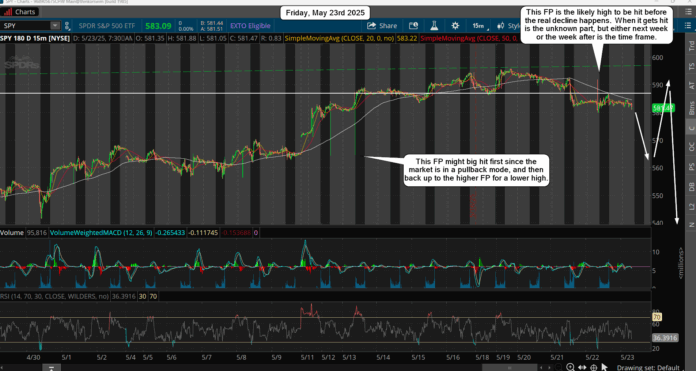

The market is continuing to slowly pullback, which is perfect for both paths I covered yesterday. If we turn back up next week and top into the FOMC there's a new intraday FP on the SPY of 591.93 that will be a magnet to get hit. On the downside there's a 564.61 FP from May 13th that might be the pullback low if instead the market declines into the FOMC, whereas then I'll look for the rally back up to the upside FP to hit the following week, which is the first week of June. That's the two paths I see, which is to either hold this zone today and go back up into next week for the upside FP (a lower high) or to decline more early next week to the lower FP and rally back to the upside FP into the first week of June.

Have a great weekend.