Technical Update For June 10th, 2012...

(to watch on youtube: http://www.youtube.com/watch?v=K94pVGWR2gk)

Red

___________________________________________________________

Technical Update For June 6th, 2012...

(to watch on youtube: http://www.youtube.com/watch?v=WT0QX1jxS08)

Red

___________________________________________________________

Look Out For June 2012 As The Illuminati Gangsters Have Lots Of Ritual Days To Do Evil Things On!

(to watch on youtube: http://www.youtube.com/watch?v=wvSwoF6SHu4)

This coming month should be full of surprises. The ritual dates are powerful and I can't imagine the gangsters passing them up without doing something evil somewhere. First off this Tuesday is a very ritual "eleven" day for the Illuminati (who control the stock market). It's the 29th (2+9=11) and a very common down day. Considering the fact that they are rallying the futures in front of this Tuesday and that the charts are all overbought and ready to rollover, I'd say the odds of Tuesday being an ugly red day are very high.

However, more important is next month as June is a "six" month (it's the 6 month of the year, as 0+6=6) and this year is a "five" year (2012=5, ["2+0+1+2=5"])... which makes the 2 added together an "eleven". This makes next month a favorite for the Illuminati gangsters and one for us sheep to watch out for. The key dates I'd watch out for are the 11th, 22nd, and the 29th.

The 11th is actually a double "eleven" day, as it's obviously an "eleven", but there is another reason. This is because the other way they calculate it is to add up all the digits in the whole date, not just the digits in the day but the month and year too. That is 0+6+(11)+2+0+1+2=22 (06/11/2012). Please note though as master numbers aren't added together (those are numbers that are dividable by 11... 22,33,44, etc...), which means that you don't add the result together because it's a master number.

If it added up to say 23 you would add the 2+3 to get 5, or if it would have added up to 29 you would add the 2+9=11, which is what I did with the day of the week for this Tuesday making it a "daily" eleven date. But if it's an 11,22, 33, etc... you don't add the digits together. That's why I didn't add up 1+1, but keep it whole as "eleven" and added it to the rest of the digits.

So, next month we have the 11th, which is a double "eleven"...

06/11/2012 = a daily "eleven" as the actual day of the month is an "eleven". Also...

06/11/2012 = a daily "eleven" as the actual day of the month is an "eleven". Also...

06/11/2012 = a yearly "eleven" as the actual digits all added up together (remember to add "11" as a whole, not 1+1) equals 22.

06/11/2012 = what the hands on the clock are pointing to in the Simpsons episode.

06/11/2012 = 9/11 upside down... and we've already had a 3/11 (when Bush, Rockefeller, etc... attacked Japan with HAARP and a planted nuke on the ocean floor fault line)

Then we have the next ritual date on the 22nd of June...

06/22/2012 = a daily "eleven" as the 22nd is a master number that is dividable by 11... therefore it's an "eleven"

06/22/2012 = a yearly "eleven" as the actual digits all added up together (remember to add "22" as a whole, not 2+2) equals 33.

Being that it's a 33 it should add more power to it as George H. Bush is a 33rd degree Free Mason (where the Illuminati hide at) and the number itself is very powerful to these murderers.

Of course the other ritual date is the 29th of June...

06/29/2012 = a daily "eleven" as the actual day of the month equals it. (2+9=11)".

06/29/2012 = a yearly "eleven" as the actual digits all added up together equals 22 (0+6+2+9+2+0+1+2=22 ).

I'm not saying that the market will crash on any of these dates, but that something bad could happen. Maybe it affects the stock market and causes a big down day, or maybe it doesn't. But one thing is certain... the Illuminati will stage something evil on these dates. They just can't let them pass by without doing something wicked. After all, they are the bad guys you know... and they must do something bad to keep their reputation.

As I said previously, they are currently running up the overnight futures prior to Tuesdays' open. They will be nice and overbought at the open, and line up nicely with the overbought SPX, DIA, IWM, QQQ, etc..., which means that just on a technical picture you have the makings of a down day. Then you add in the fact that it's a ritual "eleven" date (only a "daily" eleven, which isn't as powerful as a "yearly" eleven) and you have ever reason to expect a nice move down to start.

Since the weekly chart is also bearish I'd expect this whole week to end up going down and closing red. We had our bounce last week and put in a slightly positive close for the week, recovering a little more then a third of the previous weeks' sell off. The daily chart actually had a positive close on the Histogram bars last Friday and looks ready to rollover again. It has yet to make a positive divergence on the MACD's, which means a lower low is coming before it really turns back up to rally for awhile.

