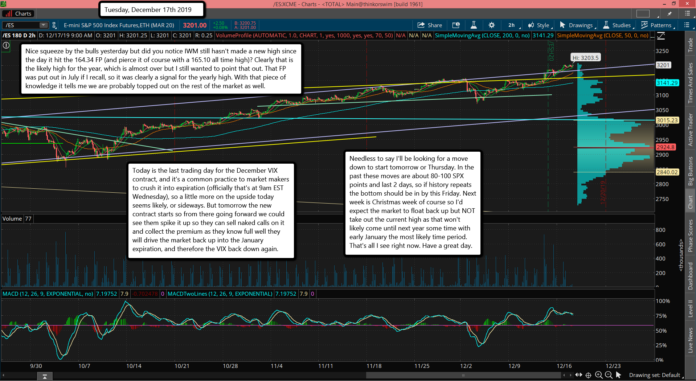

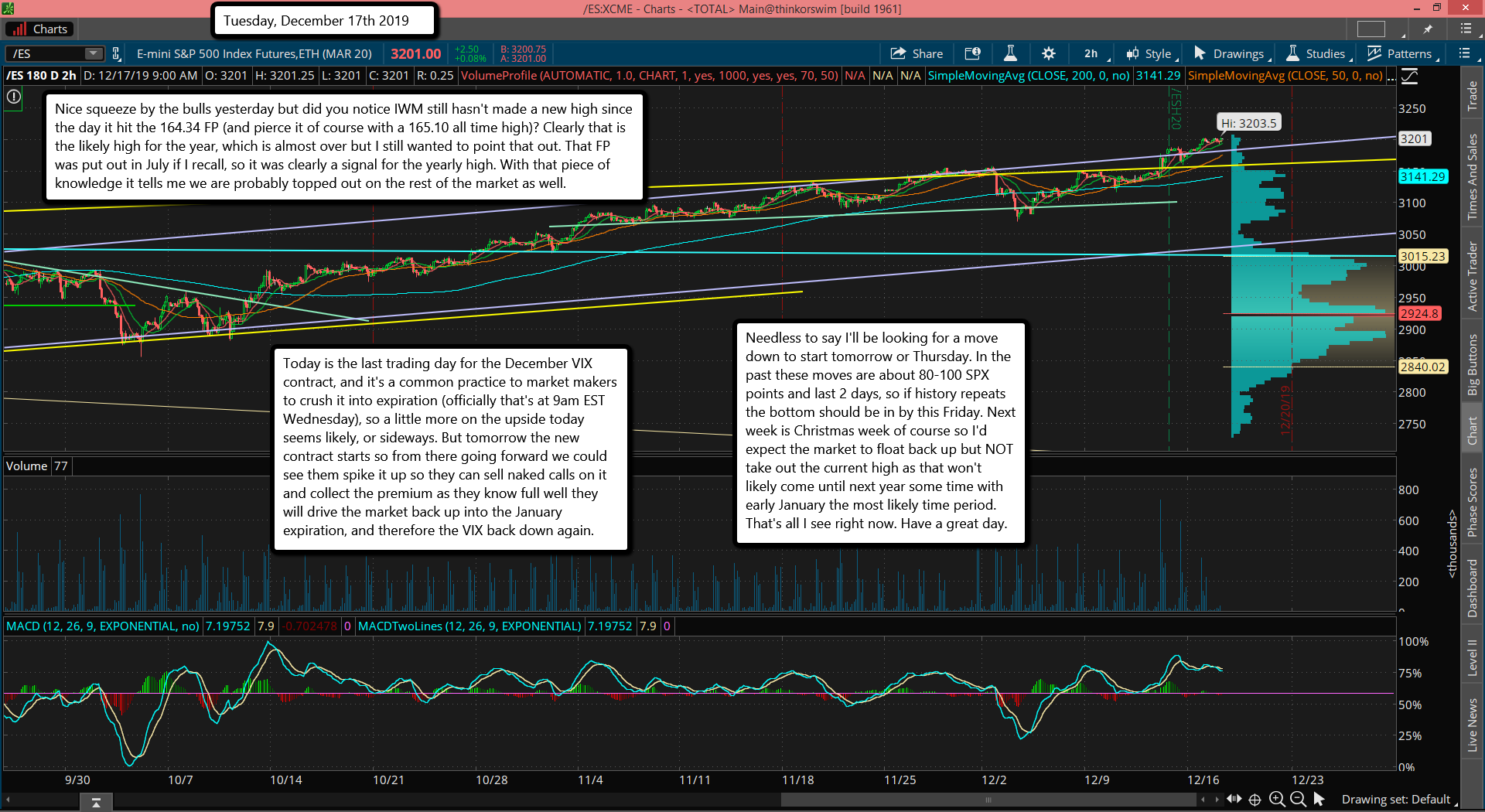

Nice squeeze by the bulls yesterday but did you notice IWM still hasn't made a new high since the day it hit the 164.34 FP (and pierce it of course with a 165.10 all time high)? Clearly that is the likely high for the year, which is almost over but I still wanted to point that out. That FP was put out in July if I recall, so it was clearly a signal for the yearly high. With that piece of knowledge it tells me we are probably topped out on the rest of the market as well.

Today is the last trading day for the December VIX contract, and it's a common practice to market makers to crush it into expiration (officially that's at 9am EST Wednesday), so a little more on the upside today seems likely, or sideways. But tomorrow the new contract starts so from there going forward we could see them spike it up so they can sell naked calls on it and collect the premium as they know full well they will drive the market back up into the January expiration, and therefore the VIX back down again.

Needless to say I'll be looking for a move down to start tomorrow or Thursday. In the past these moves are about 80-100 SPX points and last 2 days, so if history repeats the bottom should be in by this Friday. Next week is Christmas week of course so I'd expect the market to float back up but NOT take out the current high as that won't likely come until next year some time with early January the most likely time period. That's all I see right now. Have a great day.