Not Expecting Much Until Next Year!

While the market is still overbought, the gangsters at the Federal Reserve aren't going to let it correct naturally, but instead will likely just keep it range bound for the rest of this year. Then sometime in January I believe they will push it up to our DIA FP to squeeze out the last bear.

Of course those of you who have been following this blog for awhile have known about that print for many months now, and will likely get short with me and many other bears when it finally hits. I think that we'll sell off a little before the year is over, as even though we are only about 400 Dow points away now some small profit taking over the next few weeks will likely back the market down a little bit.

I still see a retest of that 1200 level, and possibly the 1173 level (on the spx). Then back up a little to finish the year off. These next few weeks are likely to be very boring, with low volume days ruling the market. Any selling will be done by the big institutions as they slowly unload their shares at the top to us unknowing sheep.

They can't do it all in one day, so it has to be done slowly. They need the market to stay up around the currently levels to rob the most sheep (err... make the most profit). This area is the "unloading zone" I believe. A range bound market is likely to continue until the year is over.

Then, when all the bears see all this chopping action as weakness, they all pile on short. This will be the fuel needed for one last short squeeze up to our FP on the DIA. At that point, I expect the market to roll over for good. The first move down should trick all the bulls (and broke bears) into the same old thinking "buy the dip". While I'm sure there will be a bounce from the first move down, it won't be to new highs.

The gangsters know this and will simply start releasing news events, (or a false flag event), that will start the panic back up again... hence the selling pressure will grow. This all leads me to believe that WikiLeaks will release their "dirty bank secrets" information right about when the DIA FP is hit.

Coincidence or Planned Timing?

I can't answer that, but my gut tells me that "they" are using and controlling Julian Assange some how. The question is... Is Assange part of the Illuminati, who plan to crash the market? Or is Assange a good guy that was just conveniently feed those secret documents by the Illuminati to be used as "the reason" for the coming disaster?

Either way, Assange and WikiLeaks will likely be the blame. He will be the pasty or scapegoat for next years' major downturn, just like Bernie Maddoff was a few years back. The difference was that Maddoff was part of the Illuminati and an actual "bad guy". But, they had to sacrifice someone, and it was just Bernie's bad luck I guess?

(to watch on youtube: http://www.youtube.com/watch?v=O_9d4_lEFKM)

As for Assange, my heart wants to believe he's a "good guy" that is just being used by the Illuminati, and not one of them. But, I really don't know either way? While there is plenty of evidence on the internet that Glen Beck works for them, and is on the air to spread dis-information to confuse us sheep, there isn't any reason to believe that about Assange right now.

Alex Jones is also one that my heart wants to believe in, but the fact that they haven't shut him down tells me that "they" are likely using him to spread more lies and dis-information like they do with Glen Beck. However, I think Alex is a "good guy" that's just being used, while Glen Beck is a "bad guy" who's doing as he's instructed to do by his masters.

What does it all mean?

Simple really... life is complicated! Isn't that an oxymoron? LOL... Yes it is, but it's the only real truth I can see right now. There are "gray area's" in life, not just black and white, or good guys and bad guys. Sorry, that only for when you are a kid I believe.

While most of the Illuminati are bad guys (especially the high ranking ones), I believe there are also good guys inside there organization too. They sometimes try to help others out, as maybe they don't believe in what they are doing is right, but were born into the gang. So, they secretly do what they can to inform us sheep of what the gang is all about.

Of course if they are caught, they will be punished but it's worth it too them I believe, as it clears there "bad karma" somewhat so that they can move on to the next life with an important lesson learned. Hopefully they will do the "right thing" the next time around.

Some of you on this blog might be one of those people, and some how you wish you weren't born into the gang, so you tell others about what's really going on. It's good to know that you are finally coming to your senses and realizing that evil isn't the right way to live. I wish you well in your current life and hope you are a good guy in the next one.

Back to Assange...

Since Wikileaks is getting so much attention by mainstream news media, it is my opinion that it is now (or always has been?) part of the planned coming debasement of the market next year. Since I don't know whether or not Assange is a "good guy" being used, or a "bad guy" playing a role, I'm going to go with my heart and simply say that what he's doing right now makes him a hero in my book.

