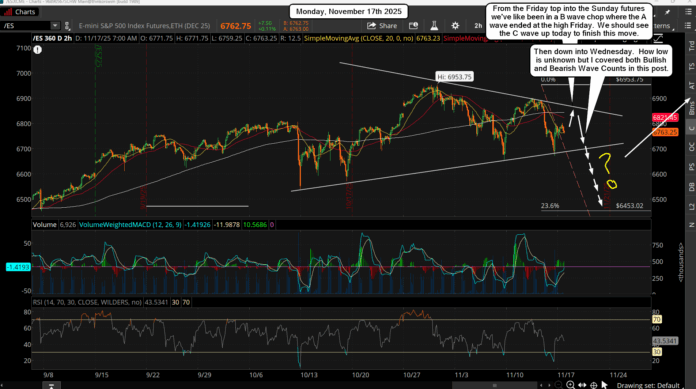

The market did hold on the lower rising trendline and rallied nicely from it Friday. Today should end that move up and hopefully it reaches the top falling trendline by the close. If so, I'd look for one more pullback into Wednesday before the big Thanksgiving squeeze to 7000 starts (maybe?... there's a bearish scenario too).

That pullback could retest that lower rising trendline one more time... hard to say for sure. But as long as it's a higher low it's going to end up being my small wave 2 down with the rally from the low Friday being the small wave 1 up, inside medium wave 3 up. It does not have to be very deep, but MUST be a higher low then Fridays low. If it doesn't hold then we are not in that Bullish Wave Count and instead we will be in the Bearish Wave Count.

