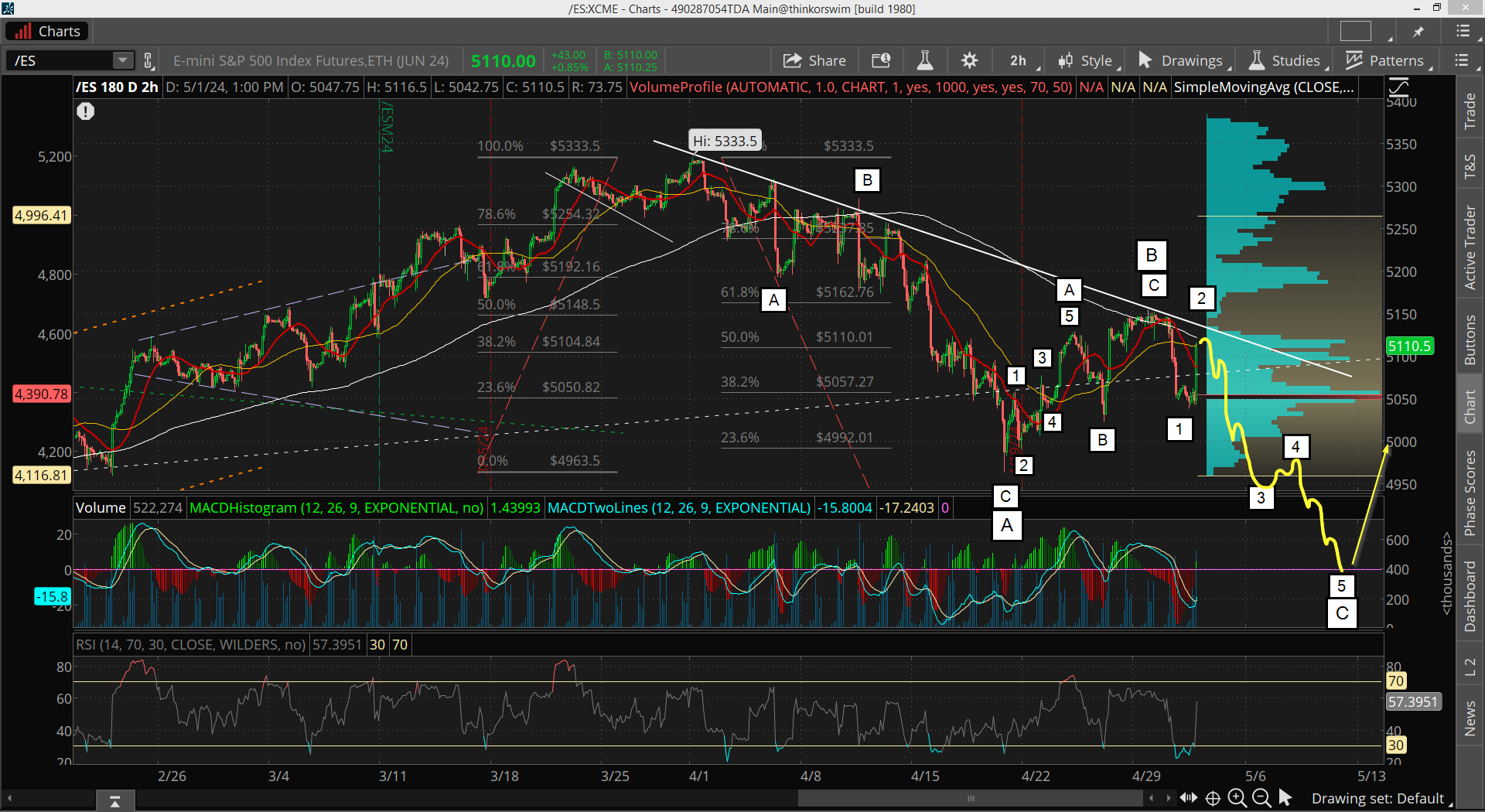

Sheesh... what a curve ball yesterday with that fast squeeze up after the FOMC that got fully reversed by the close. Insane move, and one I did not see coming. But after it rallied I thought to myself that it had to be a wave 2 up in the C down that should hit the FP in the next day or so. I then drew up a wave count and posted in the chatroom, which is below.

The market rolled over after I did that chart and I thought I was a genius as we were starting a wave 3 down inside a C wave, and the FP was within spitting distance now. WRONG! The market stopped right back into the breakout zone around 5050 and just refused to breakdown after the close.

