Wednesday Update...

(to watch on youtube: http://www.youtube.com/watch?v=3jKRnlauYLU)

Red

_____________________________________________________

Next Week I Fully Expect The Stock Market To Collapse...

DOUBLE RED ALERT... The Time Is Here!

(to watch on youtube: http://www.youtube.com/watch?v=1smsbiudMTc)

Every clue the Illuminati Gangsters have given us, plus what's showing up in the charts from a technical analysis point of view, and elliottwave patterns, tells me that the odds of a stock market crash this coming week are huge. The FP that I got a week or so back on the SPY showing a low of 119.00 could mean that is the date... as in "November 9th, 2011", and reversed it could mean "911". Of all the FP's I seen over the last 2 years none of them ended with no change on the end. That is strange too me, as I usually get them like DIA 118.16, SPX 1047.28, 34.65 spy, 20.16 spy, 349.42 vix, etc...

This means too me that it "could" be a sign as to what's coming, not an actual target for the spy. This also could line up with the interpretation of the Simpson Clock showing the nuclear explosion. The long hand points to 11 and the short hand points to 6, which could mean 11-6-11 or 11-9-11 if you turn the 6 upside down to make a 9 out of it. So what are the gangsters saying here? Do they plan to blow up a city with a nuclear bomb on the 9th or the 6th? Remember that according to Ben Fulford the gangsters stole 4 nuclear bombs from a Russia submarine, which one was used to attack Japan with while 2 more were recovered by good forces in the Pentagon. This leaves 1 unaccounted for nuclear bomb that the evil cabal have.

This means too me that it "could" be a sign as to what's coming, not an actual target for the spy. This also could line up with the interpretation of the Simpson Clock showing the nuclear explosion. The long hand points to 11 and the short hand points to 6, which could mean 11-6-11 or 11-9-11 if you turn the 6 upside down to make a 9 out of it. So what are the gangsters saying here? Do they plan to blow up a city with a nuclear bomb on the 9th or the 6th? Remember that according to Ben Fulford the gangsters stole 4 nuclear bombs from a Russia submarine, which one was used to attack Japan with while 2 more were recovered by good forces in the Pentagon. This leaves 1 unaccounted for nuclear bomb that the evil cabal have.

Does this mean that they will "try" to set it off on the 9th next week? I certainly hope I'm wrong on this and they don't succeed in killing thousands of innocent people in some city in the world. According to many people who have had contact in some form or manner with the good aliens that are helping to free humanity and rid us of the evil Illuminati cabal gangsters, they will not allow another nuclear explosion to take place in another staged 911 type event. Let's pray they succeed as these gangsters are pure evil and very sneaky... meaning that they could slip one past the good aliens and set the bomb off anyway?

Margin Calls Coming Next Week As Foretold To Us In The Margin Call Movie...

A recent development is that the gangsters have now put out a new memo that they are going to raise the margin call requirements for "Everything", and it's to be in effects as of last Friday after the close (figures that they release this information when no one is short). This could easily cause a gap down on Monday as traders are force to come up with money they don't have to meet these new rules put in place by the CME (http://www.zerohedge.com/news/cme-goes-margin-defcon-1-makes-maintenance-margin-equal-initial-everything).

A recent development is that the gangsters have now put out a new memo that they are going to raise the margin call requirements for "Everything", and it's to be in effects as of last Friday after the close (figures that they release this information when no one is short). This could easily cause a gap down on Monday as traders are force to come up with money they don't have to meet these new rules put in place by the CME (http://www.zerohedge.com/news/cme-goes-margin-defcon-1-makes-maintenance-margin-equal-initial-everything).

Of course this means that they plan to crash the stock market, but they want traders to be covered before they do. That way they can steal their money when the margin calls come in... and they will come in! This means Monday could be a very ugly day. I'm not sure about it yet as I don't know how the first reactions to this new information will actually affect the open on Monday, but I can't see it as being bullish... that's for sure! I guess we'll find out Sunday night when the futures open.