So, part of the plan or just being used, it really doesn't matter. We live in the gray zone anyway, where good guys do bad things sometimes, and bad guys do good things. The days of the Lone Ranger are best left for TV Land. The world we exist in is more like Star Wars, where Darth Vader was good once and became bad. So, was Assange bad once and now good? Who knows? But for now... he's doing the right thing.

Moving on to the short term market...

Not that odds have ever favored the bear successfully, but I do expect a pullback to at least 1200 spx, if not 1173 this week or next. Odds say (I'd state that the "charts say", but they seem to be worthless right now), that Monday should be a down day, and possibly Tuesday to?

But, this is option expiration week also. So you can expect some wild swings to shake out the bulls and squeeze the bears to happen before the final close on Friday. Remember, the gangsters don't want to have too pay out any money to the option holders... both calls and puts.

That means they should take it down briefly to get the calls to panic and close out their positions for a loss, and sucker in some bears to buy some puts thinking the market is going to have a deeper correction. I'd say the bottom is 1173 area, with maybe a brief intraday dip lower to scare the bulls and tease the bears... but a move back up before Friday is expected.

They will pin the SPY where is makes the most puts and calls expire worthless. Is it fair or right to do such a thing? Of course not... it's crooked and manipulated! But what do you expect when you are playing a game of cards with gangsters?

The bottom line here is simple... I'm not expecting too much to happen between now and the end of the year. Just a lot of chop in a range bound market. I'll likely be on the sidelines waiting for January to come... and our DIA FP of course! Let's see if it plays out this time, or if I've exposed it too much and the plans have changed now. I think it will still hit and reverse, but I'll be keeping my eyes open for new prints too... and you should also do the same.

Good luck everyone...

Red

Just came about your site and read your previous blog post. Had a few questions.

1. What is a FP or print?

2. Been reading a # of analysts predictions for 2011 (weiss, prechter, rogers, schiff, faber etc)…..was wondering if you plan to do something like this including update to the potential “depression”. General view of what 2011 can bring.

Definitely enjoy the read …thanks.

FP is short for “Fake Print”. It a print on the market that is put up ahead of the market actually hitting that level. Like the first FP I seen back in January, and 3 weeks later the market hit that level and quickly reversed for the next 3-4 months.

The Illuminati control the stock market. They tell their buddies where they plan to take the market with these FP’s. While I haven’t figured out the timing of “when” the prints will be hit… they “will” be hit at some point.

So, I just use them for future guidence when the market is finally headed in that direction. I then know ahead of time of the price level that the market will hit and reverse from, or simply pause at. Either way, you would exit your position once the print is hit.

