Yesterday the bulls failed to breakdown from the "cup and handle" pattern. The drop changed the wave count. In the chatroom yesterday I posted the following...

"This new drop to a double bottom now makes a clean 5 wave decline. This tells me odds of a new all time high now are not good. This 5 wave pullback now should be just a larger A wave and the C down should still happen in late August or September. Now the B wave up might "pierce" the current all time high by a little amount, as that is allowed in Elliottwave, but there should not be any large breakout high... like another run to 6000+ as this 5 wave decline doesn't allow it.".

And I think we'll get some kind of divergence between the different indexes with the coming bigger B wave rally... meaning we might see a slightly higher one on the ES but not on the SPX. Or it's on the ES and SPX but not the Nasdaq, and I lean that way because the Nasdaq is the weaker index and has already corrected more in percentage then the SPX/ES.

The DOW is the strongest but it may or may not make a higher high, but it's not that important really as all 3 indexes should not go much higher before a bigger pullback for a C wave in late August or September.

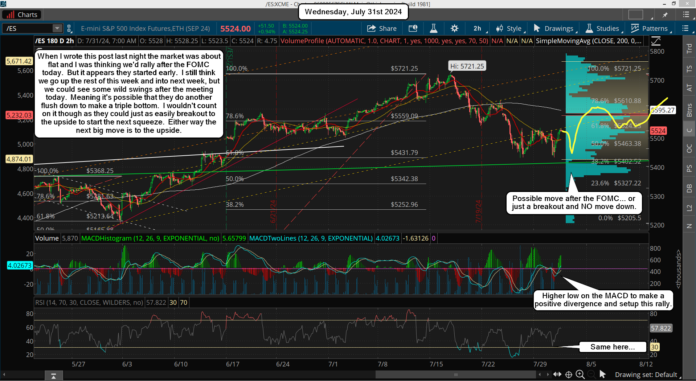

On the short term, we are getting oversold, or very near it, on the daily chart now. And the 6hr and 2hr chart are looking oversold too... but they are putting in a divergence on their RSI and MACD's. We also are close to the rising green trendline of support. Everything tells me we are either bottomed now or super close. It's the common pattern where the end of any month or the first of a new month, so you have that "clue" as well.

All of that and the fact that we have an FOMC today just smells of a short squeeze coming. There might be one more push down to run any stops on bulls that bought the double bottom but it's not needed or required.

In conclusion, I think we have a rally up the rest of this week and into early next week. I don't know if it makes a new all time high or not but I'll be more focused on the wave counts and the technicals then price. Keep in mind that many "B waves" are extremely hard to figure out and trade successfully. It will subdivide into an ABC and each of those waves will subdivide more. So don't be shocked if it takes 2-4 weeks to play out.

Have a blessed day.