Odds are extremely high for a stock market crash now. Could we have a Black Wednesday on May 19th, 2010?

I don't know of course, but we now have 4 out of 5 charts pointing down. The only chart that isn't, is the 15 minute chart, which could give any trapped bulls a small pop in the morning to exit their longs, and get short. I've called for a Black Monday 3 times in the past and been wrong on all three.

When I look back at the charts on those calls, I find that I didn't have them all lined up in the same direction... DOWN. Which is probably why my calls weren't correct. But, as each day passes, I learn more and more about how this game works. Not that I'm an expert by any means, but it's becoming clearer too me now, as to how to tie all the different charting techniques together.

Let's look at the charts now, and see what they tell us. I'm going to skip the monthly as nothing has changed since I last posted it. You can look at it again by clicking here. You will notice that it is from April 30th, 2010... and you can see where it's at now by going to Shanky's Charts by clicking here.

You will notice the red bar now in May, and if you try to find the 1260-1280 area on the now broken rising trendline, it looks like it could come in on the July candle, as I believe that the June candle would put it at about 1240 area (look to the right where you see 1240.03... that lines up with a backtest of the broken trendline on this monthly chart.

Of course there's nothing saying that it can't go back inside that trendline in June, and then fall back out into Primary Wave 3 (P3) in July. Remember the fake print we have of DIA 118.16 (about DOW 11,816 or 1260-1280 spx), and the date of June 25th on the Wilshire 5000 chart I showed in my "Great Depression Two" video (now a separate page, so you can go watch it if you didn't see it the first time I did it).

I was wrong then calling this past Monday a "Black Monday" as I stated in the video, but so far... everything else is still lining up with the projected forecast. The chart are now supporting a very large move down tomorrow, and that is what I stated in the video. However, I now have reason to believe we will go much further down then "just below 105.00" as I stated in the video. I'm looking for 980-990 now, before the rally back into June/July happens.

OK, moving on...

Let's look at the weekly chart now. I'm just going to put a link to it here, as it's playing out like we expected it too. Here is a link to a post from May the 2nd, 2010... and here's a direct link to the chart only. As you can see, we are still headed down. The Moving Averages haven't crossed over each other yet, but I think they will by July. When they do... P3 is here! But for now, I think they will move closer together over the coming month, trending sideways, and finally cross when the market rolls over in late June, early July.

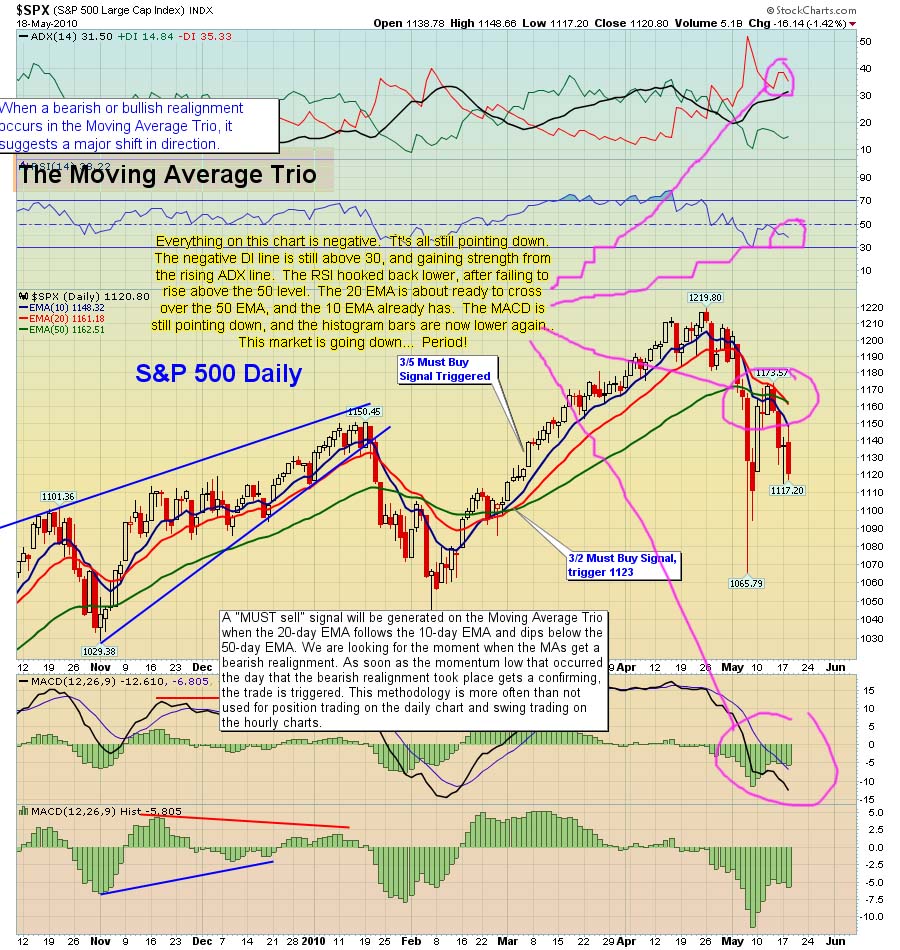

Next up, the Daily chart...

