Technical Analysis Update For 05/20/2012...

(to watch on youtube: http://www.youtube.com/watch?v=gVGi_lAJn7E)

This is the Technical Analysis of the what I see for this week in the stock market. Simply put, I see a brief bounce on Monday and selling the rest of the week. Make note that Tuesday is another ritual "eleven" day (22 = 11, as it's a multiple of 11... like 33, 44, 55, etc....). After the small bounce on Monday the market could easily be a large wave 3 down of some kind down on Tuesday and Wednesday.

Red

_____________________________________________________

Lindsey Williams Tells Us When The Stock Market Is Going To Collapse!

In the latest radio interview Lindsey Williams has been told "The 4 Things To Look For" so you will know exactly when the elite (Illuminati Reptilian Gangsters) are going to let the stock market crash. It looks like 2 (or 3?) of the 4 are already happening!

(to watch on youtube: http://www.youtube.com/watch?v=ESnDhAtspS4)

Here's the 4 things we all must look for to happen: (in NO certain order, but I'm sure the 4th one will be the trigger)

- Look for cracks in the derivatives market

- Look for currency wars to start

- Look for trade wars to start

- Look for interest rates to go up

The first one of this 4 things already happened, and it's just now starting. On May 2nd, 2012 this article shows up about Prudential Financial posting quarterly loss on derivatives. The key word that we need to continue looking for is "Derivatives" as Lindsey has pointed out many times now. And of course on Friday May 11th, 2012 we get the news that JP Morgan lost $2 Billion Dollars... which again was on "Derivatives".

Prudential Financial Inc. (PRU), the second- biggest U.S. life insurer, swung to a first-quarter loss as the value of the company’s derivative contracts fell. The stock dropped 5.6 percent in late New York trading.

The $967 million net loss compares with net income of $561 million a year earlier, the Newark, New Jersey-based company said today in a statement. Operating profit, which excludes the results of policies sold before the company went public and some investments, was $1.56 a share, missing the average estimate of $1.72 from 18 analysts surveyed by Bloomberg.

Prudential Financial Posts First-Quarter Loss Emile Wamsteker/BloombergThe headquarters building of Prudential Financial Inc. stands in Newark.

The headquarters building of Prudential Financial Inc. stands in Newark. Photographer: Emile Wamsteker/Bloomberg Chief Executive Officer John Strangfeld is expanding outside the U.S. and buying back stock as he seeks to boost return on equity. Prudential’s derivatives, which are used to guard against market risks, often lose value when interest rates rise and the company’s credit spreads narrow, as they did in the three months ended March 31.

The loss reflects “fluctuations in claims experience, expense levels, and market-driven items,” Strangfeld said in the statement. “Our business fundamentals remain solid and we are continuing to grow quality business and build our franchises in attractive markets.”

Prudential fell $3.44 to $57.50 at 5:03 p.m. Prior to the close of regular trading, the company had risen 22 percent this year in New York, compared with a 15 percent gain for MetLife Inc. (MET), the largest U.S. insurer, which reported a quarterly net loss of $144 million on April 26.

Complete story here: http://www.bloomberg.com/news/2012-05-02/prudential-financial-posts-first-quarter-loss-on-derivatives.html

Here's the JP Morgan story...

A massive trading bet boomeranged on J.P. Morgan Chase JPM -9.28%& Co., leaving the bank with at least $2 billion in trading losses and its chief executive, James Dimon, with a rare black eye following a long run as what some called the "King of Wall Street."

Jamie Dimon has been one of the U.S.'s most successful and outspoken bank executives since the financial crisis. On Thursday, he took the blame for a $2 billion trading blunder. David Reilly has details on The News Hub. Photo: Getty Images.

The losses stemmed from wagers gone wrong in the bank's Chief Investment Office, which manages risk for the New York company. The Wall Street Journal reported early last month that large positions taken in that office by a trader nicknamed "the London whale" had roiled a sector of the debt markets.The bank, betting on a continued economic recovery with a complex web of trades tied to the values of corporate bonds, was hit hard when prices moved against it starting last month, causing losses in many of its derivatives positions. The losses occurred while J.P. Morgan tried to scale back that trade.

Complete story and video here: http://online.wsj.com/article/SB10001424052702304070304577396511420792008.html

Now I'm not one to listen to the news to make trading decisions on as you all know by now. I focus on the technical analysis of the charts, some elliottwave, a little astrology and moon cycles, and of course the fake prints (FP's) and ritual dates. But this time we must all work together to watch the news closely so we can forecast the coming stock market crash before it happens.

Yes, they will still put out the usually positive news when they slowly taking the market down on light volume (like it has been for the last couple of weeks now), and they will put out negative news when close to a bottom because they want to buy at discounted prices from scared sheep in panic mode. This is what they have been doing heavily over the last 3 years (actually for as long as the stock market has existed), and I fully expect it to continue until all 4 of those things happen that Lindsey Williams speaks of.

At that point, the negative news will be real and everyone will be selling as the market crashes!

But until then I expect them to continue the usual game of tricking the bears like they have done so successfully over the last 3 years or so (ever since QE1, QE2, Cash for Clunkers, Buying back their own Treasury Bonds, and every secret injection of money into the market to keep it from crashing).

Looking back now I remember many, many times that the market was at a crossroads like where it closed this past Friday May 11th, 2012. It looks so bearish right now and I (along with many others) would always be looking for a crash on the following Monday... but it never happened. The gangsters would commonly gap it down on that Monday to lure in the last bear and then reverse it back up from oversold conditions and rally until option expiration that Friday squeezing all those bears and making their "puts" expire worthless... once again stealing from the sheep!

I know that soon it's going to really crash and not trick the bears but instead trick the bulls, but so far I don't think we are there just yet. In the past I can safety say that I would have went short over the weekend when coming into a crossroads period like we have now, and each and every time I was taken to the cleaners on Monday as the bulls returned to spank all us bears. So, will this time be different? Will the bears win out next week as we tank on Monday and continue tanking all week until Friday OPX? Or will this just be one more trick again like it was so many times in the past...

I wish I knew the answer, but I don't...

So, I just have too focus on the facts at hand and make my decisions based on those facts only... with no emotions included. Continuing on where I left off with the 4 things that Lindsey Williams spoke of I see that the 2nd thing has already happened as well. That 2nd thing is the "Currency Wars", which it seems that China has already started the ball off rolling on this one by letting their currency float from 0.5 to 1.0... essentially "doubling" the cost of goods, products and services (made in China) here in America from the devalued US Dollar compared to their more valued Yuan. Here's the story...

China to allow the yuan to float more freely

China has said it will allow the yuan to float more freely as part of its efforts to reform currency policy. The move comes as China has been facing pressure from its trading partners to let the yuan appreciate. Beijing has been accused of keeping the value of its currency artificially low to help its exporters.

While Premier Wen Jiabao said Beijing will push for reforms, he added that the yuan's value may already be close to an optimum level. "We will step-up exchange rate reforms, especially in increasing two-way fluctuations," premier Wen Jiabao said on the last day of the National People's Congress meeting.

"In the Hong Kong market, NDFs (non-deliverable forwards) have started to fluctuate both ways. This tells us the yuan is possibly near a balanced level."

'No point in predicting'

China, which for many years pegged its currency to the US dollar, began to allow the yuan to appreciate in 2005, but in a very measured way. It has risen by almost 8% in the past 24 months against the US currency.However, China's trading partners as well as currency analysts continue to maintain that despite the rise, the yuan is still undervalued. This, critics believe, gives China an unfair advantage in international trade."The currency has come a long way. But is still has a fair way to go," Sean Callow of Westpac told the BBC.

Meanwhile, China has said that while it was willing to let the yuan appreciate, a sudden rise in its value will hurt its export sector, which is already facing a tough time as key markets in the US and eurozone experience sluggish growth.

The fear for China is that a strong currency will make its goods more expensive to foreign buyers.

At the same time, profits of manufacturers may also be dented when they repatriate their foreign earnings back home.

Analysts said that until Beijing feels absolutely secure about the impact of a stronger yuan on the export and manufacturing sectors, it may continue to keep tight controls on the currency's trade.

"We have heard it so many times that there is no point in predicting when it will happen," Mr Callow said.

Broader role

Wednesday's announcement is being seen by some as another step in China's efforts to promote a more international role for the yuan.

