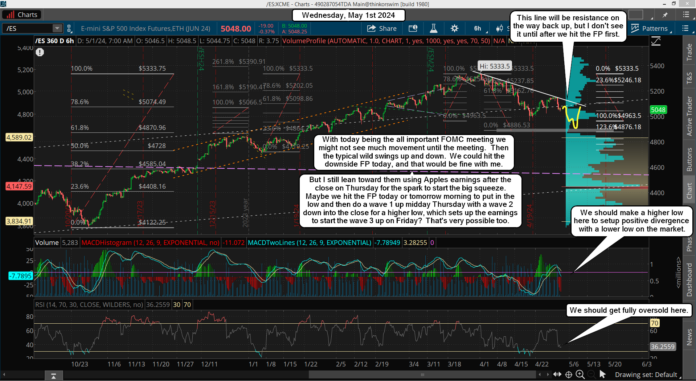

WOW! What a nice drop yesterday. As of the close we are only about 150 points away from the FP on the SPY now, so it could hit today after the FOMC meeting, who knows for sure? I'll be ready to go long after it's hit, whether that's today or tomorrow or Friday. Ideally we hit it today as then everyone will be super bearish calling for much lower prices, but since I have the FP I know it's a low and I'll be going long. The SPX target is 4851.50 for the 483.62 FP and 4845.99 for the 483.07 FP, so 30 points higher on the ES would be its target now it's that's the current spread between them.

It was about 36 points last week but it's getting closer as time goes forward and should be close to equal when the June contract for the ES expires and we roll into the September one. Anyway, my focus will be on the hitting and piercing of the FP on the SPY as that's when I'll look to exit my short and go long.

I suspect that Apples earnings at 4:30pm EST on Thursday will be used to turn the market back up and start the big rally. That's after the 4pm close, so I'm hoping that we will see the FP on the SPY hit right before so that bears will be trapped short at the close Thursday. Then Friday they can gap it up and squeeze them all day to recover a lot of the move down, which should continue into next week as well. The FP could be hit afterhours Thursday as well (this assumes it's not hit today), but that wouldn't make sense with my thoughts of them using Apples earnings to start a short squeeze as they will want to hit the FP prior to that coming out.

So that suggests they will hit it beforehand, as with only 30 minutes from the 4pm close to the 4:30pm earnings announcement that's not much time to hit it. Maybe it happens though, who knows for sure? If we are close to the FP going into the close Thursday then I'll look to exit my shorts and get long. I'd love to see it hit today though, but that might not happen. Anyway, that's my thoughts for what could play out. We'll see.

Have a blessed day.