You also still have this FP on the dollar that hasn't been hit yet. It shows 86.47 and is likely the target where it will top and the market bottom. I expect it to continue rallying up toward that target next week. At the same time of course I expect the market to continue selling off.

You also still have this FP on the dollar that hasn't been hit yet. It shows 86.47 and is likely the target where it will top and the market bottom. I expect it to continue rallying up toward that target next week. At the same time of course I expect the market to continue selling off.

This next wave down is likely to be the 5th wave down with last weeks' rally being the 4th wave up. This is on a daily chart with the first wave down starting at the high of 1422.38 on April 2nd (an "eleven" day... 0+4+0+2+2+0+1+2=11).

Then a choppy wave 2 up into the Legatus meeting May 2nd-May 4th high of 1415.32, and the wave 3 down starting on May 1st (an "eleven" day... 0+5+0+1+2+0+1+2=11). This last wave down should put in a positive divergence on the MACD's and complete the first larger "Wave 1" down from the April 2nd high to whatever the coming low is.

The wave 3 starting high on May 1st was 1415.32 and the ending low on May 18th was 1291.98... which is 123.34 points in total. If we look at closing prices only we have 1405.82 to 1295.22 which is 110.60 points. (Note that if I were to round up the 1405.82 to an even 1406 and round down the 1295.22 to an even 1295 we'd have 111 points!) Too funny! More rituals...

Ok, so have far down do wave 5's usually go?

They say that wave 3's are the most brutal but wave 5's can sometimes go even deeper. They call them "extended" wave 5's if they surpass the wave 3, or "truncated" wave 5's if they fall short. If we look at the closing price last Friday of 1318 (round up the 1317.82) and subtract this FP on the SPX of 1269.00 you have 49 points.

They say that wave 3's are the most brutal but wave 5's can sometimes go even deeper. They call them "extended" wave 5's if they surpass the wave 3, or "truncated" wave 5's if they fall short. If we look at the closing price last Friday of 1318 (round up the 1317.82) and subtract this FP on the SPX of 1269.00 you have 49 points.

If this is the low then it would be a "truncated" 5th wave down as wave 3 is about 111 points. However, we haven't opened yet for Tuesday and we could (and should from the looks of the overnight futures) be up higher at the open before starting the sell off. This high could be that 1338 resistance area, which would then make the move down to 1269 equal 69 points.

That's still a truncated 5th wave but it makes up nicely with a 61.8% Fibonacci move. Meaning that the 5th wave down moves 61.8% of the 3rd wave down. Since wave 3 down was 111 points, then 61.8% of that equals 68.598 (funny how these FP's line up with Fib. levels).

But what if it doesn't rally up into Tuesday and the high was put in last week?

Well, the actual high last week was on Tuesday May 22nd (another "eleven" day... LOL) at 1328.49 (we'll round it down and call it an even 1328. So, 1328 - 1269 = 59 points right... which isn't any Fibonacci number that I can see as 50% would be 55.5 points (of the 111 points from wave 3 down).

I could play with the numbers all day but until the open on Tuesday I'm really just guessing. The important thing to focus on here is that the likely low coming for this 5th wave down is that FP of 1269 (do note though that it's on the ES Futures and not the SPX cash, which are commonly a few points different from each other).

I would also look for the overnight sessions on the ES Futures as I've seen it hit the FP during afterhours/premarket and complete the move... validating the FP, and ending the sell off or rally. Therefore you should look for both regular hours trading and non-regular hours for the ES, and look for the FP on the dollar to be hit around the same time period.

When should this all happen?

I'd guess again and say within the next 2 weeks or less. A move of 59-69 points isn't really that much further down and could easily happen in only a few days if the gangsters want it too. Then the first larger wave 1 down would be completed from the April 2nd top. Since that's currently 8 weeks ago, and assuming the 1269 print is hit this week, that means the first larger wave 1 down will have taken about 9 weeks to end.

Then we should have a larger wave 2 up, which will likely be choppy but make up some type of ABC pattern up just like this larger wave 1 down is forming a 5 wave pattern. This wave 2 up should much less then the 9 weeks it's taking to form the first larger wave 1 down. I'd guess that it takes 3-5 weeks to complete.

