Who Really Killed The US Ambassador For Libya J Christopher Stevens

(to watch on youtube: http://www.youtube.com/watch?v=dks0IZlWCpM)

Red

______________________________________________________

Technical Analysis update for the ritual "eleven" date of 08/27/2012

(to watch on youtube: http://www.youtube.com/watch?v=MTiwtMdB4NE)

Red

______________________________________________________

Lindsey's latest report states that the gangsters are behind 6-9 months with their evil plans to take oil to $150.00 per barrel and make the dollar worthless!

In this new video from 07/28/2012 Lindsey gives us his personal thoughts that he's worried about the month of October and just after the Presidential Inauguration (January 20th, 2013) as possible months to look out for. While he says that the gangsters are still planning to devalue the dollar before the end of 2012 the late January period of 2013 could be meant for something else bad to happen... maybe like war? I'm just guessing there of course but since we have a Legatus meeting just a little later on February 7th-9th, 2013 I'd have to think that something big will happen.

(to watch on youtube: http://www.youtube.com/watch?v=zKTeIgPMmdQ)

Getting back to this October I think Lindsey's "worry" is well justified as that is the period that the gangsters will be meeting for an "eleven" day Legatus meeting... and you know how they love the number "11"! From October 10th to the 21st they will meet and make some decisions on how they plan to screw the sheep again by making some policies or changes that will make them broker then they already are... stealing their money once again.

These Illuminati gangsters are pure evil and I promise you they will laugh when they succeed in stealing the little peoples' money once again. There is NO "Robin Hood" folks... in fact it's more like the opposite exists where the rich evil gangsters steal from the poor innocent sheep. You must understand that we live in the "Matrix" where reality TV shows are all lies done by actors to brainwash you into thinking a certain way... while science fiction shows are reality as they continue to suppress technology that would free us slaves from the debt prison we live in.

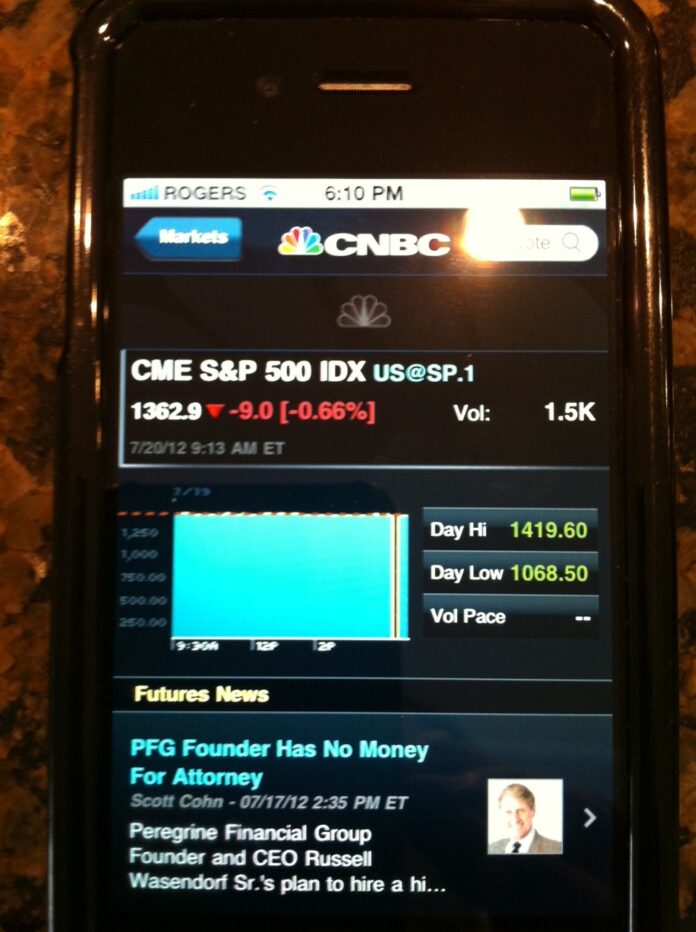

Between now and October I'm not sure what they plan on doing with the stock market. It's obvious to me right now that they are still 100% in control of it as it should have rolled over and starting selling off many days ago now. It seems like they are in a mode of "indecision" and they aren't sure what to do next. The FP on the SPX does tell me that we will go up to 1419 before any real selling starts... and the FP of 1068 SPX tells me the bottom, but when is the question?