Beijing wants the yuan to be an alternative global reserve currency to the US dollar, which analysts say will only be possible once the yuan is fully convertible. China has taken various steps in recent months to loosen its grip on the currency.

Last year, Beijing agreed a deal with Japan, its biggest trading partner, to allow a direct exchange of respective currencies without first converting them to the US dollar.

It has also approved a plan to allow one of China's largest asset managers, to offer its Hong Kong customers the option of investing in the yuan directly by buying stocks and bonds on the mainland.

Analysts said while these were key steps, China still needed to open up its markets further.

"You still have a very limited range of products to choose from if you want to invest in China," said Westpac's Mr Callow.

"They still need to do much, much more, if they want to be a real player in the global market."

We also know that Iran and India have been trading "gold for oil" instead of the US Dollar for several months now from previous statements that Lindsey Williams has told us. This is verified here in this article and video from RT News: http://rt.com/news/iran-india-gold-oil-543/ China has also decided to trade with Japan and NOT use the US Dollar in their transactions, which they have been doing already since the first of this year according to this article from Bloomberg: http://www.businessweek.com/news/2012-01-04/yen-yuan-trade-plan-to-cut-dollar-dependence-of-china-japan.html

SIDENOTE: Is this considered "Trade Wars" that Lindsey Williams spoke of?

If so, then the only thing left is for Ben Bernanke to announce an "interest rate" increase...

When this happens the stock market is going to crash! We either have "2" or "3" of the the "4" things Lindsey Williams spoke already happening. I'm just unclear on what "Trade Wars" really means according to the elite that told him? If I'm thinking logically then it means exactly what has happened with China, Japan, Iran, India, and other countries are already doing right now... "Trading between themselves without the US Dollar!".

This basically means we only have a very short time period left before we are going to see Ben Bernanke raise interest rates and cause the stock market to crash. So, when will this happen? Has the crash already started? If so, then Bernanke should just make the announcement right about the time the stock market is ready to make a powerful "Multi-Wave 3 Combination" move down... making the interest rate increase do the most damage to the market...

SIDENOTE: (In Elliottwave terms, wave 3's down are the most scary waves and a combination of more then one wave 3 down makes for a "crash wave").

I'm going to ask that everyone keep your eyes on Ben Bernanke and post anything you find on him here on this blog post. We need to know every meeting and announce this guy makes as he will be the one that raises the interest rates, and this news will shock all investors and traders when it happens. I need you all to continue to post updates on his schedule as "IF" we see something setup for a weekend, and it's some type of announcement from him.... look out below on the following Monday!

I'm going to go out on a limb here and say I'm expecting him to make such an announcement (if it's a surprise speech) after the closing bell on some future Friday coming (if he doesn't do it at an FOMC meeting). It will be a very ugly Monday after this announcement and the market will have a crash that week for sure. So, when would you make this announcement if you were a gangster evil criminal like these Satanist Illuminati Cabal are?

Let's piece together what we have already been told...

(to watch on youtube: http://www.youtube.com/watch?v=Yl8P77YBJzk)

Lindsey Williams was told by his elite source that there "Will be NO Crash in March, April, May, or June"... and assuming they are still in full control of this stock market (I believe they are) then the crash will happen after June. Maybe the selling starts now in May, chops around some in June, and crashes in July/August? We could see the larger wave 1 down happen here in May and then some chop sideways to up for the wave 2 in June... and then "BAM" the huge "Crash Wave 3" in July!

Looking here at Bernanke's schedule on the "Federal Reserve" website (http://www.federalreserve.gov/whatsnext.htm) we see he will speak next Wednesday on May the 16th, 2012... which doesn't make sense for him to announce the interest rate increase to me as it's not any ritual date that I'm aware of. Plus that goes against the "No Crash" months that Lindsey was told.

SIDENOTE: I covered the ritual dates in my prior post here: http://reddragonleo.com/2012/04/29/the-mass-arrest-timeline-is-here-as-the-stock-market-pauses-in-the-eye-of-a-hurricane/

The date that stands out the most too me is June 11th, 2012 as not only is it another ritual "eleven" date, but it's also the date on the Simpsons clock too! There's the previous 9/11/2001 false flags that the Illuminati Cabal created (twin towers staged event by the Illuminati) and 3/11/2011 (attack on Japan with a planted nuclear bomb and use of HAARP done by the Rockefellers and the Bush families), which certainly makes 6/11 look another important date for them to stage something on.

However, that doesn't line up with Ben Bernankes' scheduled speaking dates. Looking again at his schedule I see that there is another FOMC meeting on June 19th-20th, 2012... and that a couple of days later on Friday we have another ritual "eleven" date "The 22nd". From past history we find that most crashes happened on a Friday or a Monday, so "IF" Bernanke announced a rate hike on the interest points during that FOMC meeting I could easily see a crash to follow on Friday the 22nd of June, 2012!

This would only be smaller crash I suspect, leaving the bigger one for July/August...

Once we get to that point we'll be counting the "Wave 3's" that line up during that period, but I suspect that the deadliest combination of them won't happen until a month or so later. This would be what Lindsey Williams is taking about when he's mentions the word "Crash"! To simplify the wave count I'll just call them a name based on the chart that I'm looking at. For example, you have monthly charts, weekly charts, daily charts, 4 hour charts, 2 hour charts, 60 minute charts, etc...

So, basically... going back to the crash of 1929 (and even prior to that) you have these larger wave cycles that happen through the history of the stock market. (Yes, they are all created on purpose by the Illuminati gangsters... including the planned 1929 crash). Nevertheless, when many of them all line up together you get "Stock Market Crashes". If you even include a yearly chart along with all the others mentioned, you have a large cluster of wave 3's down lining up this year and/or next year.

I'm again speculating that the several of them will line up in late June and cause the crash to start the week that Bernanke raises interest rates (probably June -19th-20th, 2012). But, this might only have 3 of 5 possible wave 3's aligned up together and maybe the more deadly 4 of 5 wave 3's doesn't happen until later toward the end of this year. This again... is what Lindsey speaks of when referring to a "crash". But that doesn't mean we traders want to wait for the biggest wave down to happen as we could miss it entirely. It's going to be very crazy during this time period and I'd rather be position short prior to "The Big One" and just ride out the crazy swings.

Let's think hard on Bernanke's schedule listed below to see if I'm missing anything? The date set for this coming Wednesday, May 16th has notes below it saying "Meeting of April 34-35, 2012"... which means too me that what he's going to discuss there is what's already happened last month. This "should" indicate that nothing new will happen during this meeting.

May

May 15 Speech--Governor Elizabeth A. Duke

Prescriptions for Housing Recovery

At the National Association of Realtors Midyear Legislative Meetings and Trade Expo, Washington, D.C.

9:30 a.m.May 16 G.17 Statistical Release

Industrial Production and Capacity Utilization

9:15 a.m.May 16 FOMC Minutes

Meeting of April 24-25, 2012

2:00 p.m.May 28 Holiday - Memorial Day

The daily and weekly statistical releases scheduled for today will be released on Tuesday, May 29.June

June 1 G.5 Statistical Release

Foreign Exchange RatesJune 6 Beige Book

2:00 p.m.June 7 Z.1 Statistical Release

Flow of Funds Accounts of the United States

12:00 p.m.June 7 G.19 Statistical Release

Consumer Credit

3:00 p.m.June 15 G.17 Statistical Release

Industrial Production and Capacity Utilization

9:15 a.m.June 20 FOMC Meeting

Two-day meeting, June 19-20July

July 2 G.5 Statistical Release

Foreign Exchange RatesJuly 4 Holiday - Independence Day

The daily and weekly statistical releases scheduled for today will be released on Thursday, July 5July 6 G.19 Statistical Release

Consumer Credit

3:00 p.m.July 11 FOMC Minutes

Meeting of June 19-20, 2012

2:00 p.m.July 18 Beige Book

2:00 p.m.

SIDE NOTE: This also adds to my theory that next week we'll see the market rally some as not only is it an "option expiration" week (which is usually bullish) but it's an FOMC week as well... and turns are usually made then.

Looking at the future FOMC date in July we see the notes that say "Meeting of June 19-20, 2012"... which again leads me to believe that noting much new will be announced during that meeting as it appears to be a rehash of the prior meeting June. This of course all leads up to focus our attention on that June 19-20, 2012 FOMC meeting as there are NO notes below it... and it's a 2 day meeting. I highly suspect that whatever comes out of that meeting will be something NEW, and my personal thoughts are that it will be a RATE HIKE!