Thinking like a gangster here, as they control the stock market, I'd cut this rally short and not take it out 3-5 for this large wave 2 up. Why you ask? Because all the ritual "eleven" dates are coming up this month of June. Meaning that if I were to want to keep my evil empire going I wouldn't let these powerful days pass without using them to their fullest.

It's possible that they cut it really short and make it only last about 2 weeks or so... which means that it should end of the ritual date of June 11th. That would then start the larger wave 3 down with some type of "false flag" nuclear event like in the Simpsons show. Thinking about this week and we could actually sell off to the 1269 FP in only a couple of days and then rally back some the rest of the week to make this week considered a "half" week down.

That would mean that we could have 8 1/2 weeks down for the larger wave 1 down, and 1 1/2 weeks up for the larger wave 2 (completing again by the 11th). However, this just doesn't line up right for me. Since the FP of 1267 was given to us I'm inclined to believe that it will indeed complete the first larger wave 1 down. But the larger wave 2 up (making up an ABC move) must last longer then just 1 1/2 weeks.

I'm thinking now that they will use the ritual date of the 22nd to complete larger wave 2 up. This lines up nicely with Ben Bernanke giving the FOMC meeting on Wednesday of that week from the 2 day meeting on the 19th and 20th. What will that idiot say that will cause the next wave down? Or is that too soon and instead they use the 29th for start of the larger wave 3 down? Lot's of choices here, but few certain answers. This will be a "wait and see" game I believe.

The charts should give us clues to the possible outcome. We just have to match them up with the ritual dates and we'll have a much better chance of figuring out the gangsters plans. For all I know we could go up into the FOMC meeting (after the sell off to 1269 first of course) and rally more after it because Bernanke promises more help if needed. Then the top could be either the ritual date on the 29th (making the larger wave 2 up last about 4 weeks).

Let's not forget the coming Olympics in July...

The gangsters have put out movies showing and/or implying that a bomb is going to go off in London during the Olympic games. While I hope and pray this doesn't happen we have to look at the reality that this Illuminati Reptilians are insane and will do whatever it takes to stay in control and bring on their "New World Order". So there is still a real possibility that they pull this off and kill thousands of innocent people.

Yes, the good guys know about the plans I'm sure and will try to stop them. So will the good aliens/angels. But what if they fail? I find the alignment of the Elloittwave count very interesting when the month of July comes up. Regardless of how long it takes for the sell off down to the 1269 FP to end the first larger wave 1 down, I'd certainly speculate that the larger wave 2 up will also end before the Olympics start.

What if we are lined up for some type of larger wave 3 down to start around the time the Illuminati cabal plan to set off their bomb during the Olympics? Talk about a disaster waiting to happen... the market would drop faster then Bernanke can print money! If that happens then we will likely be on our way down to the sub-1000 level I'd say. Maybe then at that point Ben will come in and stop the bleeding with QE3?

That makes more sense too me at this time then raising interest rates as I previously thought could happen at this next FOMC meeting in June. Then they could rally up until the next Legatus meeting this coming October 10th-21st... and then let the market really crash! Notice that this coming meeting will be for "eleven" days and that the 22nd (an "eleven" day) follows the end of the meeting... which happens to be on a Monday.

Yes, think back many years to previous crashes and it's funny how October and Mondays seem to appear a lot (and "elevens"). Going back to the date of October 25th, 1929 when the stock crashed it was of course on a "Monday", and an "Eleven" day. How you ask? Just add up all the digits in the date and you get a "yearly" eleven day. The date was 10/25/1929, which is 1+0+2+5+1+9+2+9=29... and since 29 isn't a master number you must add the 2 digits together, which of equals "eleven" (2+9=11).

Just so you are clear on this, a "daily" eleven date is simply when the 2 digits of the day add up to "eleven". Obviously that is only on the 29th of every month. Since it's just a "daily" eleven I'd say that it doesn't carry as much weight or power as a "yearly" one does. This is just based on my assumption from looking at many previous months to see what happened on the 29th.

A "yearly" eleven is when all the digits add up to an "eleven". This means they could add up to a master number like 11, 22, 33, etc... or a number that when you add those 2 digits together you get an "eleven". That would be like 29 (2+9=11) or 38 (3+8=11), etc... So this coming Tuesday the 29th should be a really powerful ritual "eleven" day as it's not a "yearly" one. If you add up all the digits in 05/29/2012 you get 21... which then added together equals 3 (2+1=3).

