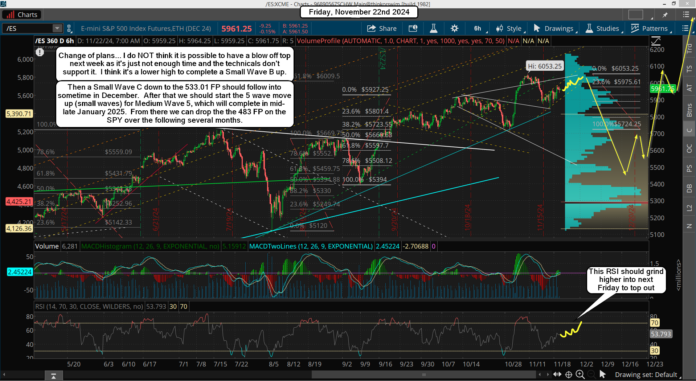

Got a nice rally yesterday after a lot of wild swings in both directions, but in the end we did go up. With just a week left into the end of November I really doubt if we reach the top by then, but who knows for sure as anything is possible. I just think that once we reach the double top zone we might spend some time there consolidating, which will eat up "time", so this could extend into early December if it's going to reach the FP on NVDA then and put in the final top?

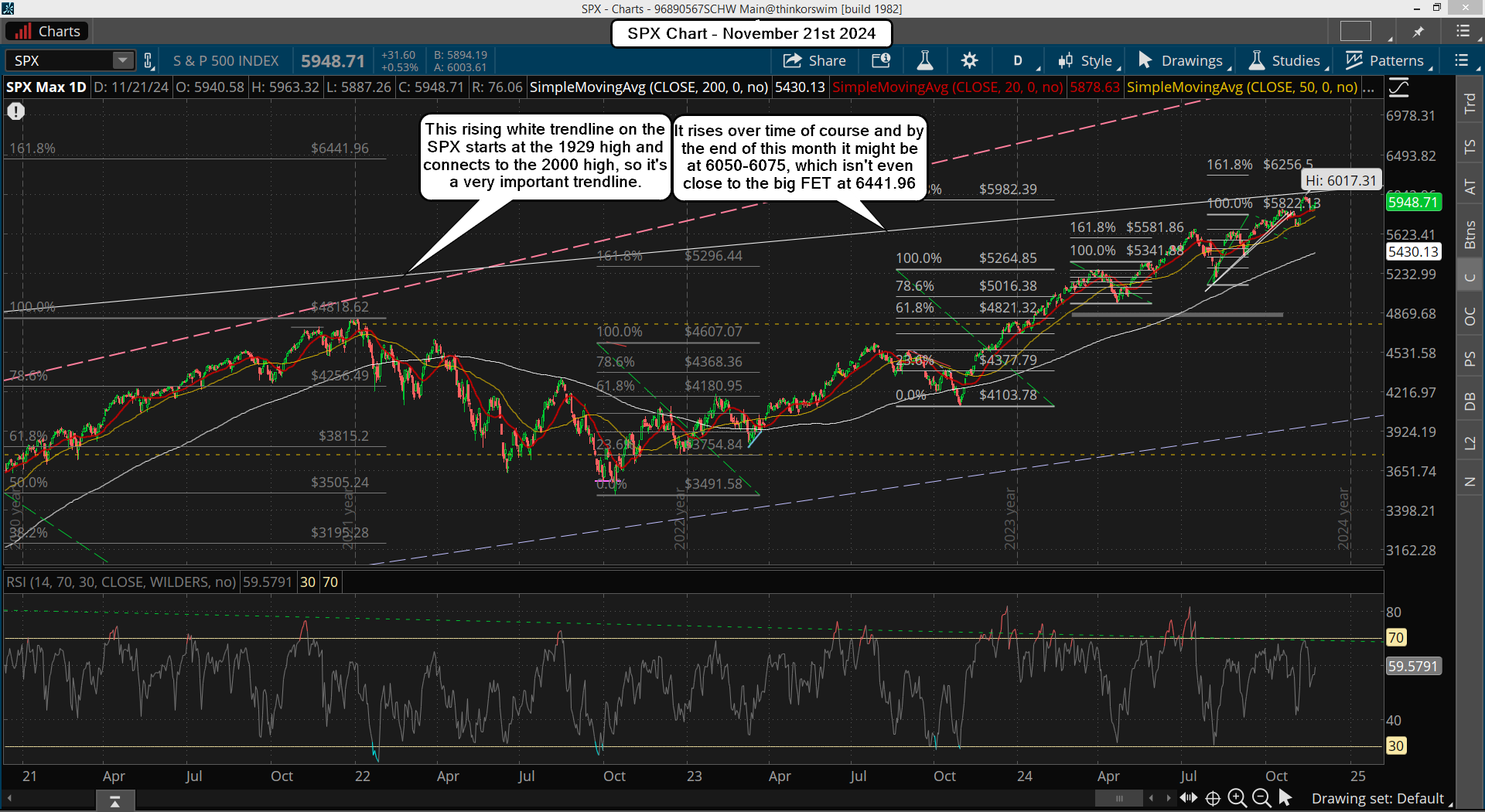

If so, it's at that point we should be topped in every market, but guessing the price on those markets are just that... a guess. On the SPX we might have already topped? I'm not positive but we've hit a very important rising trendline as posted in the chart below...

On it you can see the rising white trendline that starts at the high on 9/6/1929 and connects to the 3/29/2000 high, so it's a SUPER IMPORTANT TRENDLINE. If we go up and make another higher high into the end of next week, and hit that trendline again, it will be around 6050-6075 (roughly), which it could do for sure.

NVDA can still do its' blow off top to hit the FP on it of 160.22, but the ratio between it and the ES/SPX changes all the time as it's just one stock compared to 500 in the ES/SPX... so we could just barely go higher on it but be super strong on NVDA. Really hard too figure out, but the end of next week will have the best chance I think due to the expected light volume for the holiday.

Now my alternative thoughts...