Regardless of what happens on Monday, it's the rest of the week that I'm worried about... especially the 9th, and the 11th! Could they really be planning to stage another "False Flag" event on the 9th with a nuclear bomb going off some where? Then they would of course blame this on some third world country and start World War 3 as planned a long time ago. I can only pray that everything that Ben Fulford has been saying is true and that the gangsters won't get that bomb off as the good aliens stop them. Speaking of Ben Fulford, here's his latest...

Is the Rothschild banking monopoly finally about to be dismantled?

by Benjamin Fulford, November 1, 2011

The situation in Europe is making it clear to all but the most brainwashed that something historical is taking place. What is happening is that the criminal element at the very top of the Western power structure, especially at the very top of the financial system, has been cut off from their money printing machine. As a result, the IMF and the major European and US money center banks are insolvent. No amount of lying or paper shuffling or propaganda is going to hide this fundamental truth. The governments of Greece, Ireland, Portugal, Italy etc. know that the debts they supposedly owe to bankers were created through fraudulent book entries and thus do not have to be repaid. That is why the banks suddenly announced that Greece only had to pay back 50% of their debt even though such a write off would destroy them. They are hoping for a tax payer bail-out that is just not going to happen. It is game over. The Rothschild banking nightmare is ending.

Even the highly brainwashed priesthood known as Western financial gurus and journalists are starting to realize that something is not right. The big announcement by European governments of a “solution” to the Greek and Euro crises is a case in point. If you analyze the announcement you realize that essentially the banks and governments are saying the banks will pay for 50% of the Greek debt with money they do not have. The governments say they will pay for it by “leveraging” the money they already have. They do not say who is going to be dumb enough to finance a bankrupt gambler who wants to quadruple his risk.

Please note that as soon as the “solution” to the crisis was announced, high level begging missions were sent to Asia, including French President Sarkozy. Why would they need to go to Asia to ask for money if they had come up with a solution?

The IMF, supposedly the world’s “lender of last resort” is also continuing to admit they have no money. The reason is that the IMF itself cannot prove that its money comes from legitimate sources.

The fact of the matter is that the criminal part of the world’s financial system is falling apart. The IMF will soon cease to be solvent. The same is true of the World Bank. The BIS is also in trouble. In fact, the entire Rothschild banking monopoly is in deep trouble.

The freeze of “trading platforms” remains in place, meaning that the controllers of the fiat system can no longer pump new money into the system. The best they can do is reshuffle money that is already in the system. New money will only start entering the global financial system once the new asset-backed system is in place.

“The IMF and the World Bank existed to force the Rothschild banking system on the countries of the world,” is how an extremely senior Chinese official explained the situation. “Our goal is to reboot the system, to start over and set all the parameters in a fair way so that all countries benefit from the pooled assets of the people of the world and not just Europe and North America,” he continued.

The original system was meant to have been run by the Swiss and protected by the Americans, he continued. “The basic failure was that the system of checks and balances failed and the people who were supposed to protect the system ended up abusing it,” he added.

What is now going to happen is that the 100 countries that have so far joined the new system started in Monaco in August, are going to implement the new system in four stages, according to a White Dragon Society source. The US military and agencies will be involved in this process right from the beginning, he added. Efforts to intimidate generals by using corrupt institutions like the IRS to try to repossess their homes will backfire and lead to criminal prosecutions.

The first step will be a lawsuit that will be filed before November 15th against the individuals and groups who abused the Federal Reserve Board system. This will lead to liens being placed against many of the largest financial institutions in the world, according to the filers. There will also be mass arrests.

The other steps have yet to be disclosed. However, some basic truths are already known. First of all, all honest businessmen and bankers worldwide will have nothing to worry about. Second of all, the money created through derivatives fraud will be eliminated from the books, even if that means bankrupting many of the big Western financial institutions. Third, major historical financial injustices will be addressed and stolen monies and assets will be returned to their rightful owners. This will be good news for the vast majority of Western citizens as well as the inhabitants of long exploited regions like Africa.

