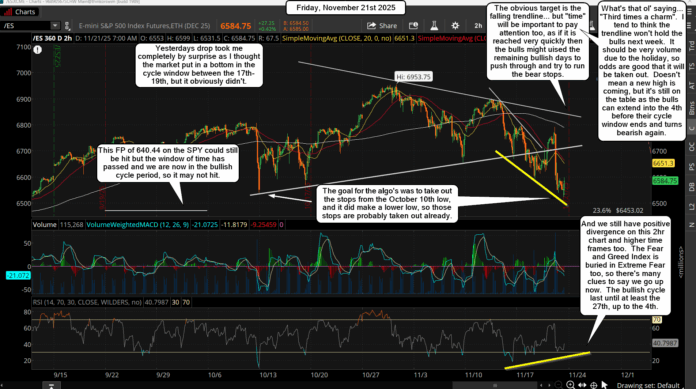

WOW! I got completed blindsided with yesterdays drop. I did not see that coming. The bearish period, from prior cycles, was calling for a low between the 17th-19th of November and then up into as late as December 4th and as early as Thanksgiving. (the 27th), and that's still valid, but I thought the low was already in on Wednesday. Yesterdays drop was completely a surprise to me.

I had originally thought we would take out the low from October 10th and maybe hit the FP on the SPY of 640.44 to hit the stops on the bulls, but I gave up on that thinking when the market seemed exhausted (on the downside) with the low on Tuesday. There was positive divergence on the charts and it was right in the middle of the cycle low period.

But yesterdays early rally was a bull trap, not a bear trap. So while can still rally up into the end of the month odds of a new high are much lower now. I'd say we first need to see a bottom which should happen today (maybe the 640.44 FP after all?).

Once the rally gets going though I can only see a move up for a lower high into as late as December 4th, but I doubt if it last that long. Most of the time we get see these 3-4 day squeezes that hit some overhead resistance area (the falling white trendline?) and/or a Fibonacci Level (61.8%?)... then it's over with. Bottom line here is that we'll still likely get a rally next week, but it should ONLY be a retracement for a lower high and then we drop much lower in OPEX of December.

Have a great weekend.