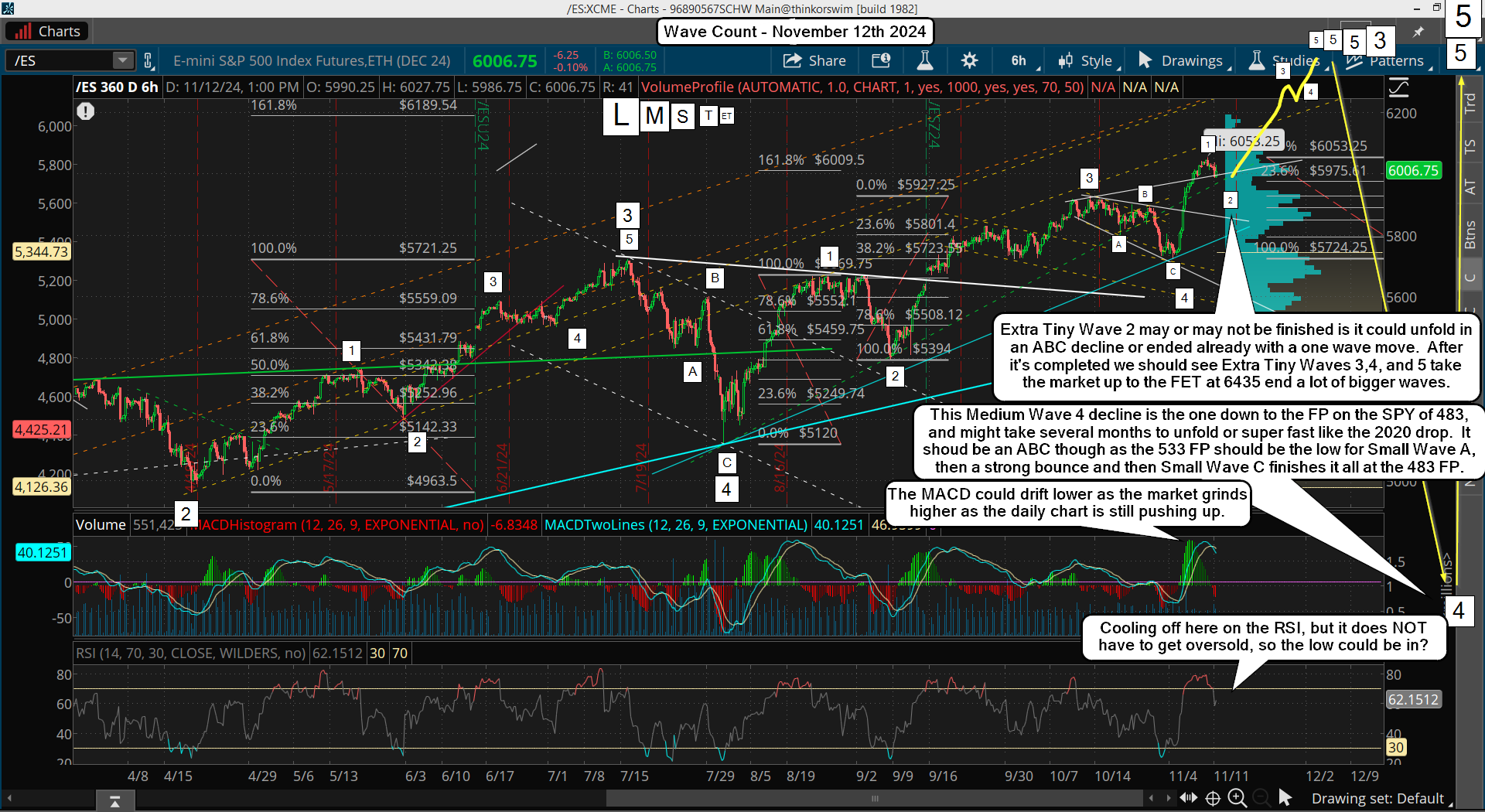

If we go up next week and make a lower high, or even a "slightly higher high" on some, but not all indexes, meaning NO Blow Off TOP, then I'll have to think something else is in play. I would then think that it's a B wave up of some degree from the recent low last week, with the 6053.25 high on November 11th being the top of Medium Wave 3 where Small Wave A drop started.

What is means is that the rally up to the 6053 top was the completed Tiny Wave 5 up, which completed Small Wave 5 inside Medium Wave 3. My wave count chart from November 12th has that Tiny Wave 5 up subdividing into 5 Extra Tiny Waves, which would probably top at the FET of 6453, but "what if" that Extra Tiny Wave 5 is just a One Wave move, not Five Waves?

Below is that old chart again...

If it turns out that is the case then we will have completed Medium Wave 3 up and we are now in Medium Wave 4 down, which the move to the 11/19 low would be Small Wave A down and we are inside Small Wave B up now, which should make a lower high into next week to complete it.

Then a Small Wave C down will follow in December that should hit the 533.01 FP on the SPY, and it will unfold in a 5 wave move, which will confuse the most traders. This actually has good odds of playing out as I can see a clean 5 wave move down from the 6053 high to the 5855 low, which if it was Extra Tiny Wave 2 down it should have unfolded in a 3 wave ABC move, not a 5 wave move.