But the month of June is different as not only does 2+9=11 for the "daily" ritual eleven date, but 06/29/2012 equals 22... which is a master number, and an "eleven" number. It's a more powerful combination date, just like the 11th and the 22nd of June will also be. This is why June is going to be something to watch for closely.

This isn't about just ritual numbers...

Yes, I've made this post about ritual numbers but the charts need to line up as well, so the move down can be confirmed by both the ritual date and the technical analysis. That's the exact situation with what I see for the open tomorrow on Tuesday, May 29th 2012... a very bearish alignment and a ritual day to add into the mix.

I've pretty much only scratched the surface here with the ritual numbers as I've only focused on "eleven". As we all know there are many more ritual numbers like 666 (the mark of the beast), .314 (the number for "pi"), and 212 (boiling point for water). Those have their own multiples when figuring them out (like 666=36 or 3 six's which also equals 3x6 or 18, etc...). I'll leave that for another day as right now the most obvious ritual number is eleven and it seems to be the most important one as well.

Ok, there you have what's coming for ritual dates of the Illuminati... which makes June out to be a very scary month. Best of luck to all and keep you eyes open for more FP's!

Red

nice post Red now what about mine LOL LOL

http://hotoptionbabe.com/blog/176-anna.html#disqus_thread

ES Chart analysis:

http://niftychartsandpatterns.blogspot.in/2012/05/es-chart-analysis.html

Hi Red,

Very nice TA. I think I missed following you alot!

Thanks… I sometimes get distracted with my passion to “wake up the sheep” (which is a good thing of course). There are enough other sites out there doing a great job of that, so I wanted to get back to focusing on where the market is going next.

This site is a mixture of a little of both so I have to find a happy medium between forecasting the market and exposing the gangsters.

It looks as though you, San and I all have short signals.

why cant i click and open my screen shots that I posted.

Ah… I see them now.

when i click on them it just opens another tab of your site, and note my chart. you get the same thing?

Don’t try to open them in a new window. Just “left click” once on them and they will open up in a “light box” window over the comment on this page. You can then “right click” on the image and open it in a new window or tab.

still doesnt do it.

Do you see the “light box” pop up? What browser are you using?

nothing happens when i left click on it. I use internet explorer

That’s the problem… use FireFox, Chrome, or Opera.

thanks, i’ll have do it tomorrow. gotta go to bed now.

This is what I see when I click on the image…

http://screencast.com/t/wqlUlzA9FM21

I’m using Google Chrome for the browser, but it works with most browsers as I’ve tested it before on other pictures.

Ah… I see them now.

I don’t see any screen shots you posted?

what? you cannot see the three black screen shots?

I don’t see any links posted from you?

on my screen I see three one inch squares of a small screen shot. Can’t anyone else see it? WTF man.

on my screen I see three one inch squares of a small screen shot. Can’t anyone else see it? WTF man.

i mean, i cannot expand profiles, view likes, or anything.

Geccko has the same problem and I think he’s using IE as well. This site shows up really crappy with IE6 and ok with IE7… but still buggy. Use a different browser and your problem will go away.

thanks man, sweet dreams.

No problem. This is what you see…

http://screencast.com/t/GcxBdE24B2v7

I would like to add that on June 5th there is the transit of Venus. 6month + 5th day = 11. It also will take place on the 5th and 6th of June (two time zones) and there again is 6+5 = 11. The constitution was also signed in 1769 on June 3rd (6 month + 3rd day = (9) which was also the transit of Venus which is rare and happens only twice in a 105.5 (11) – 121.5 (9) year span. This June 3rd will be the 225th (9) anniversary. I read the founding fathers (Free Masons/Illuminati members) waited until that particular day of the Venus transit to sign the constitution because it was a significant date to them. Something to keep in mind.

How long does this transit of Venus last Carey? If it includes the whole month of June then any of the ritual dates could be included.

Which way? http://screencast.com/t/4BgNruWN96zf

EURUSD Trend update:

http://niftychartsandpatterns.blogspot.in/2012/05/eurusd-trend-update.html

From the looks of things this morning they seem determined to go up and touch or breakthrough this rising wedge…

http://screencast.com/t/4BgNruWN96zf (earlier this morning)

http://screencast.com/t/xNPRVjuIV (now)

Red,

Did you get my email capture from this morning? Not sure what that was?

Yes Johnny… thanks. I replied back to you.

The SPX could still go up a little more, but the ES Futures could rollover anytime now…

http://screencast.com/t/66Jf0CpYz

Just emailed to me this morning…

It shows a crazy FP on the Nasdaq about 300 points lower?

