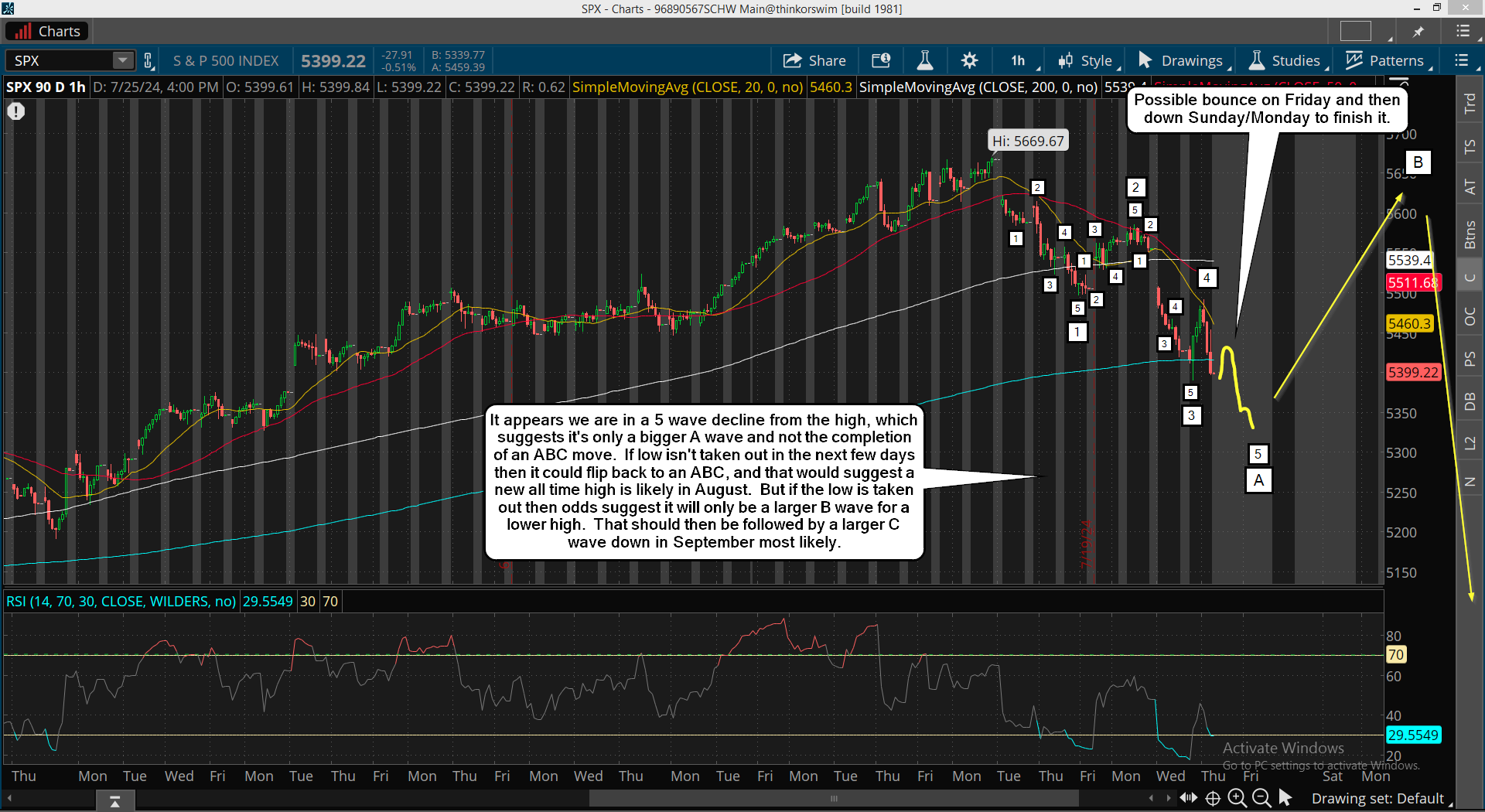

Getting close now to the low. Charts everywhere are oversold or very near it. My big question is... "Will this low finish the correction?". That's something I don't know for sure as while I do see a strong rally back up after the low I do not know if it's the rally up to new, even higher highs, or a lower high. My lean is for a lower high, a larger B wave basically, then a C down in September. Here's what I posted in the chatroom yesterday.

The reason I feel this way is because the weekly chart needs more time to "cool off" before another strong multi-month rally to new all time highs. It is pointing down on the MACD and the RSI, so it's going to be very hard to stage a long lasting rally with such negative downward pressure on the market.