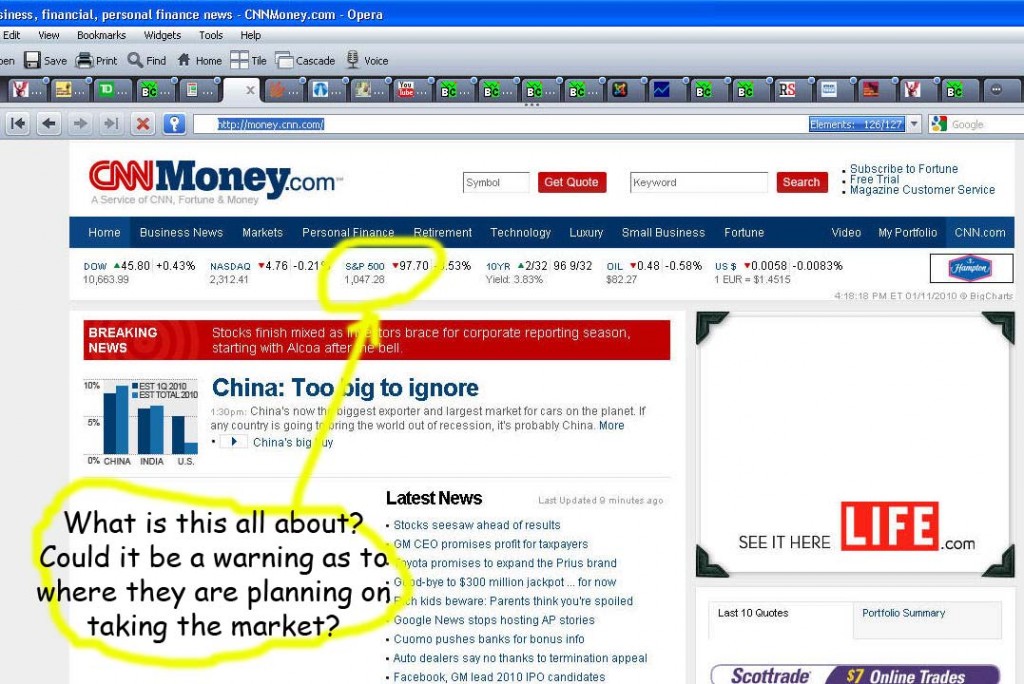

This print is my first one…

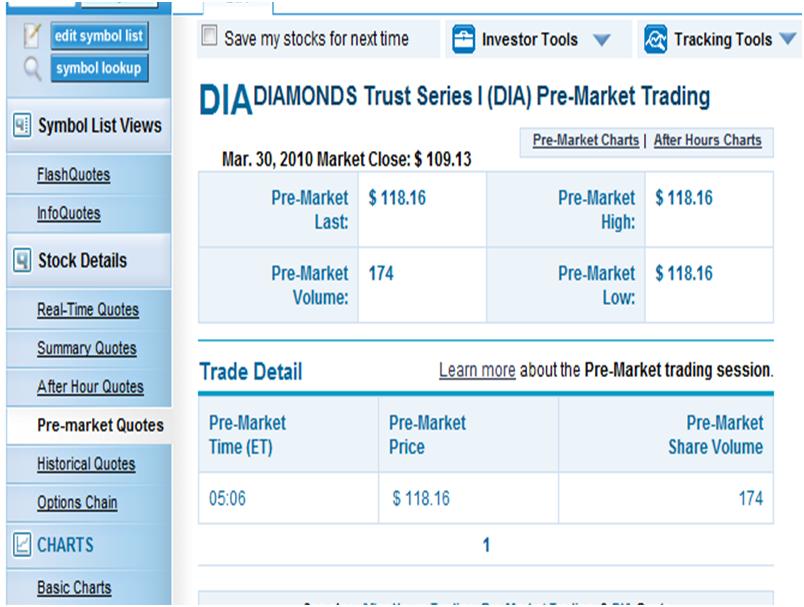

Then 3 weeks later the market dropped to an intraday low of 1044.50 spx, and then reversed back up for the next 3 months. I believe that the FP I got back in May of DIA 118.16 will be our final top in the market, which will then be followed by a crash.

This is that print. It’s about Dow 11,800 and SPX 1260-1280 (estimated)…

Watch some of my old video’s on my Youtube channel (or just read the old posts) to learn more about FP’s.

Hope that helps…

Red

My model says Tuesday will be the top for the stock market indexes and then a correction will begin on Wednesday. The current buy/sell volume matrix is identical to that of April. The April pattern was 5 phases( 1, 2, 3,13, 5 days) lasting 24 days beginning March 18th with the market topping April 23. The current pattern started November 8th with the identical 5 phases and sequence (1, 2, 3, 13, 3 days). So we now have 2 days remaining to complete the current pattern (December 14th). Trade what you see and not what you feel so I will begin shorting Tuesday. Wish me luck!

Well if we hit that DIA Tuesday, then you can bet I’ll be 100% short at that point. For now, I trade lightly.

Red,

Now that we are getting closer, I think the DIA FP will hit closer to the 1280 mark. Last check here DIA is at 14.96 (2.8% away from 118.16). Add 2.8% from here as of this writing (SPX 1246) we have 1280, so your estimates are pretty close. Considering I’m a bear (and positioned as such), is it bad that I’m cheering for the market to go up? What’s wrong with that picture? I just want to get this FP out of the way so we bears can finally start making money. Remember, Dec 21st is lunar eclipse and Wall St. comes out on DVD. Doesn’t have to be crash after that, maybe just a top?

Exactly! I agree that it doesn’t have to crash after hitting the print, but it should be the final top. Then a little selling into the end of the year, with a small rally back up in January (but not exceeding the DIA print), and then a big wave 3 down about mid-January. Sounds good too me… now let’s see if it plays out?

Yeah… I need to do another GD2 video. Maybe I’ll do that around Christmas when I have some time off? Thanks for reminding me of that.

On the SPY chart, or any stock for that matter…When its trend is headed for the clouds, and you get a Huge black Candle…See the SPY chart, last week, those huge black candles, should be treated as fake prints…Only these fake prints, are short time frames, and fairly consistently make a new higher high. ( it most definitely fits in with an Illuminati signal, category. )

While I understand where you are going with this, I don’t consider them FP’s. The market actually traded at those levels on that day with many different trades executed.

