Tuesday Update...

(to watch on youtube: http://www.youtube.com/watch?v=5EHb1svbADY)

Red

_____________________________________________________

Next Monday we should see a very powerful multiple wave 3 combination wave down start, or a big push up taking out 1300 spx and beyond...

(to watch on youtube: http://www.youtube.com/watch?v=Uw_0nzGWGds)

Which will it be? I wish I knew the answer? Call me stubborn, stupid and a fool, but I'm sticking with a powerful wave 3 down coming... not a rally to fairy tale land! Why? Because the charts just don't support it! Yeah, the patterns forming could support a move up but the MACD's and Histogram bars or many of the charts are still extremely bearish. From the monthly to weekly and the daily, I just and see a rally up to continue.

I know that we are all fighting a "Super Computer" (named HAL?) and that the charts are heavily manipulated and only right about 80% of the time, but I'm sticking with my shorts... and will go down with the Titanic or get rescued with a lifeboat on Monday. This wave 2 up that happened on Thursday and Friday literally wiped out every bear left in the market I believe. This was the first time I have ever seen a 389 point DOW drop in the market that didn't have a lower low the next day... which is extremely rare in my opinion.

So, if you feel like you got screwed as a bear after Wednesday... you're NOT alone!

I was taken completely off guard on Thursday when the market gaped up and never made a lower low then the low on Wednesday, which hasn't ever happened as far as I can see when looking back at previous large sell off days. There was always a follow through down day the day after such a huge sell off. That really trapped me and many other bears I'm sure, as the odds of that happening was very low from what I can see.

This is why I stayed short at the close on Wednesday, as the odds were tremendously in my favor of a lower low at the open of the next day on Thursday, which again... NEVER Happened previously! Sometimes no matter how good the odds are for you winning, the gangsters still screw you and steal your money. This was the case on Wednesday at the close as I'd bet the odds were 95%+ that there should be a lower low the next day... yet it never happened?

Moving on to something weird, strange and totally out of the ordinary... a dream that tells the future of the stock market!

(to watch on youtube: http://www.youtube.com/watch?v=dGEfOzR313Y)

It seems that some posters on "God Like Productions" (GLP) joined the forum on 01/27/2005, made over 5,000 posts, but the most important one was on 04/12/2010 when he/she posted the following... "The day the dow drops 389, that is the marker day. Hold on to your hats! Yep it was a dream". Then again another comment was... "Just a signal that you know it is all coming down. Not just the dow. When it hits -389. I 'think' it is a final on the day, but am not sure. That was the whole dream." Finally, the last comment was... "Doesn't matter when really. We all know it will happen. When it drops -389 in one feld swoop..."

Ok, so how far did the market drop on 11-9-11... yes, you guess it "389 points"! Now it gets weirder... as the "Member ID Number" for this poster whose handle is JCD, and made these predictions from a dream is... drumroll here, "11911"! Folks I'm not making this up! This is very strange indeed, as sure enough the 389 point down day was on 11-9-11, which was this persons ID, as well as the number for the "fake print" (FP) that I got last week of 119 SPY!

Then, to make things stranger, they closed the SPY at 126.66 on Friday at 4:15 pm! What are they saying? Does this 666 mean the top for the market just like the March 6th, 2009 low of 666 SPX meant the low? On top of that, it seems that the post put up on the GLP forum has now been deleted or removed? This is the most recent thread (basically that's a "post, but they call them "threads" in a forum) that has now been deleted...

http://www.godlikeproductions.com/forum1/message1700929/pg1

This was a new thread that was referring back to the original thread from 2010 which it located here...

http://www.godlikeproductions.com/forum1/message1021410/pg3

The title to that thread was "Warning= DOW Will Get To 11,246 And Then **CRASH HARD**!!!!", which of course that poster was obviously wrong about (but aren't we all). However, it's not about the title of the thread but what the poster named JCD said... which was of course about the dream he/she had about the DOW dropping 389 points in one day, which started the beginning of the end I'd assume?

