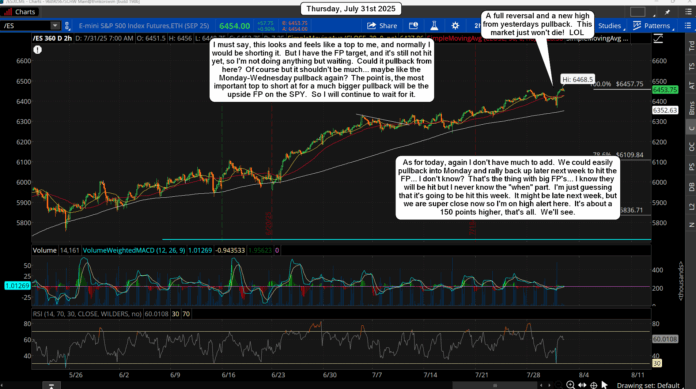

Yesterday did as expected, a drift lower in front of the FOMC, then the "wild swing" part, which wasn't too wild. Many FOMC meetings have big swings up and down in 1 minute candles, but this was just a pullback after the meeting that got reversed back up near the close. Then the squeeze started and if I'm right it will continue until we reach the 655.66 FP on the SPY. I don't know how fast it happens but with more earnings and the jobs number out tomorrow morning it could do it pretty quick. Wouldn't it be crazy to see it top into the close on Friday and go into the weekend with no one short. I have to think all the bears will give up if we go up another 150+ points today and/or tomorrow. I'm just licking my chops now at an opportunity to short the FP... if it hits this week.

Have an blessed day.