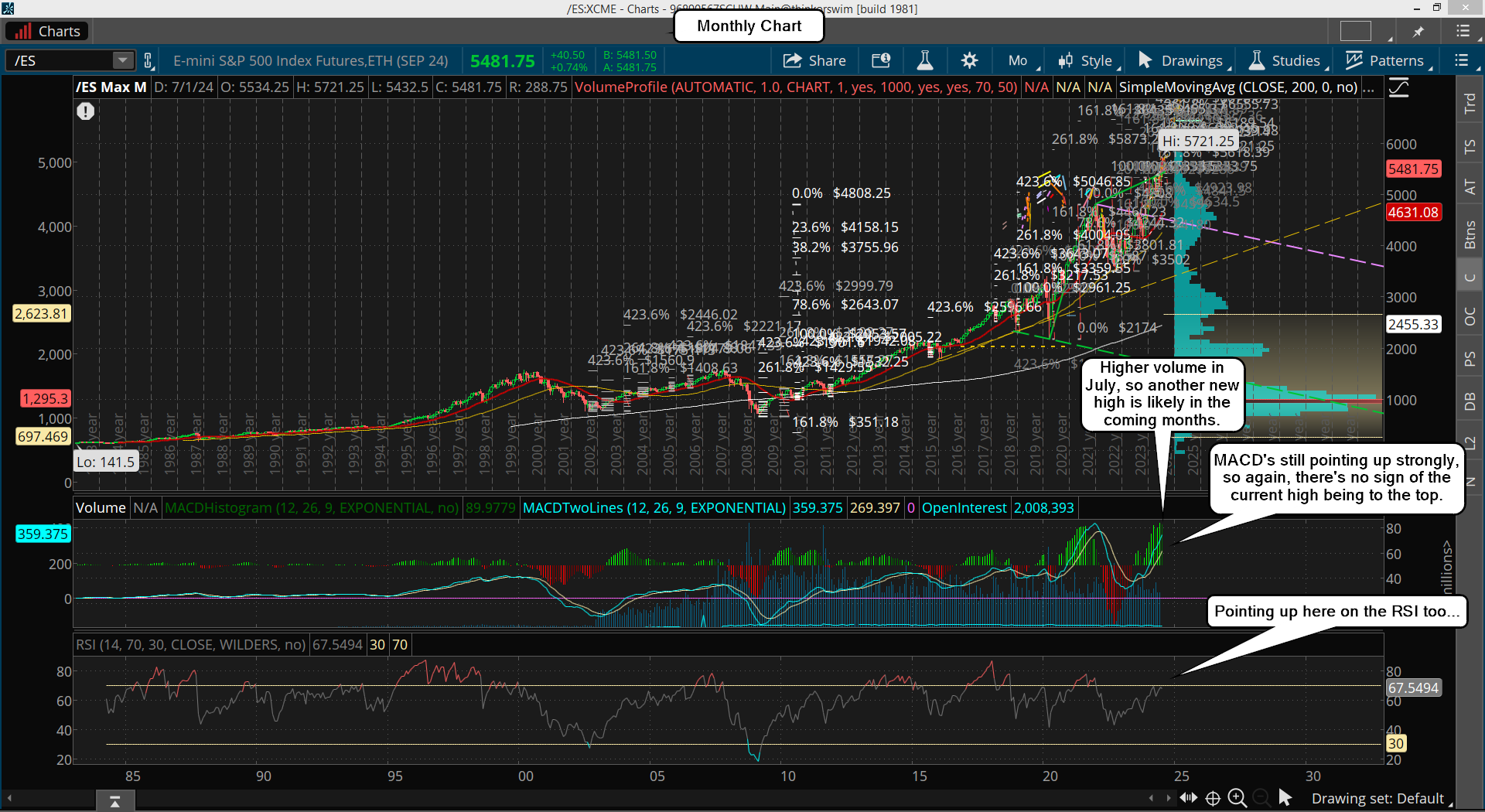

But another higher high is still likely because the monthly chart is still bullish with no sighs of a final high yet. In fact, this month of July has put in higher volume on it then prior months, so that's another clue the bull market isn't finished yet. Now that doesn't mean we can't have a good sized correction but there should not be anything like 2022.

That entire year the market was under the 200 daily simple moving average and we've been above it ever since. Could we pierce through it for awhile? Sure, but we shouldn't stay under it for a year like 2022 as the MACD's on the monthly chart back then was going down, so was the volume. It's still pointing up now, so this market has not seen any final high in my opinion.

As for the short term, I still think we will bottom in by next Monday, and we might have bottomed yesterday... I'm not sure? But we are close right now.

Have a great weekend.

We should have a little pop on Monday and then a reversal. The fiercest stage of this decline is yet to come yet I’m still a few days away from minor sells. On aTA aspect, we are on a sell. The 20 day EMaverage is about to drop through a key indicator which will happen if we continue to decline.

We’re on our way to the 200 day average and the April low. If the 2007 cycle works, then that will hold and they might do an emergency rate cut. If we’re in the South Sea Bubble of 1720 and Panic of 1873 cycle then it could be straight down into September with one bounce along the way.

The RSIs were too extreme at the recent high which has me thinking there will be another high later.

I wrote elsewhere that Jupiter will be in its October 1929 location in mid August but it’s pretty much there right now. It could be that they wait for Jupiter retrograde in December for the ultimate decline. Some incident might occur after the election.

I don’t think we’ll see a 1929 style crash until 2027. I think Charles Nenner is right on the big picture. https://usawatchdog.com/super-bull-market-in-gold-about-to-start-charles-nenner/

The market should have crashed 2020 to 2022 but they held it up waiting for the right astro positions to be in place like Jupiter in Gemini and probably Pluto going into Aquarius and some of these other long term cycles. We’re about to enter another astro condition that is responsible for the American Revolution, Civil War, and World War 2 cycle and I don’t think any market will hold up in the face of that. It also makes the December period an interesting time.