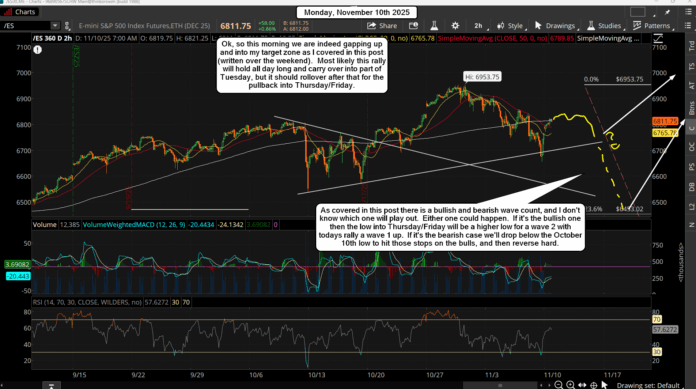

This week is an important one in my opinion as we should put in a low around the 14th, and then start a nice squeeze higher into the first week of December. The question is... will it be a higher low or a lower low? I can't answer that question unfortunately, so I'm just going to cover both wave counts and let whichever one play out that the market wants. I want to be ready for the rally after the low is put in as it should be a nice one. First, let's go over the bullish wave count below...

In this case we have already ended the wave 4 pullback and the move up from Fridays low into a likely high today is a wave 1, and the expected move down into the 14th would be a wave 2 for a higher low. The expected upside target today (possibly into Tuesday) is 6840-6870 on the ES, and that would end wave 1 up.

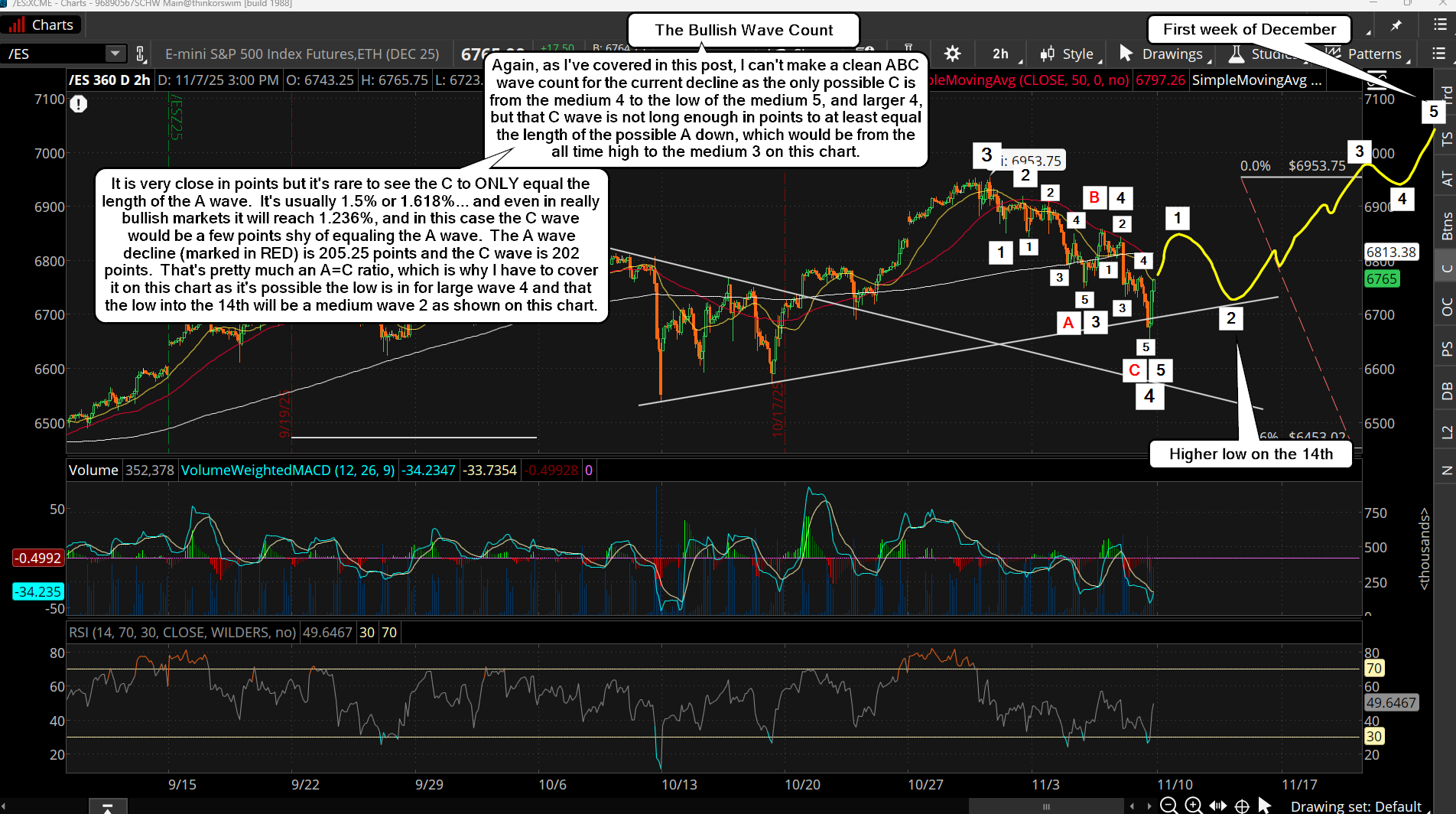

Then we'd see a choppy ABC down for wave 2 that bottoms around the 14th, which from that low we'd get a very strong rally up into the first week of December where we should reach 7000+ by then. The only issue I see with this wave count is that I cannot force an ABC down from the all time high into last Fridays low. It's a clean 5 wave decline and there's really no way to claim a valid ABC as what should be the C wave is too short.