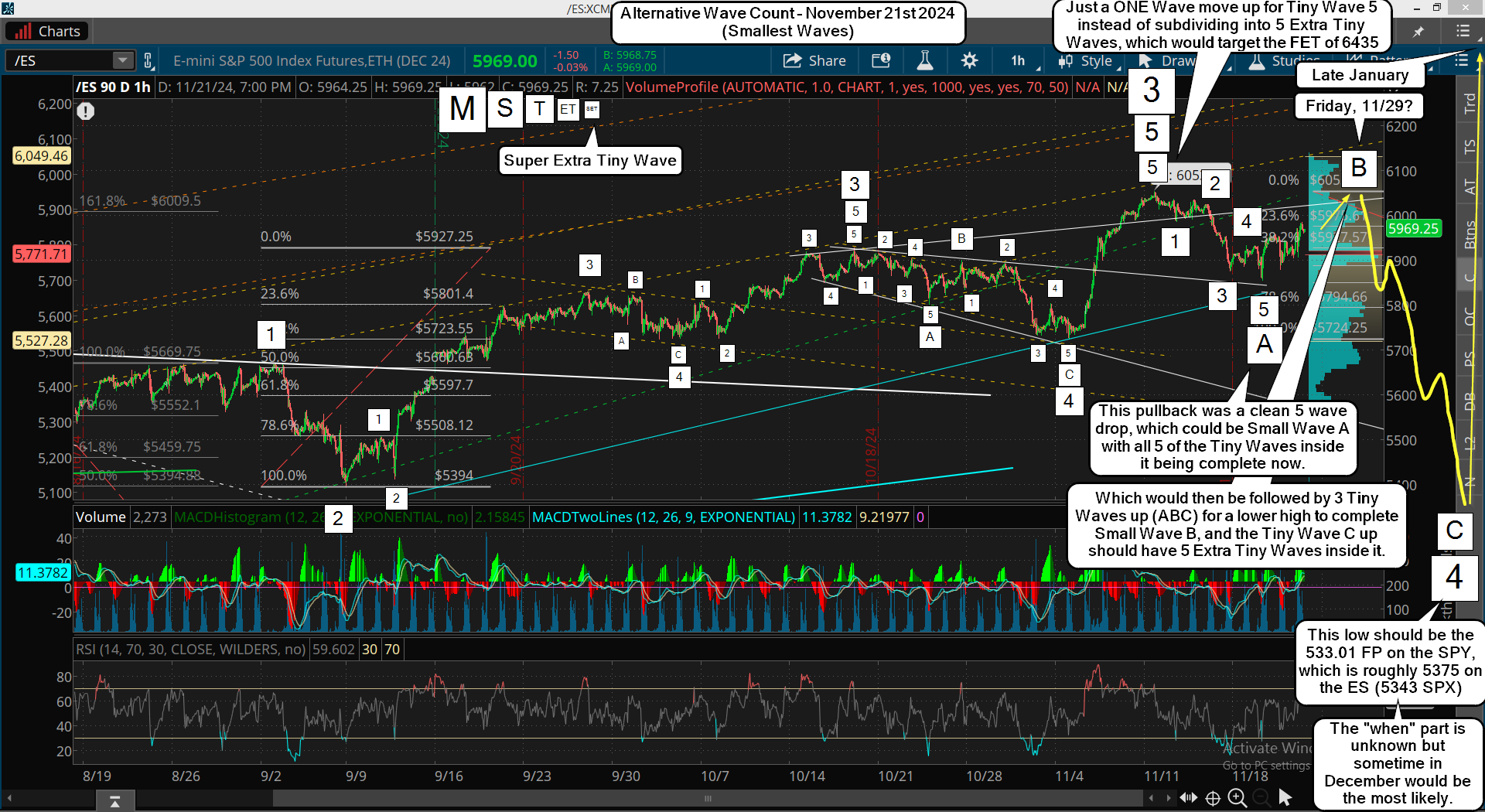

Here's a chart below showing all the smallest waves...

This also means December won't have the big drop I was thinking as possible (the 483 FP on the SPY) as the market will not have put in the final high. It will extend out into mid-late January to do the blow off top and hit the FP on NVDA, as it will have topped yesterday with its' new all tine high and it will have a lower high as well into next week. Then it will drop with the market in Small Wave C inside Medium Wave 4. The 160.22 FP won't be hit until late January just like the rest of the market.

I have to think this is the most likely scenario as I just don't think there's enough time left to get the blow off move I'm looking for, and the main wave count doesn't support it either. Plus we have that idiot Jim Cramer coming out now calling to "Buy, Buy, Buy", and we all know that when he says to buy something it's topped and a pullback is coming. He'll say "Sell, Sell, Sell" when the SPY reaches 533.01... LOL.

I don't follow him but I saw a post on twitter about it and that was just another reason for me to step back and re-look at the wave count, which I have and I now lean toward Medium Wave 4 being in play now and Medium Wave 5 up happening into late January.