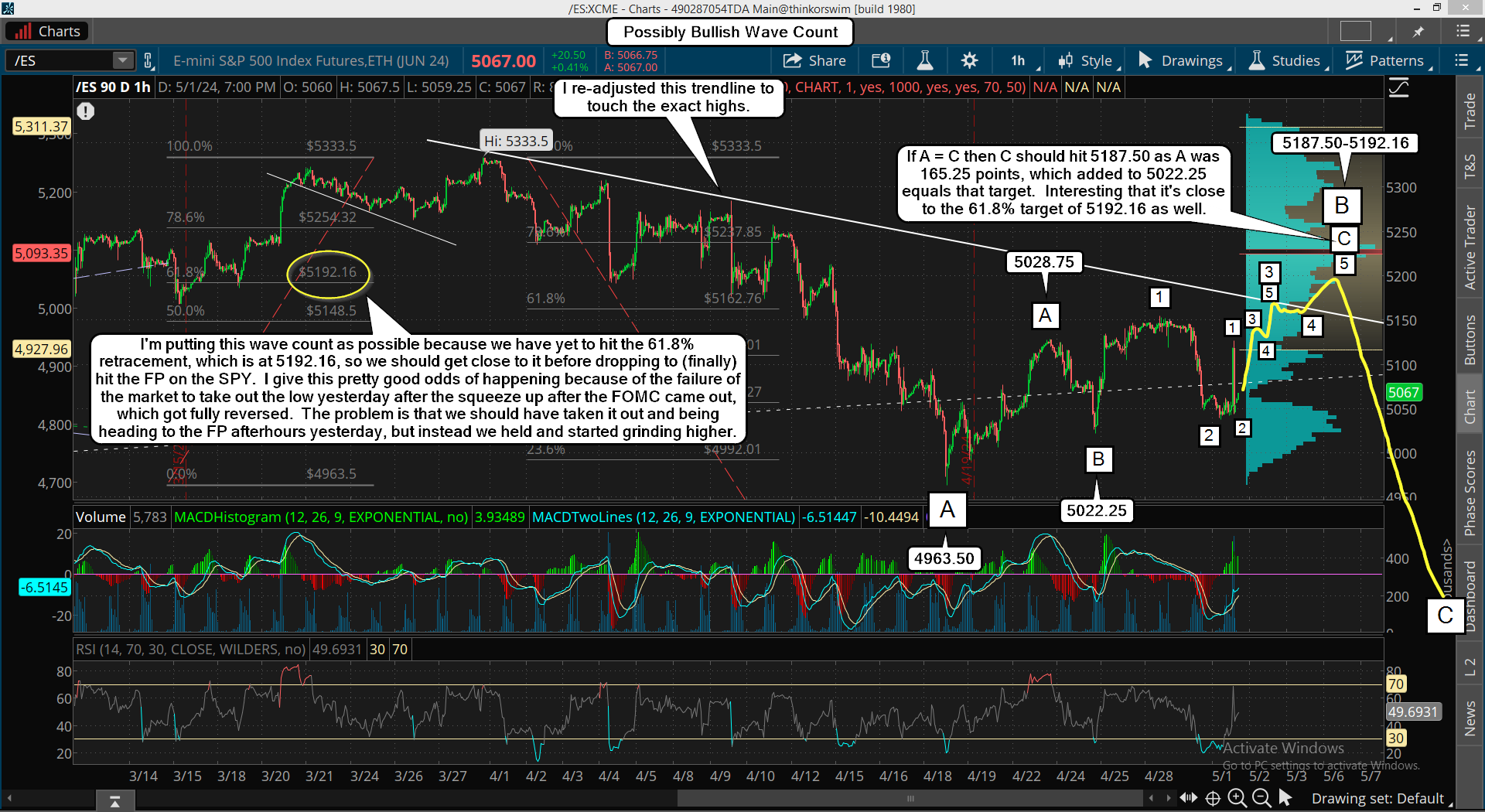

I mean, if I was right we should have dropped 20+ points after the bell rang and should be opening up the next morning with a nice gap down. But instead we started grinding higher afterwards and continued all night, so I that point I knew I was wrong and something else is in play. Back to the drawing board I went and below is what I discovered.

One of the big things I covered earlier this week (and last week) was that the market should reach the 61.8% retracement level before another big leg down. And when we were going down in the large A wave I thought it would bottom at the FP on the SPY (around 4880 ES) and then we would rally up to that 61.8% retracement level (about 5162 roughly... if it was going to play out, but it didn't).

Instead we bottomed early at 4963 and then ran up about 50% and stopped. From there we started down, which was that big drop on Tuesday (my small wave 1 to 2 move), and I thought that we would be continuing lower after the FOMC meeting yesterday to hit the FP and then we'd rally up to the 61.8% level.

But you see if it happened like that then we should go down lower again to 4600, 4400 or even 4000 as the large A down would have been just one big move straight to the FP, but that didn't happen. Instead we are going to get a complete ABC down to the FP, and that large C will end the entire correction and we will not go to any of those lower targets. Instead we'll start the multi-month rally up to 6000+ into the summer. This playing out like this make me confident that the FP is "the low" for the entire correction.

The only thing needed to confirm it is for the large B wave up to rally up to the 61.8% level, and I think that's going to happen into Friday. I think afterhours yesterday started a tiny Wave 3 up, inside small wave 3, inside medium wave C of large B. The upside target of 5187.50-5192.16 should be hit Friday, and I say that because I think they will use the earnings for Apple after the close today (4:30pm EST) to push through that falling white trendline and squeeze all the shorts out that have stops above the 5150 zone.

This will look super bullish to most but to me it's going to be the ideal short for the large C wave down that should end sometime next week. In fact, it could start on Friday and everyone will try to buy the pullback but it will likely keep dropping all day if it does start then. This is a super sneaky move, and one that I would not have figured out if I didn't go back to the drawing board and ask myself "what is missing"? The answer is the 61.8% retrace and the C=A point match... and the running of the stops over 5150. Get all of that done by Friday morning and this market is toast I think.

Have a blessed day.