I'm not sure why GLP deleted the new thread from a couple of days ago and left up the old original thread from 2010... which is odd to say the least. But, fortunately for you readers, good ol' Red just happen to make a copy of the original thread. Yes, there is a reason I have 4 monitors running on one computer with 12 gig's of ram... it's so I can leave as many windows open as possible just in case this kind of thing happens. I would say I probably have over 250 windows/tabs open right now on that main computer, while I'm typing this post on my laptop.

So, besides getting a screen shot for you guys (and gal's), I also saved the page and uploaded it to my website for safe keeping... just in case something else happens out of the ordinary if you know what I mean. Please note that this is just screen shots of the links. Here are the links...

At the time of this writing two of three of those links are still up on the GLP forum with only the most recent thread from a couple of days ago being deleted, but I thought I'd include them all anyway.... as you never know about what might happen tomorrow? Hmmm... now I just tried to go to the profile of JCD and it's not showing up anymore? Here's the link...

http://www.godlikeproductions.com/members/11911/profile

This was working about 2 hours ago and showed the history for this person. Why is it down now? Is GLP working for the Illuminati gangsters or are they being attacked by them? Very strange stuff going on right now gang (it's 10:40 pm EST Saturday night at the moment, but understand that these posts commonly take 5-8 hours to complete so things can change by the time I'm finished writing).

Holy Cow! Now the original post is down! WTF is going on here? Maybe it's nothing and it will be back up by the time I get this post up or maybe it's more then that? Something is very suspious here gang... and I do suspect big brother is behind it all. If this post, site or youtube video goes down... you'll know why! I beg you to copy this post and re-post it everywhere you can... especially if my site goes down too after posting this.

(by the way, be sure to download the screenshots and the video asap... just in case my youtube channel goes down).

Moving on to other news... here's the latest from Ben Fulford, as I know you guys love his stuff. I myself am not sure if his "good guy" gang is really succeeding or not, but since we didn't see any city burn on 11-11-11 I'd at least say that's a big plus. Maybe it was the good aliens coming in to stop the bastard reptilian Illuminati gangsters from setting off that 4th nuclear bomb, or just some white hats in the pentagon... I don't know, but I'm happy never the less.

These days, reading some of the Western corporate propaganda media, you get the feeling you are reading Axis news reports of imminent victory late during World War 2. The reality people can see with their own eyes contradicts their reports so much that only a diehard rump of the most thoroughly brainwashed now really believes the propaganda. No matter what wishful thinking headlines they conjure up about the IMF coming to the rescue, or the Feds printing more dollars or FRN’s coming to the rescue, the fact of the matter is that the cabal that hijacked the world’s financial system has lost. The criminal cabal is caput. Events this week and next will provide ample proof of this.

Both behind the scenes and in public, the world’s law enforcement agencies continue to close in on the criminal cabal from all directions. The big lawsuit expected next week against the cabal has now obtained as evidence something known as the Book of Maklumat. This is a book that details the historical ownership of much of the world’s gold by a group of Asian royal families. They also have copies of the original cash certificates and evidence of how this money was transferred to the custodianship of the Government of United States for the use on behalf of the international community. This evidence is icing on the cake in a lawsuit that will prove the private owners of the Federal Reserve Board stole this money and have been using it illegally for over 50 years.

That is why the illegal “trading platforms” that were being used to steal this money have been shut down. That, in turn, is why the International Monetary Fund, the European governments and the Federal Reserve Board have been powerless to stop the ongoing crisis affecting the G5 group of terrorist states (France, England, Italy, Germany and the United States), as well as their armed camp known as Israel.

Although these governments have threatened Greece’s government into stopping a referendum on the Euro, they cannot take their threats to the bank. The fact is that the European fascists do not have the money to help Italy, Ireland, Portugal, Spain and the five Baltic states. Furthermore, the government of Ireland has already asked the European bankers to prove Ireland is in debt to them, show where the money came from, prove that it is real and prove they have the legal rights to it. This is something they cannot do which is why Ireland is not in the headlines. It is also one of the reasons they have shut down Ireland’s Vatican embassy.