NEW FP ALERT…

http://screencast.com/t/s5m6u5pbDs

thats showing up on scottrade too. those damn things are funny

Yes, and I hate seeing them to the upside like this when I’m thinking we are going to rollover for another way down. Makes you worry that this sell off we are having right now is going to be reversed as they ram this pig up to the 135.71 SPY FP by the end of the week or early next…

they probably do it on purpose to add to the confusion. It might not go up there, one just cant know.

Well gang… the market did indeed rollover from this mornings’ high. And we came pretty close to my previous target around 1338 (1334.93 spx). But, with such light volume and the appearance of the new FP on the SPY of 135.71, I’m going to think the plans are changed now.

I think they’ll turn this back up later today and continue rallying higher this week (choppy though) until that new FP is hit. I know this seems crazy as everything is so bearish looking on the charts right now, but surprise and mis-direction is how they fool the sheep…

http://screencast.com/t/HF0el6ks

Apple resistance levels:

http://niftychartsandpatterns.blogspot.in/2012/05/apple-resistance-levels.html

Its amazing these crooks still have a hold on this market in the states. The shiit is hitting the fan in Europe yet our markets are still green.

They have too make sure there aren’t any bears in the market before the next leg down starts I’d say. That’s the way they keep stealing the money from us sheep… make it look extremely bearish and rally up until it starts to look bullish. Then of course you do the opposite and sell it off.

With this new FP on the SPY I’d say the safest thing to do right now is to wait until it’s hit later this week. Then look at the charts again to see what they say. I’m assuming they will be very overbought by then and ready to rollover. The bears should become bulls about that time too.

over at the2012scenario it seems the channelers are signaling big changes are going to happen real soon. I’m thinking June will be the month…

Post the link to the article you are talking about. And yeah, I’d say June will be the month for the big changes to happen. Today was only a “daily” ritual “eleven” day, but June will have some “yearly” ritual “eleven” dates in it. They should be much more powerful and I highly believe the gangsters will use them to do something evil on.

http://www.the2012scenario.com

You can go through the various post. Or if you want, listen to Geoffrey West who does the

Cosmic Vision News

http://www.blogtalkradio.com/inlight_radio/2012/05/25/cosmic-vision-news

He raps up the weeks news every Friday. The news includes not only what’s going on here but off planet. Finally a news station that talks about things going on off planet lol. I knew their would be a time we could listen to the news and find out whats happen in space 🙂

Well, there you have it gang… a sharp move down and a reversal on light volume. Since the short term charts are still overbought right now I could easily see tomorrow trading sideways to reset them. If so, the new pattern that would form is a “cup and handle”… which is a bullish pattern that would likely play out by pushing on up to the new SPY FP of 135.71 on Thursday and Friday.

It’s going higher then I thought when I wrote this post so it looks like we could have another leg down next week and not this week. The charts are too easy to manipulate and that’s what they are doing with this light volume.

As for the 1267 FP on the SPX, there’s no reason to assume that the market will stop there… only that they will take it there. It could be a turning point and end the sell off, or they could keep selling off lower after hitting it.

Since Elliottwave is basically useless now that all us sheep know about it (which forces the wolves to change the programming for SkyNet), the first larger wave down could already be complete now (even though I don’t see a clear 5 wave pattern), which means that we could be in a larger wave 2 up right now?

If so, then the larger wave 3 down could start in early June next week sometime. This means that we should keep our eye open for more FP’s (to the downside) so we can figure out how low they plan on taking it. The when part will be tough too, but I’ll be playing close attention to the “yearly” ritual “eleven” dates in June.

Ritual’s, ritual’s… everywhere rituals!

IWM (Russell ETF) closed at 77.70… up 1.11 points!

LOL

Ritual on S&P too.S&P 500 1,332 +15 +1.11%

I can’t say this was a scary up day. The euro,gold, and silver all dropped while the market rallied. At least gold and silver were up early in the morning but it was opex day for them and when the opex deadline came, they were no longer held up.

Now it’s the bankster overlords turn to cough up all of their positions.

There is a record euro short position according to the latest COT”s report held by hedge funds(most since 2007) and a reversal rally should have seen blown those positions out of the water today. Instead, I am glad to see they are doing their role for the grand ritual.

There is enough firepower now to get us to Quetzacoatl’s return.

The hieroglyphics at the corporate facilities of the corporate occultists that I have to deal with indicated that today should have been a key day. Maybe something pops up in after hours.