Between now and October I'm not sure what they plan on doing with the stock market. It's obvious to me right now that they are still 100% in control of it as it should have rolled over and starting selling off many days ago now. It seems like they are in a mode of "indecision" and they aren't sure what to do next. The FP on the SPX does tell me that we will go up to 1419 before any real selling starts... and the FP of 1068 SPX tells me the bottom, but when is the question?

My thoughts are that we are going to sell off to the 1068 FP right into the Legatus meeting and put in the bottom at that point. Then another rally will start as they put QE3 into the market and/or also devalue the dollar 40% as Bernanke stated he would do back in 2002 if he were elected "fed chairman" and faced with another depression. Well duh! We are definitely facing another depression here! So that means he's going to devalue the dollar just as he said he would. The question is "when"?

Since Lindsey Williams said that the gangsters still plan on making the dollar dead (worthless in buying power, but not gone from circulation) before the end of 2012 I can't help but say that the odds of a bottom in the stock market going into late October and a rally from a devalued dollar (along with QE3) are very high now. This coming week I'd say they will make a run for the 1419 FP even though the market is extremely overbought on most all charts right now. They will once again defy gravity and keep push up on very light volume.

I remember a period back in 2010 (I think? or 2011) where they chopped around in a topping zone for 2 weeks before starting the sell off. That could happen again? It's not likely of course but I've seen it before. If they sell off some early this week to drop back to the 1380 SPX area and then run back up later in the week and into the following week then this could be push out until the next ritual "eleven" date on the 27th of August.

While not all highs or lows are put in on ritual dates you still need to keep them in mind when you know the top (or bottom... from the FP given to us sheep of course), and one of those days is near. Well, if they don't hit the 1419 FP early this week then odds favor a pullback to the 1380 SPX support zone before another attempt higher. This could easily last 2-4 days and put us well into the follow week. This would imply a move down this week to last almost the entire time, but a possible move up on Friday so the week ends with a doji or basically "flat" week.

Then they could frustrate both the bulls and bears for the next 2 weeks while just chopping around slightly down for a few days and then back up for a few days. Maybe the week of the 20th to the 25th will be a slightly up week where they close that Friday on the 25th close to the 1419 FP but not close enough to consider it "full-filled". At the open on Monday the 27th (the next ritual "eleven" day) they pop it up higher to hit the FP and then sell off for real.

This is just my guessing here as everything in the charts say we should start selling off hard next week from the extremely overbought short and mid-term charts... but why is it that my guts tells me that's not going to happen. If we are going to sell off to the 1068 FP, and hit that print during or right the October Legatus meeting, then that's a pretty steep drop in only 2 months! From mid-August to mid-October isn't really that much time to shave off 351.10 SPX points... or about 3,500-4,000 Dow points. You could call that a mini-crash if you really want too, but that seems to me to be the likely plan of action.

So how do you profit from this?

(to watch on youtube: http://www.youtube.com/watch?v=LKjAmJgTksQ)

For one you must not get sucked into thinking that once we hit 1068 that we are going to continue crashing to the finally low of 34.65 SPY (about 346.50 SPX)... and you must not assume that the previous high of 1422 SPX in April was the high of "Primary Wave 2" (P2) and that we have started P3 down. This may or may not be the case? If they do QE3 and/or the dollar devaluation the stock market is going to go up hard and fast and could very well put in a new "all time" high by mid-2013. Yes, this new high will be a false high when compared to the massive inflation and price of gold, but never the less we stock market bears could get trapped short and loss a lot be not bailing out of our shorts when the lower FP is hit.

It is my plan to go long gold and silver in October when the Legatus meeting happens if we do indeed sell off to the 1068 SPX low into that time frame. This will be a clear signal to me that the dollar devaluation and/or QE3 is virtually guaranteed to happen right during or after that meeting. So everyone should remember to remind me of this very post if I get caught up into my emotional trap of thinking that we are going to continue down and crash after the lower FP is hit this October.

Speaking of gold I still have a very old FP from several years back. While I'm puzzled to when or "if" it's still valid it would be a fabulous place to buy if it really does get that low. This FP shows gold at 935, with could happen if we drop hard and fast in the next 2 months taking the SPX down 351 points. That should trigger some margin calls I'd think and make big hedge funds and institutions sell their gold to cover them.

Speaking of gold I still have a very old FP from several years back. While I'm puzzled to when or "if" it's still valid it would be a fabulous place to buy if it really does get that low. This FP shows gold at 935, with could happen if we drop hard and fast in the next 2 months taking the SPX down 351 points. That should trigger some margin calls I'd think and make big hedge funds and institutions sell their gold to cover them.