Although the G5 and Israel threaten to ignite World War 3 by attacking Iran, that is a suicidal bluff. The commanders of the US, Chinese and Russian militaries will not let this happen. These rogue G5 leaders are, of course, terrified because they know they have committed countless crimes against humanity (e.g. hundreds of millions of murders since World War 2 ended). It may still be possible for most of them to obtain forgiveness via a truth and reconciliation committee but the window of opportunity is shutting fast.

One man who has now put himself beyond the pale is Henry Kissinger.

Kissinger last week desperately tried to orchestrate a series of assassinations in the hope of somehow turning the situation around. This writer was once again last week targeted by people hired by Kissinger.

However, Kissinger has been told to back off and his orders are not being obeyed.

“President” Obama, for his part, was the subject of severe verbal attacks at last week’s G20 meeting in France. He was told the United States was in far worse shape than Europe and that he had a lot of the blame for that, according to sources at the meeting. Obama is no longer expected to be able to complete his term as President because of the various legal actions against his regime.

In Japan, meanwhile, there has been a lot of rumbling under the surface.

Senior Japanese right wing sources say that a group of Colonels in the Japanese Self-Defense forces are plotting a military coup d’etat. Their plan is to put in former Prime Minister Shinzo Abe as their leader. Abe, of course, is linked to the Moonies, who in turn have a ranch next to the Bush ranch in Paraguay. They are also linked to the international drug business.

Needless to say, these misguided Colonels have been educated and are now realizing that no matter how honorable their wish to help Japan might be, they were about to be manipulated by the very people who helped ruin Japan’s economy.

Another move in Japan came as US CIA and Pentagon types told power broker Ichiro Ozawa to permanently cease his plans to try to take over the government if he wished to stay alive. Ozawa is not trusted because of both his Rockefeller and cabal connections.

It is also worth noting that Emperor Akihito is suffering from “Bronchitis,” and has thus “temporarily” handed over control to crown prince Naruhito, according to the Royal Household Agency.

The official go-ahead has now been given for a new International Economic Planning Agency. It’s motto will be “we turn dreams into reality.”

I will comment that "if" Ben is correct that the gangsters are out of money and can't access the codes needed to print more, then we could indeed see that multiple wave 3 down next Monday that I was looking for earlier this past week. Yes, I could be totally wrong on this call, as I have been wrong many times in the past... but the evidence just doesn't support a rally. Not that the "evidence" ever stopped the gangsters before, as they usually just burn it (think building 7) so the market will go whatever direction they want it too. Remember, in the end it's just a super computer (HAL 2000) that is running the show... at least as long as he has access to unlimited supply of fraudulent money.

Anyway, I'm still in the bear camp until I at least see what happens on Monday...

If we don't tank hard like I expect then I guess I'll have to throw in the towel and agree that the Bulls won this battle. Listen, I'll be a bull when the chart line up to be bullish, but right now all I see is bearish. Sorry, but other then simply patterns (like the continuation 'triangle' pattern) that are presently current on the daily chart, I don't see any reason here to support more upside.

Yeah, the triangle pattern appears bullish and could also be considered a bull flag... but the MACD's and the Histogram on various time frames don't support it. Therefore I must remain bearish until proven otherwise. This means a clear breakout of the recent high of 1293 spx, which must happen on Monday to convince me. I know the last rally up on Thursday and Friday look very bullish to many, as it hurt many bears, but I still see it as a wave 2 up with wave 3 down to follow.

Well, I guess I put up my evidence at this point. Now it's up to HAL to prove me wrong and throw some more egg on my face, like he's done so many times before. For me I'm glad I stayed short into the weekend as I'm all about "Hell Mary" passes... maybe we'll see one on Monday? Of course most bears will miss it as that's the way it always is...

Red

P.S. Here's the latest from Lindsey Williams...

