WOW, WOW, WOW... that's all I can say about yesterday. But now that the market has calm down a little with the VIX closing at 38.57 from spike high of 65.73 the technicals should get back in align and give us some clues on the future. Everything I spoke of yesterday is still valid as the weekly chart and monthly are still around the same. The daily is just closer now to fully oversold then it was on Friday, so the technicals still point to a strong rally coming.

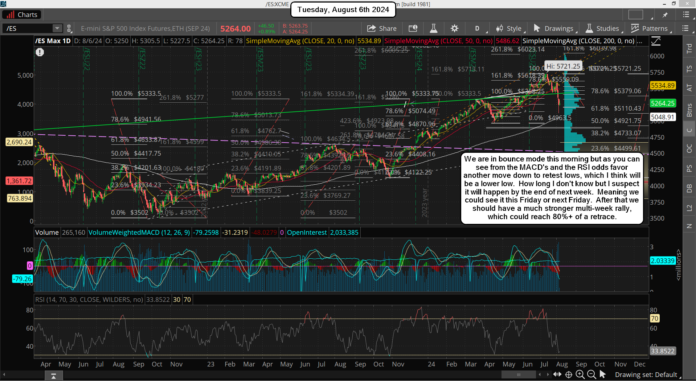

However, I don't think the current one is going to last very long. We should rollover one more time to make a lower low in price on the ES (hopefully we hit the FP on the SPY) and a lower high on the VIX. This might happen by this Thursday or Friday, but it could also drag out into the end of next week. This drop caught a lot of people by surprise so the first relief bounce will be sold by trapped bulls. The next drop should take out any remaining bulls and lure in tons of bears looking for a crash.

I don't think there were many bears on this drop as it caught everyone by surprise, so this "lack of bears" will limit the first move up as they don't have enough of them short to produce a long lasting squeeze. SkyNet needs to have a maximum number of bears short to get a week plus super squeeze This first rally should last a few days I think and then run out of steam. How high will it go? I don't know but big resistance overhead is the rising green trendline. Maybe we get there, maybe we don't, but I have no interest in any trades on the long side until I see a lower low in price and a lower high on the VIX for a positive divergence in the market. Only then do I see a multi-week rally, as right now I think it's going to be nothing but wild swings up and down to shake out both sides.

As far "turn date" the 16th-19th is a turn window, and that's the end of the week of OPEX, so it could be a high or a low... I don't know? If we bottom by the end of this week then I'd look for next Friday to top out the big squeeze, which is my "lean" as it's common to see a low on the Thursday or Friday the week prior to OPEX and then rally that week to make all the puts expire worthless. I could be wrong of course as it could flip and be a high this Friday and a low next Friday but I'd just allow it to play out which every way it wants too as I'm looking for a great long setup, and it's not here yet in my opinion.

Lastly, here's something interesting... it will be 666 days from the October 13th, 2022 low into this Friday, August the 9th. Possible low I'm thinking, but we'll see.

Have a blessed day.