I was looking for a small pullback yesterday and then a strong rally, but the pullback never happened and instead the market squeezed hard all day long. Today we have the CPI, which should produce some traps on both the bulls and bears. The move up yesterday was a wave 3 of some degree so I have to think that if we get a pullback from the CPI it will only be a wave 4 and that a wave 5 up will follow to complete the rally up from the low, which will likely turn into an ABC with the wave 3 up yesterday being one that is inside the C wave.

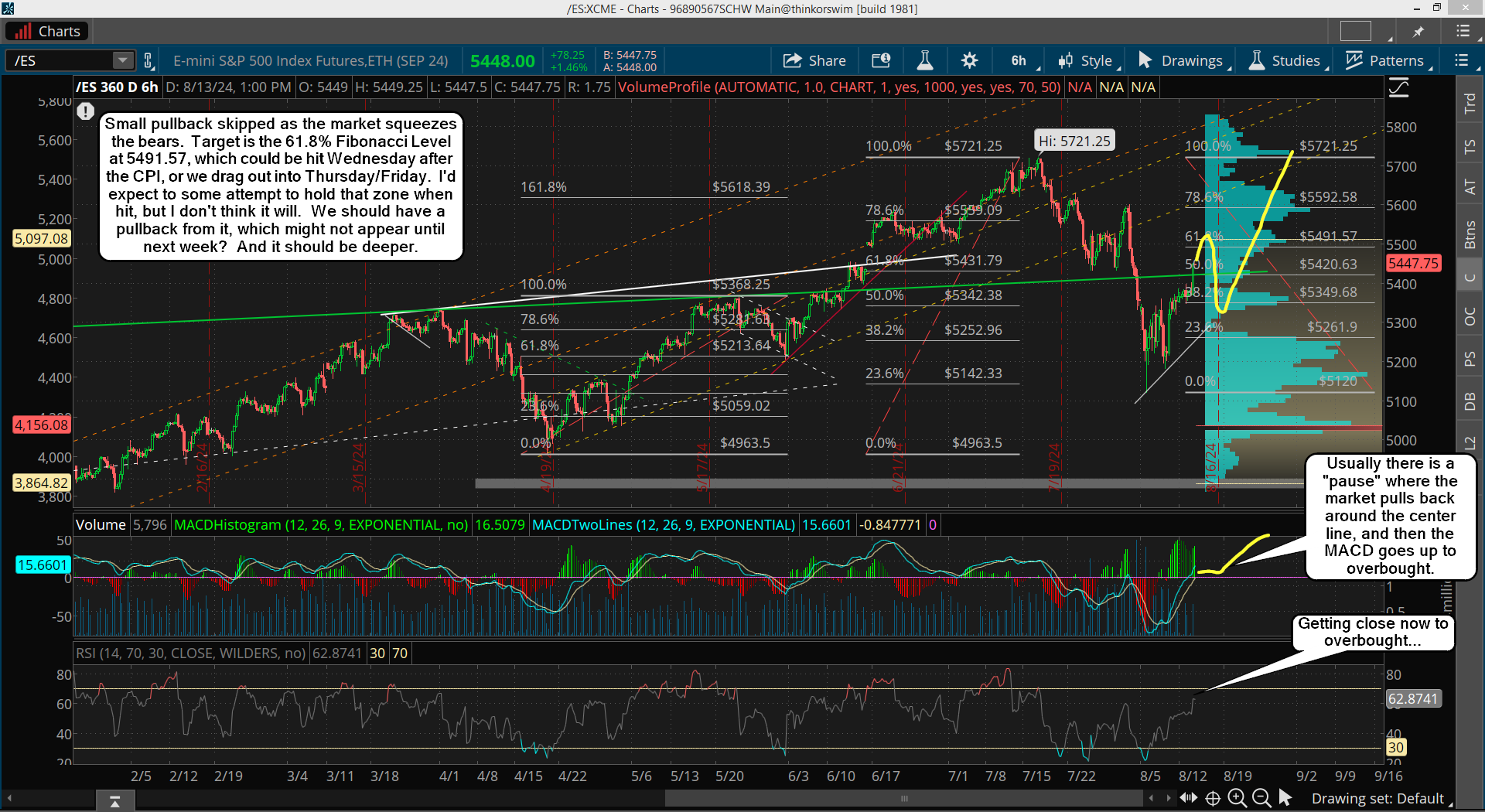

Here's a chart from yesterday...

My target is roughly 5500, give or take a little above or below it, which should finish the ABC up and I'll then call it an A wave, which should be followed by a deep pullback for the B wave. Lastly will be the bigger C wave up to a double top into the Labor Day weekend. Now, I do not know when we are going to hit the 5500 target, but it should be this week, and possibly today.

If the CPI number scares the market too much then we might need until Thursday or Friday to make that last move up, but I tend to think they will shake off anything bad from it and it will therefore be short lived (the pullback I mean, which again should only be a wave 4 inside a C wave up, inside a larger A wave). I'll be patiently wait for the 5500 zone for a short this time as I missed the long yesterday. I knew it was coming but I was wanting that small pullback first and the market never gave it to me. It is what it is I guess.

Have a blessed day.