Well first off, you can clearly see now that the 20 EMA (red line) is touching the 50 EMA (green line). It's pointing down and should cross over the 50 EMA tomorrow. Notice also that the MACD lines are still pointing down too, and the histogram bars are now getting deeper again. The negative DI line (in Red, at the top) are still above 30, while the positive DI line (in Green) is below 20. The ADX line (the Black line in the middle) is rising, which strengthens whichever DI line is on top... in this case, the Negative one. The RSI is still below 50, giving strength to the bears. This chart is still very bearish, and I definitely see more downside coming.

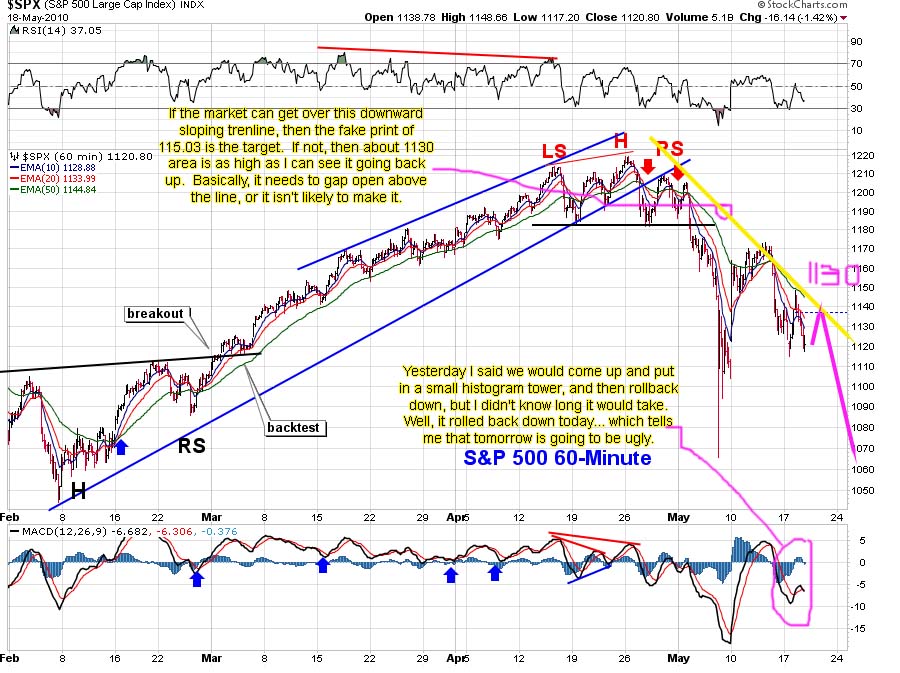

Now the 60 minute chart...

Notice how the MACD lines were pointed up this morning during the brief rally, but have now turned back down again. The histogram bars rose up above the zero line, and quickly put in a much smaller tower, and are now ready to go back below zero tomorrow. The RSI line (top chart) rallied up to the 50 line in the morning, and was quickly rejected and is now pointing back down, giving strength again to the bears.

Also notice that the market tagged the downward sloping trendline around 1150 and was rejected again. The market is headed down, and it's most likely going to be a wave 3 of 3, in Elliottwave terms.

Finally, the 15 minute chart...

This is the only chart that could give the bulls some hope, but it will be short lived if it does. I could possibly see a small early morning rally back up to the 1130 area, where the downward sloping trendline will be at tomorrow. This is the last stop for the bulls to get off the train, as the tracks dead end at the edge of the Grand Canyon. As you can see by the rising histogram bars, this could rally the market a little while it goes into positive territory and puts in a small tower, before rolling over to the downside again.

Once all 5 charts are pointing down... all hell is going to break loose next! This could line up perfect with the time that the Senate votes on the Financial Reform Bill, when they stage a huge protest march in Greece, and when Germany bans short sellers. Talk about a triple whammy! All those events together, along with what the charts tell me spell one word... Crash!

Maybe I'm little too crazy for some of you too believe, and yes I've made some stupid calls and predictions in the past. But, I was still learning the rules of this game back then during those calls. Since then, I've learned to get a better view of the whole picture. I could be dead wrong on this, and I wouldn't dare give you trading recommendations to go buy a certain etf or stock. But, if you are long, I highly suggest you think twice about going to cash, and get out tomorrow when you can.