(to watch on youtube: http://www.youtube.com/watch?v=bTc8qxzYNtw)

Of course from what he's saying the market won't crash until next year. But exactly what does he consider a crash? If he is right again, then I guess we'll just continue rallying next week defying gravity once again. So much for wave 3's down then...

Wow! I got mentioned in Red’s video =)

I’m glad you were able to save the GLP post, RED.

Furthermore, what interesting is that JCD had 12 member friends.

JCD –> (J)esus (C)hrist had 12 (D)isciples.

LOL… thanks Jesus for the “head’s up” then! Very interesting!

Doctor Copper, Euro, and Great British Pound (aka Cable) are looking

decidedly bearish, but maybe one more up day to crush bears who held

short over weekend, break their spirit, take their money.

http://oahutrading.blogspot.com/2011/11/sunday-bearish-slant.html

Go long for perhaps a couple of bucks but go short for a future fortune. The only problem is the waves seem so clear to me that something else must develop from them. The next big decision may come as ‘when to cover the shorts when a crash occurs” this may be even bigger than 1987 and that is why I am heavy the VXX. a 500 point gap down may be in our futures. Your fake print on the VIX looks like heaven.

I’d love to wake up tomorrow being 500 points down on the Dow futures… man that would be wonderful.

I was kind of curious if there was more talk about this somewhere and I chanced on this thread. Maybe it was mentioned in another comment. If so, sorry!

What is odd is if you look at JCD’s ID#s, they change whenever he/she posts. Maybe there are multiple instances? It’s odd because I don’t see the ID# change for anyone else.

http://lunaticoutpost.com/Topic-A-My-Prophetic-Dream-Comes-To-Pass

What do you mean it changes? This is a different forum then the GLP forum, so of course it will be different on this site.

Hey Red –

For example, JCD’s userID in the very first post of the thread is 60283. If you move down to her next post in the thread, it shows her userID as 47976. Then the next one, her userID shows 25596. If you look at ashesandsackcloth, his/her userID stays at 14769.

It’s odd because you would imagine that if you created a login, it should tie to one ID. However, “JCD” is tied to multiple userIDs.

Also Red, not sure if you mentioned this in vid but 389 = (3+8) 9 = 119 on 11/9/11. Unbelievable.

You’re right, I forgot to mention that! Good catch Nuggy… very strange stuff going on here. You have the FP on SPY from last week of 119 which of course equals 11-9-11, and the Simpson clock that points to a “6” (or 9 upside down) and the “11”… and now the 389 = (3+8) 9 = 119 on 11/9/11. Let’s not forget the 126.66 SPY close on Friday as well. Oh, that 119 FP came at 10:56 am on 10-26-11 or 1+(5+6=11)… which is 111, and of course 1+0+2+6=9, and then 11 = 911.

Nice find nuggy! I was trying to find other websites the JCD posts. Just like Red mentioned… you can’t change your ID# on GLP from what I have read. The site you have linked is different. Interestingly, she was not aware of her previous GLP ID#. Right now, I do not feel like going through 29 pages. All this has an eerie feeling that is much more than just the stock market crashing. I’m sure a lot of this is starting to add up… the huge VIX FP, the illuminati website, etc.

389, prime number, Eisenstein prime with no imaginary part, Chen prime, highly cototient number, self number, strictly non-palindromic number.

http://en.wikipedia.org/wiki/Eisenstein_prime

From Skippy a poster from nuggy’s link:

In the year 389, All pagan buildings in Alexandria, including the library, are destroyed by fire.

So the library of Alexandria was destroyed by fire in 389. This was the year that the great knowledge of the ancients was supposed to have been destroyed

Maybe the Fed will be destroyed by fire in 2011.

From the poster The Brazillian (giving credit where credit is due:

One more odd thing about the stock exchange:

The movie “2012” was released in November 13, 2009, a Friday.

Then we had the first weekend of the movie. During the weekend the stock market is closed.

When the stock market re-opened on the Monday, November 16, 2009, the S&P 500 finished the day at 1,109 points.

