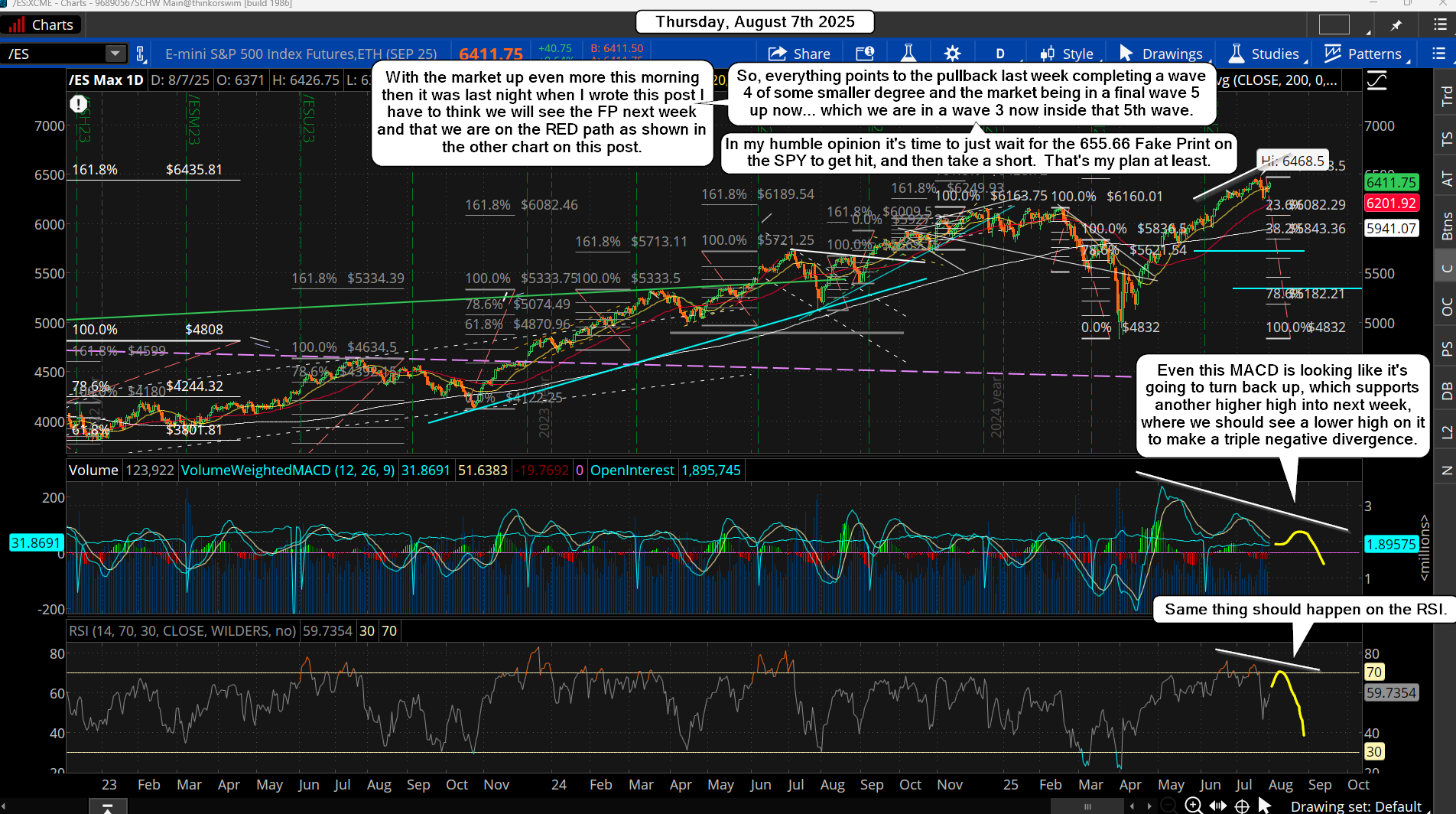

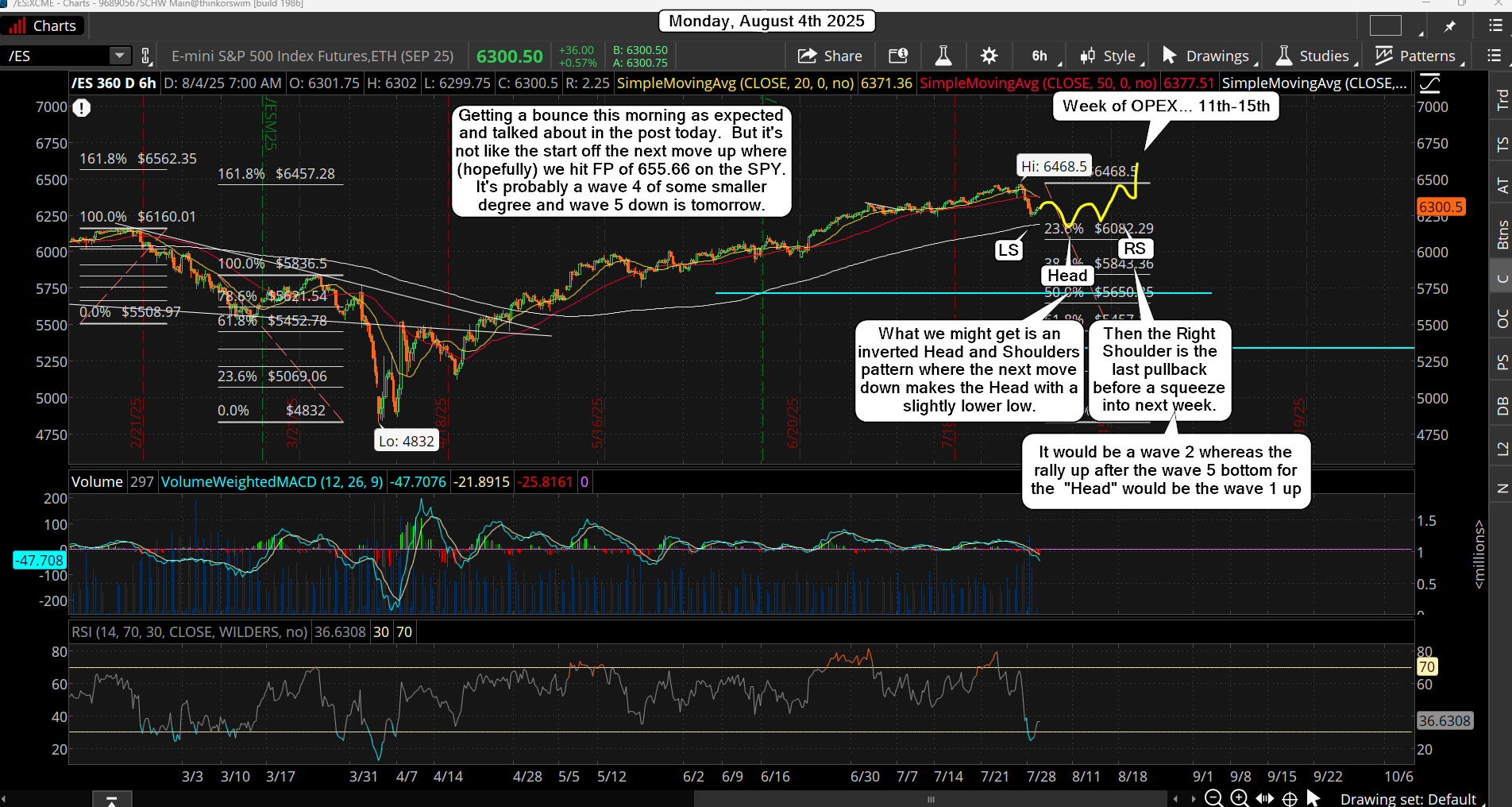

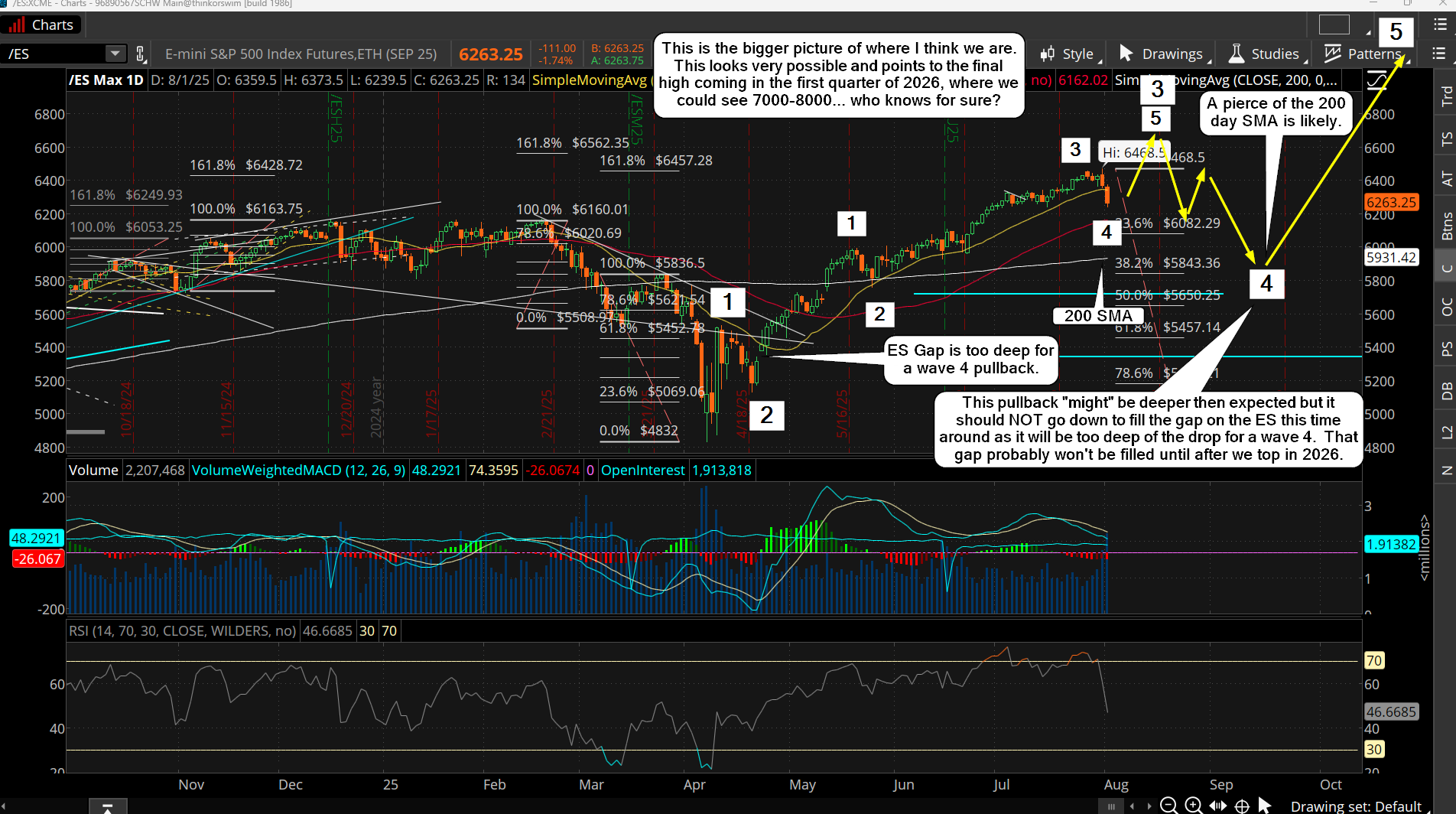

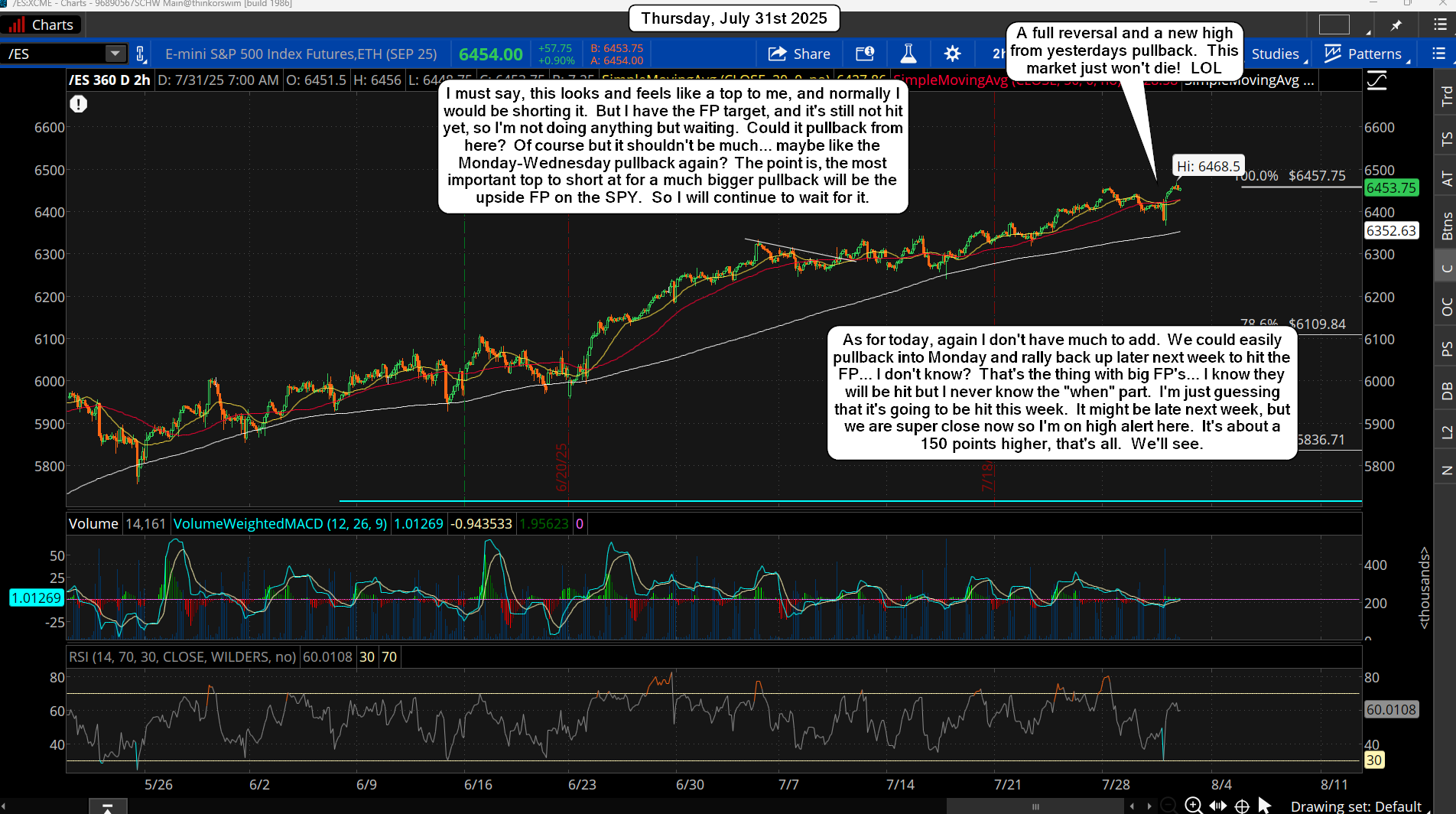