Also KNOWING wasn’t so knowing. But we now proceed to the next date, the most logical one but one that doesn’t have any 512 associations but 512 should still have some validity.

New lows for the Euro tonight. ES has allot of catching up to do.I would say 150 points…Dammm elite

Silver triangle pattern:

http://niftychartsandpatterns.blogspot.in/2012/05/silver-triangle-pattern.html

SaLusa new message came out and June seems important.

http://kauilapele.wordpress.com/2012/05/29/salusa-5-30-12-you-are-moving-into-the-month-of-the-year-that-is-going-to-be-the-time-of-a-new-beginning/

The “6” days prior” to 6-6-12 begins at midday of the 5-31-12 worldwide local time.

Is The End Nigh: Rockefellers And Rothschilds Merge

http://www.zerohedge.com/news/end-nigh-rockefellers-and-rothschilds-merge

Death cross of crude oil:

http://niftychartsandpatterns.blogspot.in/2012/05/death-cross-of-crude-oil.html

From the looks of things so far it more likely that the FP on SPY of 135.71 won’t be hit this week. I do think it will be hit before another wave down starts. I’m thinking that they could turn this into a rising channel that would extend into next week. Then hit the FP (around 1355 here on the ES Futures) by the 11th (or before).

http://screencast.com/t/uRABKHrhOeI

Washboard, your email account has been hacked. Don’t panic though as it’s just that you computer has got some spyware and/or viruses on it. GO HERE to fix it…

http://reddragonleo.com/how-to-get-rid-of-spyware.html

The Nasdaq FP showing about a 300 point drop returned again, but it gone now…

Look at the Dollar now gang… on it’s way to the FP of 86.47! LOL! I think I see the plan now, as it’s looking like we will go down in the market first while the dollar climbs to the FP, and then it will rollover and the market will rally to the new FP on the SPY of 135.71 for the wave 2 up top. (just thinking out loud here)

ES Support and resistance:

http://niftychartsandpatterns.blogspot.in/2012/05/es-support-and-resistance-levels.html

fade the ritual noise.

they weave the fabric of dreams. ha!