The international banking and payment settlements systems will remain in place after the reboot. This will mean the minimum possible disruption to legitimate business.

However, as mentioned earlier, the international institutions set up and controlled by a small group of Western oligarchs after World War 2 will be totally revamped.

My only issue with him is that it still seems too me that the gangsters are still is 100% control of this planet. The technical charts say that we should be ready to crash anyway, and his claim that they (the good guys at the white dragon society) are cutting off the funds from the gangsters so they can't create anymore money seems to be foretold already. It's like the bad guys already planned to crash the market anyway, and the good guys are just being fooled into thinking that they are succeeding. Maybe the bad guys are just sacrificing a few of their minions to make it look like the good guys are succeeding, and that all of this was already planned to take place a long time in advance.

While I support Ben's effort I just can't believe that they are succeeding until I see people like George H. Bush, George W. Bush, Bill Clinton, Hilary Clinton, Barack Obama, Michelle Obama, George Soro's, Warren Buffett, Henry Kissinger, David Rockefeller, Jay Rockefeller, the Vanderbuilts, the Rothschilds, etc... all arrested for crimes against humanity, as the murdering satanists that they all are. Show me some real murders arrested and I'll start to believe that these satanist pigs are losing control of the evil empire.

All in all, as far as I can tell, the Illuminati Cabal Gangsters still control this stock market and this economy. Getting past this coming week without a disaster would be a blessing... and one that I welcome with open arms. As for the stock market, well... all I can say is that a crash is coming this week. The technicals have been pointing at a nasty multiple wave 3 combination down coming anyway, and when you mix in all this other stuff you have the recipe for a hugh stock market crash.

I'm going to keep this post short as you should pretty much be up to date about all the stuff by now, as I've repeated it many times in most of my most recent previous posts. If you are successful in making money from this crash and what I've shared with you has help you... don't forget to place a nice "thank you" with a donation to feed the dragon.

Red

http://kiddynamitesworld.com/the-cme-margin-notice-that-has-everyone-in-a-tizzy

Wow, a rare opportunity to post normally. I heard Bradley’s ode to the 4-29-92 ritual for the first time since late August……prior to that at midnight Friday the 13th—5-13, 703years7months from the original Friday the 13th episode…and prior to that one hour approx. before the Bin Laden ritual on 5-1……6:26 pm local time……..(Ana)heim st from the ode=====Ana===1-14-1 ie 11-4……ANA from the Boeing 787 Dreamliner initial delivery on 9-27 (Nippon Airways) at 11-07am.

This upcoming week is the numerology week of the year. Unfortunately, crude oil is holding up and making it appear that the stock market can hold up.

It looks like we had a Bradley’s turn date on 10-31. It was 19years187days from the title date of Bradley’s ode to the 29 ritual…….11-11-11 will be 19 years 199 days later…..

This upcoming week will be the numerology week of the year…..

……..

Roger, 10-4, Unit 911, please proceed to the ONS Jr. Market. There is a structure fire in progress….ONS Jr. Market at 1934 East Anaheim St…..Then proceed to 938 Temple St. A 211 in progress there……..Then make your way to LBC port….Occupy LBC is in progress shutting down the docks and chanting that their bankster overlords are planning a 187 on the stock market in a revenge ritual to the Original Friday the 13th episode/ collapse of October 13,1307 and the 666 ritual to the great collapse of 1345 when the original banksters took out some of their competition.

The englightened ones putting their pawns in place to take down the financial institutions in the upcoming meltdown from within. MF Global the first casualty to be followed by the French banks who loaded up their coffers with stockpiles of weapons of financial mass destruction in a 704year old revenge ritual.

Know how you guys love fake prints… 🙂 Here’s one I just discovered. Crude oil down 9,5%!

http://screencast.com/t/eV71NC3qDd

http://finance.yahoo.com/q?s=clz11.nym

http://www.youtube.com/watch?v=NmGc7qH4-hw

This another reason why EW. and Technical s do not always work. After one looks at the chart, go with your gut feeling before pulling the trigger.