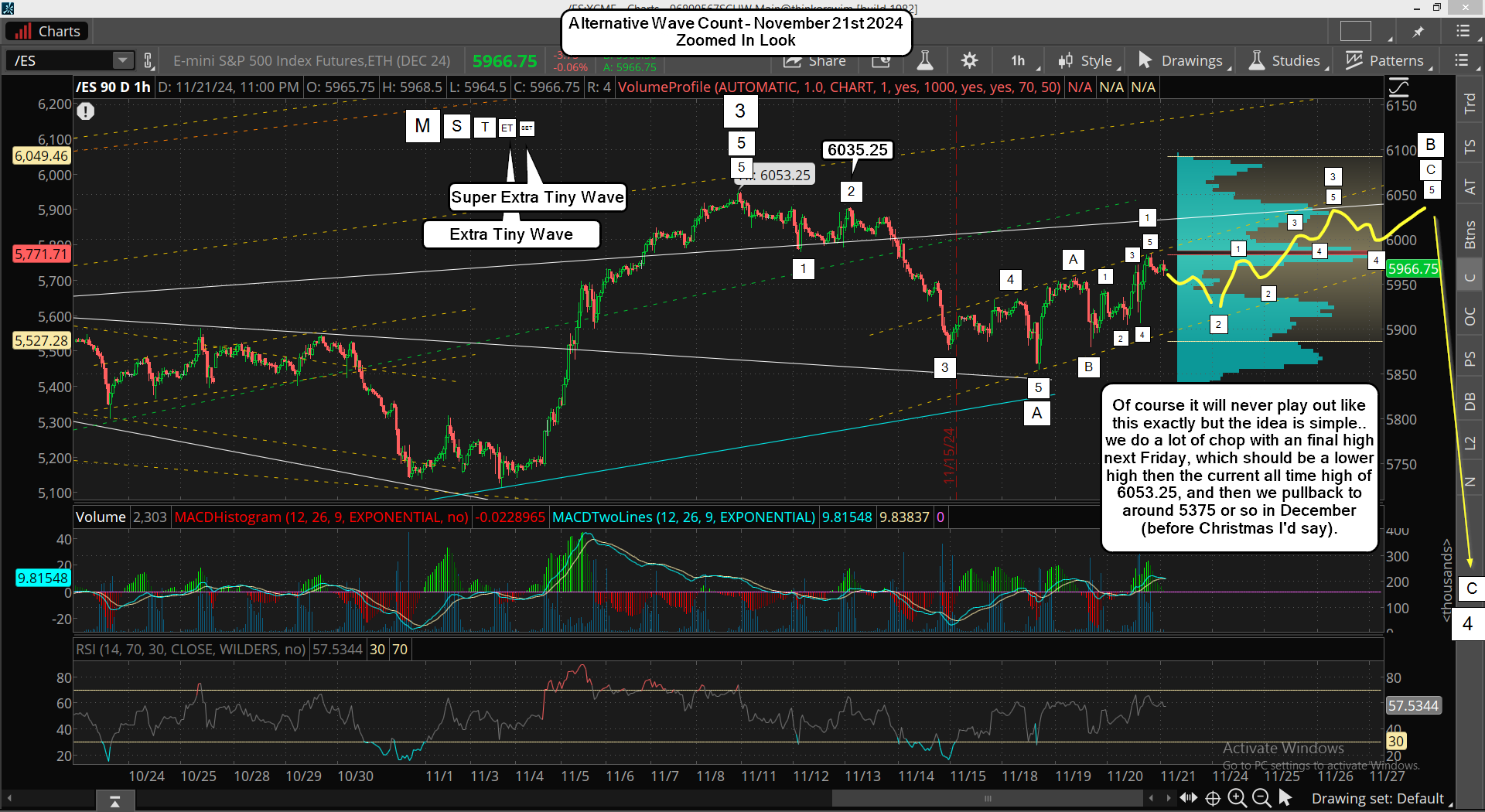

Zoomed In Look...

This is the same "Alternative Wave Count", but I've zoomed in to get a possible wave count going into next week. As you can see it "could" unfold in an ABC move with the C wave subdividing many times to frustrate bulls and bears both.

That's all I can think of for now.

Have a great weekend.