Most FP’s only have a brief, one trade executed, volume spike higher or lower. Some FP’s are so quick that you don’t see any volume or trades tied to the print.

But either way, the FP’s that I consider fake, are split second trades that spend less then one minute at that level. That black candle you are talking about doesn’t count in my book.

However, it’s still an important indicator to watch. The top is just about 400 Dow points away I believe. Again, I doubt that we will hit it this year, but we will in January I believe… and then the real fun begins.

I’m expecting a pullback, before the potential 11,800—GOOG and AAPL, look like they are stuck in a $20 narrow price channel…INTC crapped, CSCO going nowhere…etc…

December 11 was the 23rd anniversary of the release of the original Wall Street. The final ritualistic piece?? Merriman writes that Mars is translating the Cardinal Climax T Square from July August earlier this year from December 7 on though he doesn’t seem to indicate it’s a big deal. Some other interesting astro struff I have discovered. And saw the Tourist and it is centered around a mysterious Madoff like figure. Interesting that it is released 2 years from the Madoff revelations. It has some interesting numbers also. Maybe a more comprehensive post tomorrow.

Watch the Japanese yen. Once it breaks its lows from the past few weeks, the panic is on. The yen has been the funding currency for all of these speculative trades. Euro is nearing its multi-week bottom in the overnight session.

http://oahutrading.blogspot.com/2010/12/fear-factor_12.html

S&P 500 Futures chart

http://niftychartsandpatterns.blogspot.com/2010/12/s-500-futures-before-opening-bell_13.html

It’s only rare when the markets are trading normally. With Bernankes’ POMO money the impossible is possible…. LOL

At the rate the market moving up we’ll hit the DIA print within a couple more days. This is unexpected, as I don’t see them tanking the market before Christmas.

Maybe we hit the print and only sell off 50 points or so by the end of the year? Nothing major to scare the bulls out the market. These gangsters sure like to surprise everyone, that’s for sure.

I just hope it’s not caused by another False Flag event. Just let it be Wikileaks releasing dirt on JPM and GS… that’ll tank the market.

Hey Red, I still watch your videos nearly religiously…thanks for all the effort you put in them. I feel for you and others that are short because it’s so obviously the thing to do for “us in the know” about what is really going on. I just want to know how high will the market have to go before you get squeezed out of your position.

Remember the old adage, and I can’t remember the exact quote, that the market can move against you longer than you can stay liquid…..just curious what your stop is

Thanks Zen…

It was a really small position that expires this Friday. It’s worthless now, so I’ll just let it ride in case a big drop does happen. From the looks of things, they could go up to the DIA by this Friday.

If so, then I’d expect something to happen over the weekend trapping all the bulls, and catching the bears off guard. When that print hits, I’ll be going short again. Until then, I’m trading very lightly.

shorting here!!!!!

Just remember to keep a tight stop. We still have extremely light volume and that usually favors the bulls. If we don’t pullback soon, we could see that DIA print within a few days… maybe by Friday?

i got money!!! if goes higher i will reshort. light volume on way up

That’s good. Then you are just inching your way in slowly. Smart move I believe.

its gonna be too late short later!!! i remember i tried short FAS at 105 there was no shares available !!! just like shorting FAZ at 13 there was none

VXX is green today, but so is the market and so is Spy. But VIX is down?

Can anyone shed some inisght on why VXX is going up?

VIX and VXX is not the same!!!! VXX is ” short term VIX” VXX can make you fortune in 3 min but it can take it all in 2 weeks!! to trade VXX you need panic on stock market

NFLX falling pretty hard.

I tried to tell investors, don’t go long NFLX..as the news is bad..ATT wants them to pay for their broadband, hearing going to Congress, maybe.

I see major flaws in the pricing. First off it is facing competition between AMZN, HULU and BlockBuster. It only has rights to New Releases 28 days after BlockBuster (you’ve seen these commercials).

It only has 150 million in revenue. It will have to pay ALOT more than 25 million to keep it’s deal with Starz. NFLX is trading at 74 times it’s earnings.

If it trades below 180, I think all hell is going to break loose. The faster they rise the harder they fall.