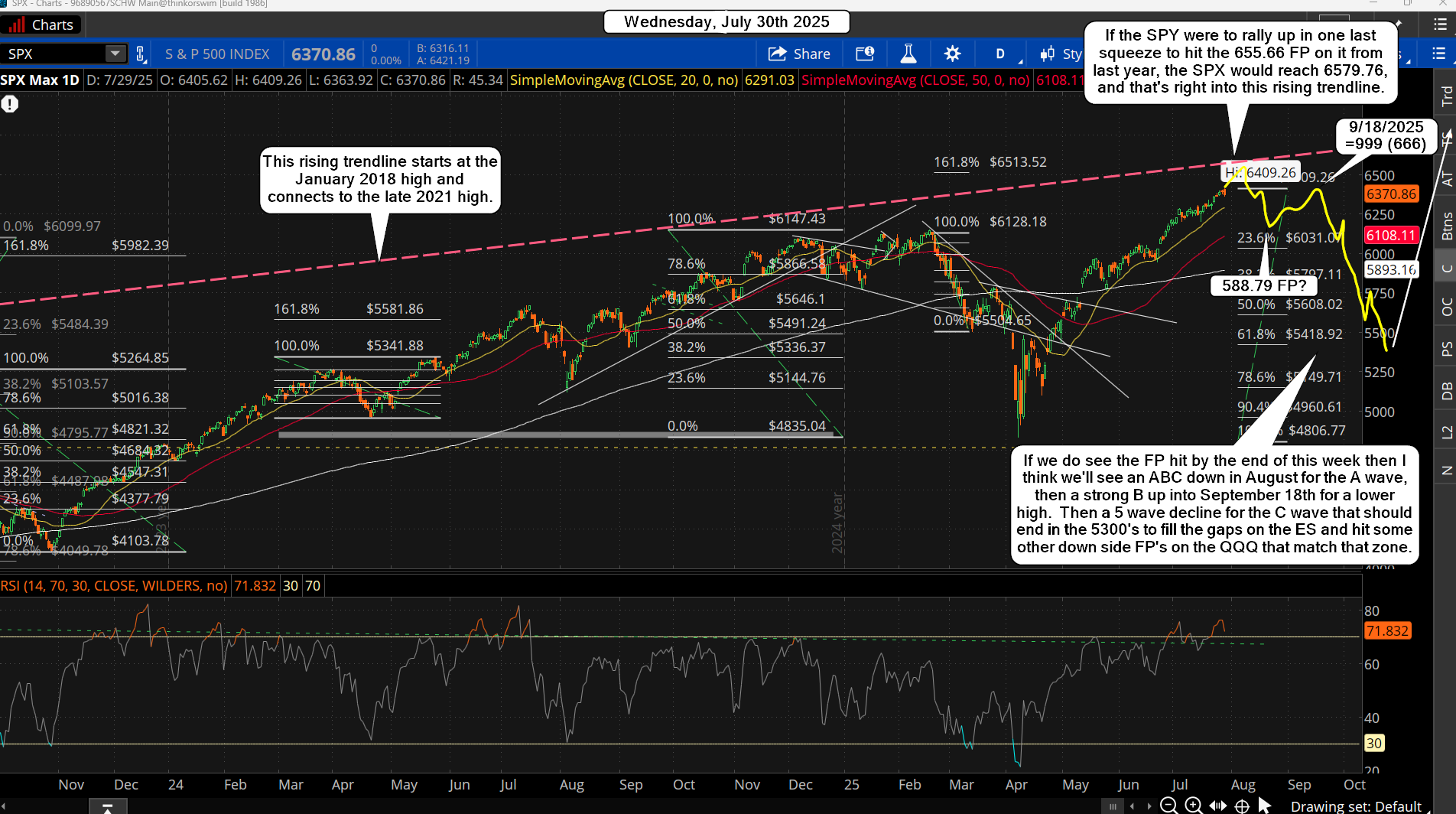

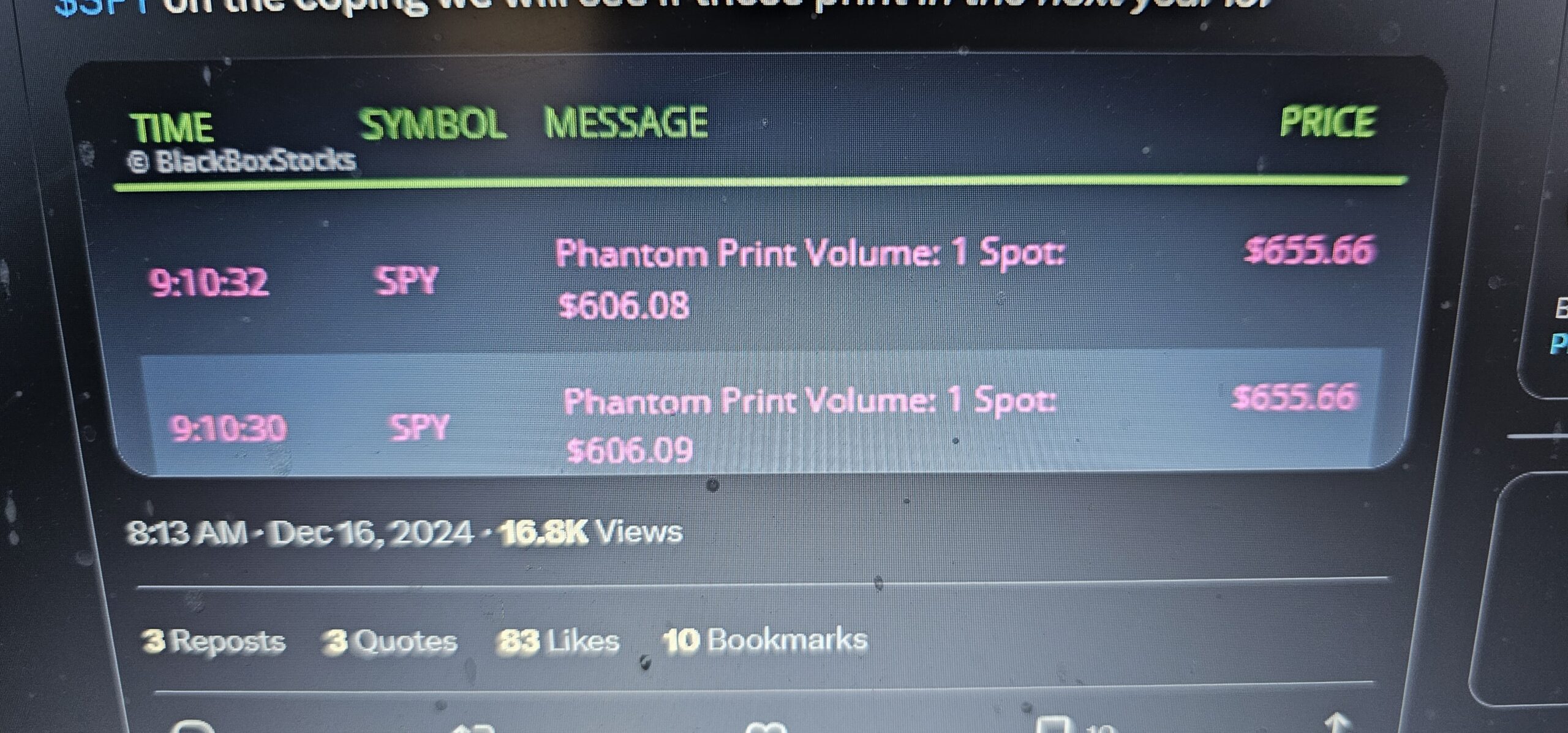

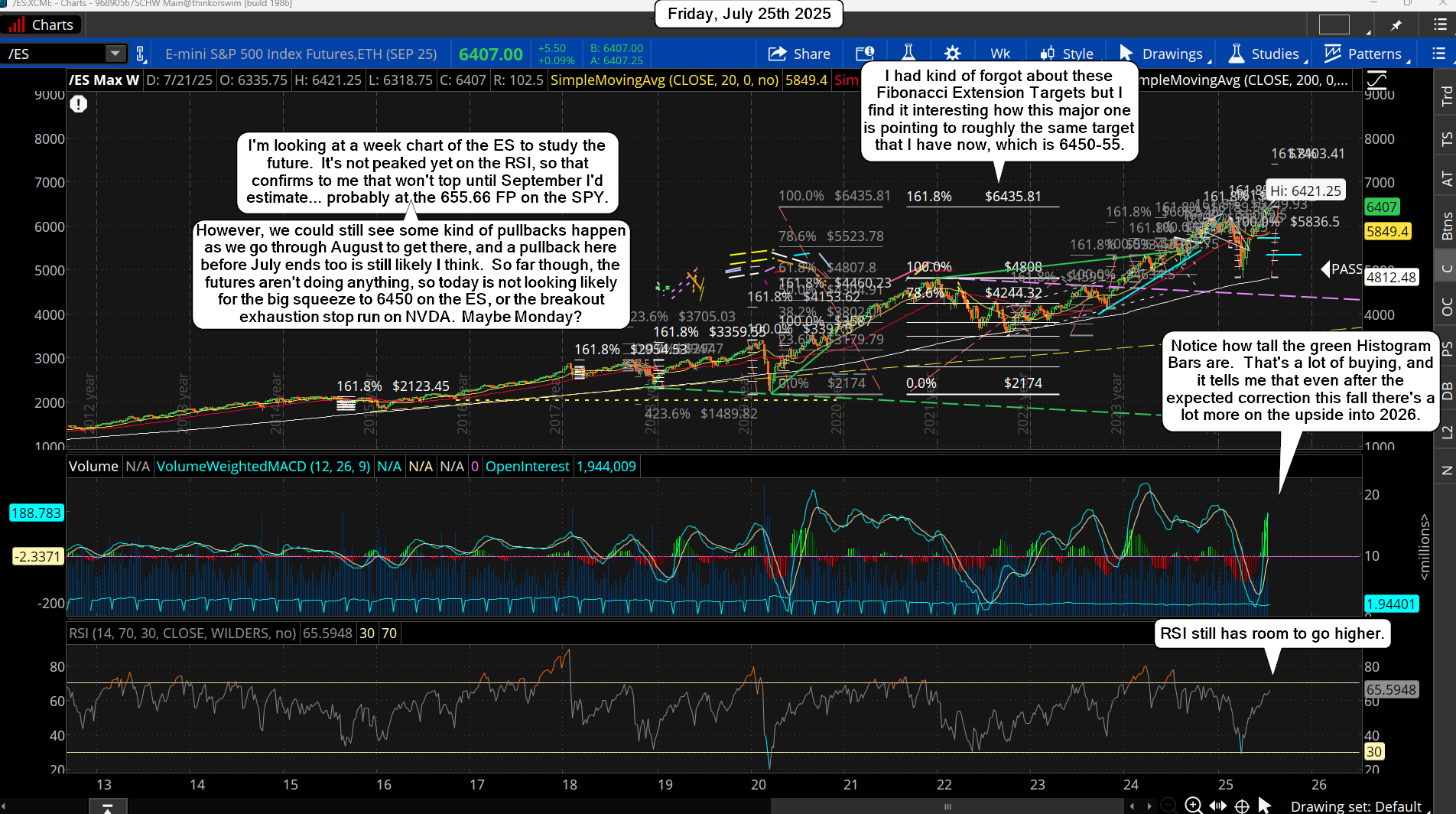