Supposably, the Illuminati Cabal Satanist Pigs are also planning another "False Flag" event for the London Olympics (http://www.london2012.com) here in 2012, and they start on July 27th... just one month after this "speculating" date of the first "Crash Wave" down the week of June 19-20 when I think Bernanke will raise the interest rates. Although I don't think they will be able to pull this one off, as I believe the good aliens will stop them from setting off another nuclear bomb, that doesn't mean that they don't have a "plan B" setup to kill thousands of innocent people without a nuke.

This could easily line up with another more power "Wave 3" combination that could be the "Crash Wave" that Lindsey Williams is talking about? It would line up with Elliottwave counts and also start the war that these pigs want to bring on their "New World Order" and cause oil prices to skyrocket up to $150.00-$200.00 per barrel.

The problem is that these murderers are now in the last year of their reign of power according to the Mayan Calendar. And, "IF" the Drake story pans out, the good guys in the Pentagon are planning to arrest them all at some point this year. However, the "When" is the tough part to know as even those people like "Drake Bailey" (http://projectavalon.net/forum4/showthread.php?44252-Who-is-DRAKE-The-Loyal-Order-of-the-Royal-Dragon), Ben Fulford, David Wilcock, Lindsey Williams and many others are doing their part to stop these evil people (maybe "people"?... more likely reptilians) they might not get it done in time before this caged beast lashes out one more time in a "Final Attempt" to bring on their planned "Armageddon".

While I do believe that we (and mother earth... Gaia) has entered a new timeline that doesn't include the destruction of 80% of world population and does include the "Freeing of Humanity"... that doesn't mean it's going to be a 100% easy transition. Every other blog that I've read where Aliens/Angels are communicating with humans here to tell us what's happening on the spiritual/alien/angel front all say the same thing... which is that it will be a bumpy road but not the end of the world as the Cabal planned.

They all say that many of these Reptilians and their human minions are being taken off this plant (to where is unknown... hell I hope! LOL! Sorry, just my human emotions coming out. I'll have to work harder on that "forgiveness thing"). Obviously the most well rooted Illuminati gangsters are still here and still in control of this stock market... for now at least!

That's what I feel that Lindsey Williams is trying to say in the radio interview above on this blog post. It's like he knows that the plans are still going to happen on schedule because the Illuminati haven't lost control yet... but I think Lindsey also knows deep down that the final demise of these pigs is coming, and I believe it's this year!

Even Lindsey quoted previously in his video's that he believes it's "The Beginning of the End of The New World Order"... meaning to me that they fully plan to make sure that this will be the "Biggest Crash in History"! Why you ask? Because it's "do or die" time for them. They are all coming to the end of their reign of power, and they know it. It's the 4th quarter with mere seconds left on the clock in this Super Bowl game and all they have left is one "Hail Mary" pass.

If the good aliens intercept the ball and no "False Flag" happens during the Olympic games... the Super Bowl is over as Satan just lost final game in this 6,000 year series of battles. Satan (the Illuminati Cabal) hasn't previously faced this kind of competition and won repeatedly in all the Super Bowls in the past. But he must face not only the superior good aliens/angels, but also he's own defense members (the good guys in the Pentagon, White Dragon Society... hopefully they are real?) who are now turning against their master and siding with the other team now (us "Light Workers"... aka, the Sheep!).

Satan had better hold on hard to the ball right now and keep his offensive team on the field as if he let's his defensive team back on... they will gladly let "The Sheep" score another touchdown. Satan has been up by an accumulated "zillion" points over the last several thousand years, but in this final showdown of "good versus evil" that insane lead is now down to less then a hundred point gain.

Here we are all are in the last quarter of the last Super Bowl game and we sheep actually have a chance to win the game!

What we do now is continue to "Do The Wave" in the stands supporting the players on the field (continue spreading the word about the plans of the gangsters on the internet like Drake, Wilcock, Fulford, Williams, and many other players for "The Light" do). My part isn't so much about spreading that news (but I've done a lot of that here in the last few months) but more about trying to figure out how all this affects the stock market... and of course how we can position ourselves to at least "not lose money", but preferably make money over the coming months.

What we do now is continue to "Do The Wave" in the stands supporting the players on the field (continue spreading the word about the plans of the gangsters on the internet like Drake, Wilcock, Fulford, Williams, and many other players for "The Light" do). My part isn't so much about spreading that news (but I've done a lot of that here in the last few months) but more about trying to figure out how all this affects the stock market... and of course how we can position ourselves to at least "not lose money", but preferably make money over the coming months.

Hopefully in the future all these good things that are coming will eliminate the need for money and we'll all live a life like in Star Trek, where money isn't needed for basic necessities but only for those who want more fancy, cooler gadgets and stuff. In other words, money is only for the "go getters"... which is fine with me as some people just have a need to achieve more.

Others will just sit back in there comfy home and take it easy. Without the need for money for basic survivor they can spend their time working on their favorite hobby or something. Maybe they will just hang out and do nothing... doesn't really matter as it's up to them to decide. The whole point here is that without the need for money we sheep will be FREE! This is what free will is all about but it was stolen from us by these Illuminati Cabal Gangsters who's plans are to force us to work everyday for them just for us to survive.

This means that we are all slaves... slaves to debt! It's their creation and one they invented for the sole purpose of controlling us sheep and making us do whatever they want us to do. Those days are over soon as we head into the "Golden Age"... where there'll be NO place for evil to exist, live, and multiple like the cockroaches that they are.

As for the short term on the stock market...

Put simply, I do still believe they will rally the market some next week. While I'm not looking for some huge rally (although it wouldn't surprise me anymore) I do think that a bounce is coming before the next wave down starts. I know that there is a bear flag on the daily chart and it could still play out on some gap down Monday morning. But I expect them to turn it back up Tuesday (maybe Wednesday since that's the actual FOMC meeting date) and continue into option expiration Friday. It's again "rare" that the gangsters allow the "put holders" (the bears) to get paid out on their short positions.

They almost always trick the bears by putting in the low on the Thursday or Friday the week prior to the option expiration week. This implies that Friday's low on the 11th could have been the low before the rally back up to squeeze out these short positions so the market makers don't have to pay out on them. Remember, they are in the business to steal your money... not make you rich!

Unless "The Crash" has already started I still expect the gangsters to continue to play the same tricks and games that they have for the last several years since they started these various "QE" programs... which is simply a system to keep this bull alive for a little bit longer. They should have let the market fully crash in 2008-2009, but they pump the bull full of steroids (free monopoly money from Bernanke's printing press).

This reminds me of the movie "Weekend at Bernie's" where Andrew McCarthy and Jonathan Silverman pretend Bernie is still alive while they track down hidden money to clear their names. It's a very funny movie and quite apporiate for these Illuminati gangsters as their story is just the opposite. They are just keeping the bull market alive long enough for them to steal all the money! So they dress up this dead bull to look alive with manufactured jobs numbers, economic growth, and unemployment data.

But make NO mistake about it... this bull is a Zombie Bull and about ready to finally kick the bucket!

As for whether or not we'll make one more "new high" or not... I don't know? These gangsters want to create massive debt before they let the bull die, so it wouldn't surprise me. However, I'm still focusing my attention on that FOMC meeting in June as I believe that will be the final icing on the cake.

So for next week I'm only expecting some sort of bounce to happen, not necessarily some new high. My thoughts are that we'll bounce next week and then sell off again the week after that. I'm thinking that we'll sell off with some type of "wave 3" down (not a huge one like I'm expecting in late June) to make a low in the last week of May or the week prior to it.

Then a final rally up into that June 19-20 time period when I expect Bernanke to raise the interest rates surprising most traders and investors. "IF" a new high is put in just before that meeting then this should be a crash like that in 1987... only worst! It would be better if the market continued down into that date, but some how I think the gangsters are going all out and will likely push it up to at least a slightly lower high or double top... if not a new high, and then create the greatest stock market crash ever!

Finally, your update about David Wilcock, Ben Fulford, and Drake... be prepared though, as you're not going to like it!

(to watch on youtube: http://www.youtube.com/watch?v=nHXgvi03fCI)

Go here: http://www.redicecreations.com/radio/2012/05/RIR-120510.php

While I'm still "hopeful" that all we have been covering lately happens soon, I need to stay grounded here right now and just focus on what I've already seen. And that is the stock market is still controlled by the gangsters right now and they have a planned stock market coming later this year. This I fully believe they will succeed in making happen. The rest of the stuff about the mass arrests is still unproven right now, which is why I need to just stick with what I know and focus on surviving.