At 1.109 points, it means that the S&P 500 was 66.6% above the multi-year bottom of 666 points reached in March 2009.

The following day, November 17, 2009, the S&P 500 finished the day almost unchanged (what is very rare), at 1,110 points.

And in the following day, November 18, 2009, the S&P 500 fell back 1 point, to close at 1109 points again.

It finished 66.6% anove the 666 bottom, three days in a row.

Do you really think it’s a coincidence?

How many times in the history of the stock market, the S&P 500 rose just one single point in a day, and fell back one single point in the following day, to close back at the same level of two days early?

The answer: just one time. And it was in the first three trading days after the release of the movie “2012”.

And last, but not least, (66.6% of 666) + 666 = 1109.

1109 = 11-09-11

Wow! How odd is that? That was a signal for sure… especially with all the other signals we now have. The ES should open tomorrow morning very overbought on the 4hr, 2hr, and 60 minute charts. Then you have the multiple wave 3 counts from an EW point of view. Man, if there ever was a perfect time to drop the market a 1000 points it would be this Monday!

“perfect time to drop the market a 1000 points it would be this Monday!”

I sure hope so… most of my shorts are under water!

Thanks again for your hard work here Red. I primarily came here to learn and hone in my skills on technical analysis. But it turns out that sometimes “truth is stranger than fiction” with all of this interesting, odd, and fascinating thinks going on!

Well, I’ve spent the last couple of years learning how to mix all the technical analysis, elliottwave, Fibonacci levels, trend lines, etc…. all together to forecast the market direction, but they only work when the gangsters aren’t manipulating the market. If we could rid the market of these gangsters, then we could probably do quite well in the market as the charts would work again.

I agree!

Well Good luck everyone! My your portfolios be gangbusters this week!

Lots of posts for a Sunday evening. Unless something “unexpected” (for those not in the club) happens, don’t think it’ll be much of a day, because put/call has taken a big dive, especially index. If they ramp this up, it’ll have to come down just as fast to reverse any payouts. OPX…entire sectors 80% overbought (retail, etc). Will be interesting.

“IF” and that’s a big word there ACP… they don’t manipulate this market tomorrow, then the ES Futures will open up tomorrow very overbought on all time frames. The SPX is already in the same situation, which again supports that Monday should fall off a cliff. But, with all the attention we are giving this with the dream about 389, the 119 spy FP, the simpson clock, etc… it wouldn’t surprise me to see nothing much happen but another boring chop feast on Monday.

Many instances of dark cloud cover on the mid cap minis. Not saying that can’t be overcome by Crazy Ben, but something to watch.

I suspect the re-booting, shifted the markets entirely from a massive collapse stage to a neutral position.

I do not know if it was the White brother hood (the good guys) that mitigated a collapse or not. But some major shift has occurred. I am totally out of my shorts from early Friday morning. As far as I am concerned, their will be NO COLLAPSE at this time. Can we get a run off in the markets later this week of 40 to 80 points. Yes we can, but over the next few weeks I certainly see 1305 in the near future. I hate to say, but we will have to wait until 2013 before we see a sizable correction in the markets.

I certainly believe in Zstocks views on the markets. He had posted earlier.

For all you bears, I hope I am wrong.

Tomorrow 11-14 is a Pi date from 2007 high and 2008 crash low……

ES Chart Analysis: http://niftychartsandpatterns.blogspot.com/2011/11/s-500-futures-analysis.html

Just overcome the ELFs and sell high and buy low. Don’t look for crashes. Just look for 19-50 point moves. Again, I have never heard or known of anyone who was short before a CRASH. The ELFs make sure of that.

Allow me to play devil’s advocate (reality is, I’m agnostic about what comes next). Currently, a large number of growth stocks have replaced the traditional flight to safety stocks and are leading the market. In addition, the dollar whipsawed out of a bull trap last week and the long term trend remains down (short answer here, don’t fight the fed). On top of all this, the Naz is looking at 10 year highs and thus far hasn’t been showing traditional signs of distribution. The kink in the situation is of course Europe and since the market hasn’t yet started buying the news, price action remains choppy. All it would take is one strong buying day to resolve this though.