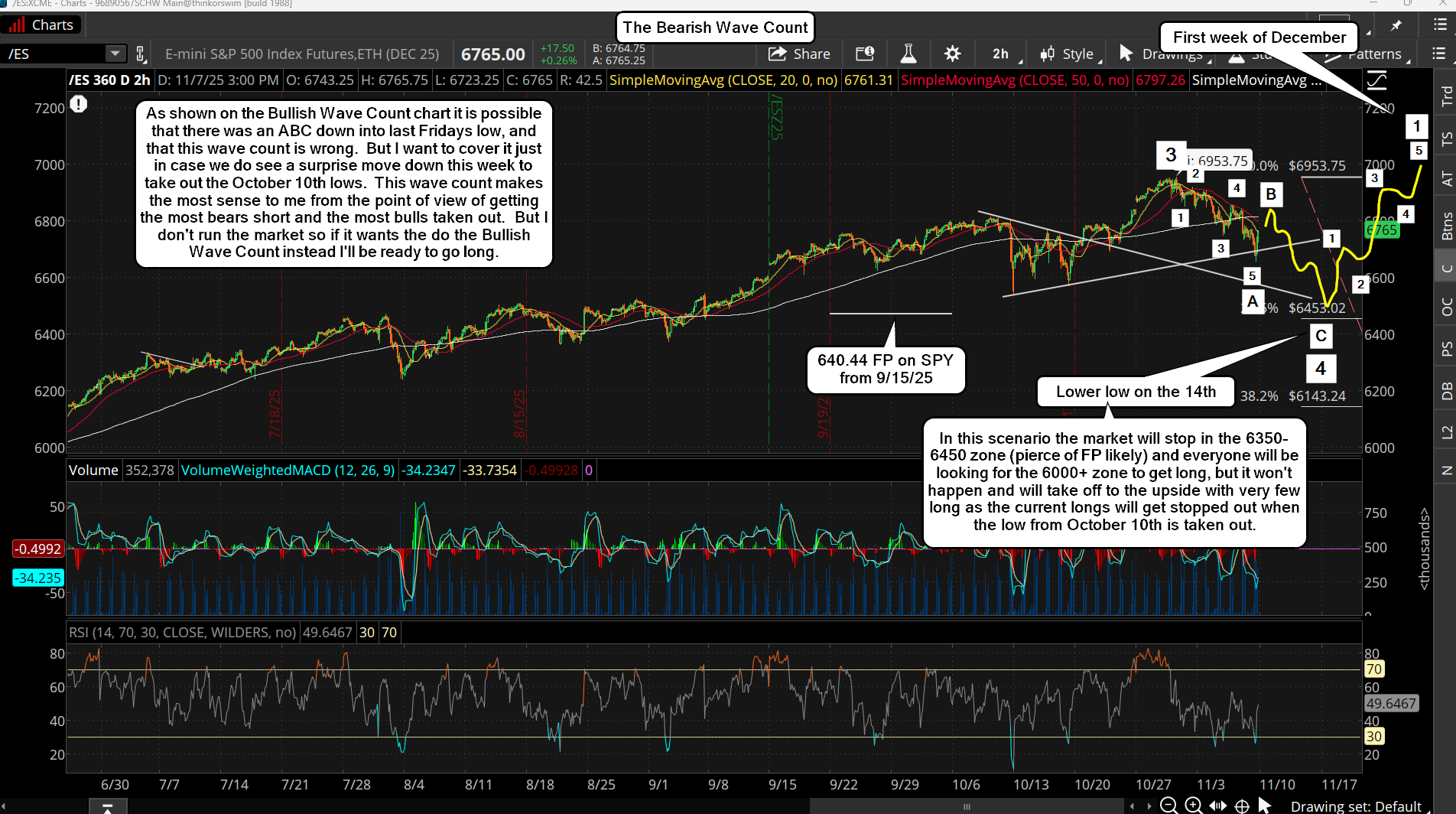

Normally, there is either a one wave decline or three wave (ABC) for any wave 2 or wave 4, as they are corrective waves. For this reason I have to be open for that 5 wave decline NOT completing the wave 4 and that is is only the A wave inside a bigger ABC down for wave 4 that should make a lower low into the 14th with the C wave "at least" equaling the length of the A wave.

The all time high is 6953.75, and Fridays low was 6655.50, which is 298.25 points. So, if we bounce today up to 6850 (for example) then roughly a 300 point move down for the C wave would target around 6550... which is a perfect A=C ratio. However, it's more common for the C wave to extend to 1.5% or 1.618% of the A wave, and that would put the ES down in the 6350-6450 area, and that takes out the low of 6540.25 on October 10th... plus it would fail to reach the 6000-6100 area where so many traders are focused on.

If it did this it would turn back up strongly from that 6350-6450 zone and squeeze hard into early December with all the bulls chasing it up because it didn't go the the obvious 6000+ zone where everyone (bulls and bears) want to pile on long. The market doesn't want it to be easy, as it loves to inflict the most pain as possible. Taking out the October 10th lows to hit the stops on the bulls, but not reaching the 6000+ zone where the bears want to exit and become bulls, will trap those bears during the move back up and keep the bulls on the sidelines. To me, this looks like the perfect trap as it will trick the most traders. Will it happen? Only time will tell.

Have an blessed day.