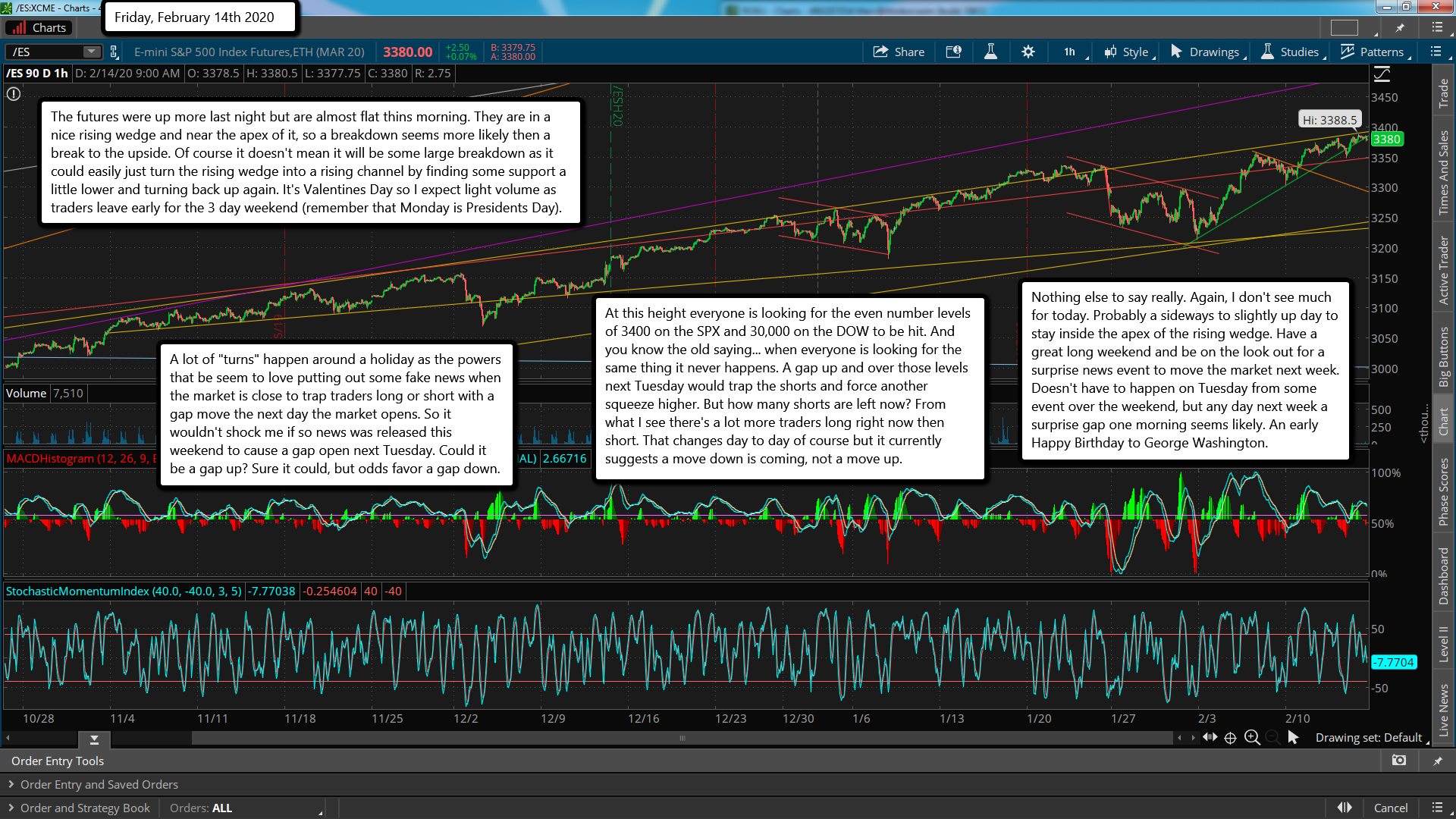

The futures were up more last night but are almost flat thins morning. They are in a nice rising wedge and near the apex of it, so a breakdown seems more likely then a break to the upside. Of course it doesn't mean it will be some large breakdown as it could easily just turn the rising wedge into a rising channel by finding some support a little lower and turning back up again. It's Valentines Day so I expect light volume as traders leave early for the 3 day weekend (remember that Monday is Presidents Day).

A lot of "turns" happen around a holiday as the powers that be seem to love putting out some fake news when the market is close to trap traders long or short with a gap move the next day the market opens. So it wouldn't shock me if so news was released this weekend to cause a gap open next Tuesday. Could it be a gap up? Sure it could, but odds favor a gap down.

At this height everyone is looking for the even number levels of 3400 on the SPX and 30,000 on the DOW to be hit. And you know the old saying... when everyone is looking for the same thing it never happens. A gap up and over those levels next Tuesday would trap the shorts and force another squeeze higher. But how many shorts are left now? From what I see there's a lot more traders long right now then short. That changes day to day of course but it currently suggests a move down is coming, not a move up.

Nothing else to say really. Again, I don't see much for today. Probably a sideways to slightly up day to stay inside the apex of the rising wedge. Have a great long weekend and be on the look out for a surprise news event to move the market next week. Doesn't have to happen on Tuesday from some event over the weekend, but any day next week a surprise gap one morning seems likely. An early Happy Birthday to George Washington.