http://www.youtube.com/watch?v=2aWVH_VaPSE

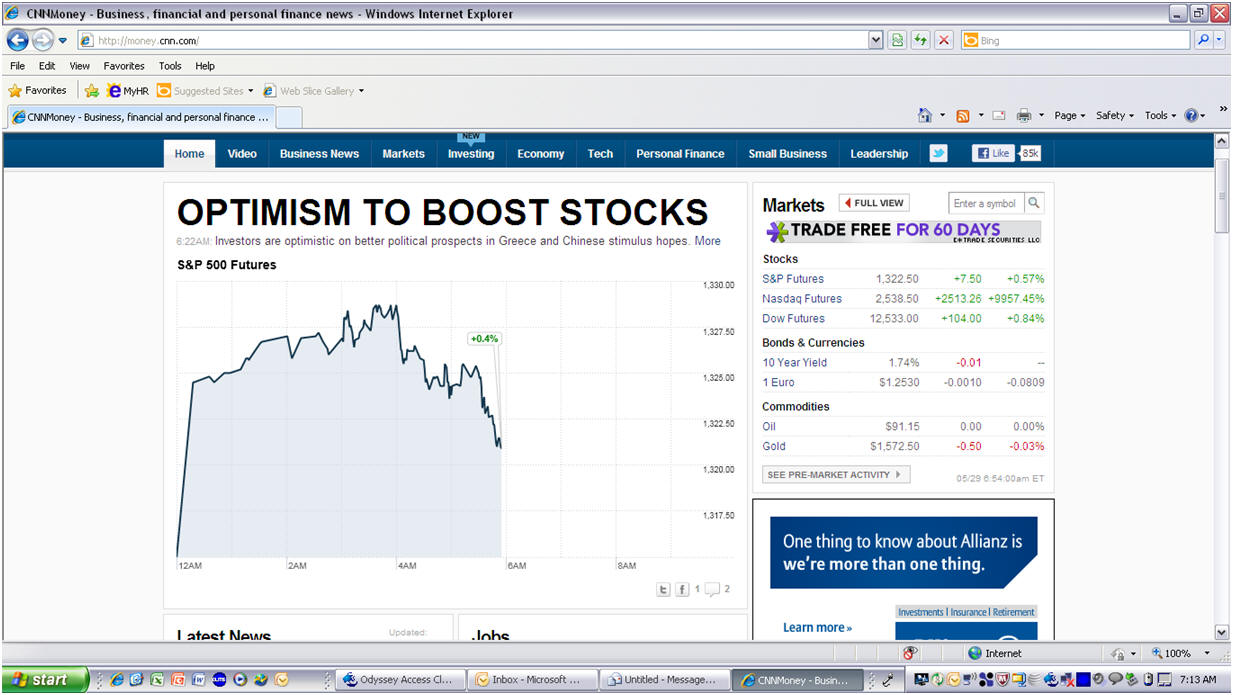

Nasdaq futures on cnnmoney.com indicating the 300 pt drop again this morning. It shows as of now 2541.25

Gold chart analysis:

http://niftychartsandpatterns.blogspot.in/2012/05/gold-chart-analysis_31.html

AUDUSD Chart analysis:

http://niftychartsandpatterns.blogspot.in/2012/05/audusd-chart-analysis.html

So what is the play then? SPY goes up to the short term fp, then we go down the equivalent of 300 points on the nasdaq?

I wish I knew the answer there but I don’t? It’s all about the timing I’d say. We want to see that FP on SPY hit around a ritual date. But we still don’t know if the 300 point drop in the Nasdaq will happen after that, or if it just hits the 1267 spx FP. Maybe the 300 point drop is for the crash in October? Hard too know about that one?

Did you get your email fixed?

I will say this… from the looks of the charts right now they are turning this thing back up quickly. If they want to hurt the bears they could rally this hard tomorrow, as the charts would support a big up day. The charts are turning bullish on the short term and could move up in a short squeeze on Friday or Monday.

Not sure if they will or not, as they could also trade sideways tomorrow and allow for one more move down on Monday. But I wouldn’t be surprised if it rallies hard as they usually like to fool the most people… which I think most people are currently short.

WB, you need to rewatch Silent Partner; it has all the clues.

Just DO IT…..DO IT like a mofo’n stone age druid

Banksters DO IT with interest.

Christopher Plummer, born December 14,1929, robs the First Bank of Toronto, in TSP, on 12-16-’77 or 12-777. As Bad Santa, he also totes a cardboard sign with 3 capitalized Gs that also suspiciously look like 6s….or 777….below TTL are capitalized. They made it simple in TSP back in 77. No CGI numerological flashes every 3.3 seconds.

I guess they needed a few movies back then that could tap into the 77-2102 or 777 connection thus Sorcerer and Silent Partner were commissioned. 34 (7) years until 2012. 34 a Fibonacci number as well as being the 8th Fib number…8(7)…

So many numerological parrallels back in 77 for TSP and today. FBs behind Elliot Gould as he performs his duty as merchant teller. He takes a deposit for $4,206 (see 127 Hours–also pre-flash crash high day) just before he is robbed.

$48,350 are stolen from First Bank which drives Plummer bonkers over and over again since Gould makes off with most of it. A kid runs up to Plummer wearing number 16 just as he is about to rob the bank. etc.etc.etc.

I guess Plummer was preparing for the grand ritual back then since his birthday is in so tune with the times. And they reward him for it in 2012 with an Oscar.

What a wild day today was… down, up, and down again! They are clearing out both bulls and bears for a strong move in one direction… but which one? They will likely either “gap up and go” tomorrow or “gap down and go”. Which way I don’t know? But a strong move is coming, that’s for sure! I’m going to lean toward a rally as I think the bears have worn out their welcome to this party. But I really just don’t know.

Well, looks like we are gaping down big not up. As I said yesterday, I didn’t know which way they would go with it. But now it’s looking more and more likely that we are going down to that FP of 1267 on the SPX.

Not sure how accurate this is but sure would be nice eh…also in the comments section was an update that Bernake was also arrested.http://nesaranews.blogspot.com.au/2012/05/deep-intel-down-rabbit-hole-5-31-12.html

Here’s the main list of people we want to see arrested…

http://www.lovethetruth.com/books/13_bloodlines/toc.htm

Well at least it’s a start and maybe these guys can aid in going after the rest =)

SPX Analysis after close:

http://niftychartsandpatterns.blogspot.in/2012/06/s-500-analysis-after-closing-bell.html

New York Stock composite actually (and quietly) made a new low today.

This definitely has an August 2011 feel to it. Big down days followed by hanging man down days followed by even bigger down days that encompass the previous day’s hanging man bar.

Now all we need is for the big 3 indices to get below their 200 day averages which I am guessing will be tomorrow (based on some fractals).