Red

P.S. This was a late day post by Diablos who caught this fake print, showing 115.03 spy. I don't know if it plays out tomorrow or if that's a sign for where they plan to close it on Friday, which makes more sense, because of the huge amount of open interest on the puts at that 115 level.

Keep this target in mind tomorrow, as if the market can break above the downward sloping trendline around 113 spy, then this fake print should be hit on Wednesday... not Friday. No way to be certain of course, but a gap open above the downward sloping trendline would then make this target highly likely.

But at this point, from looking at the overnight futures, I don't think this print will play out tomorrow, but will play out at in a future unknown date. Could it play out this Friday where all the put open interest is, or will the market makers not be able to rally it back up to that level by then? I don't know of course, but my gut tells me that they are the buyers of a lot of those put contracts, and want a market crash to make money from them.

Sometimes they like to fool you, and not close it where you expect them too. I know that many times in the past, I seen a target level that was extremely loaded up with calls at that level, and I thought for sure that they would pin the SPY at level, to avoid paying out those call holders... only to see the market blow up past that level and close higher on option expiration. So for now, let's just put it in our little bag of tricks and look for a future date. Thanks Diablos

P.S.S. The futures are down 10 points as I finish this post. It's not looking good for one more backtest of that trendline around 1130 tomorrow. We'll see... anything can happen.

Red, How come I cannot see the post. What am I doing wrong.

What do you mean? I can see it fine..

I am seeing two comments here. Your and Mine.

That's all you are supposed too see… it's a new post, and no one has commented yet except you and me. Go up to the title of the post, and you will see a link to the previous post (which was the one I made last night for day). The post you are commenting on now is tomorrows' post (Wednesday). Make sense?

Take a deep breath, Gcocks. Everything is ok 🙂

LOL

LOL!!!!!!! Yes I am slow and technically challenged.

You know I read about how the sky is falling here and I just thought it had already started. LOL

Actually, the sky is falling. The volcano in Iceland is going to mess up air travel for years, and cool the planet for years. The oil gusher in the gulf is gushing faster than anyone will admit, and it will gush until all the oil in that hole that wants to come out, is out. Gonna be a mess for years.

But this web site will be working. So, we'll be fine 🙂

I sure hope the website is still working. A year ago I didn't have a clue how to make a wordpress blog. But, I learned a lot since then… and keep learning new things every day.

I think you are ahead of the game. I count myself among the red pill ones and still I regarded Iceland and the spill to be the usual short lived disasters. Now I wonder what they want from these soon to be mega pains.

It makes more sense because MSM attacks a business that is going down anyway. For instance in recessions they start attacking hospitality etc.

Read more here: http://www.naomiklein.org/main

Great post, Red, I appreciate the charts.

Seeing as the new trading rules being bandied about include a 'circuit breaker' for a market loss of 5% rather than the current 10%, how about just one more 10% day for old times' sake? That would put us at 1008, coincidentally the same as the bottom of the target range for the Ascending Broadening Wedge that Cobra has highlighted:

http://stockcharts.com/def/servlet/Favorites.CS…

I like Cobra and read his posts regularly. He's a great chartist, and I've learned a lot from him. I certainly don't know exactly how far we are going down, but I'm pretty sure that we “are” going down.

One thing I've learned the hard way is that nothing connected with the market is certain, but I think this is the closest I've ever been to staring down an empty elevator shaft.

A 100 point day would sure be good advertising for the regulatory package that the foxes have designed for the henhouse!

Now you are starting to sound like “R”… LOL

LOL. My wife always marvels at how cynical I am. She bought a package of a new kind of Oreo cookies that has cookie crumbs mixed in the filling and I said, “I see they found a way of recycling their cookie scrap” and she couldn't believe it.

The only sense of wonder I have is wondering what the heck agenda is behind the headlines.

I know how you feel. I don't have any personal friends or family members that understand anything I talk about. It's like I'm talking in another language too them. They all took the blue pill, and I took the red pill.

I feel your pain Rip. My husband, mom and just about everyone else thinks my cynicism is nuts. That's why I hang around you guys!

I was thinking that there would be another crazy down day like that before they actually implemented that rule.

Red…when you say charts pointing down…in very simple term what does that mean to you…I always used the ma if you will to tell me …if they were stacked 50…20…10…then yep going down…5min 15min 60min all down by a little on two and the daily not…

just want to understand your thinking better…thx

Whenever the market is trading above the 50ma, 20ma, and 10ma… it's in an uptrend. When market falls below them, it's in a downtrend. The more lines it falls below, the longer the downtrend should last.

Then you need to look at the next large chart (longer term chart), which will tell you if it's going to be minutes, hours, days, weeks, or months… with the new up/down trend.

