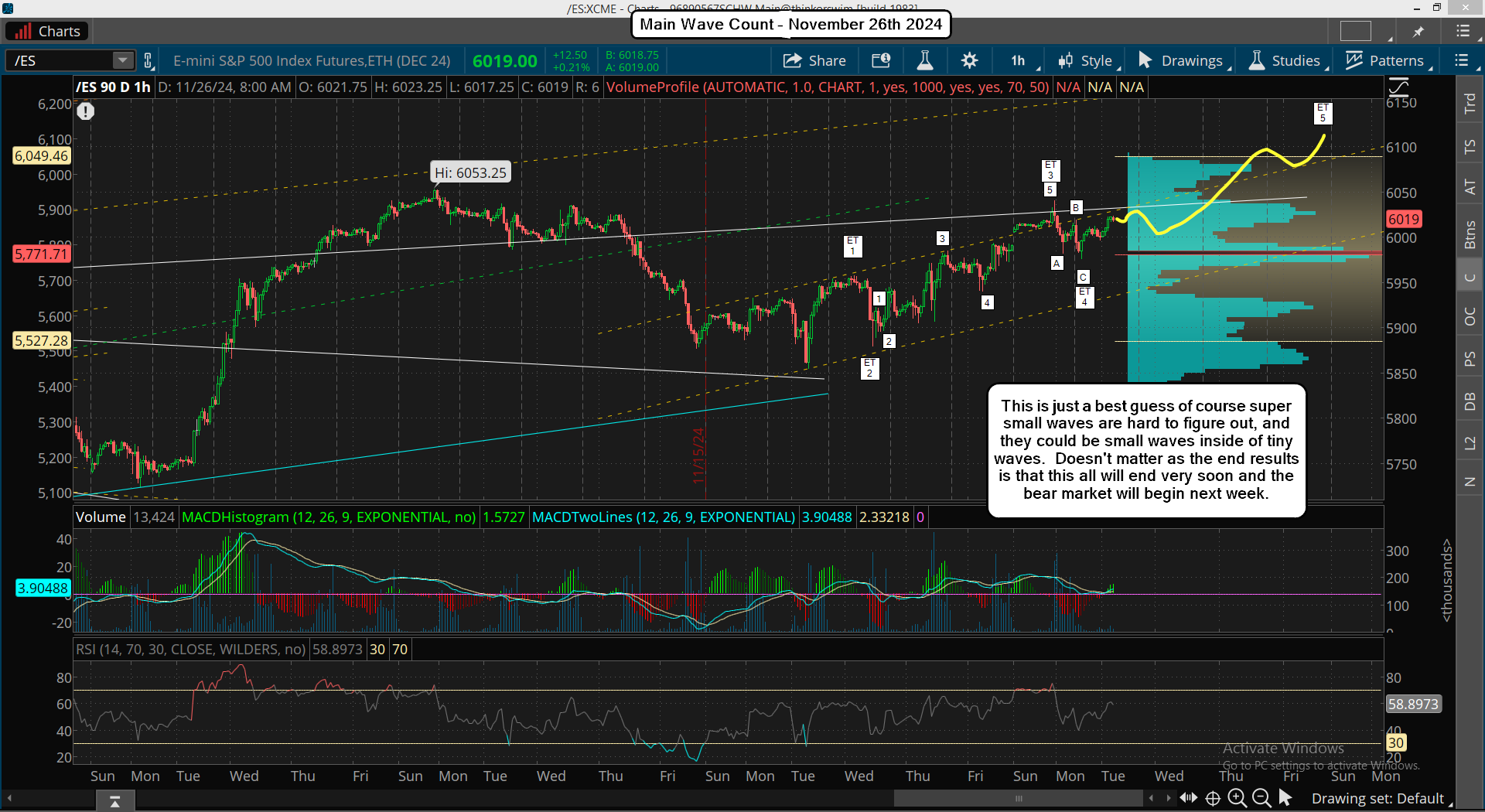

Last nights pullback of 20+ points was either Super Extra Tiny Wave 4 (SET) or Extra Tiny Wave 4, which means today we are in either Super Extra Tiny Wave 5 inside Extra Tiny Wave 3, or we are in the first wave of Extra Tiny Wave 5 up. It's super hard to be accurate on these really small intraday moves but my best guess is that we are in the final move up, which would be Super Extra Tiny Wave 1, inside Extra Tiny Wave 5, inside Tiny Wave C, inside Small Wave B. I posted on Twitter yesterday that chart. Here's the link.

https://x.com/reddragonleo/status/1861149425114153098

That all assumes we do not make a higher high, which is my alternative wave count. If we are on the main wave count then we will make a higher high to end the entire bull market. It will be somewhere between 6112.14 up to the FET of 6441.96 (SPX), which on the ES it's a little higher but still in that range. I explained those targets in my post yesterday. If this happens then the wave count is changed a little which is in the chart below.

The big difference is that after we make a new all time high (which might drag out into next week) the drop to the FP on the SPY of 533 will be followed by a rally back up next year for a lower high. That's the major difference between it and the main wave count. Not much else to add so I'll end it here for this post.

Have a blessed day.