We got the rally up yesterday that I was looking for, but it make another new all time high, so that killed my Tiny Wave count, but the overall bigger picture is still intact. I've not taken a single short in over a month now, just longs on pullbacks... and it works. That won't continue forever but as of right now all the pullbacks are getting bought up.

That should continue into the turn date on March 22nd where hopefully we top for Large Wave 3 (or C?), and then a good correction should happen. Anywhere from 5-10% is my best guess, and that''s only if it's a Large Wave 3 top... meaning the drop will be a Large Wave 4, thereby leaving Large Wave 5 up into this summer.

If the top turns out to be a Large Wave C then the bear market will start and we'll go down the rest of the year. I do not know yet which one will play out but I lean toward Large Wave 3 because of the "lack of" a negative divergence on the weekly chart. We'll cross that road when we get there.

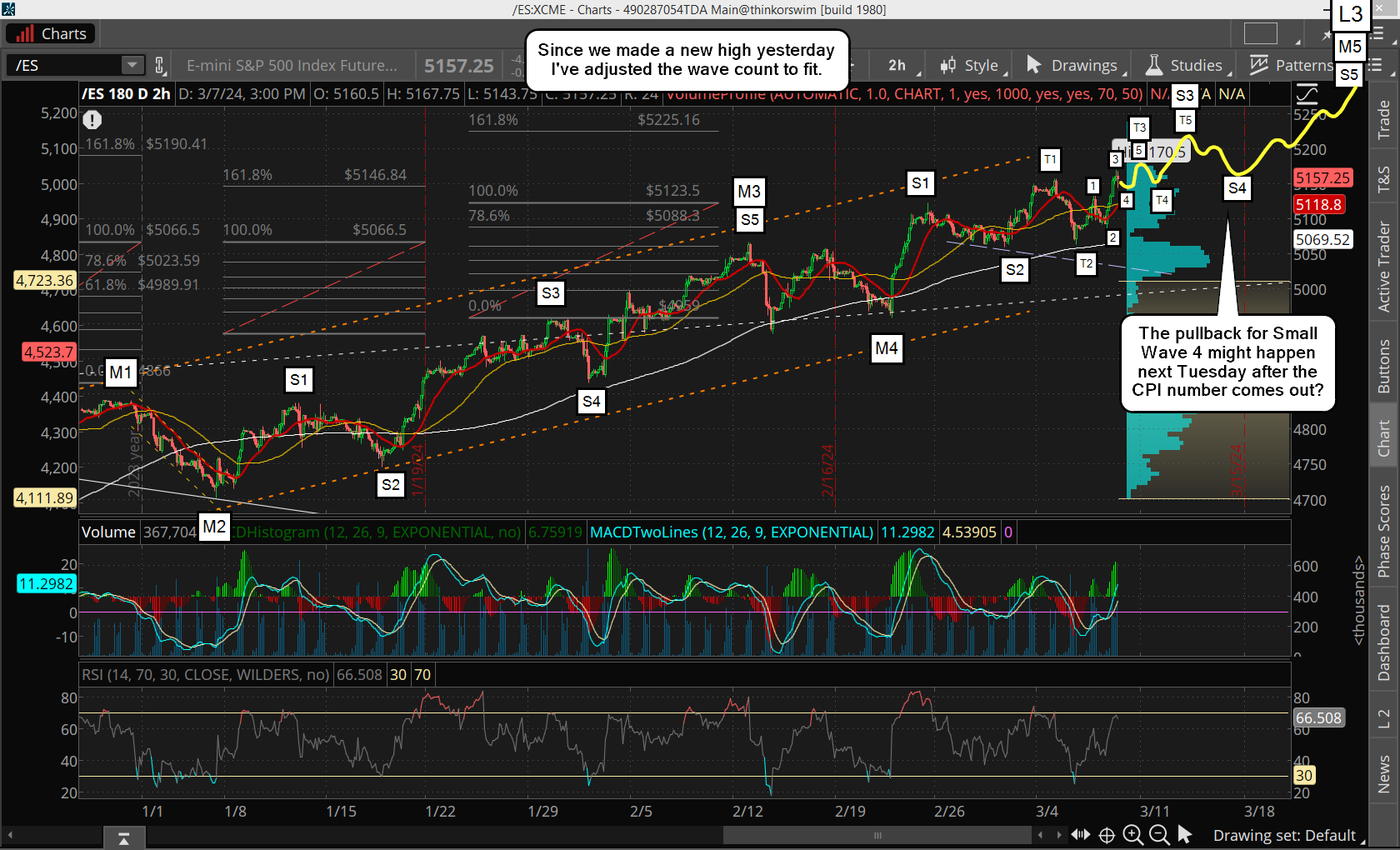

Moving on, below is the new adjusted wave count...

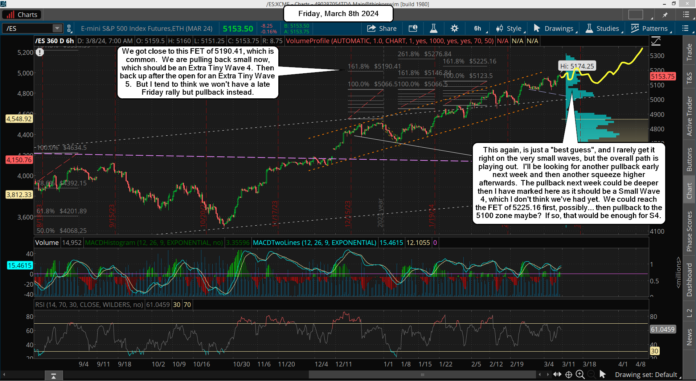

As you can see the overall picture is still the same, we are just not pulling back as much as on my other wave count. It's always a "best guess" on the smaller waves, but what it's suggesting in a small pullback in the futures, which already happened right before the close yesterday, and that is a wave 4 on my chart. I didn't label it as an "Extra Tiny Wave 4" (didn't have room to type all that inside the small box), but that's what it would be basically as it's the next lower degree below Tiny Waves.

Afterwards, I'd look for an early rally today for "Extra Tiny Wave 5", which might just be a double top, who knows? But then I'd lean toward a surprise late Friday pullback for Tiny Wave 4 down. We've had so many "Friday Rallies" that this would be a good surprise to everyone that has spotted this pattern I think.

And again, I'm guessing here on these moves, but I don't trade them. I have only been looking at deeper pullbacks to get long at, which I've been focused on watching the RSI get oversold on the 2hr chart and near oversold on the 6hr chart. So I won't be doing anything until I see a deeper pullback to once again get at least the 2hr chart oversold.

If my crazy wave count plays out then we'll go up Monday for Tiny Wave 5 instead of the typical weakness that we have been having for many weeks now. Lastly we'd see a nice pullback Tuesday after the CPI for Small Wave 4 down. These "events" are just periods where those waves can play out, but possibly it's something else next week that is blamed for the move? I just keep adjusting as we go forward in time and keep looking for longs until we get to the next important turn date.

Have a great weekend.