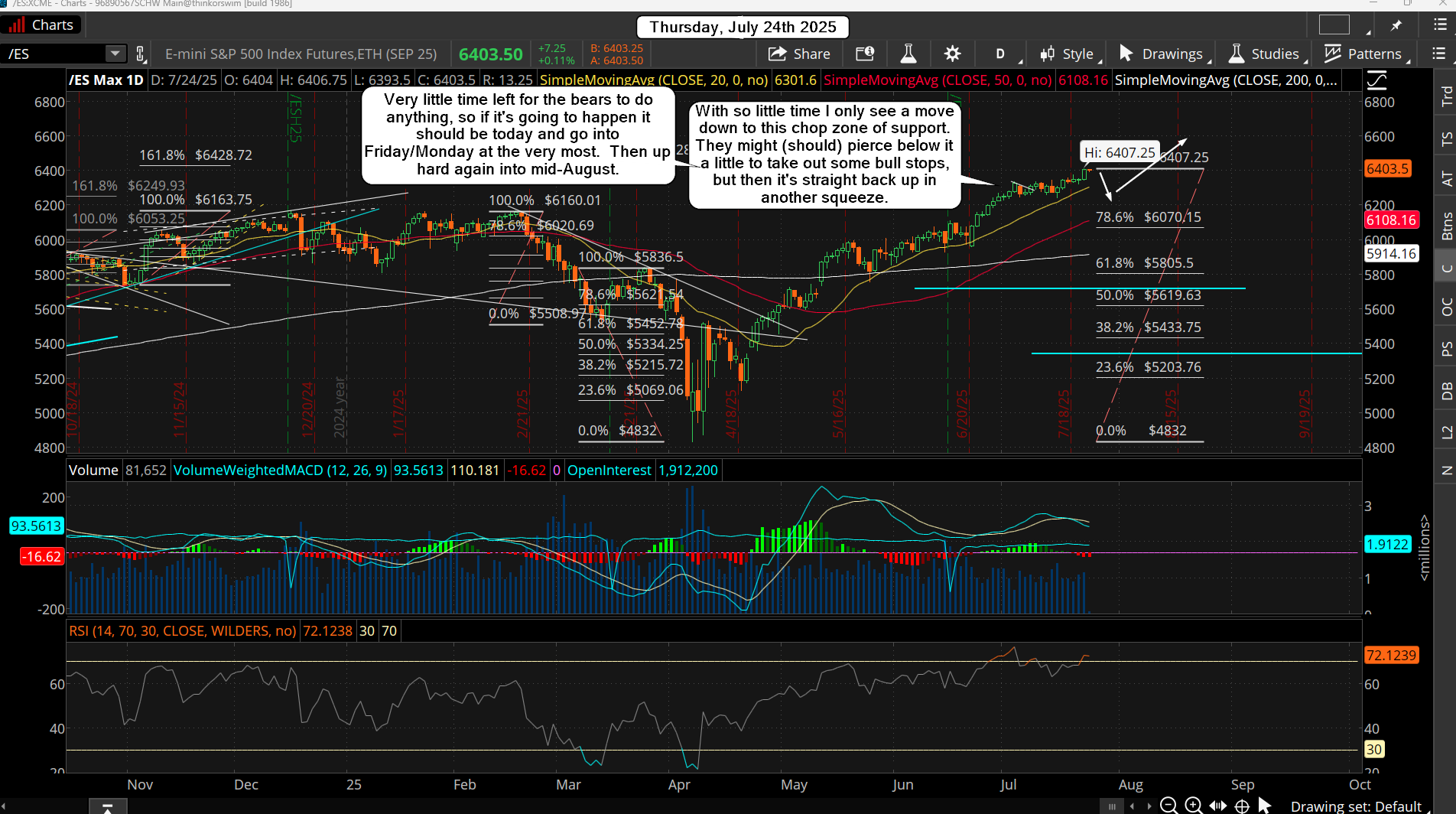

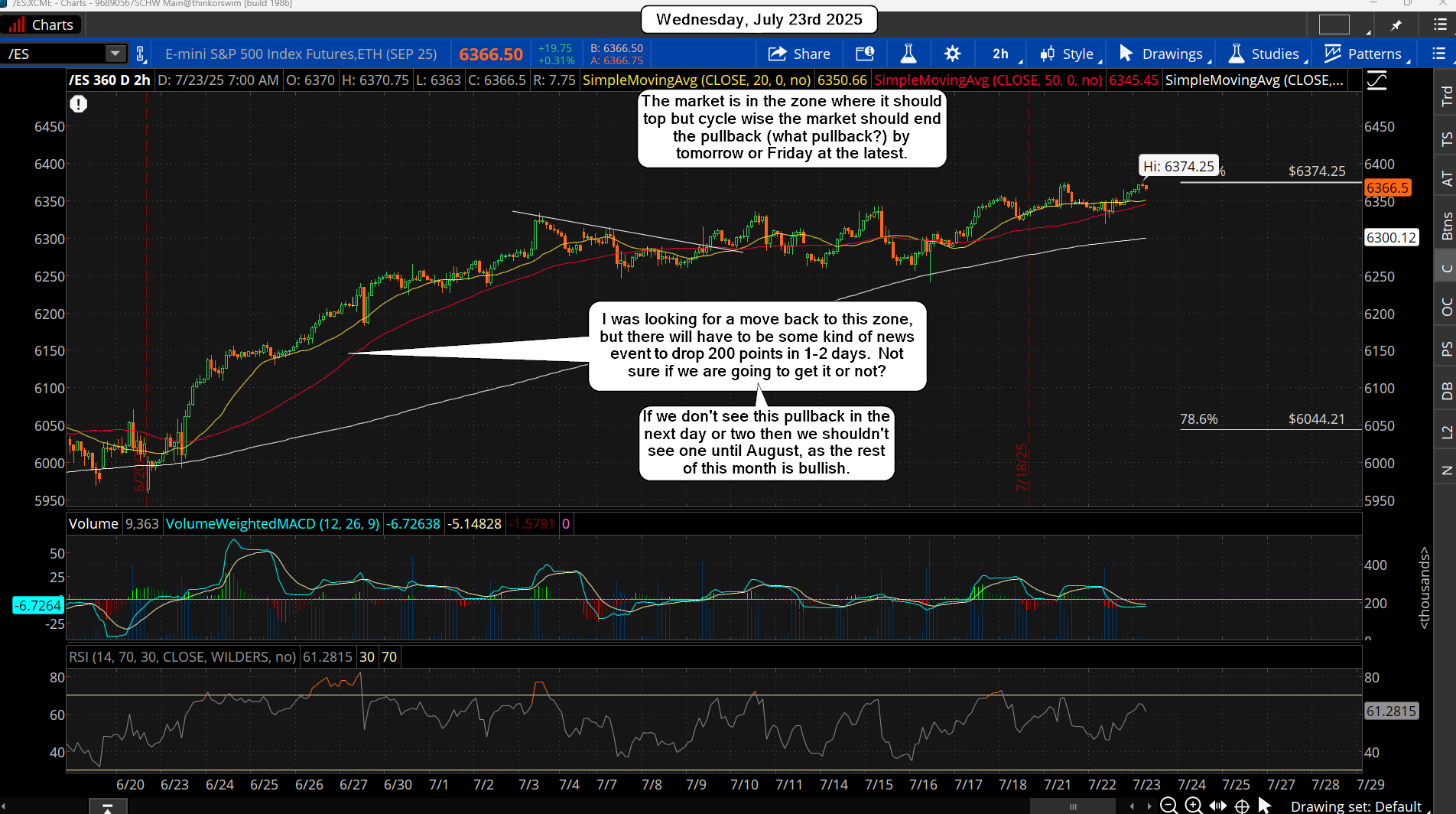

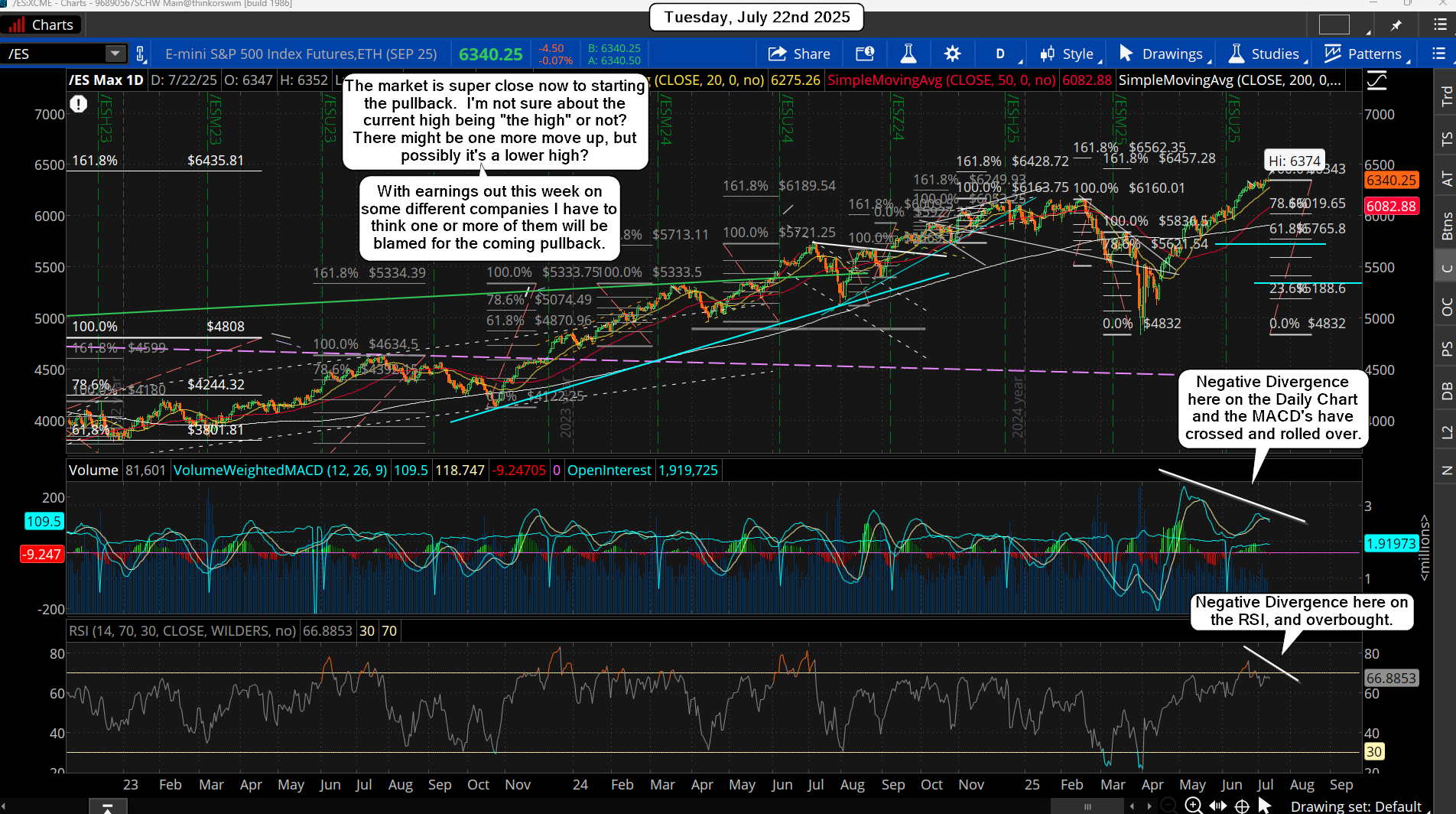

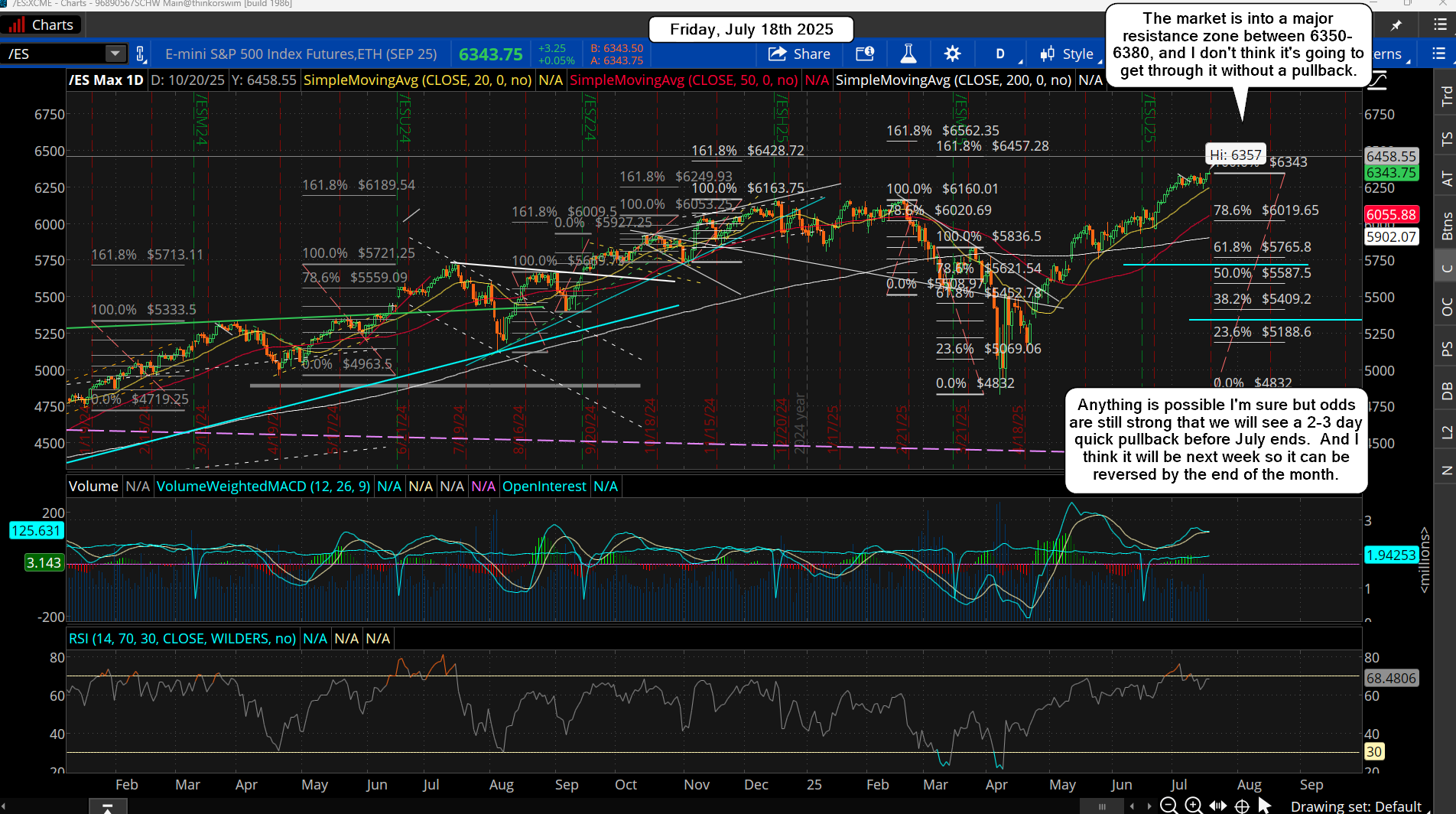

