The Preferred Path...

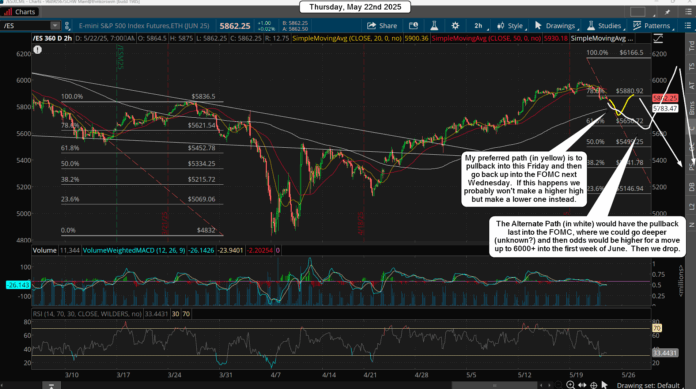

The pullback yesterday looks like an ABC move (so far) and might have ended already? It's really hard to say for sure but whether it has ended or not everything still points to next week for the best shorting spot. The end of most months has a turning point on them and this one should be no difference.

It's never some exact date but around the last week of any month or the first week of the next month. With the FOMC minutes next Wednesday I don't see much happening until then. And next Monday the market is closed for Memorial Day. so there's not likely going to be much volume until after both the holiday and the FOMC passes by.

The common pattern is that if we have weakness into this Friday then early next week we should see the opposite. That means a move up into the FOMC is likely, and the Fed doesn't have to say anything really. Just don't add anything positive and allow the overbought charts to do their work. As for today and Friday, if we continue to pullback I'd look for the 5700 zone to be the target. Then we would make one more attempt next week to reach the 6000 level. Whether we make it or fail is unknown but it's the best short in my opinion.

The Alternative Path...

If we don't see the move up next week to try to hit and breakthrough the 6000 zone, and instead we have pulled back into the FOMC, then more time is needed as that missing 5th wave up would just be delayed and pushed out into the first week of June.

This might happen if we have pulled back to say the 5700 zone into next Wednesday and the Fed leans at something that the market like, which would cause a move up afterwards, and it would likely try to hit a double top at 6166, but I don't think it will get through it. There's not much difference in either path as both say we need a pullback (in play now) and a final move up. Just in this case the pullback will last into next Wednesday and the final wave up will go into the first week of June.

In the first path the pullback will be finished by this Friday and we will rally up into the FOMC next week to (probably) fail to get through the 6000 zone. Maybe it pierces briefly but with the shorter time to do the move the amount up should be weaker too. Whereas a pullback into the event would give more fuel for stronger rally up into early June.

In each case I plan to just be patient and left the market decide which one it wants to do. Let the short come to me basically. Just give the market whatever extra time it needs to finish that 5th wave up as that's when the best opportunity should show up.

Have an blessed day.