Look at the weekly chart and you will see that the 20ma hasn't crossed over the 50ma yet. I think it will cross in late June or early July.

http://stockcharts.com/def/servlet/Favorites.CS…

I think the monthly will cross shortly thereafter, and the market is going to drop like a rock for the last half of the year. Bad times are coming…

thx red…were on the same page…

Nice site RDL.

Hi Katz – nice to see you here!

If our new bottom is dragged out a bit, maybe with a probing of very low resistance (Sundancer's projection) occurring next week, perhaps the 20 may cross the 40 and cause everyone to speculate that we are in a bear market.

This would be a perfect time for a rally that would make your ears bleed, prompted of course by concern over the dollar and rising interest rates.

Should be an interesting day today! Figures that I have a ton of real work to do.

FTSE plunged to equivalent of very low 1100s this morning and is having a bounce. We ought to meet about where SPX closed yesterday.

I suspect that this will be a very brief consolidation point for us, rather than the beginning of a rally.

Carl’s morning call:

June S&P E-mini Futures: Contrary to my expectation Monday's low at 1113 was broken by 8 points in Asian trading last night. My range estimate for today is 1100-25. I still think that last week's low at 1056 ended the correction from 1216. Strength above 1120 would be very bullish.

1104.75- 1118.25 range last night (13.50 points)

1100-1125 estimate for today (25 points)

1114 currently, so estimate is -14 to +11 from here (neutral)

Good Morning Gang…

What's everyone thinking for today? Rally, Crash, or a whole lot of nothing…

A slightly lower open, a slight move up to positive territory and then KABOOM! But this is sort of what played out yesterday so it probably won't happen again! If we get near 1140, I short more.

Look at the charts above Monica. In order to get to 1140, the market must cross that downward sloping trendline in yellow. That's not likely to happen, as sloping trendlines (up or down) seem to be even more resistance then horizontal trendlines.

The market would have to gap over the trendline to race up higher to the 1140 level. With less then 10 minutes until the open, I don't see a gap up happening. The level to look to go short at again, is around 1130 or so.

Thanks Red.

Good morning, Red–

I think that today is the day we've been waiting for. Day 1 of 2 actually, so I will stick beyond the close even though it will hurt.

My guess for today is a low of 1050-1065, where we will close. Tomorrow will be a low of 1008-1020, closing about where we do today.

Sounds good too me… I'll take it.

BTW, I respect Sundancer's low estimate, but think we will have a bounce before we go there.

I will continue to dork around with options and not take any big equity positions until that is completed or ruled out.

It's hard to say how far it will go down, but it should most definitely take out the current low of 105.00 spy. Whether that happens this week or next… who knows?

Doesn't look like a bounce today anyway!

i was thinking same thing…is the market open…

There is a ton of downward pressure overhead now. As you can see from the charts above, the monthly, weekly, daily, and 60 minute chart are all pointing down. It's going to be hard to rise up very far. The 1130 area would be a gift to the bulls.

Could be Rip – just remember that the ritual days were yesterday and today.

I agree, this should be the Big One, but if you look at old charts there appears to about a 50% chance that substantial losses are incurred the following day, though are reversed by EOD.

I think today's bottom will be a fake-out, in the range I mentioned. I will be sorely tempted to exit at 1050, though.

I am sticking to sundancer's low estimate but I will get rid of my puts either today or tomorrow. I will hold onto the June ones. Meanwhile, if we have a giant bounce, I will then use the capital from my may puts to buy more june ones.

I meant to say May puts – holding all the June ones.

you think thurs will be big down day too (as well as today?) what about wave 4 up then 5 down into friday? ??no good

I dunno, I'm not an EW guy. It could happen; I'm seeing a lot of money flow into the market right now (looking at an SPX 5 day chart on Yahoo).

Excuse me, I didn't answer your question. I was thinking about the likelihood of a morning rally.

I'm pretty sure tomorrow will be a reversal day and end about even. Whether it carries to Friday, I have no feel.

pivot is 113.41 and s3 is 109.56 so unless something out there really bad I'm going with 109 and hopin for 105…

Been looking for fake prints but can't find any.

just bought more. Figured I'd take the risk that it goes slightly higher.

Well some green for a bit. Are they giving the bulls a chance to get out or bears an opportunity to add?

With averages aligning I do not know how or who would be bullish but they seem to pull it out.

Everyone reads the charts differently, so some will view it bullish, and others bearish. I can't see anything bullish, but maybe I'm being one sided?

I don't think so…the stars are all aligned (charts) so pretty hard to find something bullish…I got this feeling in the gut somethings coming….probably need to eat…

Its the funny thing about EW. It amazes me how people can read the charts and counts differently.

I am a vix fan. i believe that sentiment along with average alignment are the critical signs for market direction. But I too am often wrong.

Jim, the VIX is above containment. There is nowhere to go here but down.