The dollar can help offer clues as to where we go next, right now the dollar says we go higher. But lesson’s learned from last week say don’t be too quick to take the dollar’s clues as they can change in a moment: http://srsfinance.com/articles/stock-technical-analysis/uup-behaves-like-lovesick-nerd/

Hello Leo,I was the OP from that Thread at GLP (AC from the Netherlands) that they have taken down. Perhaps you already know i have been banned there.Thanks for making screenshots from the beginning of that thread.I have downloaded them and i have seen your video on youtube.Thank you for doing this.Netherlands.

Thanks for stopping by AC, and so far it’s looking good for us bears.

Hello Leo,

I was the OP from that Thread at GLP (AC from the Netherlands) that they have taken down.

Perhaps you already know i have been banned there.

Thanks for making screenshots from the beginning of that thread.

I have downloaded them and i have seen your video on youtube.

Thank you for doing this.

AC_Netherlands.

My 3 scenarios for major indexes year end 🙂 happy trading

http://hotoptionbabe.com/blog/152-anna.html

I think the market is just waiting for a catalyst.

Guys, I guess I’ll be here most of the day (I usually am anyway) as the chatroom over at SMB is full (20 people maximum) and I can’t get in… LOL. I’m sure they are all doing well without me though.

😉

There is a 127.37 print on the SPY at 8:03 am this morning.

ES Fibonacci levels: http://niftychartsandpatterns.blogspot.com/2011/11/es-fibonacci-levels_14.html

The drop this morning looks corrective. I think you may be interpreting the charts incorrectly. I still see a wave 5 of C up to complete the larger countertrend… This morning we’re finishing up a 4. So I think the big move down comes in a day or so… possibly 2. I’m looking at 1276-1279 on the S&P for a top.

I agree 100%

This market has Mad Cow Disease!

Wave 4 bottom @ 1247? Wave 5 up looks like it’s starting to me…

Retail put/call essentially unchanged, index bounced right back up from Friday.

Fed powered HFTs got spanked by MMs.

right on . market coiling up for a big move. prolly up down or sideways as katzo would say and take credit for it . we have lower highs and higher lows so who knows. watch oil at 100

I actually COULD see the market going for one more good run UP. Because of the wave action on the US CAD, which is a really good indicator for me.

I wouldn’t doubt it.

Yes, I believe you will be correct. I can certainly see the 1276 area being hit before we see any significant down move.

Congrats, Red on the AC Scoop. Time to do a Red Dragon Leo exclusive on AC. Wanna know more about his story, why was he banned from certain sites.

It’s logical that the 389 pt down day occurred on 11-9 or 8787 days from the 1987 crash.

Monday night football, saw RoboQB/Superbowl Champ#12 tearing it up again with two more TDs to his favorite #87, last year,s SuperBowl wonder.

Ominous, market looks like it is done.

Oh they’ll keep fighting it until the last second. Bob Pissonme and the rest of the CNBC propaganda crew are trying to talk this market up while Italy pushes its head above 7% and France blows out day after day. Hell, as long as the presses keep whining at full speed, we get one more day of the euro not getting slammed into its intrinsic value of about 35 cents to the dollar.

ES chart: http://niftychartsandpatterns.blogspot.com/2011/11/s-500-futures-chart-analysis.html

Gold Chart: http://niftychartsandpatterns.blogspot.com/2011/11/gold-support-and-resistance-lines.html

Crude Oil resistance line update: http://niftychartsandpatterns.blogspot.com/2011/11/crude-oil-resistance-line-update.html

yup 100 area is tuff nut to crack it seems

Wow, look at that es ramp! Must be the Crazy Ben’s hedge against all the worthless MBS the Fed owns.

Unfortunately for the bears, the crackhead bulls got the 4h, 2h, and 60 min charts oversold afterhours yesterday and premarket today. Assuming they keep the volume light today I’d expect a positive close to happen.