I realize that going that low in gold seems impossible but don't just assume that it's not going to happen as it truly makes the most sense when you real think about it. Remember that they either used Lindsey Williams to fed him "timely information" (that's released at a time period that benefits them the most and tricks us sheep into taking positions short or long based on this) or he's part of the deception and misdirection by knowingly working for them.

Personally I think Lindsey's an honest person but we all know that his sources are lying, stealing, evil gangsters... so what makes you think that they are going to tell Lindsey the "Whole truth, and nothing but the truth"? They are intentionally mixing in the truth during time periods that they want us sheep to get scared and take a position based on that news only to see the opposite happen during the short term.

So all this talk of gold going to 3,000 an ounce from Lindsey is timed perfectly to trap the sheep in long positions during the next few months when I believe gold will sell off. Will it go as low as the FP... I don't know? It's possibly I guess? But the short term charts (daily, weekly) say that gold should go down. This is the opposite of the fear that Lindsey is spread (again... intentionally or not is unknown?).

All can tell you is that we have a FP that says we should go to 1419 on the SPX and then 1068. Logic (and the charts) say we will go up to the 1419 print first and then start the move down toward the 1068 print. If this happens in just 2 short months then the odds of many margin calls hitting those that aren't part of the "insiders" gang are very high. This is the opposite of what most think will happen but I see it as totally possibly.

If this works out and actually happens into the October Legatus meeting then you should fully expect that low in gold (and silver) to be a huge buying opportunity. The next move will likely take Gold up to the other FP I have of 3,500 and Silver to it's FP of 84.30 by a devalued dollar of 40% overnight as planned by Bernanke... as well as QE3! If you ever see the low in gold above you better mortgage your house and buy it by the truck loads!

If this works out and actually happens into the October Legatus meeting then you should fully expect that low in gold (and silver) to be a huge buying opportunity. The next move will likely take Gold up to the other FP I have of 3,500 and Silver to it's FP of 84.30 by a devalued dollar of 40% overnight as planned by Bernanke... as well as QE3! If you ever see the low in gold above you better mortgage your house and buy it by the truck loads!

Could this be the evil plan by the Illuminati pigs? Only time will tell I guess, but I'm not dismissing these scenario as it makes the most sense too me at the moment. While everyone is expecting QE3 to happen here soon the logical thing for Bernanke to do is to sell off the stock market hard first and then inject more money into it.

Getting the most "bang for the buck" is the game here and a drop of 3,000-4,000 Dow points would be enough to make all the traders think that the bottom is in now and the market will know resume the bull market. The truth will be that it was all just a deception to sucker the last bear into going long as the market rallies into mid-2013 to make some new high... and then pull the rug out and let it really start the collapse to the finally low of about 3,000-4,000 on the Dow.

Most people will think that the wave down from some new high in 2013 is just a buying opportunity as they will believe that the low put in this year around the 1068 FP on the SPX was the so called "double dip bottom" (that was saved from hitting the 666 prior low in 3/2009 by QE3). This is exactly what the gangsters want... everyone in disbelief as the market continues selling off day after day.

Remember, they want "MASSIVE DEBT" by every country in the world before they bring on their "NEW WORLD ENSLAVEMENT"!

This people are insane and should be rounded up by every citizen with a gun and publicly hung! Their crimes are so numerous that you would fall asleep listening to them while read out loud in a courtroom. But we all know that's not likely to happen... so back to reality (errr... the matrix). The scenario that I've laid out here seems unlikely and not possible, which is why it is likely to happen. If we tank hard over the next 2 months and then rally hard from a dollar devaluation (and/or QE3)... which puts in a new high, there won't be a bear left alive by the time it peaks in mid-2013.

This people are insane and should be rounded up by every citizen with a gun and publicly hung! Their crimes are so numerous that you would fall asleep listening to them while read out loud in a courtroom. But we all know that's not likely to happen... so back to reality (errr... the matrix). The scenario that I've laid out here seems unlikely and not possible, which is why it is likely to happen. If we tank hard over the next 2 months and then rally hard from a dollar devaluation (and/or QE3)... which puts in a new high, there won't be a bear left alive by the time it peaks in mid-2013.

This is exactly what the gangsters want... "Massive Debt" (and everyone thinking the worst is over that the new bull market is back). The bulls will constantly buy every dip the market has when it starts selling off from that all time high and the bears will sit on the sidelines scared to go short. This will likely be something similar to what they show in that video on youtube called "The Day The Dollar Died".