I'm pretty sure this phenomenon starts at 11am EST or 6pm GMT

“Civil servants and public sector employees, who have vowed to step up protests, will march to parliament late on Wednesday to protest against austerity”.

or course a riot doesn't have to break out.

Also Fed and ECB checking rates to keep things calm

from liveforex

I have it on good authority that the ECB and Fed “checked rates” about 15 minutes ago, prompting a bounce to the 1.2315 area.

The CBs call around to the banks and ask what they are seeing.

In essence, they are trying to send a message to the market that they are “watching”…

If the Euro is stable then (I assume) the S&P will be stable.

civil servants in Greece that is

hehehe…thought is was CA….its coming soon

My account balance isn't really reflecting the move down. Frustrating.

Ok – nevermind, maybe it was delayed!

Yep. 15 minutes I think.

just set trade triggers in case the systems freeze.

I need to learn how to do that. Can you key to the index??

Re: freezing, my computer was acting suspiciously like a trojan was interfering on very active days, so I disabled a program called DCOM so no one can operate it over the web. This helped a bunch.

If your cursor goes all floaty, it is most likely a trojan.

Yes, you can key it to the index which is what I do. You get lousy executions, but it is better than trying to type in the order when the market hits that exact point and having your system freeze. Red made a suggestion to me to put the trigger in somewhere slightly higher than you want to sell it (i.e. if you think SPY is going to 105, put it in at 106), so that you get the execution while the market is falling, rather than when it is bouncing.

That's a good idea. Best to execute before hope dawns. SDS is very volatile, swinging half a point in seconds. The option premium is very wild, all over the place.

comparitivly large move up in the Euro does not translate into a large move up in the S&P. ?Could be bearish sign for S&P. Just thinking out loud

The 15 MACD histogram bars didn't even make it into positive territory before falling back down… very bearish IMHO

it took almost an hr but we hit s1 111.22 next step s2110.03

RED – DO YOU KNOW WHERE NEXT CONTAINMENT DOWN IS?? I think 106? I will go back and look.

No, I sure don't know where the next containment point is… but if it breaks, there's a 50 point drop coming.

Thanks! I went back and looked and i think it is at 1080. Have some triggers there.

Never mind, I figured out the triggers. I'll set for 1020, may revise to 980 depending on how today closes.

ok – just keep in mind that Sundancer said expect a 50 point drop if we got through yesterday's containment which would put us more at the 1078 level today. If you have time sensitive options (may ones), you might want to consider putting triggers in there. For my june puts, I will only by them in when we hit 993.

I cleared out the Mays already, which was a mistake. 🙁

S' OK, my commitment level is much more comfortable now.

then hold your triggers at 993 me thinks.

Argh, wish I hadn't just looked at AAPL. I had a bunch of 250 puts.

would coulda! I know the feel. For once, I have played it right but that is because I had a map.

Looks to about 1078 or so.

I have this chart: http://www.screencast.com/users/rcjstocks/folde…

It bounced exactly at the 192 SMA. Not suggesting one way or the other if it holds.

Thanks Diablos. I don't think it will hold. I have a few trade triggers in for May puts when SPY reaches 1079.

I meant SPX.

“chart pattern trader” appears very good. Clear without equivication. He's on the blog list. watch his videos.

Yes Ben,

The chart pattern trader is very good. I watch him all the time.

OK, hope for the bulls at 1106. Next stop 1090ish, I think.

Ok – found the post I was looking for. Here is your navigational tool from Sundancer-

Should at anytime next week the $SPX take out todays lows then things ought to get interesting.

Here is a Navigational tool should that happen

http://www.flickr.com/photos/47091634@N04/46068…

Containment levels

yellow/dark purple: 1120's

light purple/blue: 1070's

burgundy: 1020's

white: 1010's

green (last containment pt.): 980's

http://www.flickr.com/photos/47091634@N04/46068…

Quick post before I hit the road for a few hours:

All the dancing this morning is because of Red Containment on the 120

http://www.flickr.com/photos/47091634@N04/46218…

The rogue bid in the market will disappear after consecutive 120 closes below Red containment.(10:30 cst, 12:30, 2:30)

Thank you! Then perhaps I can leave the house for a few hours 🙂 Does it need 3 consecutive closes or just 2?

consecutive meaning 2

(10:30 cst, 12:30, 2:30) are when the 120 prints

K! See ya later.

Someone on Kitco pointed out this USD print. I can't tell where it went, maybe you can investigate Red.

http://www.screencast.com/users/cojayhawk/folde…

Thanks Jayhawk…

I'll look into it.

wow the market is cratering and we didn't even have 2 consecutive 120 closes below containment.

What level is it that if we break it, there is a 50 point gap window to next support?

But at this rate, it looks like it could get to 993 in short order!