I am surprised to see that futures are down. I thought they at least would hold them up until the jobs report tomorrow.

Funny how they make up all these new rules to trading when the market is in a danger zone and ready to crash…

http://www.tradersmagazine.com/news/sec-volatility-measures-limit-up-limit-down-circuit-breakers-110038-1.html?ET=tradersmagazine:e1482:54026a:&st=email&utm_source=editorial&utm_medium=email&utm_campaign=tm_xtra_053112

Crude oil weekly chart analysis:

http://niftychartsandpatterns.blogspot.in/2012/06/crude-oil-weekly-chart-analysis.html

Apple chart analysis:

http://niftychartsandpatterns.blogspot.in/2012/06/apple-rising-wedge-update.html

If they don’t hit the 1267 FP on the SPX today at the close, then it should happen next Monday morning on a gap down and a reversal (assuming that’s the low and the market turns back up? You never know for sure that any FP is a turning point… only that it will be hit).

If it does turn back up from this 1267 FP the moves down from the April 2nd high to the low will make a nice 5 wave pattern to complete the first larger wave 1 down. We should then rally for 3-5 weeks I’d estimate as this move down has taken around 9 weeks.

The larger wave 2 up shouldn’t take but about half the time as the larger wave 1 down took. So, this could push this out into the July period when the Olympics starts and the planned false flag bomb is scheduled to go off by the Illuminati murders.

The only ritual “yearly” Eleven date I currently see for the month of July is the 28th (07/28/2012 = 0+7+2+8+2+0+1+2=22 or “11”). That’s the 2nd day into the Olympics as it starts on the 27th of July.

I’m still concerned about the 3 ritual dates in June, but “IF” they allow Elliottwave to work then we should rally for 3-5 weeks… which throws off anything happening big in June. But, since I suspect the rally up will be choppy, we could still have nice down days on any of these dates in June.

Maybe we chop around is some sort of crazy “ABC” pattern for the larger wave 2 up, but inside of the each of the 3 waves we see wild daily swings like we have since the smaller wave 4 up start on 5/20 and ended on 5/29 (again assuming that this is the smaller 5th wave down inside a larger wave 1 down).

Of course they could fool us all and start QE3… which would take this pig to an all time new high! LOL

Chart i did on Thursday May 31st 🙂

http://screencast.com/t/grZ4kJ8O

Nice Anna… and you’ll notice that’s 5 waves too! We are close to the FP on the SPX at 1267, and I do believe we’ll see it Monday morning. After that, who knows? I think we’ll rally for 3-5 weeks, but I’m not positive that the FP is the low. We’ll see Monday I guess…

Hello.. what a day!

just checking in. Did today line up with a ritual?

here’s my favorite chart.

when it turns up. go long.

😉

http://stockcharts.com/h-sc/ui?s=$BPSPX&p=D&yr=1&mn=0&dy=0&id=p13615842106

Gerb.

New Book out.

I recommend you listen to the podcast

http://www.michaelcovel.com/2012/05/22/jack-schwager-first-podcast-about-his-new-book-hedge-fund-market-wizards/

Full Moon on Monday. good enough for me.

http://www.calendar-365.com/moon/moon-phases.html

Today was a “Twelve” day, so nothing special that I could see.

Well we’ve moved on from 5-12 (888) and entered 6-12 (you know what).

Monday is a lunar eclipse following the 58th incarnation of Saros 128 solar eclipse.

Monday is 6-4 or 8×8 or 24 etc. and the date hinted at in last year’s NBA final finals game when refs #29 followed by the pairing of #48 and #9 served up some technical fouls with 6:25 (67??) left in the second quarter in Game 6 (26–Facebook???–FB– in a rematch between the 2 teams featured in the 2006 finals) between the Thrice and Mavs with the score at 42-40 or 64????

The Thrice lost in that game to lose the series 2games to 4.

The line as appeared on TV read: 42–40…..6:25 2 (Oh now I see an 87 at the end there)

DO IT (like a mofo’n druid)—-4-6 9-2

FB (Face Book and First Bank (of Toronto)====62 or 622(64)

62—6(11)….Is something happening tomorrow? A catalyst??

A certain little indicator isn’t oversold so it isn’t implying that a culminating crash will happen on Monday but could it be the start of the crash wave????

The big 3 (but not the Apple 100 index) finally crossed below their 200 day averages today. That usually is the initiation stage of the wave.