The only difference will be that gold will already be around 3,000 per ounce by time this all happens. If we do tank hard into this October and gold does drop to the FP on it, then when the dollar gets devalued gold will almost double overnight to just under 2,000 per ounce. Throw in QE3 and gold should start rising big time until the end of the year and into mid-2013. It should be up to 3,000 or more by the time the stock market peaks which means that movie is being too conservative on the price level. We could see gold at 5,000 from fear or much higher before the stock market finally bottoms in the 3,000-4,000 range on the DOW (34.65 SPY is the FP target).

Back to the short term...

Again, we are now in a topping phase and trying to predict the exact date that they are going to let this tank is very hard to say right now. I can only think that it's very possible that they chop this around for several weeks before letting it fall. I have no evidence that it's going to peak at the 1419 FP on the 27th, but it is the next ritual "eleven" date. We could sell off before then of course as not all highs come on ritual dates but from past history I do see that it's common to chop around for several weeks before a really big fall happens. So chopping this around until the 27th is possible... and it will certainly frustrate every bear (and bull), as they will just get tired of waiting and bailout of all positions.

I don't have any new FP's so I can only go with what I have currently. I firmly believe that we will hit the 1419 FP on the SPX before we really start a big move down. That doesn't mean we can't drop to the 1380 SPX support level before making another push higher. I just don't see a huge move until 1419 is hit first.

On another note, the good news is that nothing happened during the Olympics.

But if you listen to Lindsey Williams you'll notice that he does state that's it's possible that the gangsters stage some event to cause war to start. They want oil up to $150.00 per barrel or more and closing the strait of hormuz will do it. So a "False Flag" is still possible, but just not one that we sheep will likely see coming ahead of time. This was while I wrote that I didn't believe that anything bad would happen during the Olympic games.

But if you listen to Lindsey Williams you'll notice that he does state that's it's possible that the gangsters stage some event to cause war to start. They want oil up to $150.00 per barrel or more and closing the strait of hormuz will do it. So a "False Flag" is still possible, but just not one that we sheep will likely see coming ahead of time. This was while I wrote that I didn't believe that anything bad would happen during the Olympic games.

Anytime the gangsters put out a lot of news about something, which causes a lot of fear (something they want), I immediately raise my "dis-information" RED FLAG... meaning I no longer believe most all of what is found on the internet that is extremely popular. If it's something that very few know about then it could be true, but if it goes viral it's likely to be a lie to deceive us sheep.

I don't feel like what Lindsey is saying (as he vaguely mentions it) about a possible "false flag" to start a war to raise the price of oil is done to mis-lead us sheep. I do think this is accurate as they are still trying to start a war. Will they succeed or fail... I don't know? They have been delayed 6-9 months as Lindsey stated, so they aren't "all powerfully" as they think they are.

Remember, this "Mayan Calendar" thing isn't something to totally ignore. Something is going to happen to start a big change in the way we humans live. What that is... is something I can't answer? But I believe it's a change for the better for the slaves on the planet... which means the gangsters are going to lose their grip on us sheep as we slowly take back our freedom.

Will it happen overnight... like on December 21st, 2012? I doubt it, but change is coming. Free energy devices will slowly work there way into the hands of the sheep and they will free themselves over time from the debt enslavement that the Illuminati pigs currently have on us. The coming crash in the stock market next year will likely be the downfall of the Illuminati as the people are force to live without credit or money. Once people learn to live off bartering, growing their own food, making their own energy, etc... they won't go back!

This is the thing the gangsters aren't counting on as they think that we sheep will just bow down and worship their insane leaders and take the "mark of the beast" (the chip implanted in your skin)... but I'm confident that won't happen. The sheep bowed down in the first "Great Depression" because the technology to free them wasn't around... nor was the knowledge about the Illuminati and how they were slaves. This time things are different as we sheep know who the enemy is and more importantly we have the technology to live without the need for the money... which is the one thing the Illuminati must have in order to keep us enslaved.

If money isn't needed anymore then the Illuminati won't have any control of us... and that's what they fear the most. This is why the suppress the free energy devices by either buying out anyone that comes up with one, threatening them, or murdering them if necessary. If we sheep free ourselves from money then we free ourselves from the Illuminati pigs. This is their biggest fear... and maybe the fact that we all still have guns and know how to use them! LOL!