Interesting close on Friday…

http://screencast.com/t/qnBRA3rY5S

This is altogether incredibly strange…and very eerie. I guess that’s what happens when you choose to down the red pill!

I guess this gives me a bit more confidence for holding on to short positions.

HOw so? What does it mean? It was too small for me to make any cents out of it.

I’m personally not putting much faith in it unless I see this consistently happen, but it is very very strange from what Red pointed out for the Friday close using what muate mentioned in his video.

Adding up the digits in the point change for SPX, Nasdaq, and the Dow gives you a multiple of 6, and very odd that both the Dow and the Nasdaq add up to 12. The percentage change, with the exception of Nasdaq results in a multiple of 6. Muate specifically mentioned seeing percentage changes of 0.66% or 0.63% or 0.36% as indicators of major reversals with the direction of the move an early indication of which direction the market will go.

This could just be a very weird coincidence, but I guess we’ll see what happens this week. I hold short for other reasons not because of this.

First of all that was way too small for me RED. What did you do? That muathe guys hidden occult numbers? IF so, good for you, and what did you come up with, what does it mean? And are you going to add this to your already burgeoning tool box? Please teach me how to do it, I didn’t quite grasp what he was talking about, didn’t see how you could tell what direction it was supposed to go in. Etc…

CISCO Chart Analysis: http://niftychartsandpatterns.blogspot.com/2011/11/cisco-weekly-resistance-line.html

Selling Zone of QQQ: http://niftychartsandpatterns.blogspot.com/2011/11/qqq-selling-zone.html

It likely means that the market will go down in some type of “6” move. Maybe 6 days down in a row? Maybe 6% down in less days? The “negative” sign in front of all those numbers tells the direction coming… down. The numbers themselves are a code to the insiders. I can’t read it of course, but a good guess is 6 days down in a row.

or maybe 6 weeks down in a row…6 months down in a row…that would be something.

Hey, a nice new add on for you eh Red? This site is getting stwonger and stwonger.

Yes, I will add this to my tool chest… thanks to the link. I knew of Muathe before but had never seen that video or knew that he was also piecing the puzzles together with the num-bers that the operators put out there. It helped me understand it better now.

At your service sir. What do you think of the DJIA being six plus six?

Not sure yet, but all those “six’s” mean something, and I’m sure it’s very important.

Why is it suddenly not available? And you know what? How could anyone see the signal until AFTER the close? So, the market goes UP, monday morning just like Red predicted imo so that the last availble minions can dump and sell short. Correct reasoning?

DJIA11983.24-61.23Nasdaq2686.15-11.82TSX12408.25-60.11TSX-V1650.01+7.57TSX-Gold425.57-0.15London Au1749.00-9.00$Cad/Usd0.981547-0.000192Click on price for intraday chart

DJIA: Down six plus six. WOW. Going SOUTH huh??????

looks most likely the journey will start in 6 days, not early this week

What do you mean? It should start Monday/Tuesday, and possibly last 6 days, not start in 6 days.

11983.24= 11(9)11.6, tomorrow’s code most likely .5, and so on

I agree there has to be time for the signalees to get on board, why do you say any more than six hours? And what is 11983.24? The djia?

yes, DJIA. They give them enough time. Looking at the COT reporting it starts next week, I believe. cotstimer(dot)blogspot(dot)com. So this week retailers will be given some hard time, may be starts last day of this week.

jesus, nice find tim.

So what the hell, there are all these 11/9 signals all over the place. I am deeply concerned, I hope we get through this week in one piece…I wonder if markets would even function if there was WW3 going on.

Their will be no World war Three !

nuggy06, we are not into wars etc., all we are talking about is markets, buy/sell, short/long

Why is it suddenly not available? And you know what? How could anyone

see the signal until AFTER the close? So, the market goes UP, monday

morning just like Red predicted imo so that the last availble minions

can dump and sell short. Correct reasoning?

Why is what not available? And the code still has too follow the charts. I think they put it out on Friday to signal the insiders that it starts on Monday.