Hi – I re-posted Sundancer's containment lines below. Looks to me like next level of support is around 1076 or so. I put in a trigger at 1079 just in case. Perhaps tomorrow we get to the 1020s (that's the next level) but I don't want to take that risk with my May puts. I bought some more May puts this morning as well that I will cover at 1079. Keeping all the June ones.

PP 113.22

S1 111.22

S2 110.03

S3 108.03

thanks big bad., Do you know where 108.03 corresponds on the SPX? I have a order to buy some puts in at 1079. Sounds about right.

SPX

PP 1128.837

S1 1109.013

S2 1097.377

S3 1077.553

THANK YOU! I will leave my order in at 1079, so I catch it on the way down, rather than up.

still early but I am beginning to dought if we get there today…haven't hit S2 yet but anything can happen quickly…I like your idea to set the triggers…

we will get there at least.

SPX 18-May-10 End of Day Data

Open High Low Close

1,138.78 1,148.66 1,117.20 1,120.80

SPX 18-May-10 Pivot Points, Fib Pivots

R3 1,172.03 Fib R3 1,160.03

R2 1,160.35 Fib R2 1,148.39

R1 1,140.57 Fib R1 1,140.84

Pivot 1,128.89 Pivot 1,128.89

S1 1,109.11 Fib S1 1,116.93

S2 1,097.43 Fib S2 1,109.38

S3 1,077.65 Fib S3 1,097.74

And based on consecutive hourly closes, it should be 1:30EST when we crash.

I dont know about you guys but I think I took two red pills to many last night….My gut tells me somethings not right…anytime a government does something to try and fix something it causes more chaos down the road.. I got a bad feeling somethings going down over in la la land Germany..there cooking up something or they know something is coming and they did what they did to prevent chaos…ok let me find some blue pills now…

Careful bears

I can see a move up to 1120, and then back down she goes… The daily charts don't support any real up move coming yet. Still very bearish. I'd be care bulls…

http://stockcharts.com/def/servlet/Favorites.CS…

i'ts just that when Anna get's out of her shorts there's a good reason.

Why is so many people bullish here? The charts don't support it. The monthly, weekly, daily, 60 minute, and 15 minute charts are ALL bearish! Maybe for short term bounce, but when the 60 and 15 minute chart realign and point down again… we could have another flash crash!

Call me crazy, but the charts tell me that there is no way in hell we are going to rally up here. Look at the daily chart… both the 10ema and the 20ema have now crossed over the 50ema. That's very bearish!

That yellow downward sloping trendline (in the chart above) is going to hold the market back. It must gap open over it, before it can rally. That didn't happen today. I see a big sell off into the close.

Actually I'm not bullish just keeping my mind open for a bounce but I agree the momentum is to the down side and it seems that sell the rip is in

I'm in Reds camp on this one…5 time frames point down… down it is….we are struggling to get back to open…maybe we get to yesterdays close but then back down…picking a time…today, tomorrow, Monday, Friday, is voodoo to me…cant see the future…but the over all picture when backd by the many time frames tells me where we are going but not the time I arrive…

guys where we are at 12:30 cst is all that is important. otherwise don't read into the moves.

i would short more here if i could.

We will probably be testing 200dma again. Third should be the charm, at 2:30 cst.

What are your thoughts on adding to positions at this point? Bounced off 1102 and need to break it to continue the slide I would think.

15 minute on vxx is rolling over a bit.

S$P macd 15 crossed but rsi still down???

listen to sundancer. see if we are below red containment at 12:30cst and if so, add to shorts.

how do you read his containment chart…. what is 120?

i don't understand what 120 is… could you explain some about it?

I am just listening to him so I don't understand it fully (trying to get there). 120 means two 60 minute blocks. So we closed below the red containment at 10:30CST. Then we have to close below red containment again (consecutive 120 minutes closes) again at 12:30CST. We should know the outcome in a half an hour. If we close below that red containment level at 12:30CST, we take a plunge. If not, then I don't know!

and containment was what yesterdays close???

looks that way to me – see his chart below.

ok.. thanks. that helped a lot.

I think there will be a little rally here for an H&S, good time to buy.

Looks like a great short opportunity here to me.

where is containment? I forgot.

I believe yesterday's close. But don't kill me if I am wrong – I am trying to figure it out just like you guys!

trying to duplicate on my chart…cant see his numbers…

Yes, but I think it is yesterday's close because we closed at containment.

112.41

thanks a million.

Looks like the pop a hitting now. iam making a few small adds

K. You will be fine.

guys check out this brand new site:

elliott-wave-education.com

its loaded with free educational content and a “road map” going forward a few months. Its definitely a great resource to consult before adding any positions.

This market is just stair-stepping itself lower now, which is what it did yesterday after a high was put in. The 60 minute and 15 minute charts are point up now, which is what's causing the backtest again, of the downward sloping trendline.