When they collapse this economy next year and bring on "The Great Depression Two" they will be signing their own death sentence. We sheep will then be forced to live without money and with today's knowledge that is available on the internet once we get out of the system of debt... we won't be coming back. They think they will just be able to crash everything and then own it all because they created fraudulent paper document prior to the collapse. This will all backfire in their face as the sheep discover how to legally show the fraud and take back their possessions from the gangsters.

Revolution is coming and the gangsters hiding out in the country won't save them. Good old boys in the country are just as dangerous as city boys. They have guns too and thinking that their mansion in the mountains will be safe will be their mistake. There won't be any place for the gangsters to hide once the "blue pill" takers are awoken when the economy collapses next year. The Illuminati don't realize that it's not us "red pill" takers that they should be worried about... it's the "blue pill" takers.

While they feed us conspiracy people "dis-information" on the internet by either putting "actors" out there like Ben Fulford, David Wilcock, Alex Jones, Inelia Benz, etc... or just using this people by feeding them lies (I really don't know who's real and who's an actor anymore?) the normal "blue pill" takers won't be distracted by such nonsense. When you take away their ability to survive they will come looking for someone to blame. That will be the rich Illuminati pigs that hideout in their mountainous mansions deep in the country somewhere.

Only time will tell I guess but I'm confident that there won't be anyplace for the gangsters to hide once everyone wakes up to their murderous deeds. This 2012 period is truly going to be the "beginning of the end" for the Illuminati as they underestimate the resourcefulness of the sheep they currently have enslaved. Technology works both ways and the people will rise up against their enemy this time, as now they know who the enemy really is. It's time to rebuild the gallows again and start hanging the banksters from them...

Red

SPY Rectangle:

http://niftychartsandpatterns.blogspot.in/2012/08/spy-in-rectangle.html

great post red

Thanks… it’s not what most people see I believe. This is against what a lot of others are thinking. A new high next year will fool a lot of bears.

Yes, Had i not seen a devaluation coming for awhile now, since QE1 staqrted, I wouldn’t have believed it either. While I personally think your thoughts are very realistic, I just hope, when the time comes, the sheep are ready to

Also note the post on “options babe” wall about the new rules with brokerages. You reallynever know what they’ll do to ensure noone, but them of course, makes a killing off of such an event

“The means of defense against foreign danger historically have become the instruments of tyranny at home.”

James Madison

LUCKY DAYS==============Timmy T…………….

Speaking of Inelia Benz , seems Steve Beckow brought her up today on his website..www.the2012scenario.com Look for the title “Inelia Benz and the Global Illumination Council”..

I watched hours of this guys stuff last week… very interesting. Lot’s of actors out there it seems and Inelia Benz seems to be one them.

http://www.youtube.com/watch?v=w_cG8C_Z4Ew

I saw it too..but it just showed a pic of her but the film did not talk about her so their is no prof that she is an actor like the others he spoke about..Who knows at this point..

The moon crosses over Sirius tomorrow around 6am EST or just as Sirus rises heliacally or close to it. With Venus nearby. On Timmy T.’s birthday. His 25th one.

Didn’t get a chance to Sirius this morning. I awoke at daybreak and the sun was already too high. It even blotted out Jupiter and the moon.

Saturday morning I did get up before daybreak and Jupiter and the moon were practically cojoined at the hip although the moon had not yet moved directly over Jupiter.

I drove and drove until I did get to a point were it appeared the horizon was clear yet I could not find Sirius which had me questioning whether it really had risen.

Soon Jupiter might be above the moon. The moon is really rising late. It was more spectacular last Thursday when the moon, Jupiter and Venus were equidistant.

ES Chart update:

http://niftychartsandpatterns.blogspot.in/2012/08/es-chart-update_14.html

inching pretty close to that fp

Good Morning… and yes, it’s moving up close to the FP level now. It does seem unlikely that they will hold off hitting it until the next ritual date on the 27th, but stranger things have happened. It’s still a short area as all double tops are places to go short at (regardless of whether it’s on a ritual date or not?)

Yeah, Your analysis seems like a very plausible situation. So, if they were to ro; this over that hard, without any significant mini crash, They would probably need to get the rolling soon. If I happen to see gold/ilver that low before the meeting, then its time to tap out the cards

GOOGLE Chart update:

http://niftychartsandpatterns.blogspot.in/2012/08/google-chart-update.html

Why does it not surprise me that they take the market up close to the FP of 1419 spx but not hit it? Because they love to trick the bears into getting short before the real move down happens. Same crap, different day.