While I'm still "hopeful" that all we have been covering lately happens soon, I need to stay grounded here right now and just focus on what I've already seen. And that is the stock market is still controlled by the gangsters right now and they have a planned stock market coming later this year. This I fully believe they will succeed in making happen. The rest of the stuff about the mass arrests is still unproven right now, which is why I need to just stick with what I know and focus on surviving.

This means I must still work on trying to time this stock market crash to make a profit from it. If we all ascend and don't need money anymore then there'll be no harm done. If nothing happens and we don't ascend... and no one important gets arrested in this "mass arrest" plan, then I'll still be safe as I will have made some money to help protect me instead of losing everything from a 40% Overnight Dollar Devaluation.

This means I must still work on trying to time this stock market crash to make a profit from it. If we all ascend and don't need money anymore then there'll be no harm done. If nothing happens and we don't ascend... and no one important gets arrested in this "mass arrest" plan, then I'll still be safe as I will have made some money to help protect me instead of losing everything from a 40% Overnight Dollar Devaluation.

Let's face the facts that these Illuminati Reptilian Gangsters have been here in control for a very long time now, and getting them out of those positions isn't going to be easy. So while I'm still living here in this controlled matrix that the aliens refer to as "hell" I'm going to play the game to the best of my abilities. This means continuing to play by the rules of the one's who set the rules... and that's the gangsters! This is why I still firmly believe they will trick all us bears this coming week and rally it up some from oversold conditions.

However, I could see a "possible" gap down on Monday still, but by the end of the week I do expect a minimum of a 38.2% retracement (if not 50% or even 61.8%) back up from the initial move down that started around 1415 SPX on May the 1st, 2012. I've been sucked in to this "negative media news" bear trap too many times in the past 3 years and "EVERY TIME" I was wrong and lost money going short. I have to play those odds and assume that this time "won't" be different as the game is still to steal the bears' money with another short squeeze into option expiration Friday.

However, I could see a "possible" gap down on Monday still, but by the end of the week I do expect a minimum of a 38.2% retracement (if not 50% or even 61.8%) back up from the initial move down that started around 1415 SPX on May the 1st, 2012. I've been sucked in to this "negative media news" bear trap too many times in the past 3 years and "EVERY TIME" I was wrong and lost money going short. I have to play those odds and assume that this time "won't" be different as the game is still to steal the bears' money with another short squeeze into option expiration Friday.

Here's the thing...

What if the Illuminati Reptilian Gangsters that are resigning in masses (http://americankabuki.blogspot.com/p/131-resignations-from-world-banks.html) are doing so because they are on the "inside" and know about the coming stock market crash, and simply want to cash out at the top and steal the sheeps' money like they always have done in the past? Nothing new here, just the same old game where those in power exit first before the crap hits the fan.

Then they come in after the crash with all this money (which they stole of course) that they are going to now use to save the economy... making them look like hero's just like the Rockefeller and JP Morgan family did after the 1929 stock market crash (which they created of course). If it sounds like I'm changing sides here it's a little of that, but more like I'm just keeping my eyes and ears open and not sticking to one conclusion.

In that audio interview above Cliff High suggests that it's possible that Drake is mind controlled (that's my interpretation of what I heard him say and may or may not be correct). If so, then the Illuminati Reptilian Gangsters have infiltrated the internet realm of "Light Workers" and planted "dis-information" quite successfully with people like Drake, Fulford, and Wilcocks that all seem to be 100% genuinely good people.

Think about that for a moment now...

If you were one of the gangster pigs and had access to trillions of dollars, which will let you create the absolute best "Think Tank"... how would you trick the "Red Pill Takers" like myself and yourself (since you are reading this blog post and "an open minded" person wanting to learn the truth) into believing that the changes coming are going to be good for us sheep? It's easy to trick the "Blue Pill Takers" as they still pump out mind numbing garbage TV to distract them from the real truth.

But tricking us "Light Workers" has too be done correctly as we aren't that easy to be "Conned". You can't send in your "Trolls" with "dis-information" as we sheep would see right through that and not buy into the lies. So, how about buying off someone who is already a well respected "Light Worker" that has been spreading the truth for a long time and has a big following that will listen to what he or she says?

Seems easy enough right? They have plenty of money to do that with, so buying them off is just a matter of "how much". Problem is that the "followers" will quickly see through that persons' new material as being a lie. While you could buy these people off with either a lot of money or threats to their lives, we sheep would sense the changes in their voice and figure out that they have been compromised.

So how again to you trick the "Light Workers"?

I'd say that they would use some type of mind control to trick the famous "Light Worker" with the big following into "Believing" the "dis-information" himself/herself to the point that they are still believed by the sheep. Why? Because the sheep following that leader will sense that they are telling the truth, and not spreading dis-information. If you let someone come to their own conclusion based on separate pieces of facts that you planted, allowing them to put it together themselves (which aren't true), instead of simply telling them the whole lie in hopes that they will believe it and spread it... you have successful let them sell themselves!

Doing so will make it very easy for the sheep that follow that person to continue following that person and now believing the newly planted "dis-information". The point here is that you must always continue to learn new things and find new evidence and not come to any conclusion based on your personal feelings.

Doing so will make it very easy for the sheep that follow that person to continue following that person and now believing the newly planted "dis-information". The point here is that you must always continue to learn new things and find new evidence and not come to any conclusion based on your personal feelings.

Let the evidence speak for itself. Which in this case, is that the gangsters are still in full control. Therefore, until I actually see the mass arrests happen I'm going to assume that the closes thing to the truth is from Lindsey Williams' source. He is afterall... "one of them"! Yes, he could very well be giving out timely "mis-leading" information, as they still do want to steal you money (like giving Lindsey the news of the coming 40% Dollar Devaluation right when the dollar had bottomed and ready for a bounce... which tricked a lot of sheep into shorting it and losing money).

But there is factual evidence that clearly shows that the Illuminati pigs do indeed tell us sheep in advance what they are going to do to us. They own Hollywood and put out these warning in the movies they do. Of course it's done in a "subtle" manor so we sheep don't see it until after it happens for real, but the fact remains that we are told in advance. It's up to us to listen and prepare for it.

In conclusion...

Since I am not "mind controlled" I still have the ability to switch sides. I have now switched sides from being a full believer of this "Mass Arrests" story to "I'm hopeful but not convinced". This is due to a "lack of evidence" to support this story. If Fulford, Wilcock, and Drake aren't too caught up in this story and not mind controlled (by selling themselves on the story without proper evidence to support it) then maybe something new will come out to help them re-investigate and find out what is really happening.

I truly hope they do dig deeper to see what the truth really is, as right now I'm no longer a believer. I just don't see the proof right now. In fact, the mass resignations by the banksters world wide is actually proof that a stock market crash is coming on schedule as planned by the elite thugs years ago. Those gangsters are simply getting out in front of the crash.

I truly hope they do dig deeper to see what the truth really is, as right now I'm no longer a believer. I just don't see the proof right now. In fact, the mass resignations by the banksters world wide is actually proof that a stock market crash is coming on schedule as planned by the elite thugs years ago. Those gangsters are simply getting out in front of the crash.

They will likely "act" like they are switching sides from "the dark cabal" to working with the "light" after the crash is over so they will look like heros... just like they planned many years ago! Different spin... same outcome! We sheep get a new master... yay! Aren't you glad that the old boss is gone and you get the new one?

Yes master, I'm so glad to see you... but why am I still a lowly janitor here at the new "Godman Sachs" cleaning up the crap that comes down the pipe, just like I was a janitor with the old boss? And now that you have devalued the dollar 40% overnight, how is this new money going to buy me anymore food or make me wealthier? I'm still just as poor as before boss, but you seem so much nicer so I'll shut up now and go back to work making you richer...

Red

Yes lot’s of drama with Drake. Time will tell with his mass arrests. Got more silver in the mail the other day…I see that ES just got back from being down 7 points…What else is new..

You can’t go wrong with owning silver and gold Bighouse, as it’s going up regardless of who wins this battle between good and evil.

well the last few days silver took a dump lol…My next buying area will be $26

I think silver is about ready to rally BH…

http://screencast.com/t/B6KfZXnknlst

MF global bankrupcy was also a derivative bet that turned wrong.JPM is far from finish too IMHO.