At some point later today, the 60 and 15 minute charts will re-align again, and point back down. When that happens, a 5 charts will once again be pointing down. Another thrust down is likely to happen then.

Thats quite a step. i held off on adds. Looks like a better opportunity coming

just make sure you do it before 12:30CST

where is the downsloping trendline?? we are going up

In the chart above on this post, I show that the market could bounce to 1130, and backtest the yellow trendline drawn in on the 15 minute chart above (and the 60 minute chart)

No red, it has to be below red containment (around 1120 – yesterday's close) in 1 minute for it to plunge. We are not getting back to 1130 – that bounce was this morning.

Ok, you're right… that was this mornings target. Things have changed since then. Looks like it's stopping right at the 1120 area now. Could be a wave 3 of 3 coming into the close?

YESSSSSSSSSSSSS!

Don't let me jinx myself again 🙂

since we were below (8 or so pts) below the containment point at 12:30 cst (yest close) then we are going down?

is this correct?

you'll have to ask sundancer but my guess from his info is today we get to 1077. Longer term (maybe even tomorrow?) 993.

Are you sure the containment is around 1120? me thinks its around 1112 ,maybe I am wrong..

nope i think you are right and i am wrong.

Two earlier prints today on the 1M for SPY at 112.60, last at 10:53 est.

Thank you!

I have it….dont know what it means cause open was 111.77 and high was 112.77…PP is 113.22 hmmm

Could just be prints for the way back up.

OK – maybe we are going there before we plunge.

since we had two hourly closes below containment, we are going lower, but maybe we have to hit Diablos' fake print first 112.60. Isn;t this fun?

lets see how long it takes to get through yesterdays close

well, I think we will get through it but because we had to 120 closes below containment we should plunge once we hit Diablos' number (just my interpretation).

that puts this mornings gap down filled if that means anything

IF today is like Feb 4th, I think get down to 1077 today and then down to 993 tomorrow morning before bouncing. Let me get the popcorn out!

we can go down now heavily, me thinks.

looking at the 5 min chart the ADX and DI crossed yesterday at 1pm -DI up and today at 1pm we crossed +DI up…so according to the rules in at 111.92 but ADX not moving so I think going down…

just thinking out loud

the s&p is going up because apparently the Euro is going up. Need that Euro to tank and the news ain't there.

forget the news – this is all manipulated.

here here Mon….they wouldn't lie to us…put that red pill down…

I think I have overdosed on red pills!

;-)…feeling good are we…

Hmmm – so far no good 🙂

Red – I guess you are right after all! Sorry!

I did say be careful bears

Nice call, Newbear. Credit where it's due 🙂

I posted we could see 1130 today… not sure if we get that high, but this is just a corrective wave up, before more selling.

Red- I guess it's 112.60. You were right!

you did give a heads up…on my 5min the ADX still not crossing the MA so still no energy in the up move…but that can change

you did – sorry newbear. But I think we get to diablos number and then bye bye.

4 trys to get back to yesterdays close and still hasn't made it I dont know…

I don't know either. I am staying short.

diablos fake print was hit at about 1:30pm est? on the spy 112.16

Markets are getting pushed really hard now. They are saving the day.

Diablos, do you know what the volume was on that fake print you saw?

497.6K

Thanks Big Bad. I think sundancer said that fake prints have to have volume of 111 but maybe that isn't always the case.

Markets in the same place before I hit the road!!

Dancing with Red Containment on the 120 continues……

http://www.flickr.com/photos/47091634@N04/46216…

As I said in my morning post, the rogue bid won't disappear until consecutive closes below red containment on the 120min.

Until then, don't wear yourself out watching every tick!!!!!!!!

sorry, I meant to call you sun, not red!

Red, I thought containment was yesterday's close and that we already had two 120 closes below it. Where is it? That means, we can't make the move down until tomorrow if the last 120 close was above containment since we don't have 2 120 closes left in the day..

different setups on different time frames

Daily containment setup

120 min containment setup

195 min setup

the above chart is 120min.

Sun

Flickr is telling me to hunt you down cause your pic is gone…

try again now

You definitely have a longer view than most of us, Sun. Seen some nice paper profits come and go the past few days.

The rally was a nice buying opportunity, though. I'm bristling with May puts again.

Thank goodness that friggin' TL finally broke!

Rip – we are lucky sun's giving us any information at all. It's our job to read between the lines and figure it out for ourselves. He said a while ago not to used leveraged instruments so the fact that we are time sensitive is our fault.

Oh, I am as grateful as can be for all of Sun's input. He is VERY generous to share, and I feel like I've learned a ton in the past couple of weeks. Just an observation that he is looking at a much bigger picture.

yes, he has more capital than us I think! Not trying to get on your case Rip- sorry.

You'll know you have conquered this Ritual when you can Catch a Big Wave and ride it all the way.

