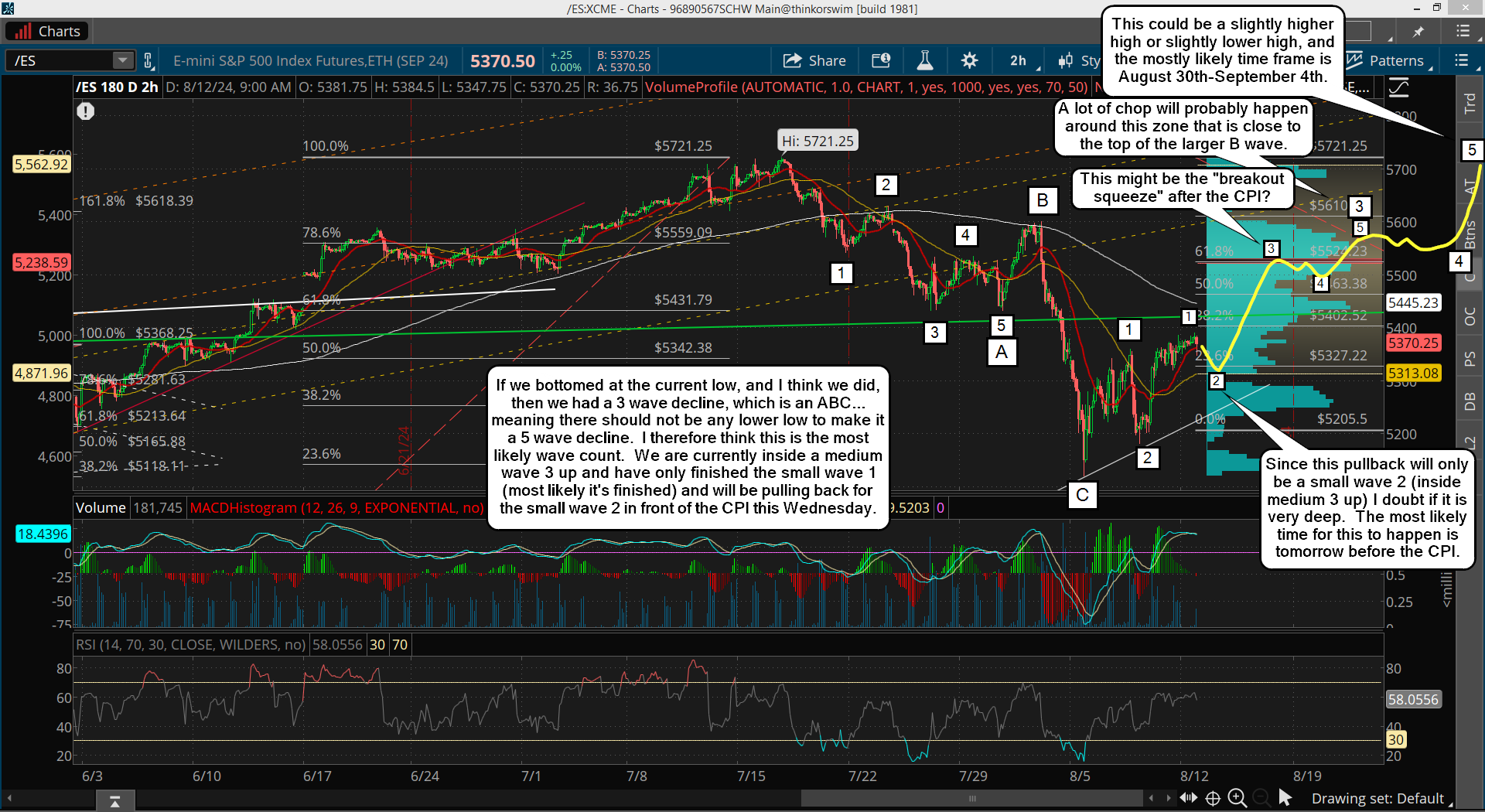

Yesterday the market consolidated with a couple of brief dips. This is normal in front of the CPI and with it coming out tomorrow I tend to think we'll get a dip of some kind today. I posted a chart of my thoughts yesterday in the chatroom, which I still think is the most likely scenario. Here's that chart...

As you can see I changed it a little but the end result is the same, which is a rally into Labor Day, which should be a slightly higher high or lower high. I think we need to pullback to the 5330's for a small wave 2 before we start the next big move higher, and I'm sure they will use the CPI for the breakout squeeze to get it going.

It should be a small wave 3 up inside a medium wave 3 up, and there's not much resistance until the 5550-5600 area. So that's my target before is slows down and start another grind sideways to build another base for the last move up into the end of this month. That's all I see for now.

Have a blessed day.