Doesn’t give them much time, unless they have already loaded up on what signal? Or maybe they get six hours. But I agee with Tim,or myself that there has to be some time to get on “board”.

Your chart showing all your figures on the 6’s.

That free account with jing reached it’s bandwidth limit. Here it is again…

I uploaded it to my website.

G. Pap seems to be intimidated by all your red lettering in the picture…hah!

If you look at http://finance.yahoo.com/q/ae?s=JPM+Analyst+Estimates,

second last line it saying 15.99, so SPy cannot be long, only thing may be IWM, or QQQQ as Z, calculated based on ESaF funds, QQQQ can go to 65-68

Heh, if you add the numbers in integers, it adds all up to five, so yeah, maybe it all happens on Friday.

yes, thats what I am thinking, spy may be doub top. I cant wait until this blog goes private, so its easier to share our numbers ,e tc

No such thing as private on the web…

Did u know that P/e calculations for the SPy is 15.7+, and half of them is complimentary of AIG, If you take out AIG, its 7.7. http://www.factset.com/insider/article/earningsinsight_11.4.11

Now I know why Arthur would generally point in a direction that was always against my logical one.

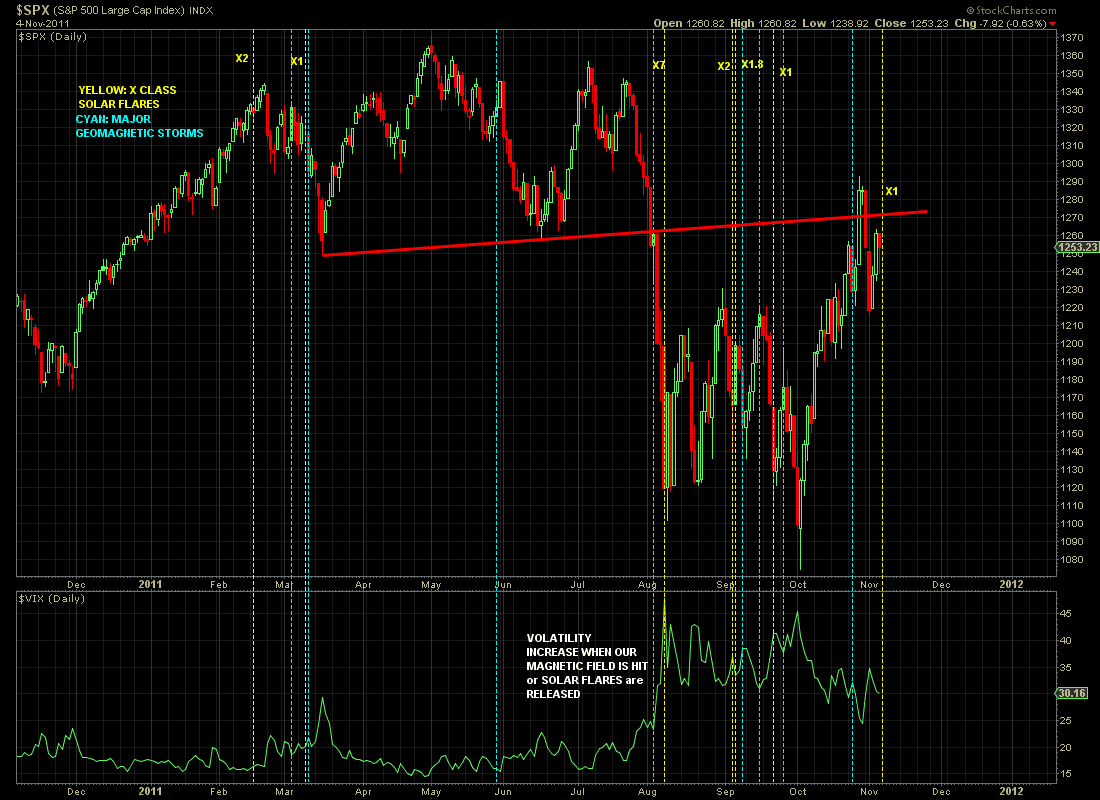

http://2.bp.blogspot.com/-rqig… This is a chart with the past moves on the sp with the solar flares.