There will be more coming Roilion… I’m sure of that. Keep your eyes and ears open for everything I discussed in this post. Timing this crash isn’t going to be easy…

By the way Red, i think you are spot on with your second video…

Thanks BH… just trying to keep myself grounded and not get too caught up in all this stuff. Mis-direction comes in many forms, and while they can’t get to me on the mindless TV programs, they are still trying to trick me through the internet. I must keep my focus on this market, and what little facts I have.

You talk about a false flag attack during olympic time but we need to not forget about the G-8 meeting and Nato summit from 18may to 22 may in Chicago.Everything is ready there for a false flag attack.

http://theintelhub.com/2011/05/30/will-there-be-a-new-false-flag-attack-in-chicagos-sears-tower/

Do you see the date of that exercise Roilion? It’s June 10th… one day before 6/11, and if you remember the gangsters did a similar training exercise one day before 9/11 in 2001. Remember the Simpsons Clock points to 6/11 too…

You are right but they just finished one in Chicago.

http://www.prisonplanet.com/black-military-helicopters-conduct-covert-exercises-over-chicago.html

http://www.chicagotribune.com/news/local/sns-ap-il–militarytraining,0,3625625.story

Looking closer now Roilion I missed the year… it’s 2011, which has already passed now. The operation they called “Red Dragon” must have already been done last year.

You are right but the big event are for this year in Chicago and they are preparing something…maybe.

Read this

http://www.infowars.com/university-told-to-prepare-for-evacuees-during-nato-summit/

Funny Red,the link i just gave you in my precedent post if you go read it,there is an operation,exercise the bad guy are doing for a false flag attact and it’s called ”RED DRAGON” like your blog…:)

That’s funny Roilion… LOL! I chose my name because I was born the year of the Dragon and I’m born in August… which makes me a Leo.

I’m a Leo too and born the year of Tiger:)

Maybe you should have a blog called “TigerLeo” or LeoTheTiger”… LOL! Very cool…

It will be nice to have my ”LeoTheTiger” blog but i don’t have your talent to talk and to white big article like your are doing.

I think a dollar devaluation could come after Friday, June 29th close of market. Monday is July 2nd and many people will be off or traveling for the holiday on Wednesday July 4th. So people will be more than distracted by the Holiday. Maybe banks will even call a bank holiday then too. I wonder RedDragonLeo what specific investments you’d plan to make if you knew June 29th was the date?

I suspect that the dollar devaluation will happen when they announce QE3… but that should be after the crash I’d say.

I would expect that any market crash, if it were to occur, would unlikely happen until after the Facebook IPO. It would allow many of the elite who likely invested in this to cash out big and suck in as much retail money for maximum pain.

I don’t think the elites really care that much about one more IPO. Most of them I believe are already out of the stock market by now. It just being held up by Fed’s PPT program right now.

Gold Triangle update:

http://niftychartsandpatterns.blogspot.in/2012/05/gold-triangle-update_14.html

Gold needs to stop from going down soon…

Silver is right on that support line now BH… it’s bounce now or look out below! I think it will bounce though, as there are a lot of bears on board this train right now… and you know what happens then.

So far, everything is going as expected. We had our gap down today, and we should put in a “bottoming tail” candle pattern on the daily chart by the close if we are to rally the rest of the week.

Honestly i think they will continue to push gold and silver down.In my point of view they need to do it if they want to save JPM witch started to have loss with derivatives.We need to remember JPM is short over 150 millions OZ of silver and i suspect they want to try to undo these bad bet.

The Death Cross: JPM’s stock price poised to cross below price of silver.

Posted on May 11, 2012 by maxkeiser| 22 Comments

As we’ve been saying for two years. JPM uses it’s own stock to collateralize naked silver short positions (echoes of Lehman and Enron). My analysis has concluded that liability from a rising silver price vs. loss of collateral value of the stock renders JPM’s balance sheet null and void when JPM’s stock price drops below the price of Silver. We’ve only seen this a couple of times since I made this call two years ago, BUT NEVER ON A SUSTAINED BASIS of more than a day or so. When the price of Silver popped over JPM’s stock price, the London desk quickly fabricated a few billion fresh naked silver shorts to tamp silver’s price down. Given this week’s revelations regarding JPM’s reckless balance sheet incineration the ‘crash jp morgan, buy silver’ trade has never been more important as a way to take down this financial terrorist. The SLA has been winning battles all along. Now we are poised to win the war as well. Bye-bye Jamie. NOTE TO HEDGE FUNDS: Sell JPM’s stock naked to Hell. This is the easiest money you’ll make this year.The JPM losses are the whiff of a significant deflationary force in play. JPM losses as a wise PM told me – $2 billion why not $20 billion. Is this bad risk management? This loss happened in the risk mitigation unit and not a risk taking one. There have been dislocations in the credit market these last few months and now we know why.Is it that the derivatives risk is becoming more and more centered with a few banks, and collateral is just not forthcoming because the collateral has been promised many times over? As we move towards central clearing of these contracts will we see legal reconstitution of said contracts to obfuscate the reality that they are worthless. They are being exposed for the sticks of dynamite, under the foundations of the financial system, that they are.

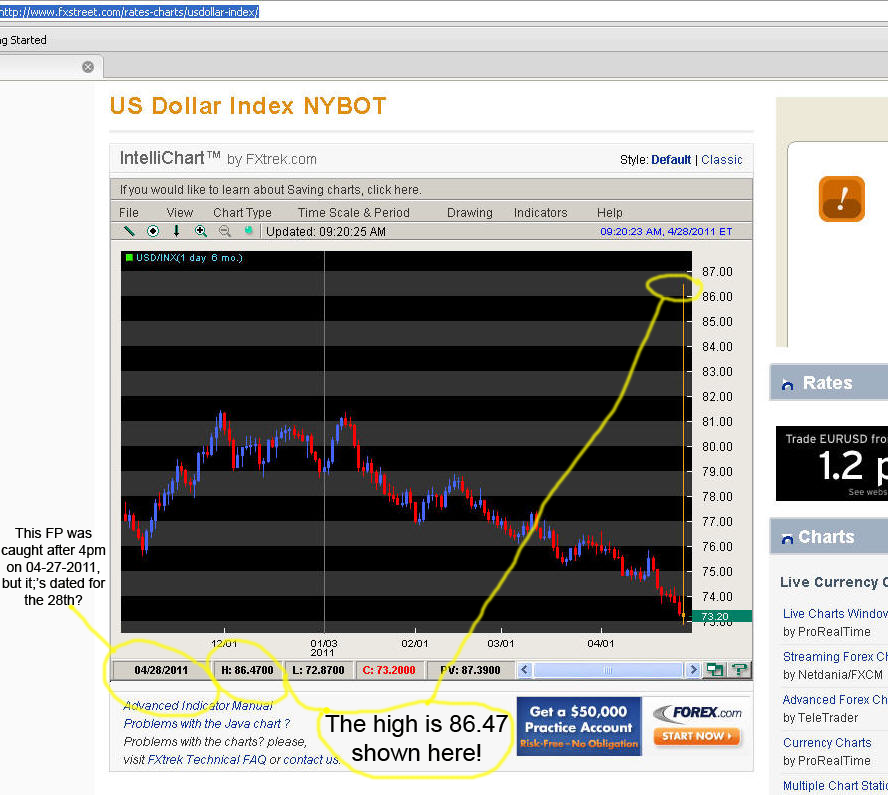

US Dollar Resistance levels:

http://niftychartsandpatterns.blogspot.in/2012/05/us-dollar-resistance-levels.html

I think the dollar is going to this FP San, but not without a pullback first…

Patterns too suggest Higher targets Leo. Above 82 it may target 86 and 88 levels with pullbacks as you said.

What will they use this time as a news to push the market and rally until option expiration that Friday?

Too soon for the QE3

Will they fake numbers of the retails sales and Business inventories due out tomorow?I don’ think soo.

My bet if they decide to push the market will be a news at the close today or tomorrow morning about Grece forming a new gouvernement.

Even the slightest good news right now should cause a short squeeze Roilion. They don’t allow the bears to make money, and right now the bears are fully loaded on this train. The news will be irrelevant, as the charts say a squeeze is coming soon.

Many of the various ETF’s are all at critical support levels right now. If they don’t bounce then we could crash… but I don’t think it’s time for a crash yet, therefore a bounce is more likely as the support should hold.