This tells me that we could (and certainly should) sell off a little over the next few days. The daily chart now has a nice topping tail forming, but of course the day isn’t over with yet. Still… if it does close around here (or lower) then I’d expect a small pullback for several days before attempting another move higher.

So if we do indeed put in a topping close today then a move down for several days is likely. But don’t get too caught up into thinking it’s “the big one” as until that 1419 FP is hit I would be too excited on the bear side.

Damn. They could really drag this out until the 27th. If so, to get to that possible 1065 low, it’s going to be ugly

They sure could Anthony. Until that FP is hit I wouldn’t get too excited on the sell off. I seen this before in the past where I thought they were “close enough” to the FP (so I shorted heavily) only to see a small dip followed by a move up to hit the FP and go slightly past it… and then the big move down happened!

The ES target….

http://screencast.com/t/ou1d7DQPlw

I see 2 ritual “eleven” days for the month of September… the 6th and the 24th!

Oops… meant to put up the 8th (market closed though), 17th, and 26th… not the 6th and 24th. Those are “20” days and I haven’t noticed them being too important in the stock market. I’m looking for “22” days as they seem too be important for turns.

Yeah, looked at historical charts for the last few years and haven’t come across anything significant on “20 days”… All we have left for this month is the 27th, and the 29th is a daily

Yes, and since the 27th is a Monday I tend to think that they will put the high in on that date instead of the 29th (Wednesday). I’ve just noticed from the past that Monday’s and Friday’s seem to be a more important turn dates then the middle of the week.

flat…. bought a 139 put at the close… Thinking they pullback to tht 1385 area before having another run up to the FP. After that, there will be a lot of money to be made. Finally.

Happy Birthday Timmmy T……………………..!!!!!!!!!!!!!!!!!!!!!!

Yahoo with a front page article that seem to be non birthday related.

May you win your over-hyped non-existent camp battle with the Sanchize #6 or #15+ #6 for 26(66) or ……………..15 means 555 or 35 or 8 so 86???????

Timmy T.’s birthday, 8-14, is 3 years 10 months 4 days from the 10-10-08 crash low or 314 for Pi and 4 years 10months 3 days from the 10-11-2007 high or reverse Pi.

134 calendar days from the 4-2 which is the Pi number rearranged. Also 67×2….There have been many instances of 67 trading day cycles going back to the 3-6-9 low and I believe there was 134 td cycle rally into the Jan 2010 top from the 7-8-9 low which covered the 9-9-9 date. Hmmm 26 days separate 8-14 form 9-9. Or 1060 days from 9-9-9. Today is coincidentally also 106 calendar days from 5-1 (The Tebow number reversed) 106===53×2.

93(999) trading days from the 4-2 high and 73 tds from the 5-1 high.

But all the fireworks are set for tomorrow particularly the astro fireworks…

Tomorrow will be 3months 14days from the 5-1 high and 4months 13days from the 4-2 high. 7 months 7 days from the great 316 performance by Tebow against the Steelers and 3 years 7 months 7 days from his 2009 NCAA National Championship game when he first donned his John 3:16 war paint. Or 1315 days later….making today, Tebow day a PIishh 1314 days later.

7 months 21 days from the 12-18 Patriots game when Tebow played pied piper to his 19 87

23 88 occultic entourage.

8-15 the Raven number from 127 Hours that I have mentioned numerous times.

Supposedly, the cost of the guns Travis Bickle buys from the travelling salesman in Taxi Driver adds up to $815 but I got $875 (812) plus $40 for the holster for $915 so I will try to watch the clip later to see if my info is correct:

There is a site LOL dedicated to discussing the description and costs of the guns DeNiro buys in that scene from which I got my info.

It could have been an occultist dropping his preferred 815 number in the youtube comments section.

We also got the T-Troll guaranteed gold contrarian sell signal last night as well.

ES Charts:

http://niftychartsandpatterns.blogspot.in/2012/08/es-chart-update_15.html

Well, I got up before daybreak but things had changed in the sky. The moon now was below both Jupiter and Venus and barely above the horizon. The moon was undertaking its own heliacal rising just as it hovered above Sirius. I ended up driving all over the place and still couldn’t see Sirius. There is a mountain in the way that might possibly obstruct the sight of Sirius’ heliacal rising.