http://2.bp.blogspot.com/-rqig…

The link stinks

You’re right, it does stink. But yes, it’s a proven fact that the market, almost without exception, has trouble when solar flares flare up. The increase of radiation not only affects human thought and emotion, but also electronics, which makes sense since the market is controlled by bots.

yeah, I been pimping that idea quite a bit, on my blog

interesting, never seen Interactive Broker be “slow” I thought maybe it was the Europe thing and HFT, but more likely problems due to magentism/EMF/carrington type crap

I will try one more tim

I give up.

Bill McLaren, who is a Gann theorist, discovered what he calls a “crash pattern” that occurs when the market peaks, then develops a right shoulder without a well-defined left shoulder. This may be what we’re seeing here, and I probably missed it before because the time period is usually significantly longer than 2 weeks; more like 2 months.

Not saying that it will happen, and I don’t know what McLaren thinks about the current pattern, but I guess we’ll see here shortly, if it plays out or not.

Damn, all I did was blink and DAX futures went from +40 to -40. Strange days indeed.

Hmm…no one mentioned the 5.6 mag earthquake in Oklahoma. Practice run for the big one?

And adds up to 11 as well.

Wow, 10 year Italian yield just blew out to 6.52%!!!

From the Alternate Reality the Soylent Green Pill

Asian Banksters invade Hawaii

Federal worker guns down Hawaii Resident protesting Asian Banksters

Highways and Public Areas shut down throughout the week as Banksters are zipped from one party location to another. Hawaii Businesses greatly affected negatively.

Mrs Obama takes Air Force 1 to Hawaii to do some Green Washing whilst Banksters Party.

Business Hurt as their workers get called on National Guard Duty to protect Asian Banksters.

Think this is some weird futuristic movie? Reality, right now.

http://www.hawaiifreepress.com/ArticlesMain/tabid/56/articleType/ArticleView/articleId/5382/Occupy-Honolulu-Waikiki-Shooting-was-Round-One.aspx

So who’s going to play Detective Thorn now that Charlton Heston is gone?

Bob Hope, Steve Jobs, Johnny Cash, all of them gone.

Who needs Chuck Heston when there is no Hope, No Jobs, And no Cash!

Forgot to mention…good to see that Five-O is still on top of things!

Wow, so far, so bad for the market. Looks like a C or a three. If it is a three……..

INTEL Chart: http://niftychartsandpatterns.blogspot.com/2011/11/intel-chart-analysis.html

Red, they thrust the market down hard last night now it has come back, which gives me belief that the underlings given the code will be given a nice chance to go short. If they haven’t already, how much time do y’all think they have been given. Or was the code on the close Friday just their occult way of indicating that the time is here?

Depending on how the day goes it looks like shorting should be done into the close today or tomorrow morning. Since the “code” was given on Friday to go short, I’d say we could see it today. I really wanted to see 1270 or so to be hit, but we might not get it?

Here’s you’re quick video morning update….

http://www.screencast.com/t/gZfRU30jk2rp

Possibly to reel in all kinds of shorts in Europe, and bust out their stops this morning and fill their last set of friends?

I think Reds original scenario plays out here you know. Its like he is reading the charts as if he was a CRIMBOT himself. Lol.

Well crap, now my stockmarketbloggers site is down? Arrrggh… I have that site and this reddragonleo site on different hosts for that very reason.

Now it’s back up…

🙂

ES Near Resistance line: http://niftychartsandpatterns.blogspot.com/2011/11/es-near-resistance-line.html

Looks like we hit 1260 on cash today…1+2 = 3 and 6…another 3*6 = 18. Also 12 + 6 = 18. Maybe I’m forcing it?

Yes, it’s looking more and more like the high is in today. I’m just looking for more evidence, but I’m almost ready to go short.

