our current low

The SPY HOD back tested the TL in which SPY gapped below on the day of the Lehman Ritual

I was going to get out at 115.00, and re-load back short again on a bounce, but I think I might just stay short now. I don't know what to think about the jobs numbers tomorrow and Friday?

Could be manufactured to look good, or just left as is… aka “Bad”. I feel safer short, and waiting out a possible bounce, then to get out and the market keep falling on me.

We had a low today of 115.97 spy, which isn't quite close enough to 115.00 to convince me that the market is ready for a 1-3 rally.

I'm kind of expecting some more selling into the close, on fear of bad jobs numbers tomorrow and Friday.

However, I think the numbers will be viewed positively and cause a short squeeze rally to happen. This should get us back up to 118.00-118.50 area by the close on Friday.

Then, I expect more bad news over the weekend, and panic selling on Monday and Tuesday. That's the ideal plan, but it never really works out that way.

Wishful thinking though…

there will be a reaction off the Suckers'R'US MA (200 DMA) which will be @ 1096 on Friday

Almost a perfect 1 : 1

1219.8 : 1058.15 = -5.32%

1158.15 : 1096 = -5.36%

I'm confused? 1096 or 1196? And are you talking about the daily chart?

1096

200 MA on the daily

I think SLX is about to bottom, SMN, ( inverse metal ETF) I’m starting to get short sell signals on it. I'm waiting for 39.5

The metal stocks have taken a big beating, and are due for a bounce.

I concur!

Covered GOOG and SINA longs from yesterday. I don't know if I can get 2 up days in a row, on any of the ( lately its been ) idiot stuff, that I follow.

Z… listen and read what is posted here. It should keep you from being on the wrong side. The market is going down to the fake print area of Dow 10,000… before any meaningful rebound.

http://reddragonleo.com/wp-content/uploads/2010…

If you are day trading, that's different. But if you swing trade, stay short until Dow 10,000 area, which is also around 1055 spx. I'll go long there for a longer term move up to Dow 11,816 area, where our other fake print is (DIA 118.16)

http://reddragonleo.com/wp-content/uploads/2010…

I concur…IWM headed to at least 66-67 = 10% correction.

RedDragonleo

How reliable are these fake prints ? I remeber seeing one in dec for 1055 when market was 1125 and a few weeks later from 1151 we went to that print and below it, but generally is it that reliable to think it is LIKELY to get hit?

That one was when I learned my lesson… after losing a bunch of money. I caught the fake print back in January. It was my first experience seeing one, so I forgot all about it in February.

When the market hit around 1060-1070 during the February sell off, I took a large short position, only to see the market hit 1044.50, before the computer bot's kicked into high gear and nearly wiped me out.

I still haven't recovered fully from that mistake, as I'm more cautious now. And, I pay a lot more attention to those prints. Here's the original screen shot from January…

http://reddragonleo.com/wp-content/uploads/2010…

It's states 1047.28, and was only up for about 10 minutes before they corrected it to show the real number of about 1150 or so. Well this time we have a fake print of Dow 10k, which will be about 1055 spx that Sundancer mentioned.

So, I'm not getting seriously long until we hit that target. I might swing in and out short term, but no longer term swings until that target is hit.

You have too realize by now that this market is 100% control, as TA's don't always work. Sometimes they work well, for weeks at a time, and then just when you think you've got a big moved figured out… BAM, it goes against all TA's and takes your money.

So, to answer your question… I think they are extremely accurate, but I never know when they will start… only that they will eventually play out. It's now started, so the play out time is within a few weeks, I'd expect.

Hope that helps answer your question…

Red

2:00 CST SPY currently has 6 consecutive lower closes than opens on the 30 min.

1 of the last 2 30 min blocks will be positive

Hey Sun,

Did you read what I posted about me an Hebert Hoover to BobArsenault? Is that funny? No wonder I'm a bear…

yeah that gave me a good laugh this morning

have a feeling they will close the SPY at 116.99 lol

Now bear/bull, thinking like that isn't nice. We don't believe in conspiracy theories here on this site. LOL

the operators still got their ritual in

$SPX – .66%

6*6 = 36

SUM 1:36 = 666

IWM volume higher than 2.5.2010

58 : 74.66 = 28.72%

74.66 : 69.39 = 7.05%

28.72/ 7.05 = 4.07

IYR – 3 TD into it's $55 high

41.71 : 55 = 31.86%

55 : 51.81 = 5.8%

31.86/5.8 = 5.49

I posted this chart on 3.27.2010 showing the 55.07 magnet

http://www.flickr.com/photos/47091634@N04/44671…

Carl at day’s end:

1156-1175 estimate for today (19 points)

1154.75–1173 actual today (18.25 points)

Not bad for guessing

Trades: No trades today

Grade: C (made no money)

TZA opened up 2.4%, and the opening gap was filled. TZA was up 6.8% at the high, and closed up 4.3%.

