As we close out the week the market hasn't really done a whole lot of anything. It's had some good intraday moves down and back up but overall it's still trading in a big sideways range. I not expecting anything to change until we get into January, and between now and then we'll likely see more confusion as the market tries to trick and trap both bulls and bears alike.

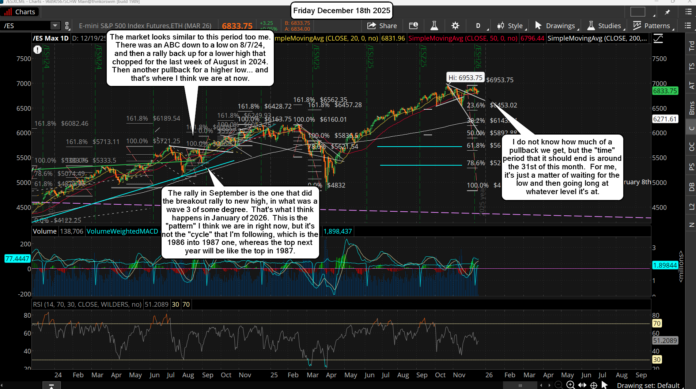

We could rise some next week but I'm still looking for another move down into the end of the month. It may or may not take out the 6771 low from yesterday... I'm not sure? If we rally up some next week could see a new high, and if that happens I'd think the pullback into the 31st would be a higher low then the 6771 low. But if we don't make a higher high next week then I'd lean toward that rally being a B wave up of some degree and a C down into the 31st for a lower low then 6771.

The low put in yesterday does appear to be a C wave from a clean ABC down from the 6932 high on the 15th, so maybe that's all there is for the wave 2 pullback? If that's the case then the 6932 high ended the wave 1 up from the 11/21 low of 6525 and we should just start carving out a series of wave 1's up and 2's down inside the larger 3 up, which would setup a breakout to start January 2nd. That's fine with me as there should still be a low into the 31st where a great long setup can happen. Of course it would be a higher low in this scenario.

If instead we get a lower low then the first ABC down to the Monday low was just an A wave and next week we get the B wave up, and finally the C down into the end of the month to end a bigger ABC down for a wave 2 down. Several possible ways this could play out be everything points to the best entry for a long, to start a big wave 3 up, is around the 31st or so. Until then I'm just waiting and watching as I'm not a day trader and I'm not interested in the chop we see each day that still has several weeks left before a trend starts.

Have great weekend.