I’m not sure if the “top” is in or not gang, but I’m going in short here. We could go a little higher, but I’m fine if we do. I’ll ride it out. We are making a bear flag and the charts are lining up together for a big down move. Add in the ritual codes from Friday, and I’d say this is close enough for me.

Holy crap. FINALLY HE GOES SHORT

Cue the crash! <1090 S&P here we come.

LOL… just in time too it looks like! 🙂

You gotta stop waiting until the last minute. It’s driving your viewership bonkers. I averaged in my shorts last week starting with the bernanke meting.

If people were following your trade waiting for your signal, they’d be chasing right now. Gotta give people more warning than <60 seconds.

Sorry… timing needs to be closer for me as I trade options. You can always average in when we are close. Many others do exactly that…

What option are you in? Would you buy weekly calls on VXX?

That’s where the money is if it crashes.

I like how you post you’re going short and VXX starts going straight up.

I was teasing red. Your timing is fine. It was just ironic that you’ve been saying no wait, tomorrow, no wait, tomorrow, for the past week, and seconds after you go short it breaks support.

It really is kind of epic you go short within less than 1 minute of the drop.

Sorry I couldn’t give more time. It’s just that the market moves in patterns and I have too just “feel it” and “sense it” to be more sure of “if” I’m getting short at the right time or not. I got some November spy puts, as I don’t like trading the vxx… never worked out for me. Don’t know why?

Tom Petty nailed it, ” the waiting is the hardest part “.

Italian 10yr auction scheduled for 11/10 was cancelled when yield hit 6.66%.

Nice catch ACP… thanks!

http://www.zerohedge.com/news/10-year-btp-666-italian-treasury-cancels-november-10-bill-auction

Forgot link.

Dude, scroll down to the Barclays story on ZH…Barclays has $66.6 billion exposure to PIIGS.

Too funny…

http://www.zerohedge.com/news/mf-global-jefferies-barclays

There’s the link.

Damn, forgot it again!

Madman Ben + HFTs = MARKET RAMP!

Yep… I had a gut feeling that I was getting short too early. But I’ll stay short to see how this plays out. So far, we are just chopping up and down in that triangle. We need to see something come out on the news to tank this pig. Maybe after the close today?

Look at SPY with 3 min charts…HFT signature volumes. Why I always use 3 min.

Jackson verdict in 2 hrs, riot on the streets a possibility

Arrggh…

Should have paid closer attention…

When did you get that? In the morning or much later. I would have held off if I had seen that. Arggh is right.

Here’s your “false breakout” and “false breakdown” that is chopping the bulls and bears up..

http://www.screencast.com/t/BsbQqIkoSsk1

I remain short.

We have a high on 11-3 of 1263.21, then 1259.62 this morning (11-7) and now we are just below that at 1259.55, which makes one wonder what they are thinking? They are so close that they could easily make a new high… why haven’t they? Triple tops are rarely not broken on the next attempt, which all bulls know.

That means the odds of it breaking out are high, which means that there are lots of bulls get on board right now. A failure to breakout above the current highs is very bearish though, and should lead to a big move down.

Thanks for the update

isn’t that something…we finish up 0.63% on the S&P. Didn’t we finish down (0.63%) on Friday or am I mistaken?

huh, exactly, nice observation. And same spot. Wow. Snuggle up to this, for a real warm and fuzzy matrix feel. http://www.youtube.com/watch?v=n3CKeJ8hYJk

I feel like I am being played like a FOOL from these Gangsters. If the markets do not come down by 20% by the Middle of Dec, I am going to hang it up for good.

I’m right behind you! This is such BS!

Thanks for the share.

Es way up after hours. I guess the s&p will be up 90 pts tomorrow. Madman Bernank doesn’t want to take any chances I guess. Look lik the Fed will be buyng 24/7 now on.

That was a good guesstimate…17.5 hous X 5 es/hr = 87.5 es at open & massive short covering rally. Pump it, Bernank!