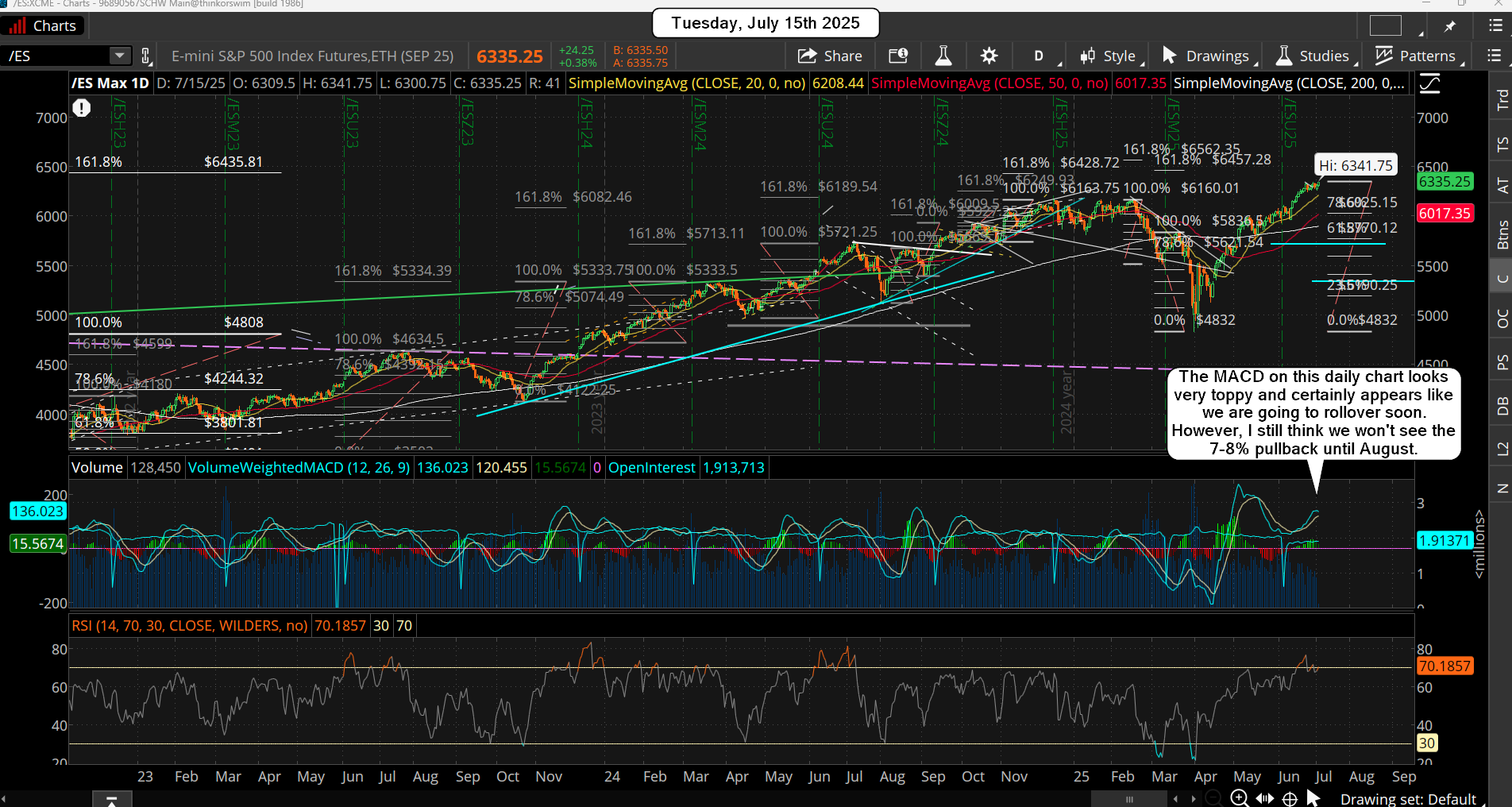

The window of time for a pullback has passed and now we go into August where we should see some volatility. It's usually a bearish month from a Seasonality perspective, and I'm starting to think that we are going to see the 655.66 FP on the SPY get hit before we pullback any. They are keeping the bears trapped and didn't even allow the small 3-4% pullback last week that should have happened.