A gap up yesterday from $5.53 to $5.77 remains unfilled.

We are now in a Full Moon Trade, which tends to favor TNA.

AmericanBulls had TNA with a Wait today, and TNA fell, so TNA will be a Wait for tomorrow.

AmericanBulls had TZA with a possible sell today, but TZA was up, so TZA will return to a Hold. TZA bought at $5.54. TZA closed today at $6.30, so this trade is now up 13.7%.

Volume for TZA today was highest since December 4th — about 2 times the average.

$RVX (VIX for $RUT) closed up 0.09% with TZA up 4.3%. I’m calling that a divergence.

TZA has been up, then down, then up, then down, then up two days now. Chop, but drifting up. Good for TZA.

The low for TZA was from seven days ago at $5.30. Today’s low was $6.04, 13.9% higher. Good for TZA.

Today, Ultimate Oscillator for TZA dropped from 55.9 to 55.09 – a small drop that mismatches the 4.3% gain in TZA. A reading over 50 is good for TZA, but this is a divergence. Good for TZA (with reservations from the divergence)

MACD is below zero, but has been moving up steadily, and up more today. Good for TZA.

Definition of terms:

White candle closes above the open

Red candle closes below the open

Black candle closes below the open, but above the prior close

Bollinger Bands for $RVX (VIX for $RUT): Black candle closed far and away above the upper Bollinger Band. MACD is aggressively rising. This could be the 1st day of a 3-day $RUT buy signal. Good for TZA for the time being.

On the other hand, a similar black candle on April 19th was followed by $RUT rising for 4 days, which would be Bad for TZA.

Bollinger Bands for $RUT: Today’s red candle touched and bounced off the lower Bollinger band. This could be the beginning of a bounce in $RUT, Bad for TZA. MACD has rolled over (down) and falling. Good for TZA.

Bollinger Bands for $RUT:$RVX ($RUT vs VIX for $RUT): The red candle today was entirely below the bottom Bollinger band(This happened Jan 22nd, and at that time $RUT fell generally for 9 days). This also happened 6 days ago and was followed by two up days. This also happened 4 days ago and was followed by one up day. And again yesterday, followed by one down day. Seems to happen a lot lately, but it’s really supposed to be quite rare. The close below the lower Bollinger Band is considered a $RUT buy signal. Bad for TZA, for a day or two.

Down volume on the NYSE yesterday was 15 times the up volume. In the recent past this has been followed by an up day either the next day or the day after that. Didn’t happen today, so should happen tomorrow. Down volume on the NYSE today was 4 times the up volume.

TZA had a higher high, higher low and higher close – Good for TZA.

Money flow for the Total Stock Market:

$ 1,375 million flowing into the market 2 days ago.

$ 1,736 million flowing out of the market yesterday.

$ 1,649 million flowing out of the market today.

Good for TZA.

I will post the AmericanBulls candlestick interpretation a bit later.

Overall, it looks bad for TZA for tomorrow.

The Daily view from Americanbulls

TNA was a Wait for today, was down today, and has a Wait signal again for tomorrow.

TZA was a possible Sell for today, was up today, and is a Hold for tomorrow. The TZA buy price was $5.54. TZA closed today at $6.03, up 13.7% since the buy.

Of the stocks & ETFs I follow, only these are to hold on to:

SLV(silver), QQQQ

The list to avoid:

IWM (1x $RUT), UWM (2x $RUT), TNA (3x $RUT) , IYR(1x RE), URE(2x RE), AMZN, DRI, GOOG, EWG(Germany), EWQ(France), EWU(England), EWX(emerging mkts)

The following are possible buys tomorrow:

DRN(3x RE), USO(oil), ERX(3x energy), GS, DIA, SPY

The following are possible sells tomorrow:

GLD (gold), UCO(2x Oil), AAPL

Action for TNA or TZA for tomorrow: None

Hi. I am forex-cat.

Your article is always useful.

Thanks.

Good luck trading today.

…my blog:

http://forex-chart-analysis-and-a-cat.blogspot.com/

black swan spy down 7%!!!!!!!!! wow