My thinking is, I’m still holding short through the end of this week given the particular importance of this week. If we keep rallying then I may have to cut my losses. Maybe sign of the top…I don’t know.

I’m trying to jinx it…

Go Madman Bernanke! Pump those futures! Ramp this pig!

Starting Tomorrow I’m (bull)ish!

We need that actually. Sorry, but for the IBot to bring the market down, everyone has to go bullish.

Unfotunately, damn put/call ratio still high…

Imagine, tomorrow is turning point day. Yes we may go up to the 1275 level, but tomorrow should be the last day for any type of a high. From their we should be thrusting down wards in the market. As I said earlier, the Nov 14 -17 will be the major part of the bearish thrust. Hang in their Imaginasian23 a little more.

Peace… I’m 100% short, but I think you knew that already. I emphasized the bull part in bullish earlier. I would like to see a 20% correction in the markets. Maybe RED can post a special update video that he is now bullish DOW 20K to jinx this market.

lolo,lol,lol,

You have a good sense of humour.

I am not worried at all, and the fear on the board emboldens me a bit. Not that it isn’t justified, as we all know in our hearts that we aren’t dealing with a free market, but a clone sister of the BEAST, that probably has been inputed due to sacred geometry and one of the mulitpliers is fear and emotion.

Major numerological reach here, but add up the ages of all the jurors here. Sorta bizarre they all are 3,6, 9’s. Weird. And gettin weirder every day.

– Hispanic man, 51, from Whittier. A U.S. Postal Service supervisor who oversees 30 people and has some college education. Believes celebrities bend the rules and feel they can act as they please. Considers himself a fan of Jackson’s music. First-time juror. Has five children, five grandchildren.

– White woman, 57, born in Spain, lives in Alhambra. Account manager who supervises others and has some college. Watches “CSI” and followed the O.J. Simpson case on TV. Has been on five juries and was once a forewoman. All those juries reached verdicts. Believes celebrities feel they can act as they please. Not a fan of Jackson. Divorced, with two children, two grandchildren.

– Hispanic male, 39, from Tujunga. Bachelor’s degree in sociology. Works in product management. Listens to Howard Stern. Believes celebrities use status to get what they want. A Jackson fan who saw last few minutes of “This Is It” on TV. Served on one civil jury. Married with two children.

– Hispanic woman, 54, from San Gabriel Valley. High school graduate and office manager at husband’s moving van business. Said the Casey Anthony case showed a jury that saw evidence differently than the public majority. Was juror on two civil cases that ended with verdicts. Watches Fox News, listens to talk radio. Not a Jackson fan but loved his music as a young girl. Has four grown children.

– Hispanic man, 52, from Lynwood. School bus driver with some college. One prior jury experience. Believes celebrities get away with crimes because of their status. Not a Jackson fan but thinks he was a good artist. Spouse is mail carrier. Four children and one stepchild.

– Hispanic woman, 36, from Whittier. Workers compensation service representative. Some college. Followed the Casey Anthony case because it involved a child. Wounded in a drive-by shooting in 1993. Once served on jury that reached a verdict. Single with two children, lives with boyfriend who has three kids.

Read more: http://latino.foxnews.com/latino/news/2011/11/07/michael-jackson-verdict-jury-in-conrad-murrays-case-included-5-latinos/#ixzz1d47GnnKx

From a cycle point and astrology this Wednesday, Thursday are suppose to be bearish. Nov 14-17 a very bearish thrust down in the markets. From their, we head upwards close to the Nov 25th time frame for another very bearish time into Dec 8/11

From Dec 9th their we get a our traditional Christmas rally.

As I said earlier, if we do get a major correction in the market. I will be throwing in the towel.

Sorry to hear that my friend. I guess no asteroid hitting earth would be good though.

Their will be NO Asteroid hitting the earth. All of this talk is no more than Pure propaganda to create fear.

Agreed. But we need a downturn to make. Bank.

And we don’t get that big downturn soon I think everybody is going to “throw in towel”… including me! But then again, isn’t that what the bastards (err… gangsters) want?