In future though, do note that “crashes” happen from “oversold” levels. There will be a point in the next month or so that the market will be very oversold and NOT bounce. Then we will see the crash…

I agree with you I don’t think it’s time for crash yet but maybe are wrong and now is maybe the time they have choose to crash the market.We will know that very soon.

Ron Paul Suspends Active Campaigning for GOP Nomination (story developing)

NOOOOOOOO ICan’t beleive that.LINK?

http://www.cnbc.com

I’m going to just write Ron Paul’s name in when I vote… Mitt Romney can kiss my ass!

I would like to wish every one much success in the next few months. This is my last comment on this blog, due to the new direction it has taken.I will not be posting any more intuitive hits that I may receive. For some, this will be a relief. LOLOLOL

If I am wrong with my earlier comments, I will be back to apologize shortly after July.

PS Expect the UNEXPECTED !!

Be well.. We will keep the light on for you…

I’m assuming you are leaving because my lost faith in this “mass arrest” thing. I hate to see you go old friend just because I have a different view then you. I’m still “hopeful” that this all happens, but I have to state my view as see it.

Just like you have your feeling, and I respect them dearly, I too have mine as well. If new evidence appears that confirms this, or any good news… I will regain my faith again and promote whatever those facts present.

For that, I ask that you do return and not view this post as me giving up but simply me focusing on what I currently see in front of me. If more is revealed, I’ll be the first to celebrate again. I haven’t switched to the darkside PW, I’ve only lost my way…

Oh!Sad I liked you!We have the same timing(almost)about the market May-June and have my second scenario in august -sep- if the may- june doesn’t happen.Keep faith in your felling my freind!Good luck with everything in your life.

Are chatting on other blog?it’s will be interseting to keep contact!

Just tought about this Peafulwarrior8 if the news about Ron paul stopping campaining is true it mean my 2 scenario just lost a little bit of power.Maybe the first one may-june and your may-july is the good one.Any way for a week now the market is going down and it is maybe it’s already the crash in action.We will see .Good luck.

Moody’s downgrades ratings for 26 Italian banks

Hum!Still bad news!

Per my post on Friday

“One(won) must know your intervals to be ready for the harvest of speculative capital.

10 of 87’1087 = 187

SPX close today 1353.39

SPX close on 10.3.8′ (friday before 2008 crash week) 1099.23

1353.39 – 1099.23 = 18.7%

5.5.10′ (day before flash crash 111 Ritual) SPX close = 1165.87

1353.39 – 1165.87 = 187.52

It’s all in the numb-ers…….”

Note the VIX close today 21.87 (187 right for everybody to see)

Then the all important $SPX -1.11%

The co-relational 111 interval to the triple 111 TL convergence.

As the script is written so beautifully….

Hi Sundancer. good to have u. I am Reza by the way

From the looks of today gang it’s not looking good for any bounce to happen. It’s rare to see a corrective rally start from an “all down day”. This means the best the bulls can hope for is to see a gap down in the morning followed by a strong reversal within the first half hour or less.

If not, then the bears are going to breakthrough the current support and we’ll likely see some type of wave 3 down happen. So could we crash this week? It’s looking more and more possible right now. Remember, crashes “usually” happen from oversold conditions… and the market certainly qualifies there.

we are right @ RL in futs tonight, 1337, next up is 1338, 1344, can’t get through there next level down is 1325, and being as i mentioned to you on phone if they bounce it tonight could give them a little rest before clawing down tomorrow 🙂

Got this from a poster on Ben Fulfords blog…Just passing it along……

Comment by beatbox151 on May 15, 2012 @ 2:10 am

Drake and the others have until the 23rd to commence arrests of the cabal. Otherwise they will miss the deadline given by Drake himself on the 8th of April.

30 to 45 days from April 8th was his original, on-schedule prediction…or more like promise. I can’t imagine how much pressure that is on Drake, the messenger. I can’t imagine how heavy this must be on his mind, but he should be held to that time frame either way.

Comment by accuchip on May 15, 2012 @ 2:32 amDrake wasn’t on the radio last night but the smoker voiced lady speaking for Drake was and she said not to expect the arrests to happen overnight like Drake implied at first. So it sounded like they are backing away from the “mass arrest” scenario. A gradual crumbling like we are seeing already will work for me. Although an overnight sweep would be more exciting.=======================================================Cobra is still staying with his Original prediction of Mass Arrest now combined with Financial Reset, most likely sometime before June 5 2012.http://2012portal.blogspot.com/2012/04/window-of-opportunity-windowof.htmlCobra has also predicted last week that “Something beautiful is about to happen”.</em?http://2012portal.blogspot.com/2012/05/normal-0-microsoftinternetexplorer4_8070.html

continued….

=Cobra, as spokesman for the Resistance Movement, has more extensive sources than Drake, including moles within all global governmental and financial systems, as well as sources with direct Galactic contacts (not channeled information).

We will soon have cause for celebration as Poof mentioned in his post this week.Hang in there everyone and join together, holding a Vision of a positive outcome including Arrests and the Financial reset coming very soon. ere.

Thanks BH…

🙂

http://www.thebullbear.com/profiles/blogs/bullish-consensus-potentially-setting-up-a-near-term-global-finan

Well at least Red came to his senses. Mass arrests? Please. One look at Fulford should tell any “intuitive” all they need to know. Thats too easy. And is there anyone short? Am I all alone? I bet I am. I have never met anyone who was short at the top. Now I have to look in the mirror. P.S. Sold more than half my position, so YES, part chicken myself. Must have been the ELFs.

Sorry, one last comment, I have never seen a more egotistical pompous ass than this washboards guy. The only thing you do on this blog, is brag about your illutionary profits. You add no substance at all to this blog. You are one very insecure man!!

Their?? Its there. And illutionary? Its illusionary. And I went on record at 1397 and change when I went short and all in at that point. But for all the weeks of waiting, its only 56 s and P points down. Nothing to retire on I can assure you. IN FACT.

The real hidden secret of traders is this. Its almost impossible to live off trading. WHY? Because you have to make 200% a year, not 100%, taxes and getting ahead and all that. So its a much, much tougher way to make money than any suggest. Of course the one firm out of the US, that controls the affiliate networks that represent pretty well ALL of the investment reports and newsletters fails to reveal that.

And you in turn are an oversensitive fellow who takes things too personally. And on top of that your supposed discernment may in fact be a ruse for an association with the ridiculous white knights that Red has just exposed as being just more of the same.

Take your blanket and run if you want Linus, its not unexpected, but do come back, you are so entertaining.

Regarding the stock market after June, I don’t see why there will be a crash. Remember Lindsey Williams mentioned before that there will be plenty of foods but people can’t afford to buy? Remember that he also said the USD will be devalued by 40%? I say there will be massive QE3 that will cause exactly such outcomes. That instead of crashing, the stock market will make a new high.

Regarding Wilcock, I believe he is sincere but I still find the “plan” that the world will be taken over by the “good guys” hard to believe. And that people like rothschild and rockefeller actually get prosecuted is simply too hard to believe.

I too agree with you that the 40% Dollar Devaluation will happen when QE3 starts. But, there must be a crash first so that they will have a good enough reason to start QE3. The people are fed up with these bailouts as they have awoken now and see that the money just goes to the banksters.

If you crash the market, the people will accept another bailout as they will see that it’s needed to save them… of course it won’t really save them (it will save the banksters again) but the illusion of it will appear that way.

Silver trend update:

http://niftychartsandpatterns.blogspot.in/2012/05/silver-trend-update.html

Apple chart analysis:

http://niftychartsandpatterns.blogspot.in/2012/05/apple-chart-analysis_15.html

Good morning gang, and see some of you have been busy stating your differences of opinions… which is fine by the way. I don’t ban anyone on this blog as I truly do believe in freedom of speech. Hate me, like me, or love me… I don’t care. You are welcome to say anything you want… good or bad.

You will not be asked or forced to leave my me, but of your own free will. I can only state my opinions, interpretations, and views of the matrix we live in. You are free to do the same, and aren’t restricted by any rules. There are no rules of what you can or should say here on this blog.

Since I have an opinion about the market, I’d like to state it here again. The market is very oversold right now and due a powerful short squeeze. Tomorrow Bernanke speaks (although I don’t think he’ll say anything new) and usually FOMC days are bullish.