NFLX revenue’s been going up nearly around a Billion a year..

http://finance.yahoo.com/q/ae?s=nflx

Anyway, I’ll raise (poker term) your under 180, that’s more than likely to happen, but where’s the next support 150-170?

It’s about 2 Billion in Sales. But they only net 144.67 million in Income.

According to MSN the first support is 172.18 (50 Day MA)

124.65 (200 Day MA) and 209.24 52 Week High.

That’s a pretty big move down and a nice profitable put option. I’m not sure how fast this is going to go down but, “the shit will hit the fan sometime in 2011”.

For NFLX to hold this price is impossible. There is just no logical way it can sustain itself.

Keep your eyes on WYNN and OPEN (they are also overpriced).

WYNN has insider selling of 2,000,000 shares recently.

I’ve been in and out of WYNN shorts…past couple of weeks…w/great success! I’ll check out OPEN! thanks!

Wow, EUR up 2c on USD…I guess $7 bil in illegal manipulation is not enough to for both forex and the S&P…need to ramp up the money printing!

Hi Red…Do you still follow that crazy ass benjamin on http://benjaminfulford.blog.shinobi.jp/? That guys head is not screwed on right. Not only that but he hasn’t posted anything in almost 2 months.

http://benjaminfulford.net/

I’m 30% LONG and 70% short, ahead of down Tuesdays….

Not a bad day overall. Picked up some packaging stocks today. Retail sales and Fedex should propel this sector……..

There was a 24 (888) trading day cycle on Friday (in existence since the August lows) and it looks like we had the turn today. It looks like the tax bill passed the Senate. Now time for a sell on the news event. Or does it wait for final passage by the House later in the week. Tomorrow is a very important astro date plus 77 (14). And the Tourist numbers point to tomorrow as an important day. Small change reading in $nymo (which has never exceeded Dec. 7 highs). 10 day average of ISEE (probably every subindex now) higher than at the April highs. $trin again was low and 5day 10day averages are even more extreme.

This is getting ready to break out…

TSL chart http://zstock7.com/?p=3824

How can you tell something more sinister isn’t going on – that’s an ADR right?

Hi ACP,

Is this a gut feeling you have?

Have you traded this stock in the past?

Is there some news on it, I may not be aware of?

Is something in general, wrong with the sector?

Is there anything in the Technical Analysis, I may have overlooked?

I’m just a beginner technician, so I wouldn’t know if you did miss something. An article came to mind when I read your blurb – not saying this is one, but that just came to mind.

http://www.zerohedge.com/article/more-chinese-fraud-kerrisdale-claims-china-education-alliance-nyseceu-mostly-hoax-stock-monk

I’m sure China will be able keep the music going longer than the US ever could, but it’s just sketchy. That’s one reason I started looking into technicals more seriously, after realizing it can be an accurate representation of human behavior, instead of just “reading charts”.

Hey ACP, there’s always something wrong with China! Don’t trust em!

Looks like a possible rectangle pattern. If so, there should be another touch near 22.0

Hi D,

I think you and I must have bought the same book, because we are most definitely on the same page!

Hi D,

I think you and I must have bought the same book, because we are most definitely on the same page!

Red…thanks for the link to benjamin’s blog. I see that he is now charging to read his crazy stories. What is even worse is that it appears that people are actually paying to read that crazy blog. What a strange world we live in.

Ben has always been charging for his stuff… but I just found a website that was publishing it for free. Apparently, Ben must have found it too? LOL

ES Chart

http://niftychartsandpatterns.blogspot.com/2010/12/s-500-futures-before-opening-bell_14.html

Unbelievable… that’s all I can say!

Its raining money

I imagine Ron Walker (the chart pattern guy) is extremely frustrated right now, as the charts are about worthless. I like him better now that he’s seen the “red pill”, as he used too be a “blue pill” taker only.

But watching his video’s now he seem a little bit pissed off about what the gangsters are doing. LOL! Of course I just did see the “red pill”, I quickly swallowed it… so I’ve always been angry at the thugs.

I’m glad to see everyone else now waking up now. Since the charts aren’t working right now, let’s see if the FP’s do? I’m still waiting for the DIA to hit 118.16 and then the selling to start.

And, from the looks of the B.S. going on right now with the market, we could hit that print by the end of the week… as it doesn’t look like they want to even pullback again right now.