It was quite spectacular to see Venus and Jupiter aligned together and both pointing to the moon. And another planet will be adding to the mix tomorrow morning. Mercury will have its own heliacal rising at daybreak when it will barely hover above the horizon at it’s most westermost point of elongation (furthest point away from the sun in its orbit). Mercury will be in Leo and a website indicated to follow the line emanating from the Jupiter and Venus alignment to find Mercury (at the horizon). This is getting very Three Kingsish.

Meanwhile, Mars and Saturn along with the star Spica are also forming their own alignment in the night sky. (There was a triangle formation a few weeks ago)

The major astrology for 8-15 then:

Venus moves into a Cardinal T-square with Pluto and Uranus. Mars and Saturn form a conjunction in the other Cardinal Sign, Libra. The moon will form a square to that Mars Saturn conjunction sometime in the wee morning hours near a possible heliacal rising of Sirius (during the eastern time zone???). The moon will also be close to forming a conjunction to Mercury also in a heliacal rising position.

Jupiter can be seen in the sky a few degrees to the east of the Alderaban (sp) star, the eye of the bull Taurus. The Pleiades and Orion are somewhere in the vicinity but I believe Orion at least is lower in the sky. I have been trying to find the 3 Kings in the sky to find Sirius but haven’t noticed a cluster like that in the sky.

So Jupiter the planet of expansion and material wealth is finally pulling away from the Bull while the malefics form squares and conjunctions.

Pin Bar of APPLE:

http://niftychartsandpatterns.blogspot.in/2012/08/pin-bar-of-apple.html

Weak open… just got in for a pullback

Crude oil triangle pattern:

http://niftychartsandpatterns.blogspot.in/2012/08/crude-oil-triangle-pattern.html

Face Book chart analysis:

http://niftychartsandpatterns.blogspot.in/2012/08/face-book-chart-analysis.html

Looks like we’re going to stay in this range today

This is truly wearing out bulls and bears both.

Yeah, haven’t stopped out of my 140 put, but with the range this tight, i think I’ll be better off closing it

EURUSD Support and resistance:

http://niftychartsandpatterns.blogspot.in/2012/08/eurusd-support-and-resistance.html

Looking at the futures tonight looks like tomorrow will be just like today… a whole lot of nothing!

Great. I bet you they do this throughout next week too. I’ll sit on the side until we have a decent pullback, 1385 area, or we hit the FP. Too easy to get squeezed with moves like today

I’d be shocked if we actually do make it all the way through next week and then peak at the FP on the 27th.

ES Chart update:

http://niftychartsandpatterns.blogspot.in/2012/08/es-chart-update_16.html

2 trillion in new taxes hit the b ooks in Jan. I bet it’s a down Jan…

market probably won’t find support until mid Feb.

barrage of EU news and meetings, late Aug, early Sept, and with gasoline so high, seems to me, back to school store sales will be dismal. that’s two possible trend changing events, to watch for.

If we don’t tank into the October Legatus meeting to bottom at the 1068 spx FP then it’s entirely possibly that we crash after that meeting. Hard to say right now but there doesn’t seem to be enough time left before the meeting to drop 350 points. So what if they just start the first wave 1 down and then back up for wave 2 into Legatus? Then the wave 3 down to follow should be very ugly.

Yeah, was going to bet pretty heavily when the fp was/is hit, bit 350 before October, while possible, seems a bit extreme. They wouldl need a fairly steady flow of bad news

Yes, I agree. It does seem unlikely to drop that far before October. So, that implies that we could see a huge “wave 3” down after the meeting and not QE3 and/or the Dollar Devaluation.

I’ve thought about this for awhile now, and this now seems more likely then what I wrote in the post. I just don’t see it dropping that hard and that low before the meeting… and just before the elections. Instead we could just have a wave 1 down and wave 2 up.

That would look better for the elections… regardless of which puppet they plan to have as the next president. Then maybe the dollar devaluation and/or QE3 happens after the next Legatus meeting in Feb. 2013?

Oh well , just a nice crash to nail to load up on commodities before the devaluation. I’ll gladly take that. However, I have a lot of higher up friends, who said Obama, for re-election, is already a done deal. That’s why, to me, a dollar devaluation wouldn’t make sense until after November. A market crash wouldn’t make people hit the streets, at least I dont think so?, but a dollar collapse certainly will

i’m expecting that jan wave down to get ugly. at least rsi 25 on the QQQ

SINA Chart analysis:

http://niftychartsandpatterns.blogspot.in/2012/08/sina-chart-analysis.html

another boring day. I hope they dont chop like this throughout next week as well

Yes… very boring.