Add those two things with an “option expiration week”, and you have high odds of a rally into the rest of the week. Will it happen… I’m not sure yet? This first half of the day should gives the clues we need. If the bulls can get some traction here in the morning when the volume is the heaviest and not collapse below support, the rest of the day should be easy for them.

Light volume is the bulls best weapon, and that’s usually after about 11:30 am to around 3:00 pm. They just need to hold their ground here and the bears will tire out in a couple of hours and go to lunch.

So, if I were short right now I’d probably exit and go to cash. It’s not safe to go long yet, but the bears have just about worn out their welcome now.

So how will the IPO of facebook play into all of this, if at all?

I don’t see it affecting the overall market much as it’s weight isn’t enough to move anything right now. Just look to commodities to rally first, as they usually lead the way. Also watch the leader stocks that the gangsters use to pump the market with (like Apple, IBM, Exxon…)

QQQ Chart Analysis:

http://niftychartsandpatterns.blogspot.in/2012/05/qqq-chart-analysis.html

Doesn’t leave any room to wiggle much, does it San? It kinda forces a gap up out of the wedge and over the 60 minute moving average, or a gap down to collapse through the 100ma on the Daily chart. Which will it be?

Difficult question to answer Leo. If QQQ holds above 100 SMA today a reversal is possible for bulls. If price closes below 100 SMA today then correction will extend.

This market will crash hard very soon .I fell it.

Bulls had their chance today and failed. Now the short terms charts are all reset. A big down day could happen tomorrow.

We have a reversal here a complete new paradigm.They will not keep this shit market up and all of this is by design.Anything can happen now,watch for a black swan event.

EURUSD Near Monthly trend line:

http://niftychartsandpatterns.blogspot.in/2012/05/eurusd-chart-analysis.html

Still, we might get that wave ii up tomorrow.

I’m getting that feeling of a big down day tomorrow, and I think I’m being heavily influenced by EMF waves right now. Meaning… everyone is short now! That’s scary in itself as too many people on one side doesn’t usually work for too long. Maybe… just maybe we do tank hard tomorrow.

Or, maybe I’m just a little too early on my call for a bounce? Now that my “emotions” are telling me “Crash, Crash”, I should be thinking “Squeeze, Squeeze”. Surprises always come when we least expect them.

Few people really think for themselves. They don’t follow through the chain of events and see where it will end. Instead we the people listen to the experts who reassure us in spite of the fact that their position makes absolutely no sense. If we really think about it, no person, business, state or country can keep printing money indefinitely. Even logic (as well as history) would tell us that it would eventually have no value. Nor can we borrow indefinitely. We either pay it back or “stiff” the lender (but we use the technical word “default” – sounds a little better).So here is the thesis. The entire world is living beyond its means, printing too much money which will lead to massive currency inflation, hyperinflation, devaluation, a complete loss of all savings, and the eventual destruction of our currency. We live in a world that is interrelated. Just think about it. The GDP of the U.S. is $15 trillion and the whole world is about $50 trillion. The amount of debt out there is beyond a quadrillion (a thousand trillion dollars). When that debt and the associated derivatives unravel, the global financial system crashes.

These numbers are so big we can’t comprehend them. Do you know how long a million seconds is? Eleven and a half days. How about a billion seconds? 31.7 years. How about a trillion? 31,709 years. And a Quadrillion seconds? Only 31.7 million years. Okay, back to earth. If global GDP is only $50 trillion, how on earth could you ever pay off debt that exceeds a Quadrillion dollars

Not only that, the amount of currency and debt continues to grow so that the debtors will either default or become impoverished (off to debtor prison) or the whole financial system will just collapse and currency will be worth nothing. Zimbabwe here we come! We listen to the assurance of our leaders but we know deep down, whether it’s Obama or Romney, the problems will grow just like they did with George Bush and every administration before. No one has the guts to find real solutions to real problems. Look at the Greeks and French? They voted the belt tightners out! Give me cake! Give me circuses (now replaced by junk food, entertainment and reality TV). I’m not going to put links through the article like I usually do. Consider it commentary and if you want to check it out, it will check out. Believe me!

A Look at Greece

There never was a bailout of “Greece” – just a bailout of the bankers who had purchased “sovereign debt” – another way of saying Greek Bonds. Greece doesn’t have a central bank and can’t print money so they borrow from banks. The banks took a haircut on their principle but received interest payments. The Greeks got nothing other than more austerity – cut budgets, cut programs, increase taxes which only made matters worse – more unemployment, declining GDP, declining tax revenues. They voted out the Prime Minister put in office by the IMF and put in a good socialist. If he can form a government, he will cancel all agreements, default on debt and leave the EEU.

European leaders agree. Greece will be the first to drop out. Greece is now the biggest sovereign debt default ever but it will be dwarfed by Portugal, Spain, Italy and possibly France! Talk about too big to fail! These countries are too big to even think about bailing out!!!

Greece first received $200 billion which was to be followed by another $700 billion in three installments. Yet the bankers have been rewarded in billions of low interest loans they will never be able to repay. Meanwhile, the Greek economy decreased in size by 10 percent. Unemployment is near 20 percent. People are sleeping in the streets. Those who still have houses can’t afford to have the utilities turned on. Only the rich have electricity. You don’t read about this in the news.

A Look at Portugal

Portugal is the next country to go broke. They (the bankers) already received $300 billion. GDP has dropped every quarter for over a year. Unemployment is 15 percent and rising. The housing bubble has collapsed and a fourth of all homes went into default in 2011. Personal bankruptcies are soaring into record territory as government, private and corporate debt exceeds 4 times the country GDP. The government response? Increase taxes making matters worse. The news is more wishful thinking – that a few hundred billion in banker bailouts will solve a few hundred trillion problem! They are just making the problem worse and leaving the people with nothing.

A Look at Spain

Spain is facing Depression Era unemployment – 25 percent for the country as a whole and over 50 percent for adults under 25. In a country of only 38 million people, over 5 million have lost their jobs and are no longer paying taxes and are burdening the “safety net”. Once the IMF imposes its “austerity” program, we will see unemployment go from bad to worse. Housing prices have plummeted by 40 percent and a third are “under water.” The practice of having a several people co-sign for the home loan puts a lot of people on the hook and lets the bank book the old value without ever writing it off. And so they push the same formula onto Spain as they did Greece and Portugal. Bail out the banks, raise taxes, cut services and the Spanish government runs greater deficits. Spain is the ninth largest economy in the world and a bailout will be twice the size of Greece, Portugal and Ireland combined. Who is going to put up the money?

A Look at Italy

The IMF will not allow (according to its rules) a country to have a debt to GDP ratio of greater than 60 percent but Italy’s is twice that at 120%! Once it gets this high, the risk premium goes way up so interest rates rise and the country follows Greece and the others into a debt/death spiral they can never recover from. As interest rates rise, the debt burden increases and the hole grows deeper. When Berlusconi was kicked out as Prime Minister, the EU put a central bank lackey named Mario Monti, he began to raise taxes and cut spending, imposing the Eurozone austerity programs. Italians do not like the medicine and are likely to reject it just like Greece and France.

A Look at Europe

Remember, this doesn’t happen over night. These economies unravel slowly. Now that momentum is increasing in Greece, Portugal is hot on their heels and Spain is crumbling as we speak. Once Spain goes, Italy will be sure to follow. By then, central bankers – mainly Germany will have no stomach for trying to save another country – particularly one that doesn’t want to be saved. Last week France voted out conservative President Nicolas Sarkozy in favor of a left wing socialist. This is a resounding slap in the EU face and its austerity programs. The French haven’t changed much in the past two hundred years. The people are still demanding “cake and circuses”. Here comes more big government, debt and spending. Say a final good bye to the EU.

Last man standing is Germany. Surely, Germany not only can’t bail out all these countries, but does it even want to? Why give away their nation’s considerable wealth to bailout undeserving, undisciplined, ungrateful PIIGS?

A Look at Asia

Japan has been in a slowdown for over 20 years, but still is the third largest economy in the world. Japan is currently in another contraction and export demand is falling. Even South Korea is in a massive slowdown. China is also in a slowdown, a housing bubble burst, and manufacturing is decreasing as world demand drops off the map. Chinese banks are sitting on trillions of dollars of losses they refuse to report or acknowledge.

http://www.the-tribulation-network.com/new_tribnet/dene_mcgriff/death_of_the_world_economy.html

Everything is in position for a big down day tomorrow. Most averages barely clinging onto their lower BBs. A certain little indicator has blown through its April low and rarely puts in another bottom in no mans land before venturing into debacle territory. European markets crashing on a day by basis with Greece seeming to put in nonstop 4% daily down moves while already 90% off its high which suggests an exit from the euro is inevitable.