Too bad Ron doesn’t follow FP’s, as I do believe this one is going to be extremely accurate. I’m just sitting on the sidelines until then…

(sorry I had to edit that, as I can’t type too well with some coffee in me. Refresh page for corrections).

So Jim, is it snowing up there where you are? It’s 39 degrees here in Jacksonville Florida. And the way the wind blows off the ocean (I’m about a mile away), it just cuts right through you.

We have had a lot of snow but the last few days we are in a Dec thaw with highs yesterday at 38. snow pack in mountains is at about 138% of normal and skiing has been great. back country is much safer than last year with base layers bonding well.

I miss the country sometimes, as that’s where I grew up. It’s a great place to retire and live peacefully without too much to worry about. I’ll probably move back when I’m older and retired, but for now I still like it here in Florida.

You can have that summer heat and humidity. i experienced that all I needed to when in the military. nothing worse than Ft Benning in July and August or Iraq any time

Well definitely the charts are nearly useless

If there is one thing I’ve learned… the gangsters like to trick you. They will let the charts work naturally for days and weeks sometimes, then just when a big move looks ready to happen… Bam! …they go against the charts and fool everyone. It’s pure 100% manipulation!

Hey red, do you know ron walker personally and do you know what got him to start seeing things for what they are? I used to follow him but haven’t in awhile. Maybe I’ll check him out.

No, I don’t know him personally. I like his charting skills and do use his charts and Cobra’s in my video’s (hope he doesn’t mind?). I know that a year ago when I would watch his video’s, he was very much a “blue pill taker”, and believed that Obama, Bernanke and Geithner were doing what they could to help jump start the economy.

But I guess he’s seen the light lately and at least nibbled a little on the red pill. He’s a smart guy, and is finally starting to see the corruption in the system. You can tell by listening to his tone of voice now that he’s frustrated with the gangsters.

His charts (and everyone’s) has been worthless lately, as the thugs manipulate the market higher, day by day. This really upsets chartists and EW guys, as nothing seems to work the way it should.

This couldn’t have happened in the Great Depression One, as we were still on the gold standard and couldn’t print a trillion dollars at will… like we can now. The next depression (starting next year) is going to end a whole lot worst I believe.

You and your readers may like the information (as it talks about the coming economic collapse) presented inside this video. http://tradewithzen.com

It’s hard to trade off the charts when the market is so artificial. Patterns and rhythms don’t work like they do in nature when unnatural forces change things.

Hey Red,

Have been reading your blog for a while and you keep mentioning this fp on the dia 118.16. Why do you think this one is so important? I mean there are fps weekly, but whats different with this one? And when did it show up?

I do agree we may see 118 onthe dia being reached before we get a more significant correction.

It’s important because of where the market was when I got it, plus the ritual side of the FP is clearly shown in the numbers. It’s also a FP that showed up at the end of the day, not an “intraday” one… which usually are close to the actual trading range that day, and play out within a one to two days.

This print is as important as the first FP I seen back in January of this year. It played out the next 3 weeks, while this one has taken months to creep up close to it. My only concern is that I may have exposed it too much (to the sheep they plan to rob), and that they may change the plan?

Well yea, that could be… However, they dont seem like they change plans. They are just too organized and too precise. Think of all these hollywood hidden messages way before 911. If we would not have been sleeping we could have stopped it. I think thats more kind of the message. Something like; we told you!

I do not believe that some people knowing that the stockmarket might crash will held them from doing it. Think of Reinhardt who predicted the september 15 market crash in april of 2008 already. There were people who knew about this. Many people are just too sober and will not ever believe they are being fooled.

By the way, could you show me the FP?

SPY CHART

http://niftychartsandpatterns.blogspot.com/2010/12/spy-hour-chart-with-ichimoku-cloud.html

keeping my short in FAS

Good Luck Darek… I think we are close now.

i dont care i got money to reshort if goes higher!!!!

With rates like these, shorting any hedge fund with a half-life will be a good move.

http://cobrasmarketview.blogspot.com/2010/12/12132010-market-recap-not-as-strong-as.html

no PULLBACK only bonus $$ mln

I think it’s pretty apparent now that they aren’t going to pullback any until they decide to tank it.

Bets anyone? Up 900 Dow points by EOD?

LOL… not 900, but 300 is possible.

Or maybe just sell into it and do it all again tomorrow…nice pump day for no POMO…like that video said, just buy the F’ing dip!!!