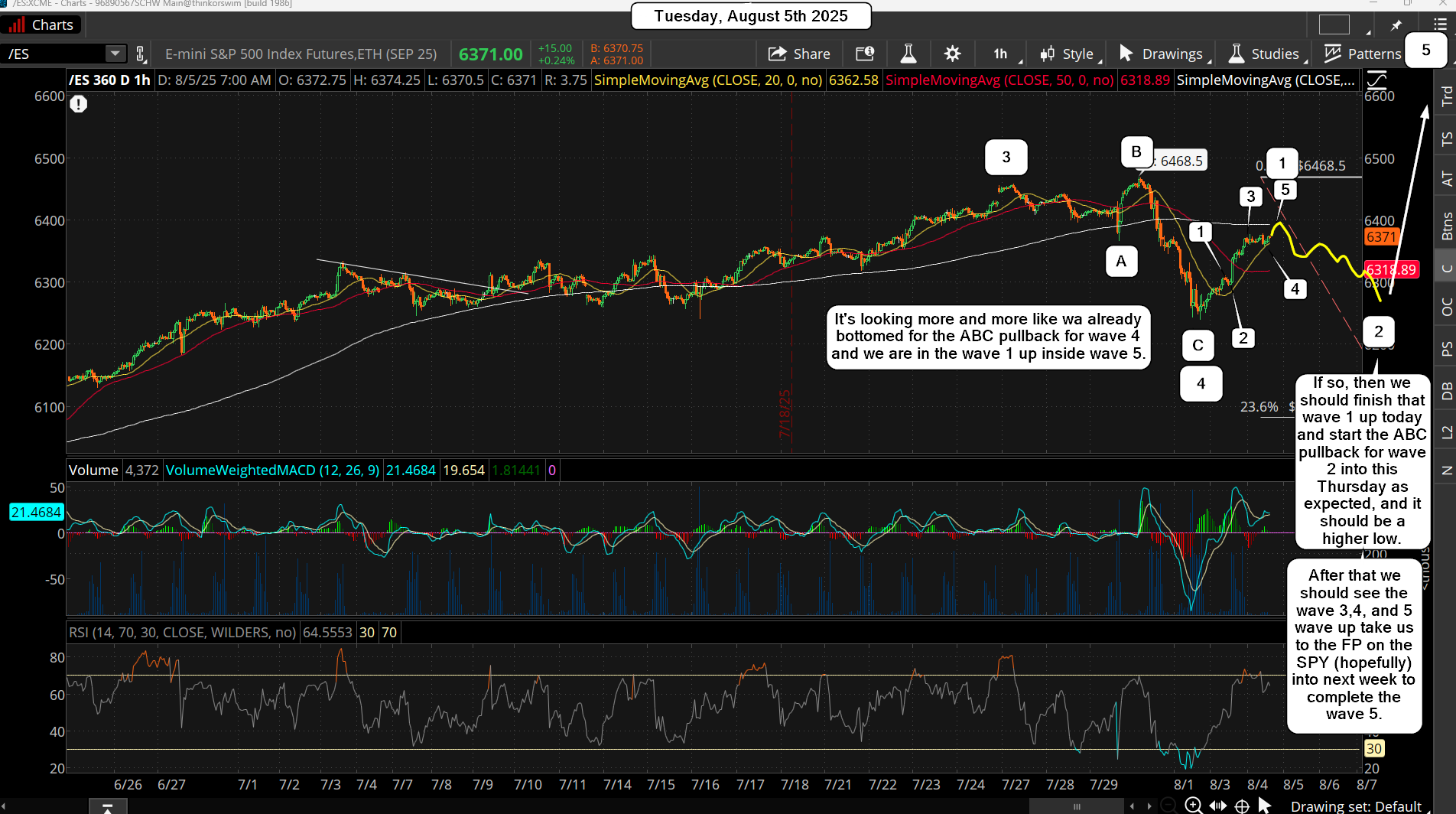

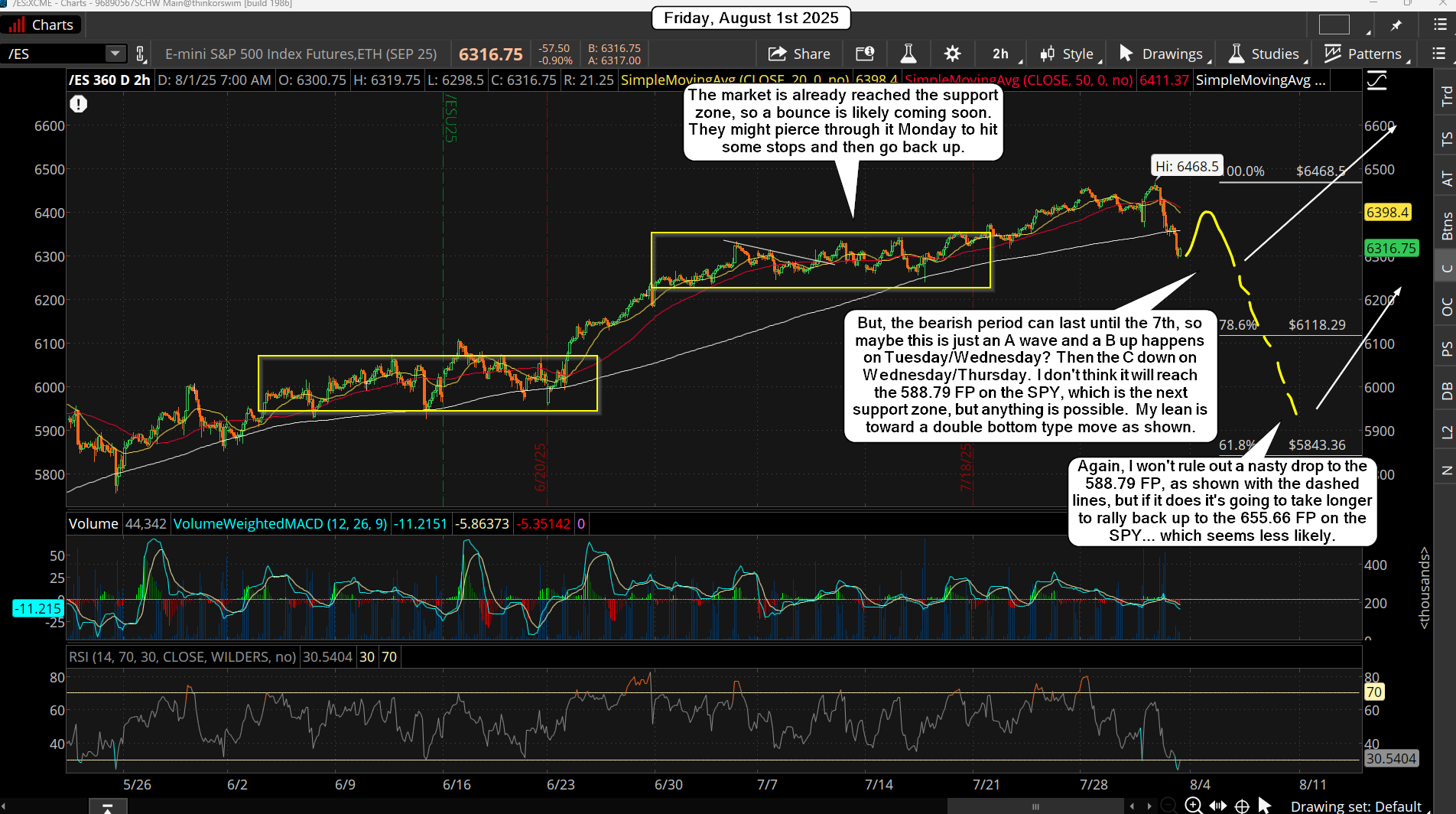

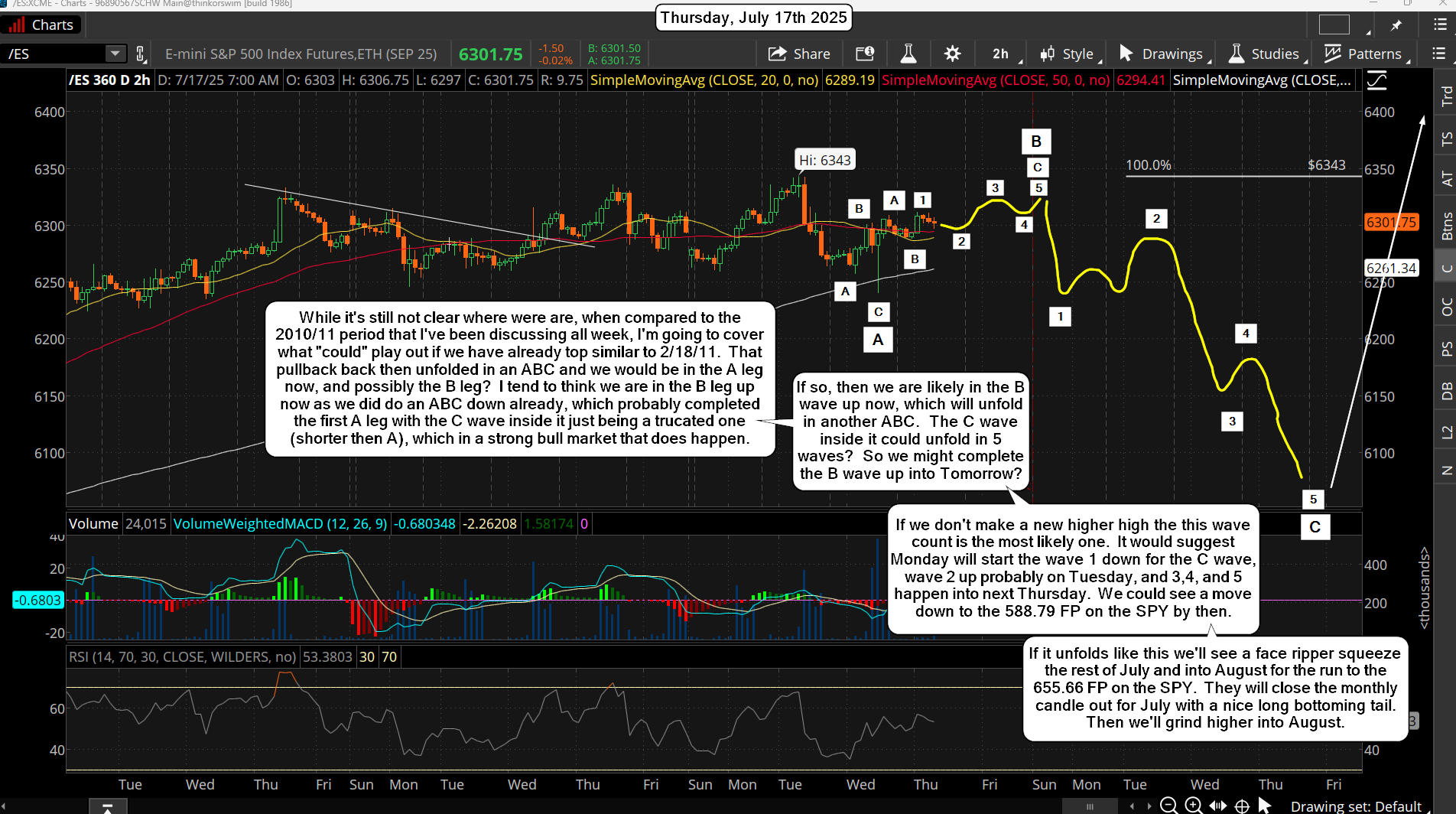

That means the drop coming is not going to stop at just 3-4% and instead will be a 8-10% move instead. The 588.79 FP on the SPY from a week or so back would be my target low in an ABC correction where the A move reaches the 6150-6200 zone, then a strong B up for a lower high into mid-August, and then the C down to the 588.79 FP on the SPY finishes the move. But... "if" we hit the 655.66 FP into early August the rally up from the ABC pullback should ONLY make a lower high into my ideal target date of September 18th, and from that level we should see the C down to fill the gaps on the ES with the lower one being in the 5300's.

This scenario would destroy bulls and bears alike I think, and currently everyone is getting bearish, so a final squeeze up to 655.66 would kill the last bear. As far as "time" goes I'd say between August 1st and 8th would be the time window for this last move up to happen. I know, it's sounds crazy, but last week was the end of the bearish period from a cycles point of view and this week is not normally bearish. Plus, we are super close now to reaching that upside FP of 655.66, as it's just around 20 SPY points higher, which is roughly 200 SPX/ES points.

A move like that should be easy to do with any good news this week, and it should cause the DOW to make a new all time high as well... which I think they want to happen. Bottom line here is that everyone is expecting a pullback either "in front" of the FOMC this Wednesday, or after it. But most FOMC meetings (probably 80% of time I'd estimate) have a bullish outcome for that day and the rest of that week.

It opens the door for the move up to hit by this Friday, August 1st. Will it play out like this? Who knows for sure... only the insiders do. I have been guessing for months now on "when" the upside FP of 655.66 would be hit, and I thought it would happen either in August or September but I wasn't sure which. It now leans toward August, and early August so that the ABC down can play out to make the larger A wave. And then the larger B wave up into September 18th for a lower high should follow, which I thought might be when the 655.66 FP is hit, but now it's leaning toward that not happening as odds are shifting to the FP getting hit first in early August.

As for the short term... hard too say. The typical pattern is chop (slight "tiny" pullback) into the FOMC and up afterwards. Tons of earnings out this week on various companies, so we could see both directions for a change but probably not a lot on the downside until the last move up to hit the FP on the SPY is done.

Have an blessed day.