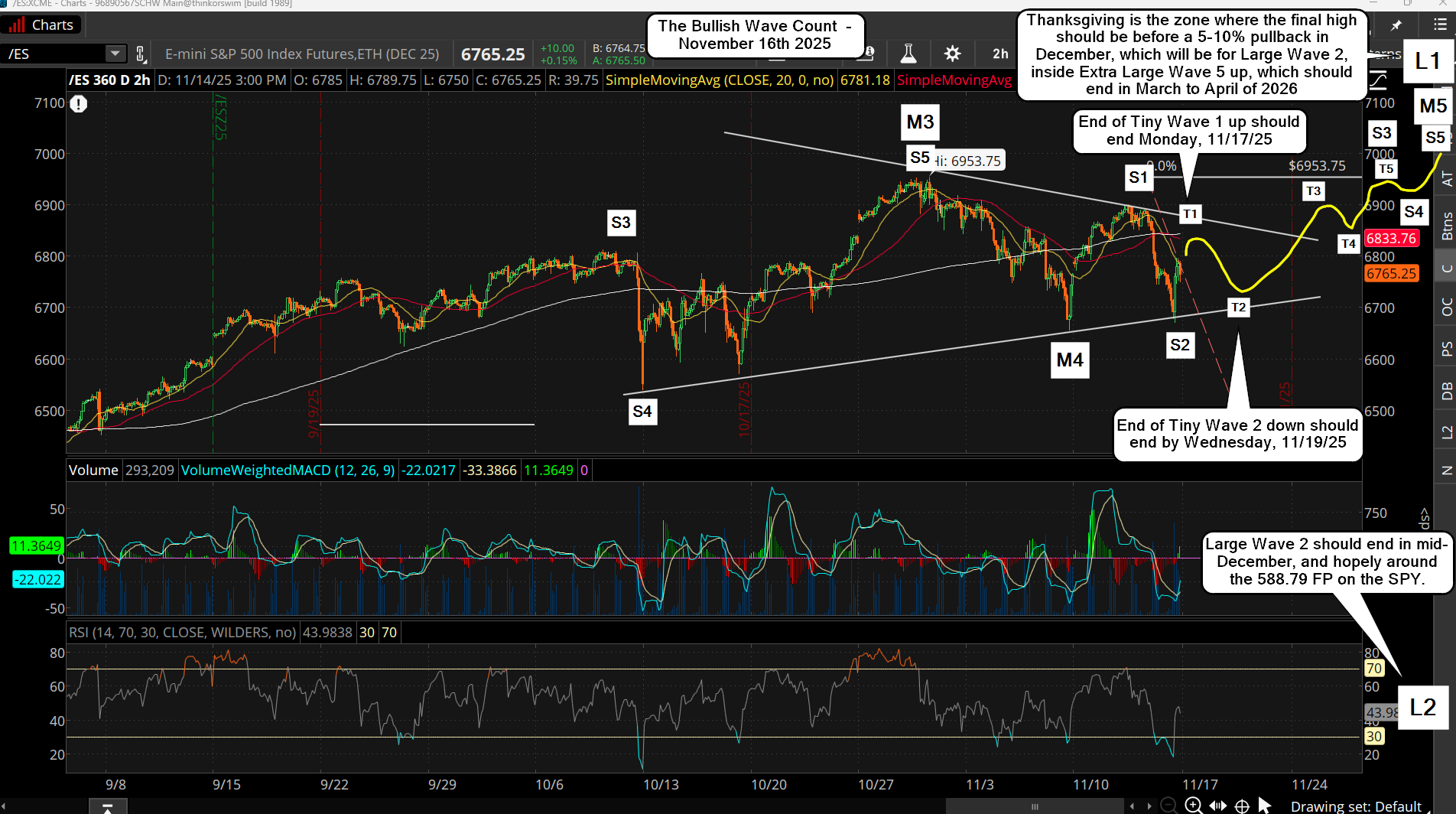

The Bullish Wave Count...

As you can see, if we are in the Bullish Wave Count the move up from the Tuesday/Wednesday low will be the small wave 3 inside medium wave 3, which should last into the end of this month to finish off the remaining waves before a 5-10% correction in the first 2 weeks of December is expected to happen.

This Bullish Wave Count should have the market reaching the 7000+ level into Thanksgiving, and it is my "lean"... but I could be wrong and we could be on the Bearish Wave Count instead. If we are on it then the drop into the low last Friday was a small wave 1 inside a medium wave C down, and the rally up from Fridays low was the small wave 2 bounce, which should end by the close Monday.

The Bearish Wave Count...

If we are on this path we'll see a new lower low into this Wednesday where the bearish period should end (cycle wise), and that final low could reach the 640.44 FP on the SPY, which is lower then the 10/10/25 low as well. If this happens then I suspect the rally up into Thanksgiving will not reach 7000+ but instead it will put in a lower high (double top but pennies shy of a new high) to fool all the bears into thinking the low is in, and suck the bulls into going long looking for a breakout.

But it should not happen as if this does this move into the end of this month the bullish period will end and we'll enter a bearish period (cycle wise) for the first few weeks in December. This is where a 5-10% correction could happen, and that's where I think we could reach the 588.79 FP on the SPY.

Side Note: ... it does NOT have to go that deep. The drop for the A wave was 298.25 points, and if C=A then 298.25 points down from the high of 6900.50 on 11/12/25 is 6602.25, so that "could" be all there is?

Remember that there's only 2 days for the drop for the C wave (in the Bearish Wave Count) to play out as after this Wednesday cycles get bullish again, and stay that way into the end of the month, and/or the first few days of December.

As for the big drop for the 5-10% correction... a drop like that would get all the bears looking for the April lows to get taken out, but that should not happen. It will create enough bearishness though to get a powerful squeeze going the rest of the month and into early 2026. This could be the plan but I won't know until I see where the market stops at this Wednesday as only then can I tell which wave count we are on.

On a big picture view the February 19th, 2025 high of 6166.50 ES was likely the end of an Extra Large Wave 3, with the October 2022 low being the bottom of the Extra Large Wave 2, and the January 2022 top being the end of the Extra Large Wave 1 up... which started from the 2020 Covid low. The pullback into the April 2025 low was the Extra Large Wave 4 most likely, and we've been in Large Wave 1 up, inside Extra Large Wave 5 since then.

The expected pullback in December should be the Large Wave 2 inside Extra Large Wave 5 up. This sets up a massive rally after that low for 5 Medium Waves, inside Large Wave 3 to play out into the first quarter of 2026. Then we'll see a Large Wave 4 pullback and Large Wave 5 up will be the blow off top somewhere between March to May I'd estimate. After that we get a bear market the rest of 2026.

Have an blessed day.