I’d say this will be a flat week like last month’s OPX and then the Xmas rally next week. Monday Bernanke is pulling a DP (dual POMO, not what you were thinking) and blast off! The sky’s the limit!

LOL… you never know about that? Maybe Obama, Geithner, and Bernanke are all into each other?… ROFLMAO!

Bets anyone? Up 900 Dow points by EOD?

They’re really trying to crush the dollar ahead of the minutes.

Silver look bearish for now. It needs direction so I am staying on the sidelines. I’m not convinced FSLR is bullish. I’m guessing it will close negative in after hours with $120-$130 near term price target.

Since Friday I am short on FSLR, STEC and NFLX.

OPEN tanked today..good call..added VMC to my next to tank stocks, list.

Do you know where to get free or low-cost price information on stocks in the major exchanges? Like bulk data for analysis purposes?

Off with Their Heads 2.0:

http://app.bronto.com/public/?q=preview_message&fn=Link&t=1&ssid=12927&id=80g90ceju8sb45uewhwb60xv0tz2l&id2=057mb29kzhiwj9bqijxfx8tfesgey&subscriber_id=caqzepfqehksqhziiycfudnqlulibdf&messageversion_id=bdawwkdkzieudhswfbzphgqmgftlbbi&delivery_id=bymuhfkddlkxpynwlejanbzazvqebnb&tid=3.Mn8.Bl71JQ.CBDv.JB95..L6gR.b..s.ARmN.a.TQfk_A.TQgZuA.y5KYaw

red,

for what it is worth….today another hindenberg omen was triggered….

do you think this time it will follow through and we get a crash??

Interesting Richie…

I don’t know if that “hindenberg omen” will be accurate this time or not, but I do know that I’ll be diving in short with both feet when we hit the DIA FP.

Interesting Richie…

I don’t know if that “hindenberg omen” will be accurate this time or not, but I do know that I’ll be diving in short with both feet when we hit the DIA FP.

BBY lowered its guidance…to practically no growth…ahead of xmas, bs…earnings report…

Seasonals bullish next 2 days. Small caps will outperform…………….

I dunno, It’s not looking very bullish to me.

Bullish, bearish, does it really matter? It’ll be right back where it started during OPX week. The PDs don’t want to lose any of their hard-stolen money, do they?

JP Morgan Covering Silver Short Position:

http://www.inflation.us/jpmorgancoveringsilver.html

my short FAS looking great!!!! waiting Ffor SPX 1210

Smart move on shorting FAS, instead of going long FAZ.

i got some longs in FAZ but shorting FAS at 27 is better move!!!!

Since both FAS and FAZ are designed to slowly lose value over time, it’s always best to short them as opposed to going long.

true but there is no free money on Wall Street!!! you can get hurt shorting if you on wrong side of the trend

Remember when those banks were crashing and FAZ was worth $1,000+ Happy Days for investors.

I sold my FAZ at $12.43 but like I tell my dad you gotta keep that in your portfolio as a hedge in case of the worst case scenario.

Red,

Big picture question here – bear with me here: We all know about the DIA 118.16 print as a potential turning point. You also have the DJI ~8300 .

.

Beyond that, I believe you have a SPY print in the 20’s and to the upside we have QID of 4.96 .

.

So we have one that is waaaay down and one that is waaay up. Of course we have no idea when these could be hit. Either could be many years. My expectation is we hit the DIA 118.16 and then move down to the DJI 8300. If my intrepretation is correct, I believe that is way you are leaning also. My question is: Do you have any FP’s below the 8300 that would indicate if long term trend is SPY 20’s before QID 4.96? It’s probably an impossible question to answer, but I’m just looking for other opinions. With the VIX print in the 300’s (that’s just crazy scary – let’s hope this doesn’t play out) and gold print in the 3500 range, I see us hitting the SPY 20’s first and then hyperinflation hits after several years of some level of deflation. Thoughts?

Yes Johnny, I agree. I do think we will hit the DIA print first, and then head down to the 8300 print. That VIX print and gold print will probably be more of a longer term out, as in several years I believe.

The VIX in the 300’s would match up with some type of false flag event. The SPY at 20.16 should be the finally bottom before a massive rally with hyperinflation.

The gold print should happen with the rally, as I expect the big hedge funds to dump gold to pay margin calls when the crash begins. While on one hand gold will be bought as fear rises, it will also be sold too. In the past, gold has went down with the stock market during crashes. I believe the same will happen this time around.