Only thing is that I am worried about a ramp job into the Facebook IPO especially as we are getting close to extreme oversold territory in a certain indicator but maybe the EMFs are causing me to think that. Haven’t checked a certain guru who was so adamant about a bottom as all of his support levels have been penetrated and the cycle high or low days have been exceeded. A secondary top should have been made on Friday and that in conjunction with the weekly reversal signals suggest that any bounce should be muted and short-lived. Plus the August 2011 drop never saw a bounce. Just about 20 consecutive red days.

Looks like things might crash sooner eh? http://online.wsj.com/article/SB10001424052702303505504577406310678151998.html

Apple broke and closed beneath its 555 low. With the Nasdaq up 30 at one point today, I thought(worried) that it would be the perfect day for a pop into the Facebook IPO. But with the bloody red close, it pretty much was almost like a daily reversal lower.

Wednesday during opex week is historically the most bullish day of the week. That and Fed speak has me worried but maybe its the EMFs putting those thoughts in my head.

I just want a bloody down day tomorrow and then we can have the pop into the Facebook IPO. Very odd that they will have the IPO on a Friday. An idea which I will dedicate a future post to.

Market are going down on Grece exit fear and France new President proposal for EU. Funny that the election in these two country was 6 may the same date as the flash crash 6 may 2010.Maybe a sign.lol

One(won) must know your intervals at the alchemical wedding….

Sum 1:36 = 666

Intervals from todays $SPX close

5.5.10 close (close before 111 Ritual)

$SPX 5.5.10 1165 : $SPX 5.15.12 1330 = 165 (111)

10.9.8 Day before final harvest of 2008

$SPX 909 : $SPX 5.15.12 1330 = 421

1.1.12 : 4.21.12 = 111 CD

10.16.87

$SPX 282.7 : $SPX 5.15.12 1330.66 = 1047.96 (111)

10.19.87

$SPX 224.83 : $SPX 5.15.12 1330.66 = -83.1% (111)

Note the $RUT’s close 777

Largest $DJI pt. loss ever -777 pts 9.29.8

alot of 111.

almost everytime i watch for the time on my clock often I’m seeing 11:11 or 1:11

Is there any link? 🙂

Boy, silver keeps getting hammered..

Just bought another 20 onces today.Bring the price down I like it.Will buy more.I think silver can go around 21$ if the market continu to go dowm.

you might like this chart.

http://stockcharts.com/h-sc/ui?s=$SILVER&p=D&yr=0&mn=6&dy=0&id=p21798257785

Nikkei 225 /quotes/zigman/5986735 8,807 -94 -1.05%

Hang Seng /quotes/zigman/2622475 19,450 -445 -2.24%

Shanghai /quotes/zigman/1859106 2,476 -11 -0.45%

S&P ASX /quotes/zigman/1652099 4,240 -77 -1.77%

Sensex /quotes/zigman/1652085 16,328 +112 +0.69%

GlobalDow 1,799 -8 -0.46%

Euro/$1US 1.2729 -0.0001

$1US/YEN 80.3700 0.1807

Pound / $1US 1.5974 -0.0019

Dollar Index 81.31 0.08

10yr T-note 1.77 0.00

$1US/Aussie 0.9927 -0.0010

I have a funny feeling.I think they will ”MAYBE” cancel the Facebook IPO.

Gold testing 100 Week SMA:

http://niftychartsandpatterns.blogspot.in/2012/05/gold-near-100-week-sma.html

I think this market will finish down Today

I think I know the level where they will bounce this market at…

http://screencast.com/t/qwHk6sUF

We will close at least 100 points down today!

Down seems to be the current direction for sure Roilion…

Yes but i’m not realy sure if it will be down as much as 100 points but for sure I wish.When we consider this,the Dow as not gone down alot compare to other stock market in the world.US bankster are the best manipulator in the world.They have complete control of the nasdaq and Dow index direction and they can influence S&P but not as much.

Looks like we will survive the most bullish opex day of the week and close in the red. I don’t know when the chief fed gangsta spoke but it appears they greased the wheels for his speech with a magically aided early morning pump to the stock market.

On another note, the EMFs are hitting me hard…..I can’t pull the trigger here. Still worried about Facebook day. Also reached a TD 9-10 downcount where a rally could sprout but knowing in this instance in opposition to every previous event as opposed to the bull counts where they never seemed to work, that the market will continue its downside momentum without ever producing a bull flip.

Yes Geccko…

I just keeping getting this feeling that they will squeeze the bears hard tomorrow and Friday because it’s opx and they don’t want to pay out all the put holders… but then again, the biggest surprise right now would be to continue selling off.

I agree it’s opx and they don’t want to pay out all the put holders… but except if the majority of the put holders are themself(The Bankster)witch i think is the case right now.We will see tomorrow.

New paradigm!

Down hard tomorrow I believe… possible rally later in the day, and up some on Friday. But tomorrow morning should be down.

Exactly the scenario i see going on for tommorow but there is another possibility but i will play both.

All those put holders could be insiders.

Agree,exactly what i just wrote in my last comment.

”I agree it’s opx and they don’t want to pay out all the put holders… but except if the majority of the put holders are themself(The Bankster)witch i think is the case right now.We will see tomorrow.New paradigm!”

The equity put call ratio has been high since last Friday which some of the trolls over at D.E.’s are using as an excuse for the market to start rallying hard. Of course, the market has been consistently dropping instead.

Where are the FP’s these days? Using some other signal?

Wow! I think i understand what they will do now.If i’m rigth woow$$$$.OK dinner time.Bon appetit!

Prep for the final harvest….

http://www.flickr.com/photos/47091634@N04/7212082018/in/photostream

Terminal velocity will occur after 111 TL is violated

One(won) must know their midpoints to know the Ritual at hand…

Note the $VIX close 22.27

You must know that 22/7 = Pi

Find the Pi Midpoint…..

$SPX terminal low of 2011 1074(111 low) came on 10.4.11

10.4.11 : 5.18.12 = 227 CD

5.18.12 : 12.31.12 = 227 CD

227 : 227

The co-relational 111 Ritual 5.6.10(111) 1065(111) low

5.6.10 : 5.18.12 = 2y12d (212)

Welcome to the macro boiling point 2012(212)

227 = Pi

Pi*212 = 666

The operators would like to thank everybody for their ongoing participation in this Ritual…

Mary Kennedy, wife of Robert F. Kennedy Jr., dies

wow, I’m thinking (suicide via) alcohol poisoning.

(we will have to wait and see if ole Jr. trades up)

The Kennedy curse continues!!!

ps. I was looking for the squeeze today.

looked promising at open, then….FAIL.

maybe Facebook will save the World!?

Do the RIVs’ mean something!!! Already aware of the initials below. They were used in the raVen and Tebow and #3 of the Thrice were advertising it on Jackie Robinson(#42) day last month.

SPX Analysis after close:

http://niftychartsandpatterns.blogspot.in/2012/05/s-500-analysis-after-closing-bell_17.html

Tomorrow will be 106 weeks from the flash crash (Guess which week was flash crash week??? or 742 days later ie 76 or 7×106. Never expected anything for tomorrow but the numerology is too appealing. And the market is in the perfect technical position for one. Just can’t see them doing it ahead of the Facebook IPO. But then again this decline has been lagging and things need to get going.

Following the fractal from double 4 years ago, everything is moving smoothly and there really shouldn’t be a pop until Monday but I can’t expect it to follow it exactly. And any bounce did not produce a bull flip.

We could also see a trend week move down for opex week as in the double 4 case.

Now need to look at the double ninen precedent.

Yes, in the double ninen episode, it appears the equivalent period for tomorrow saw a drop with an intraday low of -5.5% with a big gap down open. 5.5% off of 1330 is 73points. Of course, in the double ninen fractal, the market had dropped quite a bit more going into that trading day.

Yesterday’s action in the $dax,$mib(Italy),$ibex(spain) and even $atg (Greece) mimicked the action seen the day before the flash crash in the US indices. $xeu (euro)with a similar bar as well.

It looks like I might not be sleeping tonight or I might just get up early.