Yeah, either way positive or negative. Nice to have bots they bought with stolen money to trade while they’re asleep so they can steal more money.

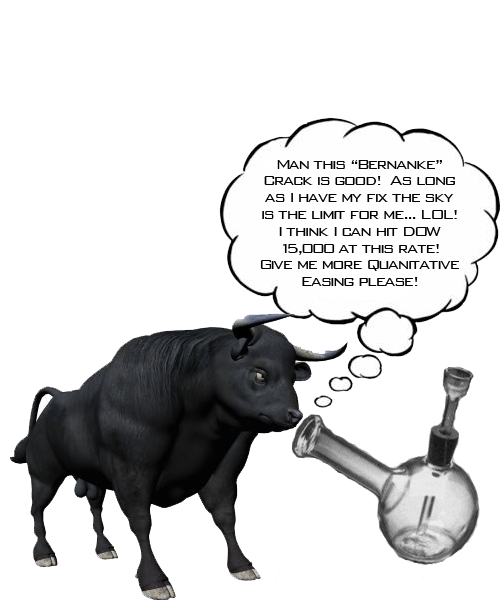

I see no reason why we can’t hit DOW 15,000 by the end of year…

no way Red, if in Oct we get 2000pts up, add 2000+2000 nov & dec = 16000. what were u thinking, missing 1000 pts

I am going long here. 1246 level It will be a ramp up job into the close today.

Wise move PW… crash ain’t happening now. At least not today…

It takes time for the criminals to offload all their euros and other garbage to the Fed.

Hot Fed HFT pump action! Nice measured bot move.

If we can break up threw the 1253 level, we are off to the races into the close.

Nice…Italian 10 yr now over 7% again. Which, unlike last week, is apparently good for equities.

Here’s your midday quick video update…

http://www.screencast.com/t/PTxr3HpL

Watch those HFTs burn!

Wow, Mad Ben is really buying those euros like crazy now. Fill ‘er up, Ben!

They gotta bring it down just a bit so they can gap this sucker over 1292 tomorrow.

If we see 1292 tomorrow, I will be shorting that pig!

For now I am just going to do swing trades

Weird thing is, HFTs are hitting this market every 30 mins now, with less & less effect. I can’t figure out why they would do that. The last HFT ramp 10 mins ago just got hammered. Clobbered. There must be something on the horizon.

Depending on the close, I may short the market. Or I may have to short tomorrow morning.

Another 20 minutes or so, they will ramp this up into the close.

If we break 1263. we head up to the 1270 area in by the close.

Wow, consistent $100 oil is sealing the fate of he economy.

remember the fake book said retail sales up (aka gas sales), so pump it up, so people pay high price and fake book says again retail sales up

Of course…it won’t affect the stock market in the slightest.

USO in a rising wedge, FWIW.

Now that momentum has turned away from resistance, it’s a perfect time to gap over tomorrow…

ES Diamond pattern: http://niftychartsandpatterns.blogspot.com/2011/11/es-diamond-pattern.html

I know it is opx week, the markets should head up. But I have this nagging feeling we may get a surprise downward move that will catch a few bulls offside. I sold most of my longs 1/2 hour before the close.

It’ll have to be a big surprise. As long as the euro drops before market hours and rises during market hours, the bots don’t care and will keep buying. I think the reason the bots were on overdrive, banging the market every 30 minutes today, was retribution for the MMs slamming them yesterday. 6th graders run this market. 6th graders with a lot of money.

All, remember VIX options expire tomorrow.

Here’s another chartist I check once in a while:

http://www.youtube.com/user/oldschoolchartist

He really gets thrown for a loop by the HFTs, but otherwise has a very credible and basic analysis technique. I used to think he was a permabull, but is rightly bearish now.

acpzed, thanks for the update. His most resent update looks very ominous looking if we break the 1240 level.

Crash is here?

A lot of PUMPing can be done in 11 hours. I’ll believe it when I see it.