Yeah, picked up a far out Sina call this morning, Doing pretty well.

ES at channel resistance:

http://niftychartsandpatterns.blogspot.in/2012/08/es-chart-analysis_16.html

This is getting rediculous…I’m at my witts end with our markets..

it is, i just got short slightly. I think it’s to early to hit the 1419 area. The manipulation is out of control

Crude oil update:

http://niftychartsandpatterns.blogspot.in/2012/08/crude-oil-update_16.html

At least we all know that the market isn’t likely to rollover until the 1419 FP is hit on the SPX. Think of all the un-informed bears out there that have been shorting this for the last 2 weeks… man that must suck!

CAn we please hit the FP’s on the downside now…Good god

LOL… I’m with ya BH!

If we dont hit those FP on the downside in the next few months i’m done with this market…

I do need to see a Market crash. Hope soon.

But again they may drag it to 9/1 for the JH meeting.

i hope there’s a 9/11 #2—just kidding, but it would help a lot! i’m underwater on all my shorts…

I was one of those bears…just found this site a few days ago. Tired of losing money in this market!!

I have a feeling they’ll bounce around here and maybe touch it quickly tomorrow morning. To drag out a whole week ,when they’re this close, would be a bit much. Anything’s possible though

Yes, I agree. I’ve seen them come close to a FP before in the past and not hit it (which I got short thinking it was “close enough”) and then latter (after a brief “few days” pullback) they rallied back up to hit the FP and pierce it slightly before rolling over for good.

However, according to “Gary the Numbers Guy”, today qualifies as another “eleven” day as it equals 20 (0+8+1+6+2+0+1+2=20… which “2” equals two “1’s” or “11”). I’m just not sure if “20” days are that important to the gangsters as far as the stock market is concerned. I didn’t see any previous highs end on a “20” day, but I never checked back further then this year, so it’s possible prior to that I guess.

close, butt jut not there…..

Exactly… just tease us “awake bears” that seen the FP. It’s not time to get heavy short in my opinion yet.

I am just going to buy up as many shares of a company that I found, and sit on them. I think they could go to 50-100 a share, and they are only around a buck(slightly less). Its the biggest deal I have ever found, and I have found about 20 big ones over the years.

care to share the company?

XOM update, plus..

MY spy q2 earnings report, says to short DIA at 134—info is there too!

http://zstock7.com/?p=6791

my guess, of we dont hit the fp in the morning, is that we’ll chop back down slightly to get us bears in for the ride. And then have a few nothing days like we just did

While all important tops and bottoms aren’t on ritual “eleven” days many are. So the possibility of the FP being hit tomorrow and then rolling over is there… but some how it just feels too me like they will take it down a little first to lure in some bears (maybe 1380-1370 spx) and then push back up next week toward the FP.

If so, then we should top on Monday the 27th (a ritual “eleven” day) by hitting the FP and possibly piercing it a little. The first move down isn’t likely to be the real move. Think of it like they do… there are tons of bears short now as we’ve given them 2 weeks of chop to position themselves.

That’s way too many bears on the train right now. They should tease them a little here with a move down starting tomorrow and carrying into early next week. Then push them off the train with a nice squeeze up to the FP of 1419 spx by Monday the 27th… and then tank for real.

Thanks for your thoughts red- always appreciated. Makes/made me look at the market in a completely different way. a possible drop to 1385 is still worth riding on a weekly. I’ll see what the oepen looks like

Any thoughts on silver/gold soon exploding? I personally thought they would’ve wanted to drop it a bit lower, to get the hedge funds out.

Chart by Tim Knight of Slope of Hope “I’ve marked with an arrow where the S&P was the last time the VIX was this low” agrees with your assessment that the market will go up a little more then down – hitting the FP

http://slopeofhope.com/2012/08/volatility-at-wow-levels.html

nice chart… Same game as always with them

CSCO Resistance levels:

http://niftychartsandpatterns.blogspot.in/2012/08/cisco-chart-update_17.html

Thin i’ll short this open

ES Resistance levels:

http://niftychartsandpatterns.blogspot.in/2012/08/s-500-futures-chart-analysis_17.html

roll over already! sheesh.

I am having doubt about Lindsey. so fars calls have been off. If his calls are for energy spike, but energy guidance is down. Wonder if he is fooling us to go to the opposite.

http://www.factset.com/insider/2012/8/earningsinsight_8.17.12

I’m not sure what to think of that chart as all earnings can (and are) be manipulated.

manipulate at will, there are no limits