I use to try & push pennies together as a daytrader when I first started. It's the allure of instant gratification. Once you get past that, you can lengthen your time frame.

I have been more of a swing trader and have been superstitious about the market when it is at extremes, especially at the top. Not a day trader, though, except by accident. My usual holding period is a couple of weeks.

I have generally missed out on big moves like this, so it's quite an experience.

Guys – don't forget FOMC minutes come out now. Maybe that will be the catalyst.

my 5 min is rolling over…ADX still flat MACD about to roll

Sundancer we need you. Doesn't seem like anyone knows what your talking about

Ditto. i am not sure what he means either

can you clarify where is containment was the 120 (two 60's ) reached at 12:30cst?

http://www.flickr.com/photos/47091634@N04/46222…

THX

thank you for the post but there is no time or price. I assume this is the spy or esm.

it kinda looks like we are NOT below containment for two periods.

can you clarify. no one on this site knows except you.

thank you,

$SPX

correct, there is no consecutive 120 closes below RC.

the last candle on the chart started @ 12:30cst

This is a weird day. i thought the bulls were overpowering there for a bit.

should have bought a bit more.

To me it looks like 2 options for the close

close above 111.77(SPY currently has 4 consecutive lower closes than opens)

OR

Close near 110.34 which is the SPY crash gap that was left from 9.29.2008 weekly print

Thanks a lot Sun.

Thanks – do you make anything of that fake print diablos saw at 120.60? Since we didn't have 2 120 closes today below containment, I am think we go up to that level tomorrow morning before hitting those two consecutive closes below containment? If we close below containment, and open below containment tomorrow, does that count as two 120 closes below containment?

I see it too, we could go up there this afternoon if they plan to close the SPY above 111.77

alright.

oh yeah – last time we had so many consecutive closes lower than opens, the shit hit the fan the next day.

hello sun

where is that containment line so we all know. I assume its the bottom red line? what level is that. It's probobly the spy.

thank you

Ben – I think ashsail is right – about 1112. You have to read between the lines:) just don't worry – we may not go down in a straight line, but we will go down.

I started playing short positions last dec. .

until i see a good confirmed Stage 4 decline I will worry. Too many times i thought we were there and the bulls pulled a move.

what do you mean my stage 4 decline?

Stocks move in 4 phases.

1 Bottom consolidation

2 upward movement

3 top consolidation

4 decline movement.

Until upward trend is broken by all averages aligning downward and moving below trend line we are in consolidation.

On the 60 minute time frames we are in stage 4. in 15 minute we are either there or close.

Me to Jim but I believe this time is different. And if you wait to get confirmation, the big move will be over! You either have to believe one thing or another or stay out.

You are correct and iam in. I add very cautiously but am very short. Question will be whether to ride out a bounce or not.

In Dow Theory if we go below 10,221 there will be a crater.

we just dropped below red containment line on spy at 111.77. But NOT two consecutive 2hr (120) closes

thats right. at this point it cant happen until tomorrow.

$SPX 195 min

http://www.flickr.com/photos/47091634@N04/46223…

3rd reaction in 4TD's off the White ENV

seems like typically when that happens we get a bounce?

What does this mean? I can see the 3 touches maybe 4 off the white line

don't know what ENV means

is this bullish or bearish?

This looks scary, I am in cash now. Thanks Sun

Ashsail, why did you get in cash? To me it looks important that we close below containment and if not, big gap up tomorrow even if the downtrend continues.

Monica, I made a mistake on monday when I went long but couldnt watch the market yesterday until afternoon due to some meetings, and then I came out with a loss.

makes sense. I want to see if we close below 111.77. If not, I will have to close out my may puts. Will hang onto my june ones.

You're welcome, should we lose the White ENV, the Purple ENV is in the low 1070's

If I may ask, how is number 1 for (sun) and number 8 is related in Pi?

1 : One : Won

8 : Eight : Ate

The co-relational nature of the CON-struct

The 390 in my AVA-Tar is for 390 minutes of trading per Ritual period(market day)

9=6

390=360=Pi

Drop the placeholder off 390 & you have 39 which = 36

SUM 1:36 = 666

666/Pi=212

Interesting, thanks.

Last hour will be drama. Bulls may be bolstered by those week fed comments.

forget the news!!!!!!!!!!!!!!

I know. but something is giving the market a little back bone and it does not appear to be charts.

this would be the back bone you're looking for

http://www.flickr.com/photos/47091634@N04/46223…

Sundancer,

I am unfamiliar with these charts so I presume the bouncing off the white line is the spine referred to. What are these lines representing?

Thanks for your assist.

Jim Hobson

the lines on my 195 min chart are ENV (envelopes)

Looks to me that if we don't close below containment, there will be a big bounce tomorrow but that is just my interpretation.