Thanks Red. This is sort of how I think it will play out. If the TPTB take the market down first to the 20.16 and then create hyperinflation, they can make alot of money that way. They could scoop up all assets at rock bottom prices ($.10 on the dollar) and then have significant inflation (Weimer inflation would probably hurt them and the Fed, so I personally think it will fall short of hyperinflation) to make their assest worth much more and block the common man from being able to buy anything.

ES Before opening bell

http://niftychartsandpatterns.blogspot.com/2010/12/s-500-futures-before-opening-bell_15.html

Red only UP JP, GS = SP500 1275/1280 end 2010 🙂

China’s 7-day repo rate is highest since the Lehman collapse and Europe is getting worse, so what does the US market do?

RALLY! RALLY! RALLY! Hellz yeah ain’t goin’ stop no POMO!

my short FAS looks great

SPX Hour chart analysis

http://niftychartsandpatterns.blogspot.com/2010/12/s-500-hour-chart-analysis.html

still short this pig market

haha UP UP and of day

Hi Red!

I have those exactly 50/50 signals on the major indexes, and Financials..Thursday or Friday, the market either gaps higher, or goes 1 to 2 % lower.

When Silver is tanking the market is not far behind.

When Silver is tanking the market is not far behind.

I can’t believe FSLR was up to $143.00 in after hours yesterday then down to $135.10 today.

Do you see the the manipulation? Up again $2.66 in after hours.

It’s probably Soros crashing the stock then buying back at the bottom.

I can’t believe FSLR was up to $143.00 in after hours yesterday then down to $135.10 today.

Do you see the the manipulation? Up again $2.66 in after hours.

It’s probably Soros crashing the stock then buying back at the bottom.

FSLR headed to 143–sort of like a fake print, is my gut feeling. TSL will propel that sector higher….TSL is getting ready to break out.

Aren’t all solar panels made out of Cadmium telluride? Which is both toxic and extremely rare.

A problem I see with this sector is the government subsidies. It seems like many countries are trying to cut back on spending. Germany leads the way in solar power meeting 1.1% of Germany’s power demand. Projected to be 25% by 2050.

That’s a huge increase, however there is also a lot of uncertainty;

It may or may not be a “sure shot” investment.

FSLR headed to 143–sort of like a fake print, is my gut feeling. TSL will propel that sector higher….TSL is getting ready to break out.

$nymo should hit -100 today. Yen making an intraday new low today with gold dropping below its 10 day average. Yesterday had the perfect astrological formation for the start of a meltdown. Now we have to wait for the doofi in the House to pass the tax bill because it is the final piece and those doofi are waiting for the proper astro ritual. Another new ritual: Facebook clown named Time’s Person of the Year….this just guarantees a tech meltdown. Back in 1999, Bezos was named Time’s person of the year and almost immediately Amazon’s stock tanked while the Nasdaq’s orthodox high was put in early January.

$nymo ended at -68……Today is 66 days from 10-10-10 and yesterday was 56days (+23years from 10-19-87) so tomorrow is 58days from the date. We were at 518tds from Nov 2008 lows and 448tds from 3-6-9 lows either yesterday or today (can’t remember—-a raven flies above James Franco in 127hours at 8:15 every morning except for the final day—tomorrow 12-16 could be interpreted to be 12-7 although $nymo really isn’t low enough for anything catastrophich except for an initiation thrust). Just dug up some more interesting astro info since Mars and one of the lunar nodes is in a similar position to 9-11 although they were both closer a few days ago but the trickster Mercury in retrograde will cross over caput draconis tomorrow(Mercury and Mars are apparently buddies). All the while a lunar eclipse approaches…….Tax bill goes to the House tomorrow. Hopefully, they vote on it before the market open……….

Drys bounced off 10dma. Seeing some buying in AH. Possible nice upside tomorrow…………

S&P 500 Analysis after closing bell

http://niftychartsandpatterns.blogspot.com/2010/12/s-500-analysis-after-closing-bell_16.html

Traderbean, thinks it’s time to buy some VIX…

http://traderbean.blogspot.com/2010/12/volatility.html

5 star trader…

VIX jan 19 calls, the price channel looks stable enough–I might get those, just in case we’ve topped out.

New post…

I am bookmarking this post which us more update & insist me to visit here frequently for daily updates…